Chart pattern screener

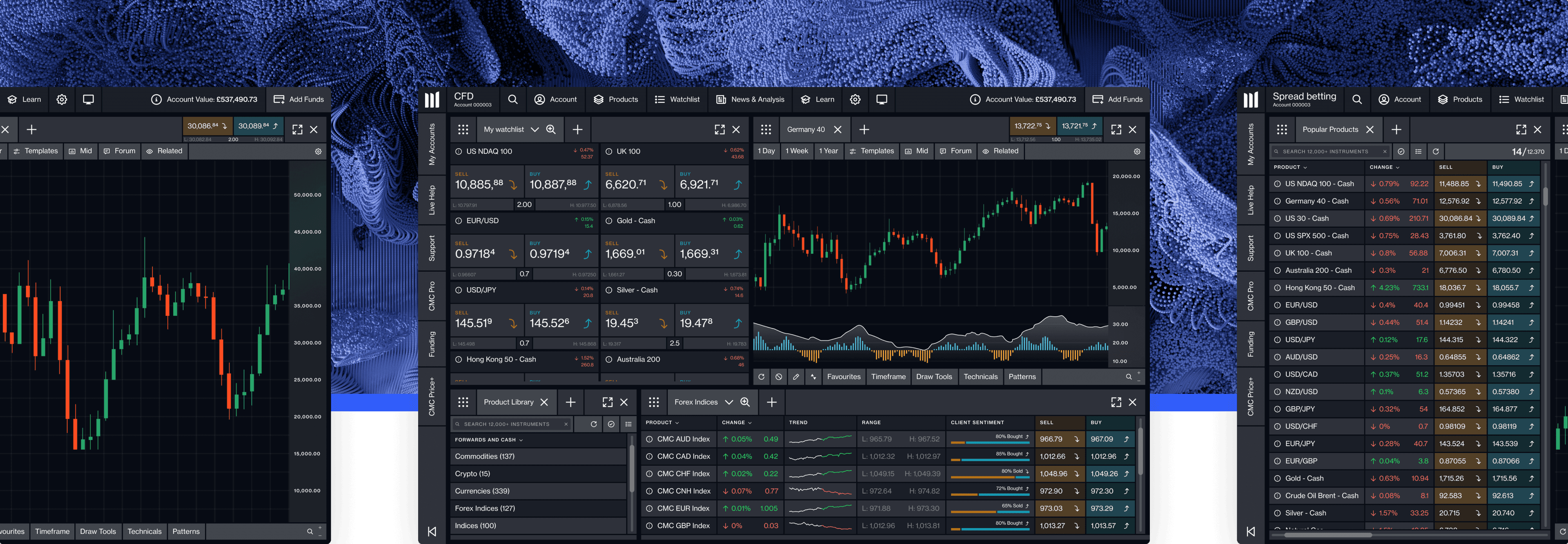

Pattern recognition is very important when it comes to technical analysis in trading. Price charts display a multitude of data that can be difficult to interpret on your own without pattern recognition software, meaning that you may miss entry or exit points in a trade, or ignore the potential opportunity completely. This is where our chart pattern scanner on the Next Generation trading platform is useful.

An important part of technical analysis is to understand the price action of an asset in a rising or falling trend, as price movements usually signal a new trend. Based on these trading signals, traders can then decide whether to enter, exit or avoid a trade, depending on how promising the trade looks. Trading patterns can also help with where to place stop-loss orders and set profit targets.

What is pattern recognition software?

Pattern recognition software is designed to identify significant trading patterns, popular within financial markets. It uses artificial intelligence and algorithms to recognise candlestick patterns within price movements. The software aids traders by helping to eliminate pattern misdiagnoses.

It is most popular with volatile markets where traders are required to pay close attention to price charts, in case of sudden price movements. Among these are forex and share markets. Our chart pattern scanner acts as the following:

Different types of pattern recognition

Wedge, channel or triangle pattern scanner

Head and shoulders pattern scanner

Forex pattern scanner

Double bottom or top pattern scanner

Harmonic patterns scanner

Stock pattern screener

Cup and handle pattern scanner

Learn to trade with our chart pattern screener

We have put together a comprehensive video below on how to assemble and trade using our chart pattern recognition scanner. This explores the type of pattern you can trade, along with assets and the timeframe for the chart.

Free candlestick pattern scanner

Trading patterns are most commonly displayed on candlestick charts, although we offer a variety of chart types, such as line graphs, bar graphs and Renko charts. This allows you to display your data in the clearest way possible that makes it easier for you to understand.

Open a trading account to make the most of our free candlestick pattern scanner.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Chart patterns are reliable in terms of showing past price movements and helping to detect the potential future direction of an asset. However, they should not be exclusively relied on and traders often combine multiple elements of technical analysis to carry out a more thorough inspection of the data. Try trading with the candlestick pattern scanner by signing up for an account.

Bullish patterns usually form after a downtrend in the market to signal a price reversal, meaning that an instrument’s price is starting to increase. Investors may then want to take a long position if they think it will continue.

On our Next Generation trading platform, you can find the pattern of a chart both manually and automatically. Either open a specific instrument’s chart and apply manual pattern recognition analysis or select the pattern that you would like to view from a list of instruments where it has automatically been detected. Learn how to spot trading patterns.

There are a wide range of trading chart patterns. Examples of simple patterns are triangles, wedges and diamonds, whereas head and shoulders, cup and handle and double tops/bottoms are more complex.

Most short-term traders look for similar patterns when trading the financial markets. Day traders may look for breakouts and reversals in patterns that form quickly, such as doji candles, head and shoulders and engulfing candlesticks.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.