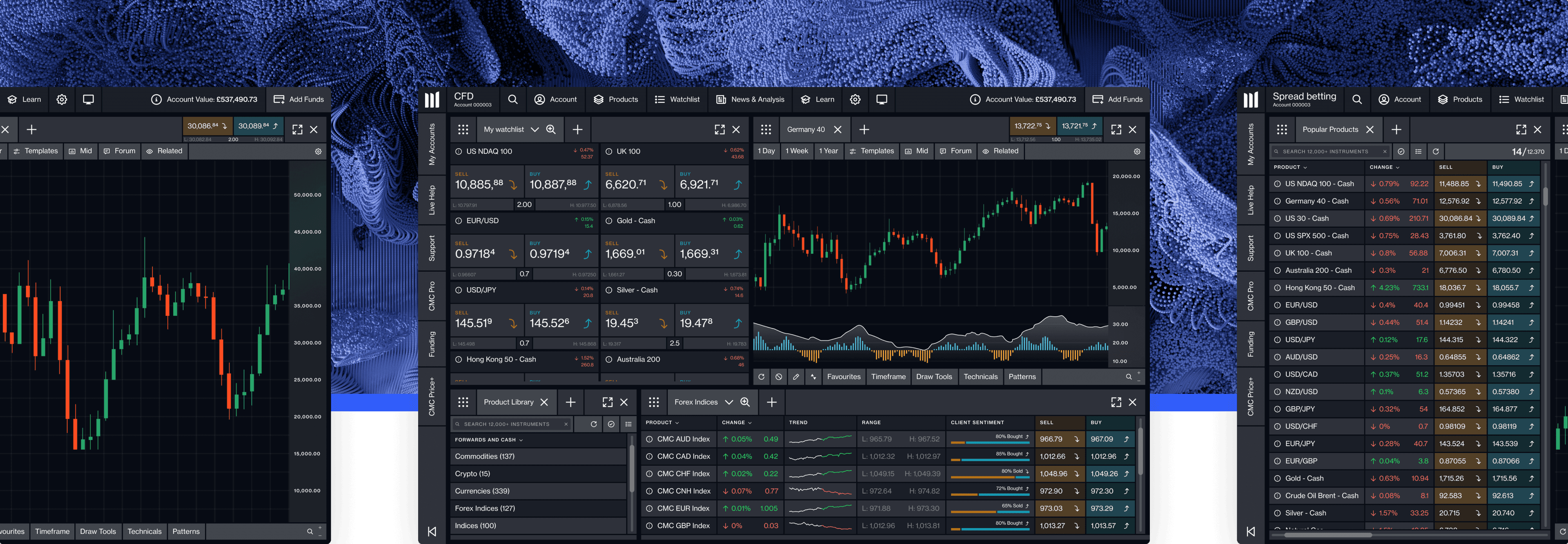

Spread betting vs CFD trading

Although spread bets and contracts for difference (CFDs) share some similarities, there are also important differences between them. Here we'll help you to understand the key differences between these two forms of financial derivative trading, and we'll also explore their potential benefits and risks to help you decide which product might be right for you.

Main similarities between spread bets and CFDs

Spread bets and CFDs are both financial derivatives, so called because the value of these products is derived from an underlying asset. When you trade these products, you do not take ownership of any assets in the underlying market. Instead, traders of these products speculate on whether the value of an underlying asset is going to rise or fall in the future.

Traders buy or 'go long' when they expect the underlying asset to increase in price, and they sell or 'go short' when they expect the asset to decrease in value. They make a profit if the market moves in their favour, and they incur a loss if the market moves against them.

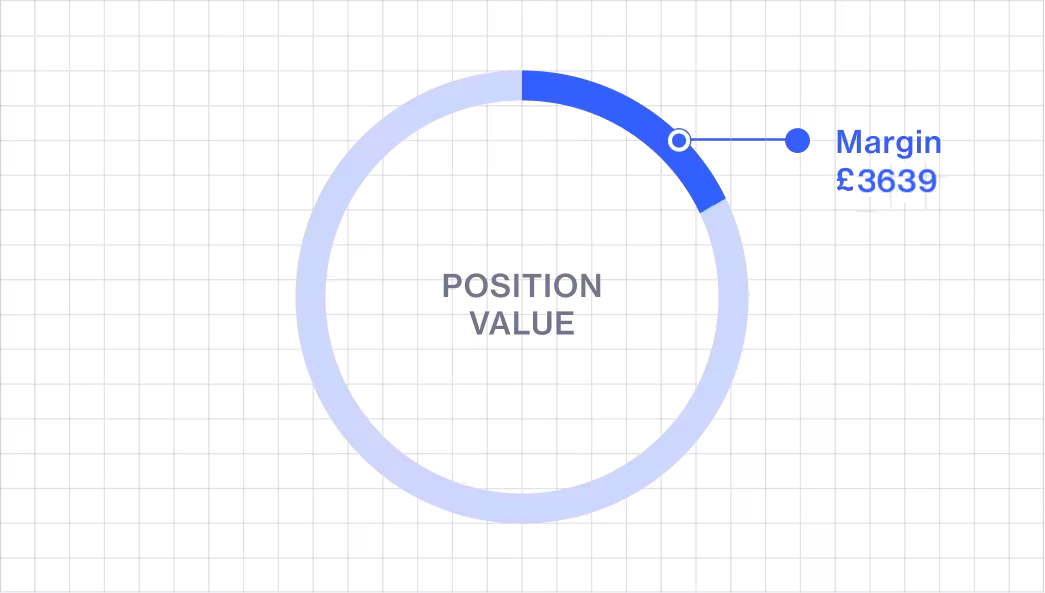

Spread bets and CFDs are also leveraged products, which means you deposit the margin (a fraction of the trade’s full value) while we put up the rest of the full notional value of the position.

Leverage increases your market exposure, potentially enhancing your profits. However, it's important to remember that leverage amplifies potential profits and losses equally, and you could lose all of your capital. It's therefore essential that you understand the risks of spread bets and CFDs before you start trading. If necessary, seek independent professional advice before placing any trades.

View our dedicated pages on spread bets and CFDs to learn more about each product.

Main differences between spread bets and CFDs

The biggest difference between spread bets and CFDs is how they are taxed. They also differ in terms of where they're available and how they're priced:

Taxation: Both spread bets and CFDs are exempt from stamp duty as neither product involves ownership of underlying assets. The point of difference between the two products relates to capital gains tax (CGT). Spread bets are free from CGT, but profits from CFD trading are subject to CGT1.

Regional availability: Spread betting is available only in the UK and Ireland, whereas CFD trading is available in many countries, including the UK (where CFDs originated), Australia, Belgium, Canada, Denmark, France, Germany, Italy, the Netherlands, New Zealand, Norway, Singapore, South Africa, Spain, Sweden, and Switzerland, among others. Neither product is allowed in the US.

Currency: When you spread bet, you trade in your local currency. But with CFDs, you trade in the currency of the underlying market, potentially exposing you to foreign exchange (FX) risk.

Spread betting vs CFDs: Trade example

Now let's compare a spread bet and CFD trade on the same financial instrument. For this example we'll use the UK 100 - Cash, which is based on the FTSE 100, the UK’s benchmark stock index that tracks the performance of 100 leading British companies.

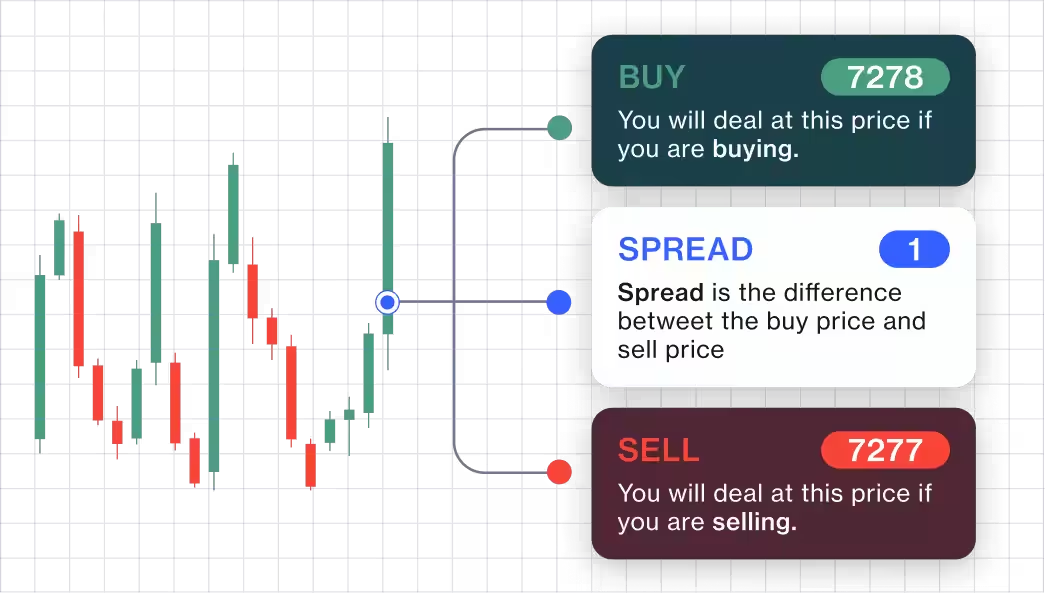

Whether you trade on the UK 100 via a spread bet or CFD, certain aspects of the trade will be the same. These include the sell price, the buy price, the spread (the difference between the sell price and buy price), and the margin rate (the percentage of the full value of the trade that you need to put up to open a leveraged trade). For the purposes of this example, let's assume the following:

Sell price = 7,277

Buy price = 7,278

Spread = 1

Margin rate = 5%

Let’s suppose you think the price of the UK 100 (and the underlying asset on which it's based) will rise, so you open a 'buy' position:

The UK 100 has a margin rate of 5%, which means you deposit 5% of the total value of the trade to open a position. Whether spread betting or trading CFDs, your deposit would be the same:

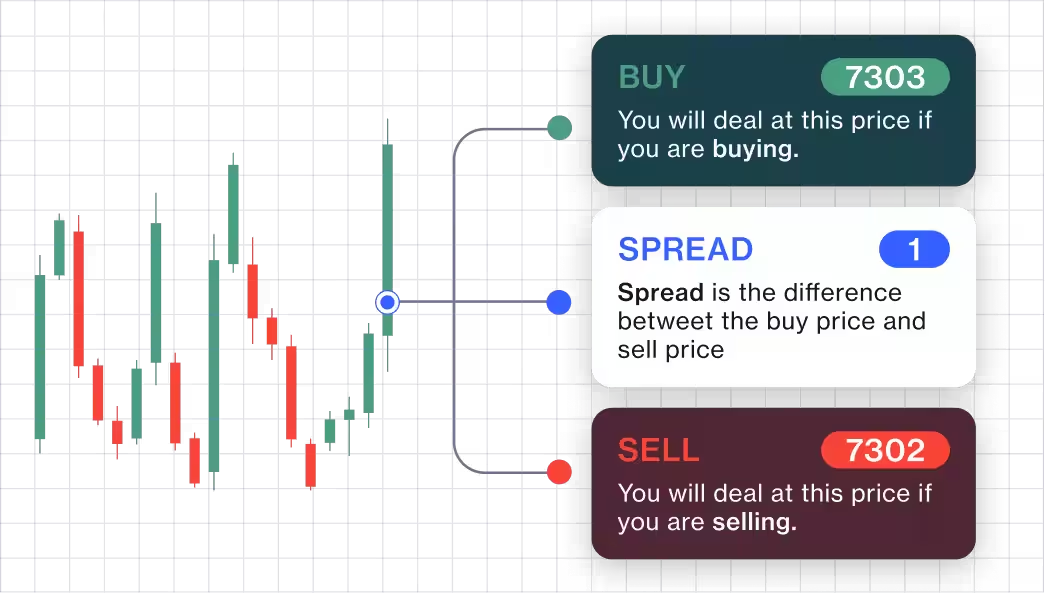

After you place your trade, the UK 100 rises by 25 points. The sell price is now 7,302 and the buy price is 7,303. Your prediction that the index would rise in value proved to be correct, so you decide to close your profitable trade by selling at the new sell price of 7,302. Again, whether spread betting or trading CFDs, your profit would be the same:

What about taxes and fees? Here, you may find a few differences between the two products:

View our spread betting and CFD trading costs.

Spread bets or CFDs: Which is right for me?

Spread bets vs CFDs: In-depth comparison

In trading, the spread is the difference between a financial instrument's buy price and sell price. The buy price is typically higher than the sell price. The spread can widen or contract depending on market conditions. Read more about calculating the bid-ask spread.

Spread betting is available for customers in the UK and Ireland only. However, contracts for difference (CFDs) are available to trade in many countries.

Spread betting profits are free from capital gains tax, and there's no stamp duty to pay because you're not buying and selling any underlying assets. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Yes, leverage works in the same way for spread bets and CFDs. Traders use leverage – essentially a loan from a broker – to increase their market exposure and potentially enhance their profits. When you open a leveraged trade, you deposit the margin (a small portion of the full value of the trade) while your broker puts up the rest. It's important to remember that leverage amplifies potential profits and losses equally.