Top 10 NFT stocks to add to your watchlist

NFTs and NFT stocks are a growing field, with investors still figuring out where they can get in on this emerging digital world. NFTs, or non-fungible tokens, are essentially one-of-a-kind items that are supported by the blockchain — where information such as who owns the token and who created the work is stored. Here, we'll discuss some of the top NFT stocks for those looking to capitalise on this new asset class.

What are NFTs and why should I care?

NFT stands for non-fungible token, and for the most part, these tokens take the form of trading cards or digital art, such as the Beeple artwork Everydays: The First 5,000 Days, which was sold by auction house Sotheby’s for $69m.NFTs are also unique items that can't be replaced by something else. By comparison, a share of stock is fungible because a company issues millions of shares all the same. One share of Apple common stock is like another. But if you buy an NFT, it is unique and the specific data relating to the token is stored on the blockchain (normally on the Ethereum blockchain).NFTs include digital information, including who the creator is and who the owner is. When buying an NFT, it is possible to support the artist directly at every sale, whereas when physical art is sold through galleries, the artists tend to get a cut of the initial sale price and no benefit from subsequent sales.Major brands, including Marvel, Adidas, and many more have launched their own NFTs. It is a new asset class, with lots of interest and large amounts of money being exchanged. That's why investors care. Digital art can be bought as a passive investment, or it can be traded like a stock.Here are several companies working in the NFT space to keep any eye on. While these stocks are linked to NFTs, they are still stocks, so learn how to invest in stocks before purchasing.

10 NFT stocks to watch

DraftKings [DKNG]

The fantasy sports and betting company has entered the NFT space by launching an NFT marketplace focused on sports and athlete-related digital art and media. While NFTs may not replace traditional trading cards, NFTs have a place alongside them. Investors and traders can buy exclusive pieces of digital art related of their favourite athletes, or NFTs they believe will appreciate in value a bit like baseball cards. Buying and selling is done seamlessly in the marketplace, and since the NFT stores information, each investor knows what they are getting, which should reduce the instance of frauds or fakes.

PLBY Group [PLBY]

Playboy has entered the NFT space, partnering with Miami Beach Art Collection, as well as many artists, to bring a wide array of NFTs to market. The NFTs are based on both old photographs and new art. With almost 70 years of photographic history, the company has the potential to produce a ton of content, monetising both on traditional platforms as well as with NFTs.

Funko [FNKO]

Funko produces, markets and sells pop culture toys and other products. Popular products include bobbleheads and Pop! figurines. They have agreements with major leading media franchises including Marvel, DC and Star Wars, as well as the professional sports franchises. And they are now selling products as digital art, such as Pop! images of Bob Ross, the famous television painter. The NFTs present a new stream of revenue for the company.

Cinedigm [CIDM]

Cinedigm is in the movie and entertainment business already, but has moved into the NFT space with Fandor Selects. This division of the company produces NFTs of classic films. In addition, the company produces trading-card NFTs based on popular classic films. The firm offers several subscription “channels", such as Screambox, which is a horror movie subscription app. These channels, and their content, may also eventually be used to create additional NFTs.

Hall of Fame Resort & Entertainment Company [HOFV]

The company has a hotel, bar, and the Hall of Fame Village close to the Pro Football Hall of Fame in Canton, Ohio. This company has entered the realm of NFTs by offering digital art of great moments in football history. The NFT series is called “Playbooks” and offers buyers exclusive perks like signed memorabilia and events with players.

Dolphin Entertainment [DLPN]

This media production company recently launched a division focused on NFTs. It has a partnership with Hall of Fame Resort & Entertainment Company (above) to bring to market the Playbooks NFT series. The firm now labels itself as a PR company, leveraging its own brands and helping other companies bring their entertainment visions to life. The company has launched its own “multi-season” NFT event/story line called Creature Chronicles: Exiled Aliens.

ZK International [ZKIN]

This Chinese steel company launched an NFT marketplace called MaximNFT, in partnership with Maxim magazine. The site offers targeted advertising, where NFT creators can purchase advertising to highlight their work to prospective buyers. The company sponsored NFT.NYC, an event that took place in New York in November of 2021.

Takung Art [TKAT]

Takung is a Hong Kong-based art platform that brings together artists, dealers and investors. It enables fractional ownership of physical artworks. Investors got jumpy in mid-2021, pushing the stock up more than 2,000% before it came crashing back down. The stock’s price rise was based on speculation the company would get involved in the NFT space. So far, that hasn’t happened, but fractional ownership of NFTs is a thing. Takung could offer that service as a potential revenue stream if they choose to do so, capitalising on their existing market and clients.

Cloudflare [NET]

Cloudflare provides digital infrastructure and security services. It’s not a direct NFT play, but NFT owners can use Cloudflare’s Stream service to embed their claim of ownership for videos on the serverless video streaming platform, which is one of the few that support embedded NFTs. This gives Cloudflare a competitive advantage, as those using NFTs are more likely to use its service to stream videos. This could increase revenues for the Stream service, which has a monthly cost based on use.

eBay [EBAY]

eBay has started to allow NFT sales on its marketplace, mainly in traditional currencies. This allows people who are not necessarily crypto enthusiasts or crypto holders to purchase NFTs. Many other platforms only allow NFT payments in cryptocurrency. Whether NFTs significantly add to eBay’s bottom line is yet to be seen, but, even if NFTs add only a bit of extra revenue to the already massive company, that is an achievement. The company does not currently accept cryptocurrencies for payment, but has said it may do so in the future. In the same statement, eBay said it was looking into ways to get NFTs on the platform. The company has already acted on NFTs, so cryptocurrencies could be next.

An example of one of the most expensive NFTs sold to an owner is the Everydays: the first 5000 days collage, which includes 5,000 works by the artist Beeple. It sold for $69.3m. Another example is The Merge by the artist Pack, which raked in over $91.8m from roughly 30,000 collectors, who each own a stake in the NFT. Making money on NFTs, traditional art, or stocks requires investing strategies, and learning some of these is the best bet for long-term success.

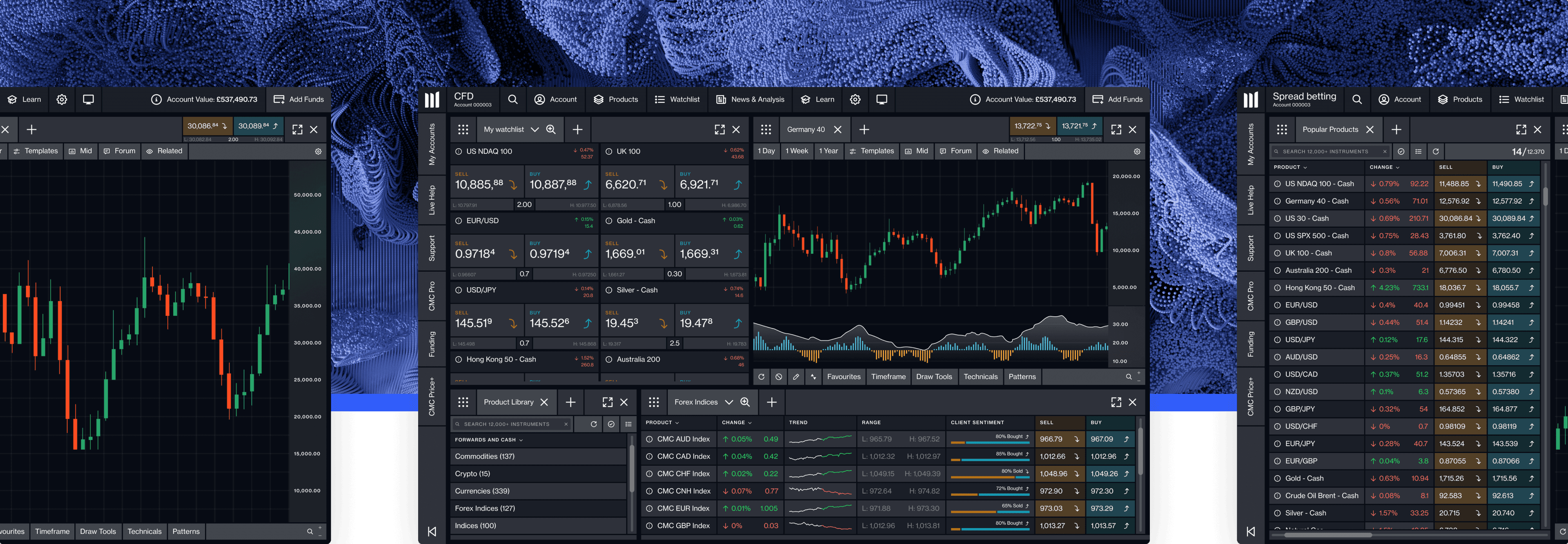

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.