Trading strategy

A robust trading strategy is the cornerstone of successful trading. That’s why we’ve compiled this guide to help you understand different approaches to trading and build a solid strategy of your own – one that suits your personality, goals and risk appetite. You’ll also learn how to test and refine your trading strategy to adapt to changing market conditions.

What is a trading strategy?

A trading strategy is a plan or set of rules that a trader follows when buying or selling financial products. Your strategy is there to help you make well informed trading decisions calmly and dispassionately, drawing on financial data, technical indicators and your research skills, rather than being guided by gut instinct or emotions.

A good trading strategy takes various factors into account, including:

Market conditions

Risks, and your risk appetite

Your personal trading goals

Why use a trading strategy?

Seven best trading strategies

Here we look at some of the main trading strategies, most of which involve short-term timeframes. Traders often adapt one or more of these approaches to suit their needs and circumstances, developing them into a personalized plan or trading style.

The strategies outlined below carry risks as markets can quickly change direction, leading to potential losses. To help manage these risks, traders often add take-profit orders and stop-loss orders to their trades.

News trading

End-of-day trading

Swing trading

Day trading

Trend trading

Scalping

Position trading

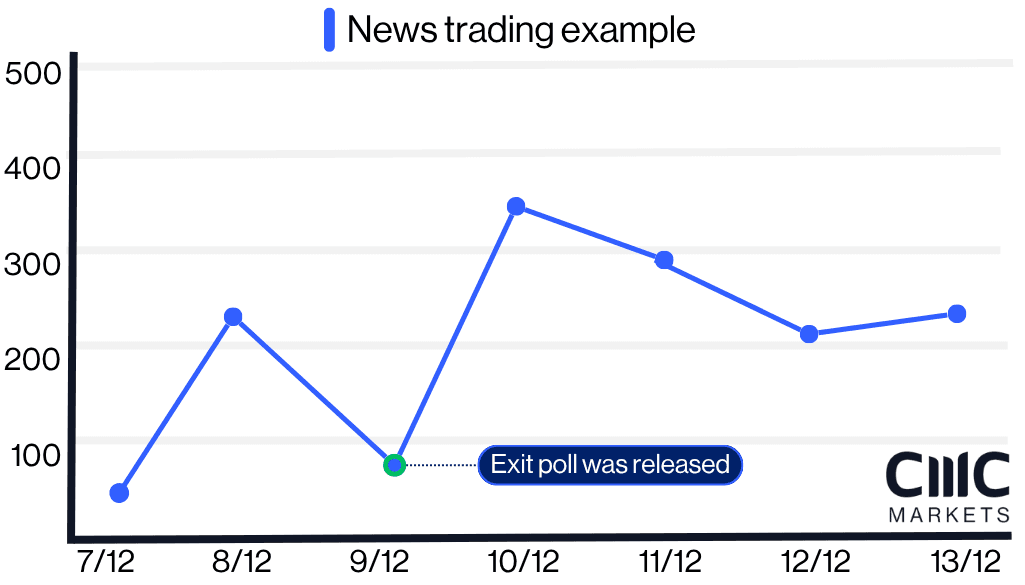

News trading

News trading involves monitoring financial newswires in an effort to capitalize on the shifts in market sentiment that may emerge as news breaks. For scheduled economic and company news events, such as interest rate decisions and earnings reports, news traders might open, close or adjust their positions based on how they think the market will react to the announcement. Unexpected news can trigger market volatility, which may present possible trading opportunities.

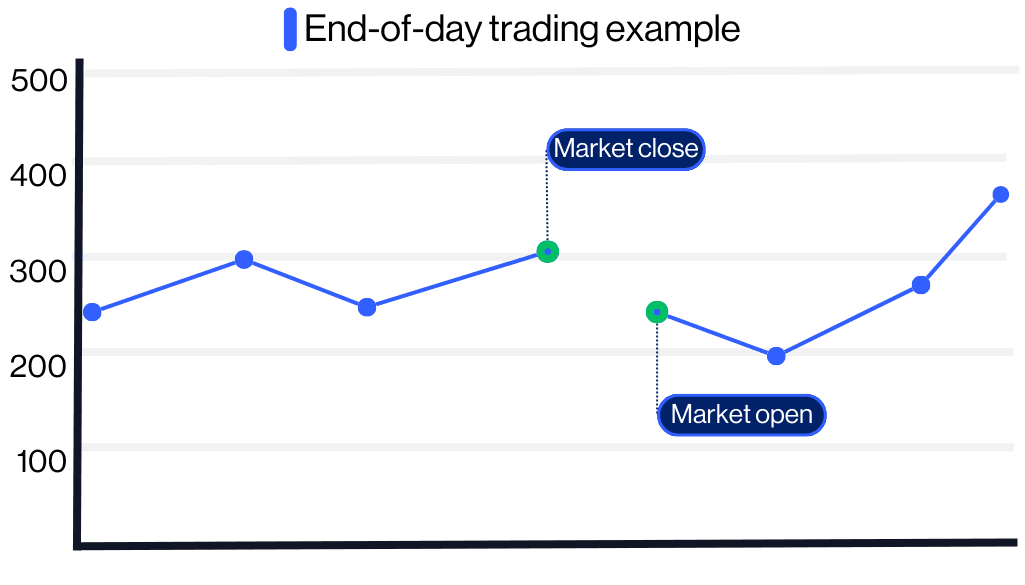

End-of-day trading

End-of-day (EoD) trading is all about seeking potential opportunities in the final hour of the trading session. EoD traders analyze the day’s financial news and price action, then place their trades before the close. They may exit those positions shortly after the next trading day begins, or keep them open for a few days.

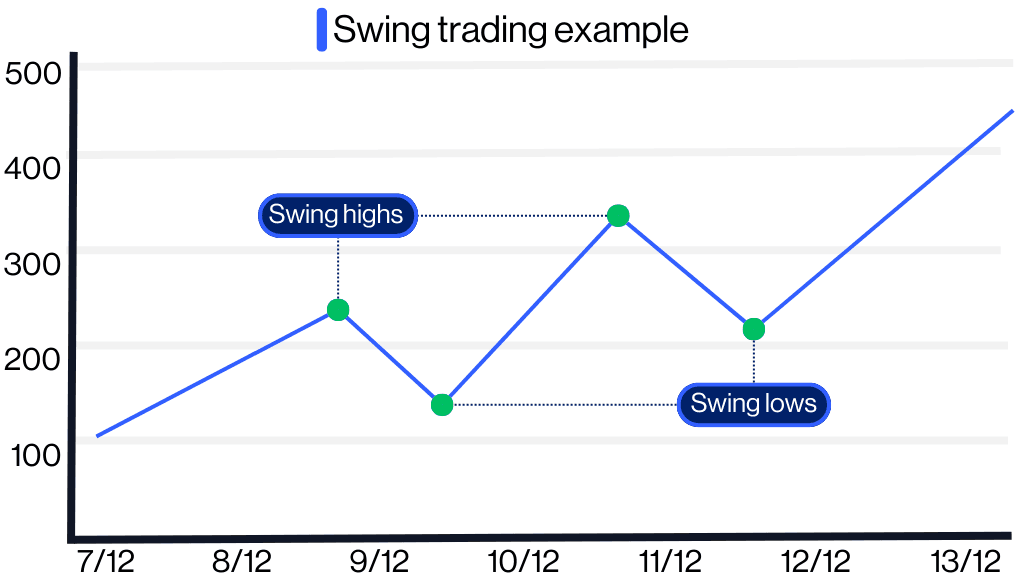

Swing trading

Swing trading refers to the practice of trying to profit from short-term price changes, or ‘swings’, in a financial instrument. These swings can be part of, or run counter to, the prevailing price trend. Swing traders use technical indicators, such as support and resistance levels, to look for potential opportunities. They often hold their positions for just a few days.

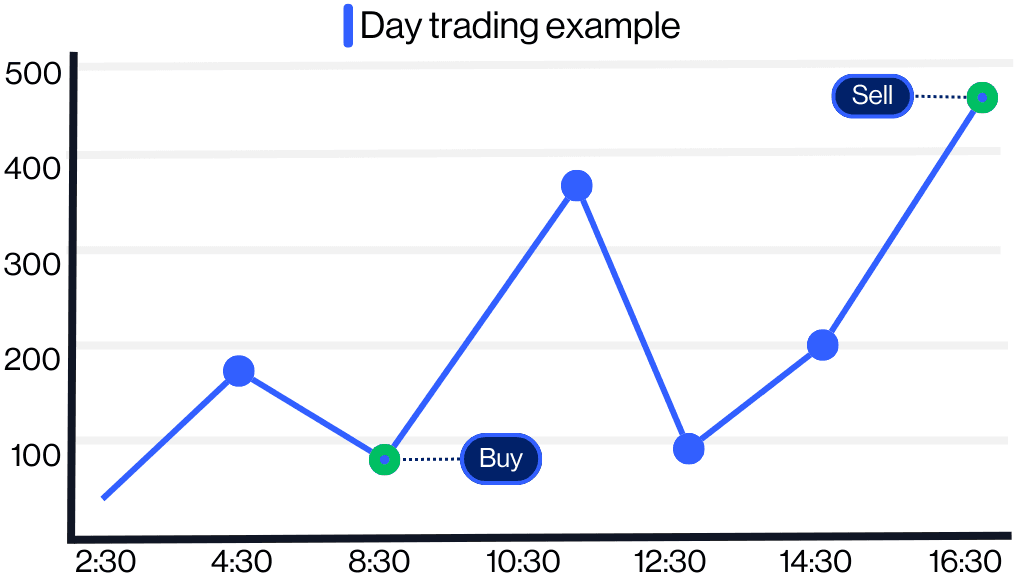

Day trading

Day trading is a short-term approach that involves entering and exiting trades within a single trading day. Day traders carry out technical analysis of charts and indicators to make their trading decisions, typically keeping their positions open for a few minutes to several hours, but rarely overnight.

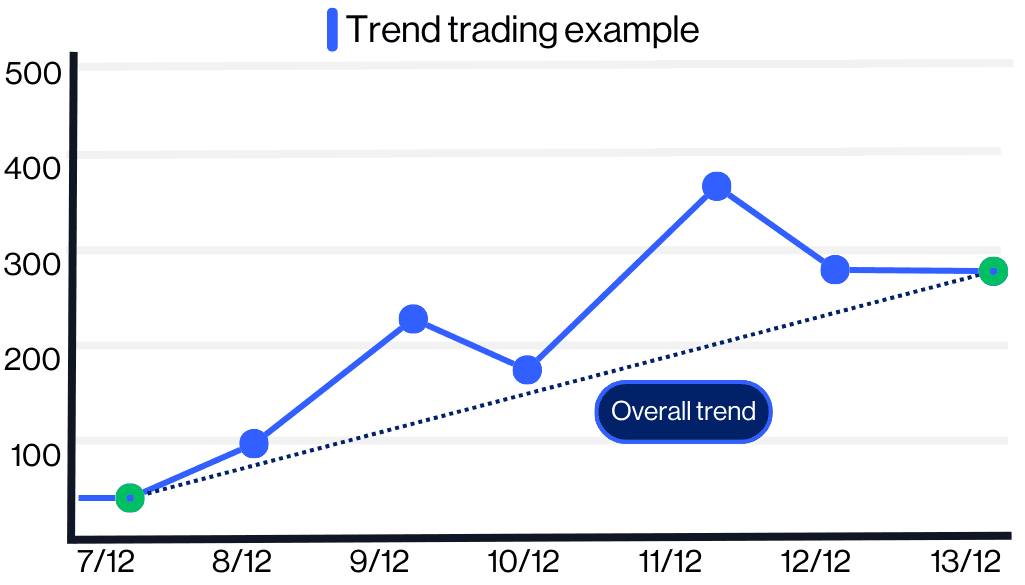

Trend trading

Trend traders attempt to identify and capture gains from market trends. They place trades that follow the direction of uptrends, when an instrument posts new highs, and downtrends, when an instrument posts new lows. They aim to maintain their positions for as long as the trend continues, exiting the trade when the trend shows signs of ending.

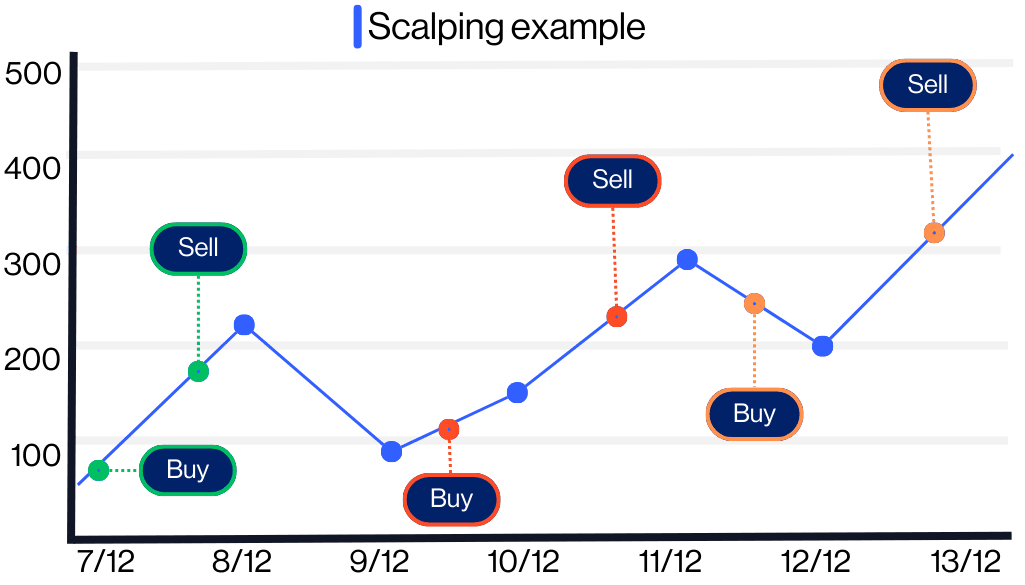

Scalping

Scalping involves making multiple short-term trades with the aim of making a small profit on each trade. Scalpers enter and exit positions quickly – sometimes holding positions for just a few seconds or minutes – with a view to capturing gains from small price movements.

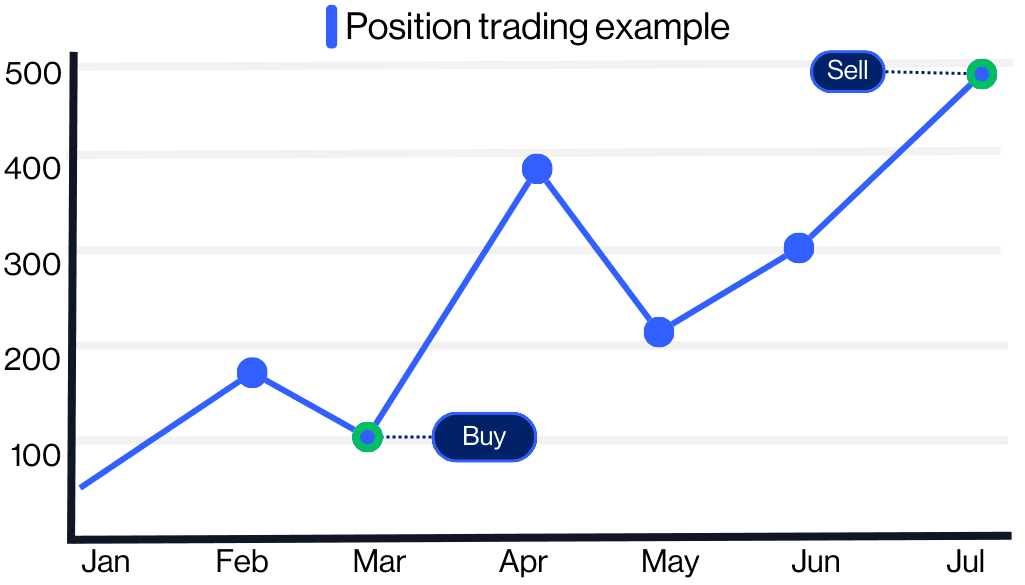

Position trading

Position trading is a long-term approach to trading, in contrast to the strategies outlined above. Position traders may keep their positions open for weeks, months or even years in the hope of capitalising on long-term market trends. Traders who adopt this strategy need to be aware of overnight holding costs and other charges that may apply to their trades.

Finding the right strategy for you

Trading strategies are highly subjective. You may not hit upon the ideal strategy right away, so it’s worth experimenting with different approaches until you find a strategy – or a blend of strategies – that’s right for you.

You can test out different trading strategies by opening a free demo account with us. Your demo account comes with $10,000 in virtual funds, allowing you to practice implementing different trading strategies in a risk-free setting.

It's important to remember that the best traders are adaptable and can modify their trading strategy to suit the market conditions and the available opportunities. Therefore, it’s a good idea to learn about various trading strategies and to try combining them in different ways.

When developing your trading strategy, keep the following points in mind:

All traders make losing trades, so don’t become disheartened if you incur losses. Start small, and don’t put up more than you can afford to lose.

Patience is vital. Open a demo account with us and take the time to learn how to apply different trading strategies.

Formulate a trading plan and keep track of your profits and losses. Doing so will help you maintain consistency and discipline in your trading.

Hedging

Hedging is a risk-management plan that aims to offset potential losses in one position by opening an opposite position in a related asset.