What is day trading? The complete guide for beginners

In some ways, day trading is like a 'made-to-order' profession. To a large extent, you can work when and where you want. You can dictate exactly how and when you want to trade, working from your office or home, or even when travelling, thanks to the advances in mobile technology and the increasing popularity of mobile trading.

As a day trader, you can be your own boss, being in control of your own time and money. So what's the downside? The very fact that you have total control is sometimes a frightening prospect for many, especially those who find it difficult to create and manage their own timetables.

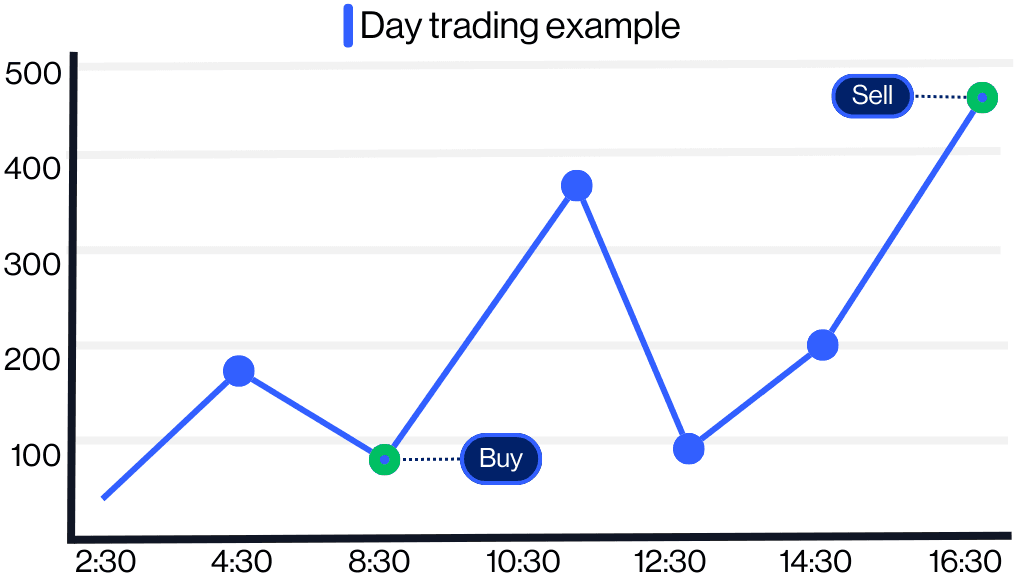

Day traders add entry and exit points for the same day

Most day traders focus on price-action trading, which tends to utilise data based exclusively on price movement rather than wider, longer-term factors

A range of technical analysis tools can be used in day trading to help you predict your chosen market’s future direction

Day traders aim to accumulate profit through smaller, short-term trades, which reduces the potential for making a larger profit or loss

Successful day traders tend to have to be decisive and move quickly, based on a pre-determined trading plan, remaining disciplined and avoiding panic moves

What is day trading?

As its name suggests, day – or intraday – trading is a short-term approach that involves the buying and selling of a financial instrument, and closing out of the position by the end of the same day, with the goal of making a profit from small movements in price. The more the market moves, the more profit or loss you’ll make, based on whether the trade has moved in the direction you predicted.

Trading in such a short time horizon offers traders the potential to profit from small price fluctuations, while gaining protection from negative price gaps that could develop overnight between trading sessions.

This approach has increased in popularity over recent years. Technology has played a large part – thanks to faster broadband and mobile connections, we have a wealth of real-time market information at our fingertips. This has led to more people accessing the markets and placing trades throughout the day, to try and profit from short-term volatility in market prices.

What are the different types of day-trading strategies?

As you’d expect, looking for buying and selling opportunities requires a strategy. Here are some of the most popular day-trading strategies:

Price-action trading

Price-action trading is the foundation for all technical analysis, helping traders to identify trends, breakouts and reversals. The strategy involves analyzing the movement of a security’s price over a period of time, to help determine its potential trajectory.

Scalping

Scalping is a very short-term strategy, where the trader buys and sells an instrument several times over a day, aiming to make numerous small profits, with the hope that it adds up to a larger cumulative gain. Some scalpers may trade on the same instrument hundreds of times a day, sometimes with only a few seconds between buying and selling. This strategy requires commitment, concentration and a sharp eye and understanding of short-term charts.

When formulating your strategy, you should consider the trading costs that may apply, to give your strategy the best possible chance to become profitable.

Short selling

Short sellers target a market that they believe will decline in value, by selling at what they hope is a higher price, with the intention of buying it back later at a reduced rate, and making a profit on the difference. Short sellers are reliant on a drop in a security’s price.

With short selling, you’ll lose the more the instrument gains in value, so traders should consider their risk-management strategy carefully.

Any losses affect your account value, and could trigger a closeout (also known as liquidation). It’s important to monitor your account closely when opening a short position, and use the risk-management tools available on our platform and app.

Momentum trading

This strategy focuses on price action and movements rather than fundamental factors, such as the state or overall future of a business (if trading on shares). The technical analysis around momentum trading looks at price projections based on historical price data. Traders should though still be aware of macroeconomic events and news stories that could influence price action.

How to day trade

Choose your instrument. CFDs allow you to speculate on an asset’s price action without directly owning it.

Explore the global financial markets. Trade on 11,000+ financial instruments, including indices, forex, commodities, shares, ETFs, and bonds.

Decide whether you want to buy or sell. Determine your entry and exit points based on whether you think the price of an asset will rise or fall.

Keep up to date with market-moving news. Markets can be impacted by major macroeconomic news, as well as regular events such as inflation and unemployment data, and central bank interest-rate meetings.

Utilize risk-management controls. We offer a range of stop-loss orders, which can help to close out positions if the market moves against you, minimizing your risk of capital loss.

What are the costs?

Every trader pays fees to their broker. These vary depending on the product and market you trade, but most forms of trading are charged according to the spread – that is, the difference between the buy price and the sell price quoted on any given market.

For example, if your broker quoted you a sell/buy spread of 99-101 and you bought at 101, you would make a profit from the price rising to 102 and upward. If you choose to short sell shares, this will cost more as you have to borrow the shares to sell, and pay interest on them – this additional cost is factored in the overnight holding costs, explained below.

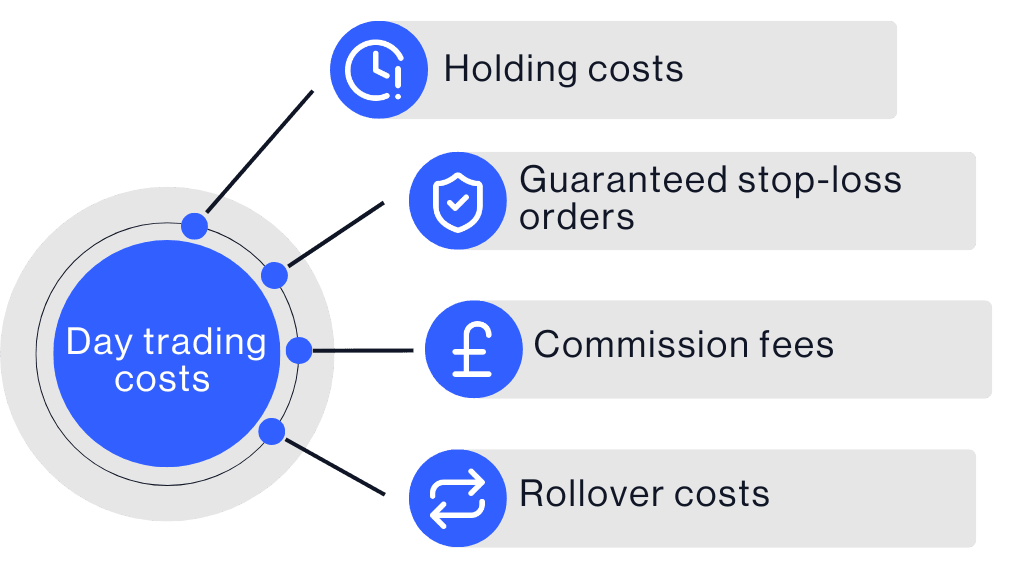

Potential costs to bear in mind include:

Holding costs – if you keep your positions overnight. These can be positive or negative depending on the direction of your trade and instrument you’re trading

Guaranteed stop-loss orders (GSLOs) – allow you to exit a trade at a certain price point regardless of market volatility. This guarantee comes with a cost, known as the premium, which is refunded if the GSLO is not triggered

Rollover costs – payable when you roll an open position on a forward contract to the next available forward contract

Learn more about our trading costs. You can also find information on our costs within the product overview section of the platform from the product library, and also on an order ticket when you place a trade.

Pricing is indicative. Past performance is not a reliable indicator of future results.

Which technical indicators do day traders use?

Day traders tend to focus solely on technical analysis and price movements rather than fundamental factors. They can apply a variety of trading indicators to help predict price movements, trends and reversals. Each trader has their own attitude to risk and specific trading plan.

Some of the most popular technical analysis tools include:

Simple moving average (SMA): shows the average price of a security over a certain length of time plotted as a single line on a candlestick chart, and customizable over different time horizons.

Stochastic oscillator: highlights price momentum and helps to identify overbought and oversold assets.

Relative strength index (RSI): gauges whether momentum is accelerating or decelerating and can potentially foretell reversals.

Bollinger Bands: are based on a moving average with two trading bands above and below it, which move further apart in times of volatility. When the average touches the upper band it’s considered overbought, and if it touches the lower band it is oversold.

Mean reversion: is a financial theory which suggests that after an extreme price move, asset prices tend to return to normal or average levels.

Day-trading tips to bear in mind

Here are some popular day trading tips and rules that you may want to implement into your trading plan.

Manage your risk. Risk-management is about limiting positions so if losses happen, you can afford to soak them up. It’s not about just about whether you win or lose, but by how much.

Use stop-loss orders. Be mindful that regular stop-losses can be prone to slippage when price gapping occurs, whereas guaranteed stop-losses will always close out positions at your chosen level.

Stay level-headed. Always try to remain calm and remember the rules you’ve set.

Act decisively, but be flexible. Market conditions can change rapidly, and therefore you should be prepared to be flexible, ideally as part of your trading strategy.

Patience is a virtue. Don’t trade for the sake of it – if you can’t find any viable opportunities, it may be better to wait for the right trade rather than trading impulsively.

Make your own decisions. Try not to let other traders’ opinions unduly influence you – what works for someone else may not match your day-trading strategy.

Monitor your stress levels. Intraday trading requires constant attention and motivation, so if it gets too much, step away – you can always return to trading later. You can also contact us for support via email or phone.

Learn from your experience. Write down your reasons for entering your trades, what you did and how, why and when. This level of detail will help you to learn from your past trades.

Track your progress. Set goals. After you’ve been trading for a month, take time to evaluate what you’ve done, and whether you achieved what you intended, and ask yourself if there is anything you’d do differently.

How to get started

You can start by opening a demo account with us, and trade CFDs on 11,000+ global financial instruments. Costs to consider include spreads, and overnight holding costs if you hold a position overnight (day traders avoid this cost). It’s also important to understand margin rates, which dictate the percentage of the overall position’s value you need to deposit to open a trade.

When day trading, it’s helpful to study a range of chart timeframes, rather than one single timeframe. For example, a day trader could study 15-minute, 30-minute and hourly charts for different purposes, such as overall trend, and entry and exit points. Learn more about choosing the right chart timeframe for your strategy.

Intraday traders should have a good knowledge of the financial markets, and make use of risk-management tools. When trading volatile markets in particular, the use of a stop-loss order type can help to protect you against the potential for making a larger-than-expected loss. However, for retail (non-professional) clients, your account has negative balance protection, which means any loss is limited to the available cash in your account. See our range of execution and order types.

Day traders aim to make small but frequent profits based on the fluctuating price movements of one or more financial instruments. These profits have the potential to add up over time if the trader is successful, but as with all trading, there is no guarantee of success. It’s important to have a trading plan, and only risk small amounts of your overall budget on each trade.