The Week Ahead: Alphabet, Amazon earnings; US jobs

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 2 February.

The coming week brings a heavy dose of potentially market-moving US economic data, including the ISM manufacturing and services reports, the job openings and labour turnover (JOLTS) survey, private sector employment data from payroll processing firm ADP, and – the headline event – the Bureau of Labor Statistics’ jobs report. Meanwhile, earnings season continues at full tilt, with Amazon and Alphabet* among the leading names set to report quarterly results.

Across the Atlantic, the European Central Bank and the Bank of England will hold rate-setting meetings on Thursday. While economists expect the two central banks to leave interest rates unchanged, the subsequent press conferences and minutes might shed light on policymakers’ plans. The ECB is seen as being in pause mode, and the BoE is expected to cut rates later this year. Any policy signals may impact EUR/USD and GBP/USD. As long as neither central bank comes across as too “dovish” (favouring lower rates to encourage spending and stimulate growth), the euro’s and pound’s upward trajectories could continue.

*Michael Kramer and his clients at Mott Capital Management own shares in Amazon [AMZN] and Alphabet – Class A [GOOGL].

Alphabet Q4 earnings

Wednesday 4 February

Analysts expect Google parent company Alphabet to report that fourth-quarter earnings grew 22.4% to $2.63 a share as revenue increased 15.5% to $111.4bn. Capital expenditure – a key concern among technology and AI investors – is expected to have risen 91.3% to $27.3bn. The Nasdaq-listed tech giant doesn’t typically provide guidance, but is likely to outline its spending outlook for the year, with analysts expecting capex to climb 70.9% to $89.8bn in 2026.

Options markets imply that traders expect Alphabet shares – up 7.3% this year at about $338 – to move by an average of 5.5% in either direction post-earnings. Implied volatility for options expiring on Friday 6 February is around 55%, a figure that could rise ahead of the earnings release and then fall afterwards. The options market indicates support for the stock at $310 and resistance at $350, based on gamma levels. Meanwhile, delta positions indicate traders are leaning bullish. The stock may need to rise above $350 to sustain an upside breakout.

The technical chart below paints a similar picture, with support at $310 and resistance around $340. The stock is in an uptrend, supported by the rising 20-day moving average. However, the chart also reveals the formation of a bearish divergence – a pattern that occurs when the share price rises while the technical indicator, in this case the relative strength index (RSI), falls.

If Alphabet reports better-than-expected results and spending plans are within estimates, a push above $350 is possible. However, if the numbers are in line with analyst forecasts, or if spending soars faster than expected, the stock could come under pressure, potentially sending it below the trend line and the 20-day moving average.

Alphabet Class A [GOOGL] share price, July 2025 - present

![Alphabet Class A [GOOGL] share price, July 2025 - present](/neptune/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fvl2kvsmutclx%2F1y7JaFzgq67g2lyIIU9qcC%2Fa3ca25e458c0697a4afbcbb8d3b60ef0%2Fgoogl_30_1_26.png&w=3840&q=75)

Sources: TradingView, Michael Kramer

Amazon Q4 earnings

Thursday 5 February

Amazon is expected to report that Q4 earnings grew 5.7% to $1.97 a share as revenue jumped 12.5% to $211.3bn, based on analyst estimates. Revenue from cloud computing division Amazon Web Services, closely watched by investors, is forecast to be up 21.1% at $34.9bn. Meanwhile, capex is set to be up 24% at $34.5bn. Looking ahead to Q1, analysts expect overall revenue to grow 12.7% to $175.4bn, and AWS revenue to increase 18.1% to $34.65bn. Capex is seen rising 15.8% to $144.1bn in 2026.

Shares of the e-commerce platform have gained 6.7% year-to-date to reach $241. Options markets imply that the stock could swing roughly 6.4% in either direction after the Q4 earnings release.

Options expiring on 6 February indicate that the stock's implied volatility is around 63.5%. As with Alphabet shares, Amazon’s volatility levels are likely to rise going into the earnings announcement, then dip afterwards. Positioning is bullish, suggesting that the stock may need to rise above $250 to sustain a move higher. A failure to rise above $250 could result in call premiums decaying after the results, as implied volatility declines and hedges unwind.

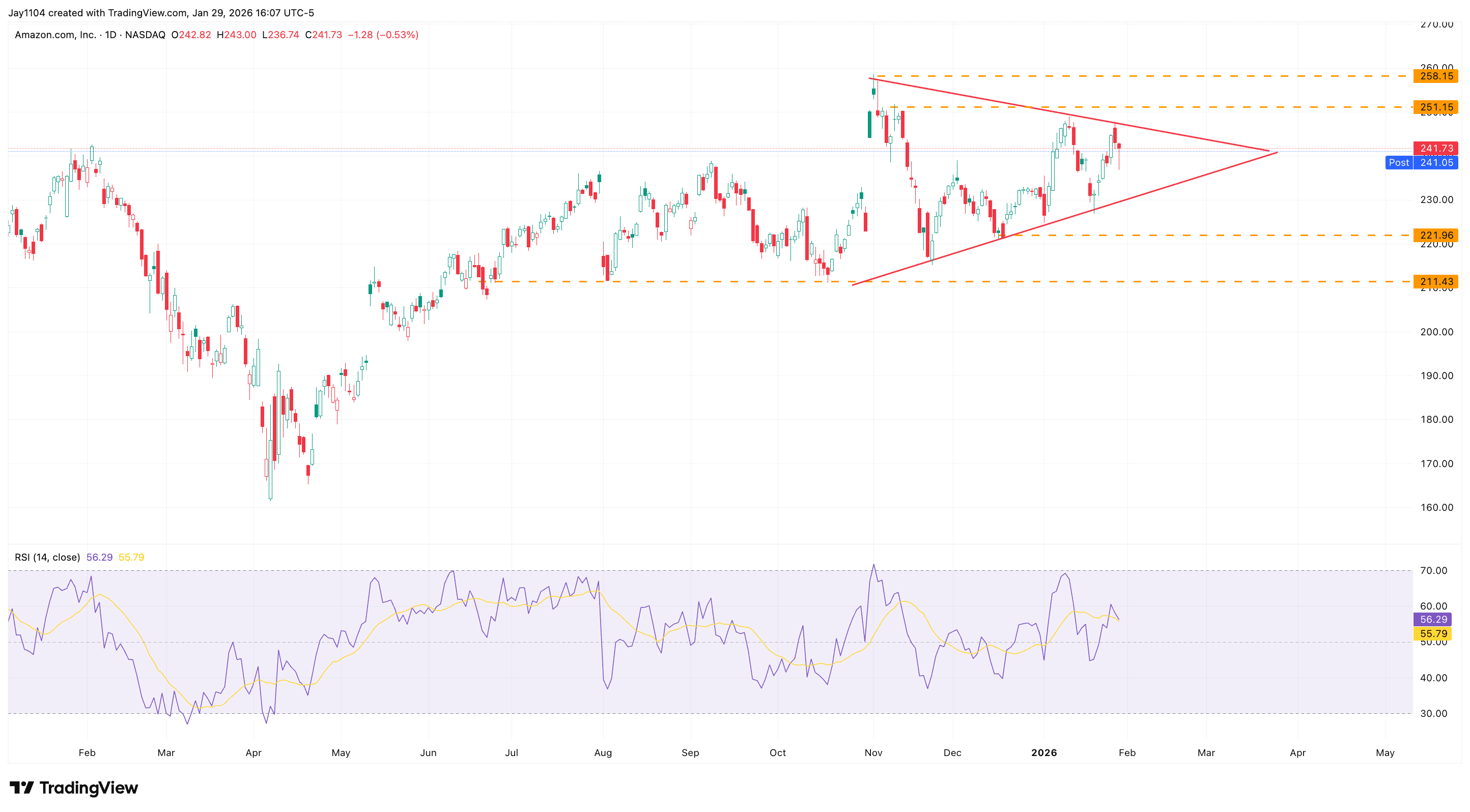

The technical chart below shows the shares in a symmetrical triangle, with resistance around $250 and support around $220. The consolidation over the last few months may reflect indecision among traders, suggesting that an earnings beat could be needed to drive the stock higher, while underwhelming results may send the shares lower.

Amazon share price, January 2025 - present

Sources: TradingView, Michael Kramer

US jobs report

Friday 6 February

Economists estimate that the US added 70,000 non-farm payrolls in January, up from 50,000 in December. The unemployment rate and growth in average hourly wages are expected to remain unchanged at 4.4% and 0.3%, respectively. Any revisions to the December figures will be highly scrutinised. Together, the data will help give the market a better understanding of the strength of the US labour market, with potential implications for the dollar.

Although the dollar has come under pressure of late, it rose on Friday 30 January as Donald Trump nominated Kevin Warsh to be the next Federal Reserve chair. Warsh is thought to be less dovish on rates than some of his rivals for the role.

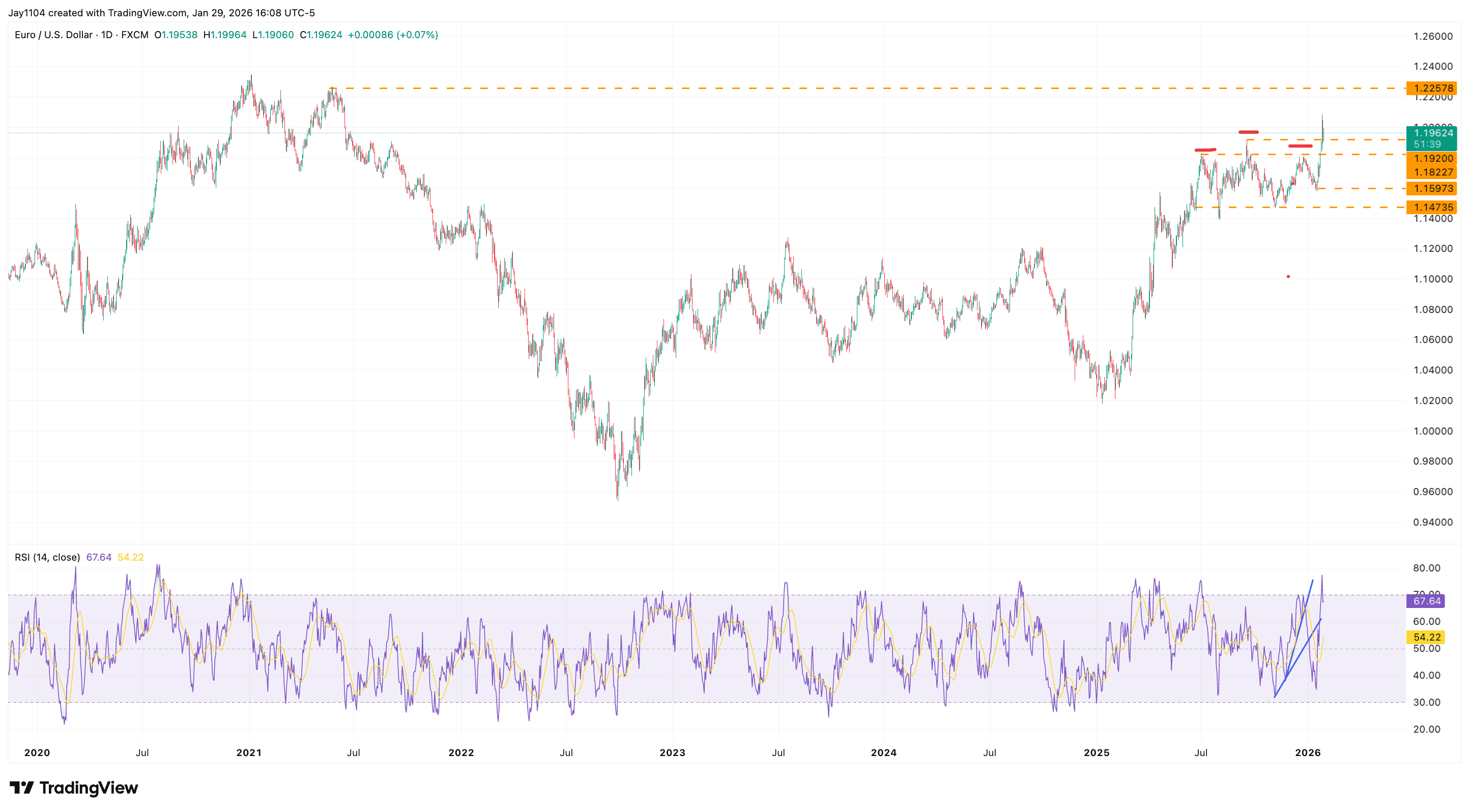

A better-than-expected jobs report could further bolster the dollar against the euro. However, the ECB’s rate meeting on Thursday may also play a role, especially if EUR/USD sustains its breakout above the $1.19 resistance area. If EUR/USD holds above $1.19, there is little to prevent it from rising back towards $1.22.

EUR/USD, January 2020 - present

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Saturday 31 January

China: January NBS purchasing managers’ index (PMI) data

Sunday 1 February

US: OPEC meeting

Monday 2 February

• China: January RatingDog manufacturing PMI

• Germany: December retail sales

• US: January ISM manufacturing PMI

• Results: NXP Semiconductors (Q4), Palantir Technologies (Q4), Walt Disney (Q1)

Tuesday 3 February

• Australia: Reserve Bank of Australia interest rate decision

• Eurozone: European Central Bank bank lending survey

• New Zealand: Q4 employment change, Q4 unemployment rate

• US: December JOLTS job openings

• Results: Advanced Micro Devices (Q4), Amgen (Q4), Eaton (Q4), Merck (Q4), PayPal (Q4), Pfizer (Q4)

Wednesday 4 February

• China: January RatingDog services PMI

• Eurozone: January harmonised consumer price index (CPI)

• US: January ADP employment change, January ISM services PMI

• Results: AbbVie (Q4), Alphabet (Q4), Boston Scientific (Q4), Chubb (Q4), CME (Q4), Eli Lilly (Q4), GSK (Q4), Qualcomm (Q1), Uber (Q4), Watches of Switzerland (Q3)

Thursday 5 February

• Australia: December exports, imports and trade balance

• Eurozone: ECB interest rate decision, December retail sales

• UK: Bank of England interest rate decision

• US: Weekly initial jobless claims

• Results: Amazon (Q4), Bristol-Myers Squibb (Q4), BT (Q3), Compass (Q1), ConocoPhillips (Q4), KKR (Q4), Reddit (Q4), Roblox (Q4), Shell (Q4), Strategy (Q4), Vodafone (Q3)

Friday 6 February

• Canada: January net change in employment, January unemployment rate

• US: January jobs report (including non-farm payrolls, average hourly earnings and unemployment rate), February flash University of Michigan consumer sentiment index

• Results: Cboe Global Markets (Q4), Philip Morris International (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

The Week Ahead: Fed rate decision; Meta, Tesla earnings

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 26 January.