Learn - What is a Spread

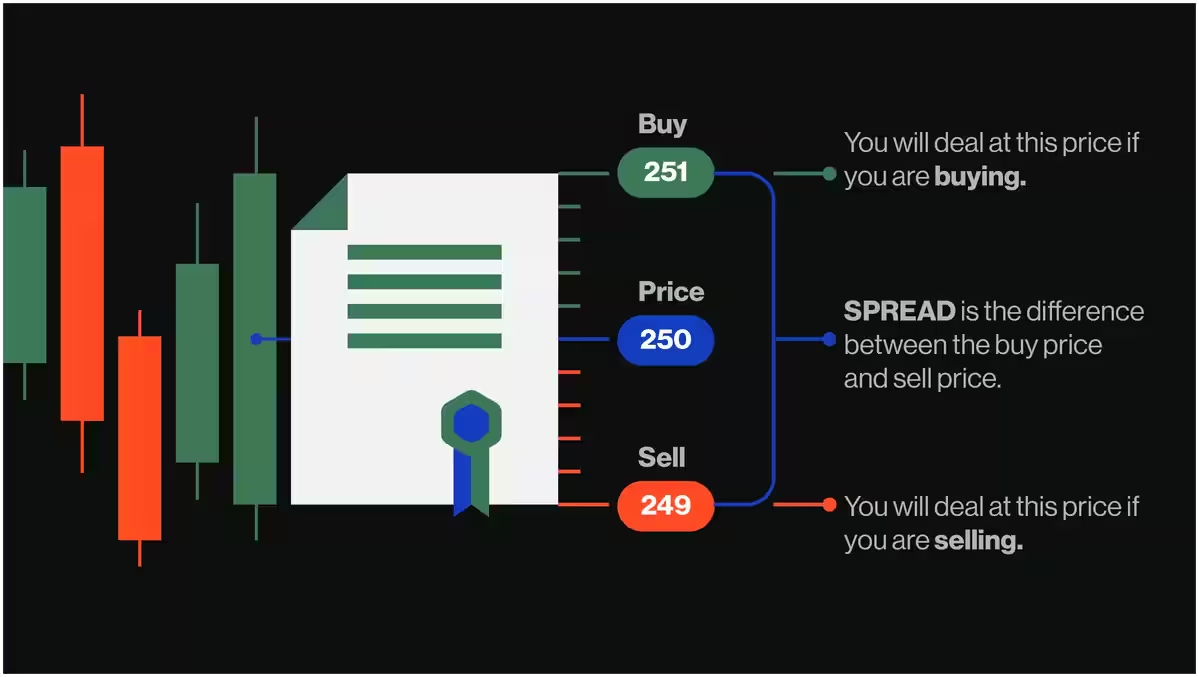

When online trading, whether spread betting or trading CFDs (contracts for difference), the spread represents the difference between the buy and sell price of an asset. The price at which you buy (bid price) is always higher than the price at which you sell (ask price), and the underlying market price will generally be in the middle of these two prices.

Trading spreads are implemented by market makers, brokers and other providers to add costs to a trading opportunity, based on supply and demand. Depending on how expensive, volatile and liquid an asset is, the spread will fluctuate along with an asset's price and trading volume.

Spread definition

The word ‘spread’ has a variety of definitions in other areas of finance, but the fundamental concept of being a difference between two prices is always evident. A spread in trading is an example of this, where the purchase of one asset and sale of another occurs simultaneously with an option or forward contract. The spread, in this case, is the difference between the bid and ask price.

What is a spread?

When you place a trade, you will either buy or sell the particular instrument that you are trading, depending on whether you believe the underlying market price will rise or fall. This is through the use of derivative products, such as spread bets and CFDs.The spread is one of the key costs involved in spread betting. Generally, the tighter the spread, the better value you get as a trader. We offer consistently competitive spreads, starting from just 0.7 points for EUR/USD and USD/JPY currency pairs and from 1.0 point for our UK 100 and Germany 40 products, which are based on live stock indices. See our markets page for more information about our spreads.

Bid-ask spread

A spread in trading is calculated as the difference between the bid and ask price for a financial asset, whether this be a currency pair, index or commodity. This is also referred to as the bid-ask spread. Our online trading platform calculates the spread automatically so you do not have to, but it is still useful to know where our spread costs come from.

The spread of an instrument is a representation of how closely aligned the supply and demand are. If the bid-ask spread is very low, there is a common consensus on an assets price. However, if there are some disparities between buyers and sellers opinions on an assets worth, the spread is generally wider.

How to calculate the spread

For example, let’s say that an asset has:

A buy (bid) price of 1449.5

A sell (ask) price of 1451.1

The spread = difference between buy and sell price = 1.6 points

How does it work in trading?

The spread is a crucial piece of information to be aware of when analysing trading costs. An instrument’s spread is a variable number that directly affects the value of the trade.

Spreads are constructed around the current price or market price of an asset. Market makers and brokers may add some transactional costs in the spread to simplify the transaction process, which can be particularly prevalent in forward and futures contracts. Learn more about our trading costs.

A number of factors influence the spread in trading, as follows:

Liquidity. Liquidity is determined by the volume of trades. A liquid asset can easily be converted into cash, while this is more difficult for an illiquid asset. Less commonly traded assets tend to have a wider spread, whereas popularly traded assets tend to have a tighter spread.

Volatility. When markets are fluctuating with large and rapid price movements, the spread is usually much wider. Market makers can use volatility as an opportunity to increase their spreads, and traders attempt to profit from the fluctuations.

Price. Linked to both liquidity and volatility, when an asset's price is low, volatility is much higher and liquidity is much lower, which causes a wider spread. The opposite is true when an asset is more expensive.

What is a spread strategy?

Once you have placed your trade and either selected buy or sell on a particular product, you will be looking for the market to move further than the price of the spread. If that outcome is achieved when you close your trade, this may result in profit by either buying your sell trade or selling your buy trade. Likewise, while the price remains between or outside of the spread range, this will most likely result in a losing trade.

Examples of the spread in trading

Let's say that we are calculating the spread on the FTSE 100 stock index using the following information:

Sell price = 6,446.7

Buy price = 6,447.7

The spread is calculated by subtracting 6446.7 (sell price) from 6447.7 (buy price). Therefore, the spread is 1.0.

Now, let's say that we are calculating the spread on the GBP/USD using the following information:

Sell price = 1.65364

Buy price = 1.65373

If you subtract 1.65364 from 1.65373, that equals 0.00009, but as the spread is based on the last large number in the price quote, it equates to a spread of 0.9.

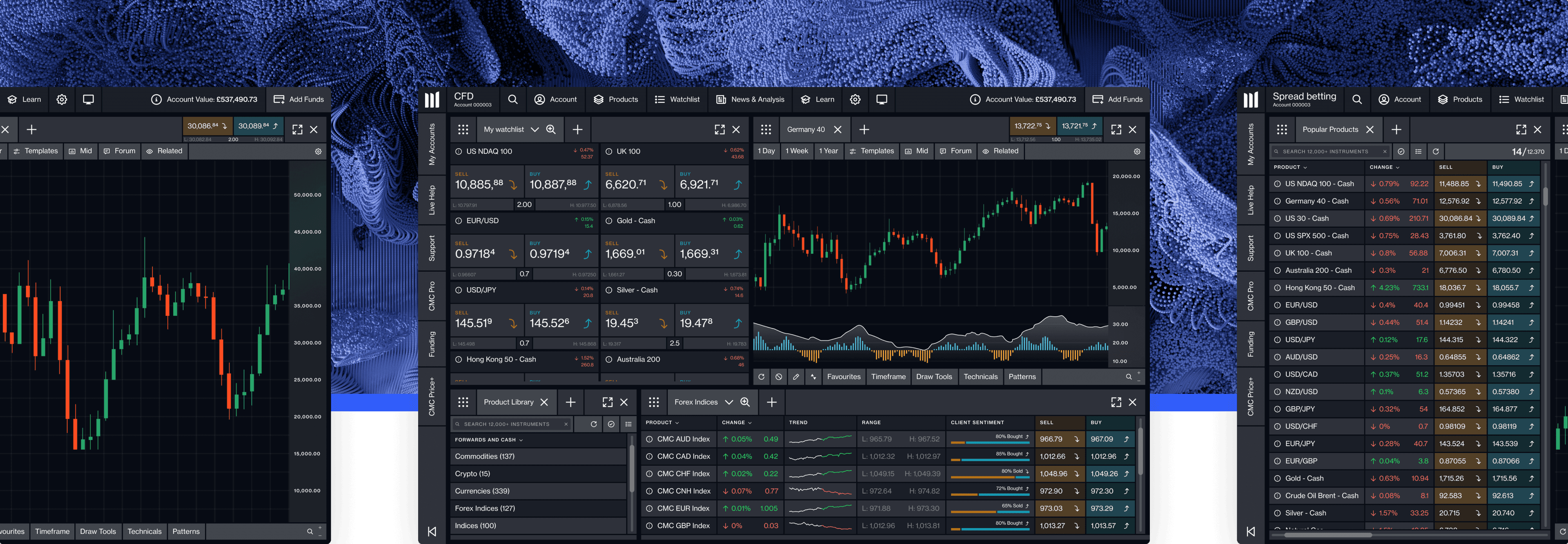

Practise your strategies on our trading platform

Trade our competitive spreads for a range of financial markets, including forex, commodities, shares, indices and treasuries. Our spread trading platform, Next Generation, comes with a range of charting features, including price projection tools, multiple chart types and order types, and automatic calculations for spread trading.

More information about how the spread in trading works:

In trading, the spread is the difference between a financial instrument's buy price and sell price. The buy price is typically higher than the sell price. The spread can widen or contract depending on market conditions. Read more about calculating the bid-ask spread.

The bid-ask spread is the difference between the bid (buy) price and ask (sell) price for a financial instrument. Live buy and sell prices are displayed on our platform, and change depending on a number of factors, including market sentiment and liquidity in the market. Read more about bid and ask prices here.

In general, a narrower spread is seen as less risky to trade. For example, forex traders often look for major currency pairs with a tighter spread of around 0.7 or 0.9 pips, as this generally represents lower market volatility and higher liquidity. View our markets page for more details.

A spread cost simply represents the transaction cost for an instrument. Instead of charging a separate trading fee for when traders place an order, the cost is instead built into the buy and sell price. Read more about our trading fees.

A wide spread indicates that there is a large difference between the bid and ask price of an instrument. This could potentially signal that the market is more volatile than usual, or there is low liquidity. A wider spread usually comes with a higher level of risk, so you should consult our risk-management guide before opening a position.

To calculate the spread of a financial instrument, you subtract the bid (buy) price from the ask (sell) price. You don’t need to calculate the spread manually when opening a position; instead, our platform does this automatically. Check our markets page to view the current spreads for our most popular instruments.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.