What is a head and shoulders pattern in trading?

In this article, we explore how head and shoulders patterns can be used to potentially identify entry and exit points for a trade, as part of technical analysis.

Plus, we’ll look at examples of this type of trading in action during uptrends and downtrends, and explain how you can potentially incorporate technical analysis into your trading strategy.

Head and shoulders pattern defined

The head and shoulders pattern is a technical formation that indicates a trend reversal is underway. Traders use it to identify potential danger when trend trading or when they want to catch a trend reversal near the turning point.

Head and shoulders patterns can be used to highlight price action within a wide range of markets, including forex trading, indices, and stocks. This makes it a particularly flexible and simple setup for traders to spot on price charts.

Head and shoulders formation

When the head and shoulders pattern occurs within an uptrend:

The pattern starts with the price rising and then pulling back, forming the left shoulder.

The price rallies again, creating the peak of the head.

The price moves lower again and rallies into a lower peak, forming the right shoulder.

The swing lows following the left shoulder and head can be connected with a trendline to form the neckline. When the price breaks below the neckline, the pattern is complete, and there is potential for a further decline.

Example of a head and shoulders pattern

Below is an example of a head and shoulders pattern that formed on a forex candlestick chart, where the pair dropped through the neckline, signalling that it might continue declining.

In this case, the right shoulder is quite small. The fact that the price couldn’t bounce significantly back toward the head showed there was a lot of selling pressure before the decline, what’s called a head and shoulders top chart pattern.

What’s an inverse head and shoulders pattern?

An inverse head and shoulders, or head and shoulders bottom pattern, occurs in a downtrend:

The price is dropping and then has a temporary rally, forming the left shoulder.

The price drops to a new low before having another temporary rally. This forms the head.

The price drops but is unable to make a new low before rallying again. This forms the right shoulder.

The swing highs (rally highs) following the left shoulder and head are connected with a trendline to form the neckline.

When the price moves above the neckline, there is potential for it to keep moving higher.

How to draw a head and shoulders pattern

You can identify head and shoulders structures on trading charts, whether these are candlestick or Renko charts, using various drawing tools to identify support and resistance levels and trendlines.

Support levels are price points where downward movement tends to pause or reverse.

Resistance levels are price points where upward movement tends to pause or reverse.

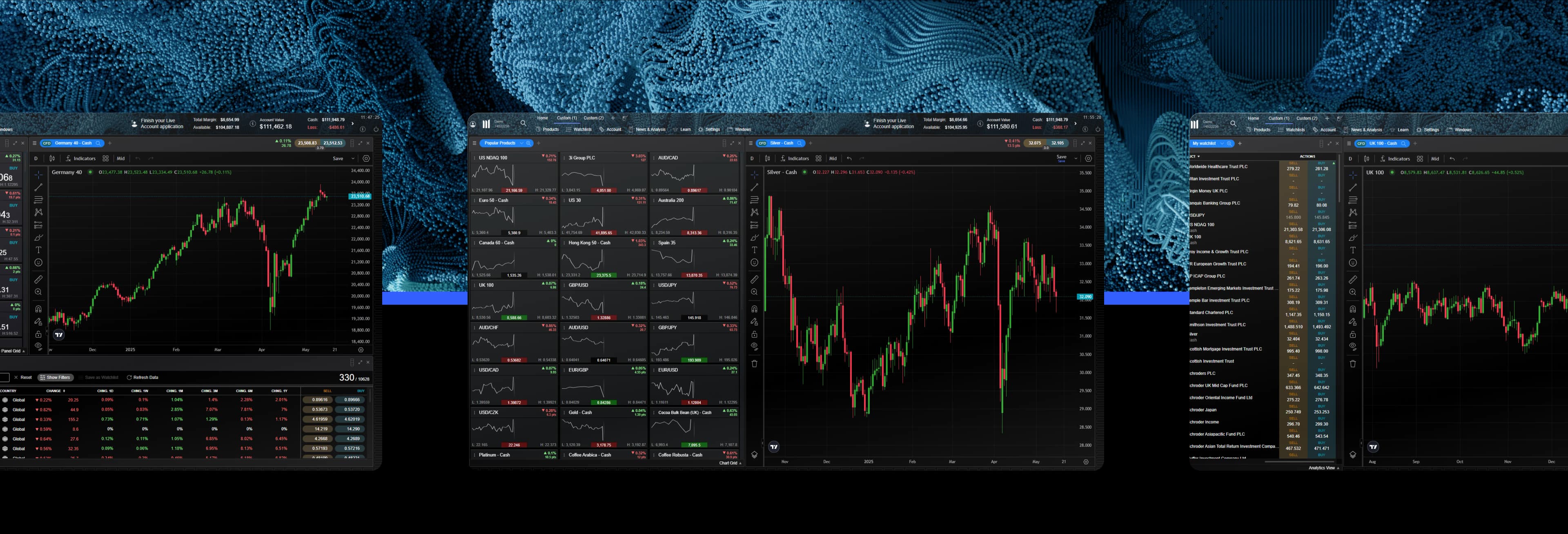

Our online trading platform has a wide range of drawing tools, price projection tools, and chart types to display your positions clearly.

Using these tools helps traders visualize and identify patterns that appear on similar price charts. Here’s how you can get started:

Open a live account and start trading today, or practice first with virtual funds on our demo account.

Open a live chart by choosing an instrument from the Product Library. We offer over 330 forex pairs and 9,000+ shares on our platform, along with other popular financial assets.

Along the bottom of the chart, you’ll see several tools: Timeframe, Draw Tools, Technicals, and Patterns. For head and shoulders, choose Draw Tools.

Now, you can choose to:

a. Draw lines over the price action to better see the head and shoulder patterns.

b. Draw the neckline, select the Trend tool, and click where you want the line to start and finish. Click on it again to change its settings or to move the line. This way, you can see the head and shoulder pattern more clearly.

Pro Tip: With the Note tool, which is under the Draw Tools menu, you can make annotations like “left shoulder” or “peak of head,” to remember exactly how the head and shoulders formed.

Head and shoulders trading strategy: Entry, stop loss, and profit target

Traders can use the head and shoulders pattern to plan precise entry and exit points and potentially manage risk. Understanding the height and breakout point is essential to estimating potential profits and protecting capital.

Entry

Traders who are using this strategy aim to enter the trade when the price breaks the neckline of the pattern. Traders using this strategy believe timing is key as entering too early can lead to false signals, while entering too late may reduce potential profit.

Stop-loss placement

Stop-loss placement potentially helps manage risk around the point where the pattern becomes invalid. For a topping pattern, traders may place it above the right shoulder; for a bottoming pattern, below the right shoulder.

Profit target

To estimate a potential profit or price target, traders use the height of the pattern:

Calculate the height

For a topping pattern: Measure from the peak of the head down to the lowest swing low in the pattern. If the lowest swing low is unusually extreme (creating a very steep neckline), use the higher swing low for a more conservative target.

For a bottoming pattern: Measure from the bottom of the head up to the highest swing high. If the highest swing high is extreme, use the lower swing high for a more conservative target.Apply the height

Inverse head and shoulders (bottoming pattern): Add the height to the neckline breakout point.

Regular head and shoulders (topping pattern): Subtract the height from the neckline breakout point.

Using CMC Markets’ head and shoulders pattern scanner

Our award-winning platform* includes a chart pattern scanner, not just for head and shoulders, but many other patterns as well, such as cup and handle and double top/bottom patterns.

This way, you can more easily spot entry, stop loss, and potential profit target opportunities.

However, while the software is useful, it shouldn’t be relied on alone. Sometimes, it may spot a set of price bars as a head and shoulders where it doesn’t exist, or identify one that doesn’t provide potential trading opportunities - perhaps because it is too small or too large to trade, or simply not visible.

Pro tip: Pattern recognition is a good starting point, but you might also analyze the results manually to find patterns that resemble the examples shown in this guide.

Pattern recognition tools are designed to assist with market analysis only. Patterns identified by the platform may not always align with market outcomes and should not be relied upon in isolation. Users should independently assess all signals and market conditions before making trading decisions.

Are head and shoulders patterns bullish or bearish?

Head and shoulders don’t initially look bullish or bearish until there is a breakout.

An inverse bottoming pattern could form, but until the price breaks above the neckline and keeps moving higher, the price could still be in a downtrend. If the price breaks below the pattern, that might signal a continuation of the downtrend, not a reversal.

Similarly, when a topping pattern forms, this doesn’t mean that the price will reverse. It has to break below the neckline and keep dropping to confirm the reversal.

If a head and shoulders pattern forms but the price rallies above instead of dropping below, this potentially signals a continuation to the upside, not a reversal to the downside. To confirm which direction the price is going in, in some cases, you could wait for the neckline break.

Head and shoulders in forex

Head and shoulders patterns occur in all markets, including forex trading, and they’re traded in the same way. Below is an example using the major currency pair USD/CAD, with entry, stop loss, and potential profit target opportunities marked using our online trading software.

Stocks with a head and shoulders pattern

With stocks, traders might look for an uptrend where the price has formed three peaks, with the middle peaks being the highest. At this point, traders might place a stop loss and wait to sell or short stock until the price moves below the neckline.

The default location for the stop loss is above the right shoulder, but to reduce the size of the possible loss, you could place it above any swing high before the neckline breakout.

Then, calculate the height of the pattern, and subtract that amount from the breakout point to attain a profit target.

Learn more about chart analysis patterns

How reliable is the head and shoulders pattern?

The head and shoulders pattern is widely respected in technical analysis, but it isn’t foolproof. Some traders opt to focus on patterns with certain characteristics. For example:

A small right shoulder often means a smaller stop loss, compared with a large right shoulder, potentially improving the risk-to-reward ratio of the trade.

A gently sloping neckline is typically more reliable than a steeply angled one, which might exaggerate price targets.

Decreasing volume during the formation of the head and right shoulder, followed by an increase on the breakout, might strengthen the validity of the pattern.

While on a single trade, anything can happen, looking for similar characteristics might move the odds more in a trader’s favour over multiple trades.