Outlook 2026: The dollar, yen and shifting market dynamics

As part of our series exploring the outlook for key financial instruments and markets in the year ahead, our market analyst Michael Kramer surveys the FX landscape in 2026 and considers what might happen if central banks take different policy paths.

As global monetary policies diverge, we may be heading into more volatile times. The year ahead certainly looks like a step change from the years that followed the Covid-19 pandemic. In that period, governments injected large amounts of fiscal support and central banks cut interest rates, backed by aggressive bond-buying programmes. While this helped stabilise the world’s major economies, it also laid the groundwork for the surge in inflation seen in 2021 and 2022. That, in turn, led to rapid interest rate rises, higher bond yields and a prolonged period of US dollar strength.

As we enter 2026, the picture is changing. Rather than moving in harmony, major economies are now heading in different directions. Japan remains firmly on a path of raising interest rates. In the euro area, improving growth means the European Central Bank may shift from cutting rates to raising them. In the UK, the Bank of England appears close to the end of its easing cycle, even though economic growth remains weak and inflation has proved stubborn. Indeed, we’ve already seen a divergence in central bank policy begin to play out – in the last full working week before Christmas 2025, we got an ECB rate hold, a BoE cut, and a Bank of Japan rate hike.

How much will the Federal Reserve cut rates in 2026?

The United States remains the biggest source of uncertainty. Much depends on the future leadership of the Federal Reserve, with current chair Jay Powell due to step down in May. Even so, markets continue to expect further rate cuts in 2026, most likely two or three, and possibly as many as four. Such a path would normally put pressure on the US dollar.

A weaker dollar could benefit currencies such as the euro , yen and pound , making imports cheaper in those economies and helping to dampen inflation. At the same time, the US itself could face disinflationary pressures, particularly as energy prices continue to fall.

Market indicators support this view. Measures such as two-year inflation-linked swaps in the US have fallen sharply, pointing to cooling inflation expectations. Currency markets are increasingly pricing in stronger European and Japanese currencies against the dollar, alongside a steeper US yield curve as investors anticipate easier monetary policy from the Fed.

Yield curves and market volatility

If short-term US interest rates fall while longer-term Treasury yields remain relatively stable, real yields could rise. That would tighten financial conditions and create a headwind for riskier assets such as stocks.

A more pronounced steepening of the US yield curve, where long-term rates move significantly above short-term rates, would be particularly important. Historically, when the yield curve shifts out of an inverted position towards more normal levels, it has often coincided with periods of market stress or sharp increases in volatility. There is little reason to assume that this pattern will not repeat, especially if the steepening reflects weaker growth expectations and falling inflation.

At the very least, these dynamics point to a bumpier and more volatile market environment in 2026.

The yen could become 2026’s standout currency

Against this backdrop, the Japanese yen may be well placed to strengthen, particularly if the Bank of Japan continues to raise interest rates during 2026. The gap between US and Japanese interest rates has already narrowed, reducing one of the main forces that has kept the yen weak in recent years.

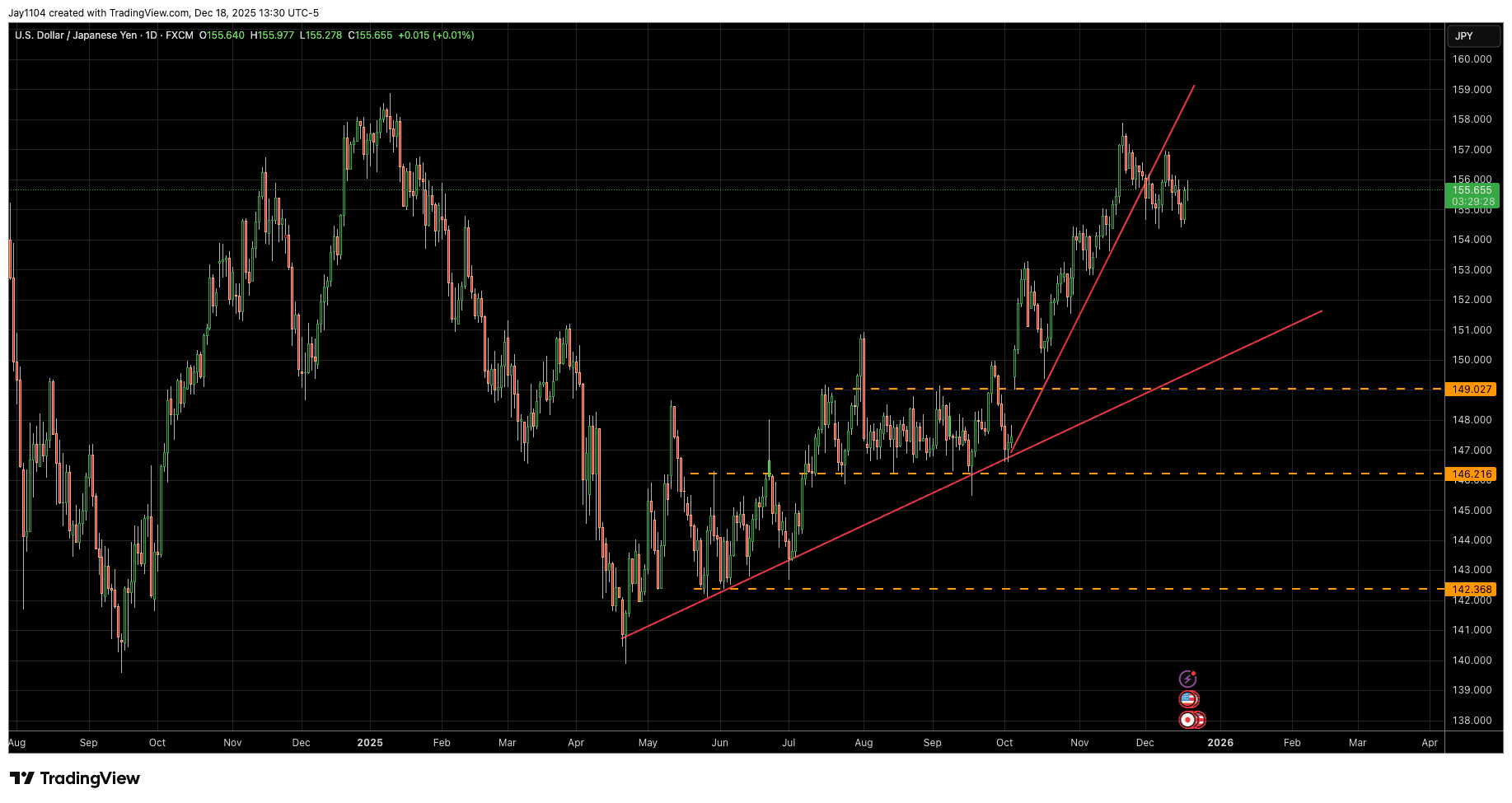

Forward currency markets also suggest room for further gains. Technical signals indicate that the yen could recover gradually at first, before strengthening more decisively. A move back towards ¥142 against the dollar is plausible if momentum builds.

There is also a noticeable gap between where the yen is trading and where interest rate differences suggest it should be. That mismatch could begin to correct in 2026.

USD/JPY, daily chart, 2023-present

Source: TradingView, 18 December 2025

Does gold have more to prove?

Gold’s recent strength sits less comfortably with this outlook. If financial conditions tighten and inflation expectations continue to fall in the US, the case for higher gold prices becomes less clear.

Gold is often seen as protection against inflation or currency debasement. However, falling inflation expectations challenge that narrative. It raises the possibility that gold has been rising for other reasons, or that prices have been driven higher by positioning rather than fundamentals.

A weaker dollar can support gold, but it would also typically lift oil prices, which has not happened. Oil is currently trading at its lowest levels since 2021. If inflation fears are not the main driver, gold may need a new justification to sustain recent gains as 2026 unfolds.

A more difficult year for risk assets

Predicting the year ahead is never straightforward, particularly in a world shaped by shifting policies and geopolitical uncertainty. What does seem clear is that the market environment in 2026 is likely to look very different from that of 2025.

Historically, a strengthening yen has often been associated with more cautious investor behaviour and the unwinding of the yen carry trade, a popular borrowing strategy. When combined with a steeper yield curve, falling inflation expectations and higher real interest rates, this points to a more challenging backdrop for risk assets and a higher likelihood of market volatility in the year ahead.

The Week Ahead: Cisco earnings, UK growth, US inflation

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 9 February.

USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.