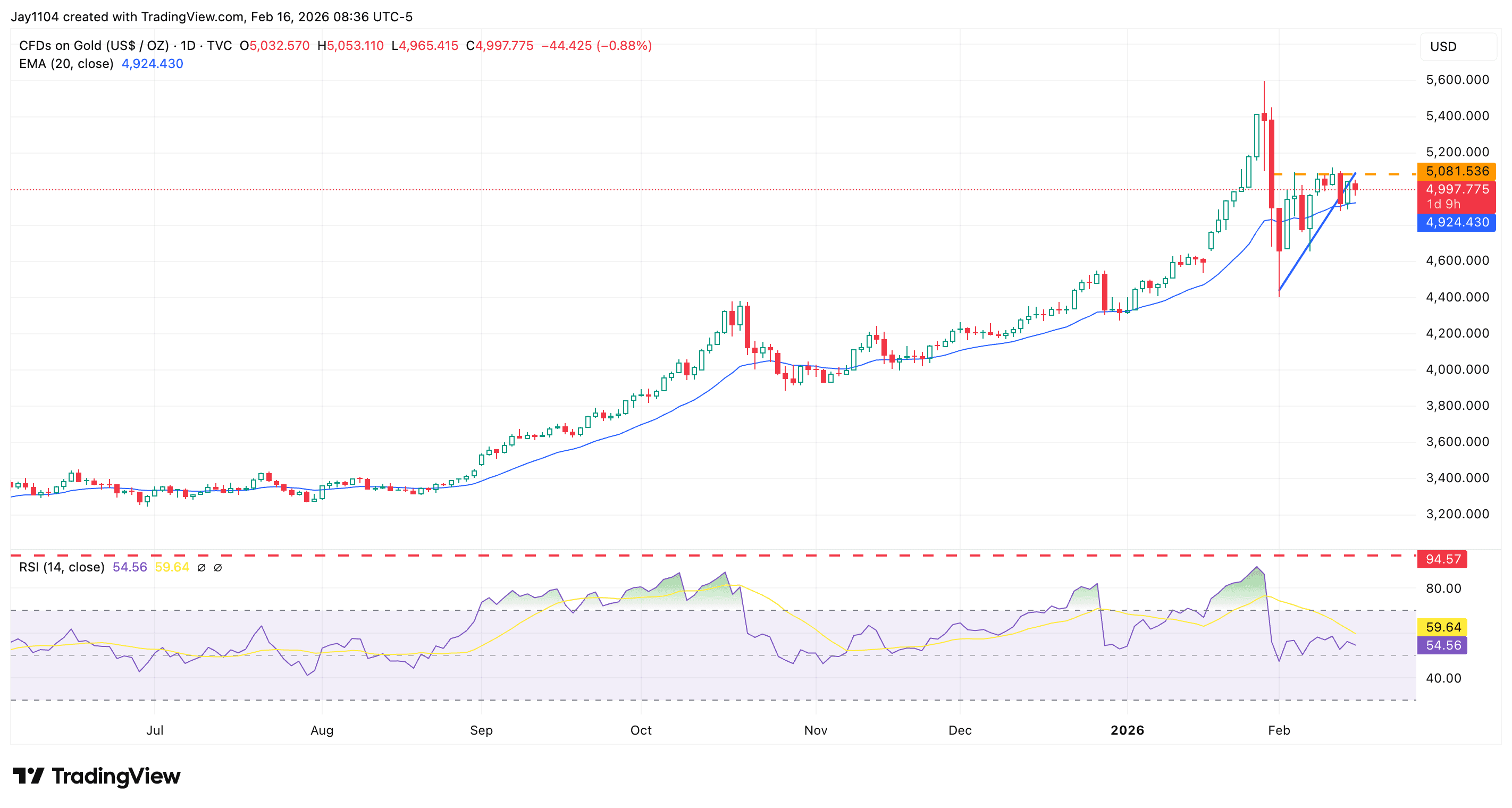

Gold struggles at $5,000 as momentum fades

Gold has been consolidating below $5,000 since the beginning of February and, despite several strong attempts to break through that psychologically important level, has been unable to do so. A breakout above $5,000 would be extremely important and would likely push gold higher toward the highs around $5,400. However, that outcome is increasingly unlikely.

Momentum signals turning lower

Momentum in gold, as measured by the Relative Strength Index, may be turning bearish, suggesting that gold has lost significant bullish momentum in February. At this point, the RSI is struggling to remain above 50, a level that often separates bullish and bearish momentum.

Additionally, after being firmly above the 20-day exponential moving average, gold has been oscillating around it and now appears to be using it as support, wedged between the moving average and the $5,000 resistance level.

Source: TradingView, 16 February 2026

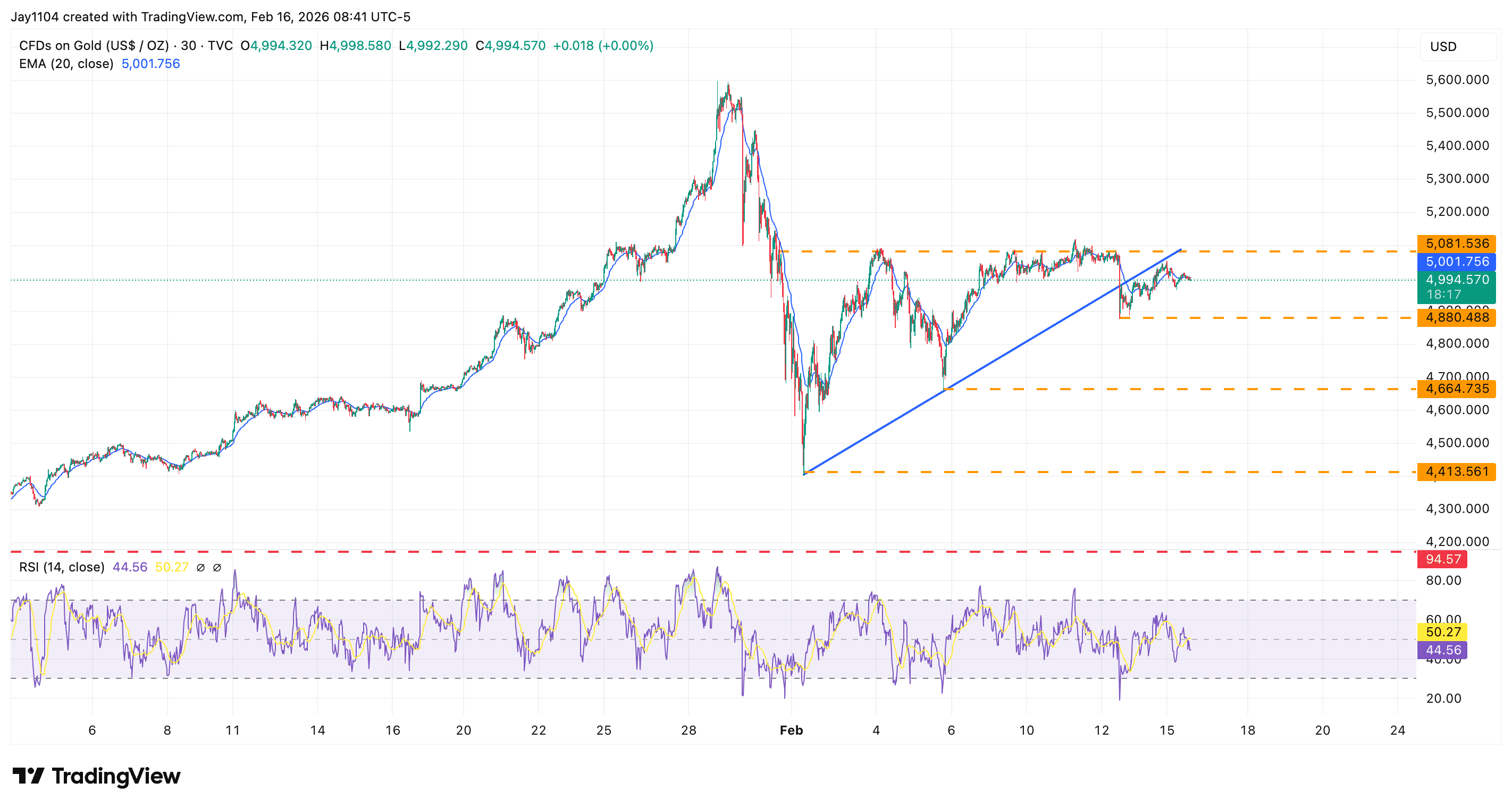

Short-term structure weakens

The 30-minute chart shows that gold had been forming what appeared to be a bullish ascending triangle, but it now appears to have fallen below that uptrend. That former uptrend is now acting as resistance, and the price has failed to push back above it after several attempts.

Key support levels in focus

Gold has several levels that could act as support should it begin to break down: $4,880, $4,660, and $4,420. Each price point marks an important low for gold over the past month. If gold is to make a bullish move above $5,000, it will need to do so soon; otherwise, it appears at greater risk of heading lower, not higher.

Source: TradingView, 16 February 2026

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.

Precious metals: purge on COMEX and retail investors stand firm

Following steep recent falls in gold and silver prices, the market has gone through what can be described as a “purge” of speculative positioning on derivatives markets – particularly on COMEX. The drop in prices has effectively wiped out the high level of speculative net positions that had previously shown extreme greed.

DAX back above 25,000 points – Wall Street turns, Fed minutes and US economic data in focus

The recovery on Wall Street has lifted the DAX back above the 25,000-point level, with investor attention now on upcoming economic data and the minutes from the most recent meeting of the United States Federal Reserve (Fed).