The 10 largest economies in the world

Global trade has been a popular activity for centuries, allowing some of the richest and most powerful countries in the world to interact. Economists have divided the economy into three sectors of activity: extraction of raw materials, manufactures and services, according to the three-sector model. These are all very different and provide each country with a different avenue of profit for which they are best known in the financial markets.

The top 10 economies in the world contribute approximately 66% of the global economy, and the top 20 economies contribute approximately 79%, meaning that the remaining majority of the world's countries only equate to approximately 20% of the total global economy. This shows the immense power of the 10 richest countries listed in this article and their influence on global economic decisions. Read on to discover some of the world's top financial stocks that can be traded on our Next Generation trading platform, including global stocks, indices, currency pairs, treasuries and commodities. This information is current as of May 2021.

Most of the world's richest countries have strong trade ties with other competing nations, as this is essential for global growth. This involves the interaction of currencies, stock markets, and commodities that are valuable to both buy and sell. There are stock exchanges in every major region of the world, and often multiple exchanges per country. Unsurprisingly, the five major exchanges are based in New York, Tokyo, London, and Shanghai, all global centers of the world economy.

Technically, the European Union has the world's second largest economy, with a combined nominal GDP of $18.7 trillion. However, it is recognized as a political union and not a separate country; for this reason, it is not included in this list.

How to measure a country's economy

The easiest way to measure a country's economy is through macroeconomic indicators, including the most popular ones listed below. These are important for measuring economic growth, inflation rates, and local currency exchange rates.

World Economic Indicators

Gross domestic product (GDP): the broadest indicator of overall economic activity.

Unemployment Rates: The higher the unemployment rate, the lower the demand for goods and services.

Consumer Price Index (CPI): The main measure of inflation in a country at both the consumer and producer levels.

Purchasing Power Parity (PPP): A measurement of prices in different countries to compare the purchasing power of each currency against the other.

Economic news trading

The world’s largest economies regularly update their performance by releasing new data for economic indicators such as unemployment, GDP, and industrial production. If this release of new economic information is better or worse than expected, it gives traders the opportunity to speculate on future economic and monetary conditions for that country and the resulting impact on asset prices. For example, let’s say new unemployment data is released in the United States and it is worse than expected. Traders will likely speculate that the economy is weaker than previously thought and that the central bank will potentially cut interest rates in an attempt to boost economic activity, which in turn will hurt the value of the dollar or boost bonds and stocks.

Traders can profit by speculating on these economic releases. If you want to try trading the economic news, check out our economic calendar, open a free demo account, and try trading the economic news in a risk-free environment. A demo account gives you access to our institutional-grade trading platform and €10,000 of virtual funds to practice with. Get your free demo account here .

The richest countries in the world

These statistics are from the International Monetary Fund, based on 2021 estimates. The two statistics reflect nominal GDP and GDP using PPP. The latter takes into account a country's inflation rates, as well as the relative costs of goods and services, rather than simple market exchange rates. However, nominal GDP is more commonly used to represent the overall figure of a country's economy. Open an account to start trading global assets, including stocks, indices, currencies, and more.

1. United States

Nominal GDP: $22.66 trillion

GDP (PPP): $22.68 trillion

The United States has held the position of the world's strongest economy since 1871, having surpassed the United Kingdom at that time. The United States dollar (USD) is one of the strongest currencies in the world and the most popular currency to trade overall. It is often a component of major forex pairs, including some of the most widely traded currency pairs , such as EUR/USD, USD/JPY, and GBP/USD. For this reason, some traders consider the US dollar a "safe haven" currency and seek to hedge the currency in times of political or economic uncertainty.

Additionally, the United States is home to some of the world’s largest and most capitalized companies, including blue-chip companies in a variety of industries such as Amazon (e-commerce), Microsoft (technology), Coca-Cola (consumer goods), Visa (financial), and Johnson & Johnson (healthcare). All of these companies are included in the Dow Jones Industrial Average stock index, which is comprised of 30 blue-chip companies that serve as a benchmark for industry standards. The New York Stock Exchange (NYSE) and NASDAQ are the world’s largest stock exchanges by market capitalization.

The United States is the world's largest supplier of crude oil, accounting for about 18% of global production. It surpassed Saudi Arabia as the number one country in 2013. Some of the world's largest oil stocks by market capitalization are headquartered in the United States, including Exxon Mobil , BP (shared between the United Kingdom and the United States), and Chevron . Many oil platforms are located in the Gulf of Mexico and neighboring states, including Texas and Louisiana.

2. China

Nominal GDP: $16.64 trillion

GDP (PPP): $26.66 trillion

Although China's purchasing power parity is a higher number, its nominal GDP is significantly lower than that of the United States, leaving it in second place among the world's richest countries. However, many consider PPP to be a more indicative and truthful representation of the economy, as it takes price inflation into account. China is the world's largest manufacturing and exporting economy of goods, as well as the largest country in international trade. The gap between the overall nominal GDP of the United States and that of China has narrowed significantly in recent years, and market analysts predict that China will one day surpass the United States in both nominal GDP and PPP aspects.

The Chinese tech industry is particularly popular among traders, as it is home to some of the world's largest and most blue-chip companies, including Alibaba, JD.com, and Baidu. Our China Tech Stock Basket allows you to trade multiple Chinese tech stocks with just one position. Additionally, China is a major contributor to the 5G industry, as well as gaming, streaming services, and mobile phone development.

In terms of agriculture, China has the world's largest agricultural economy, accounting for about 10% of the country's GDP, compared to other developed countries on this list, including the United Kingdom and the United States, where agriculture only accounts for about 1% of their national GDP. This makes China a jack of all trades in terms of global exports.

3. Japan

Nominal GDP: $5.38 trillion

GDP (PPP): $5.59 trillion

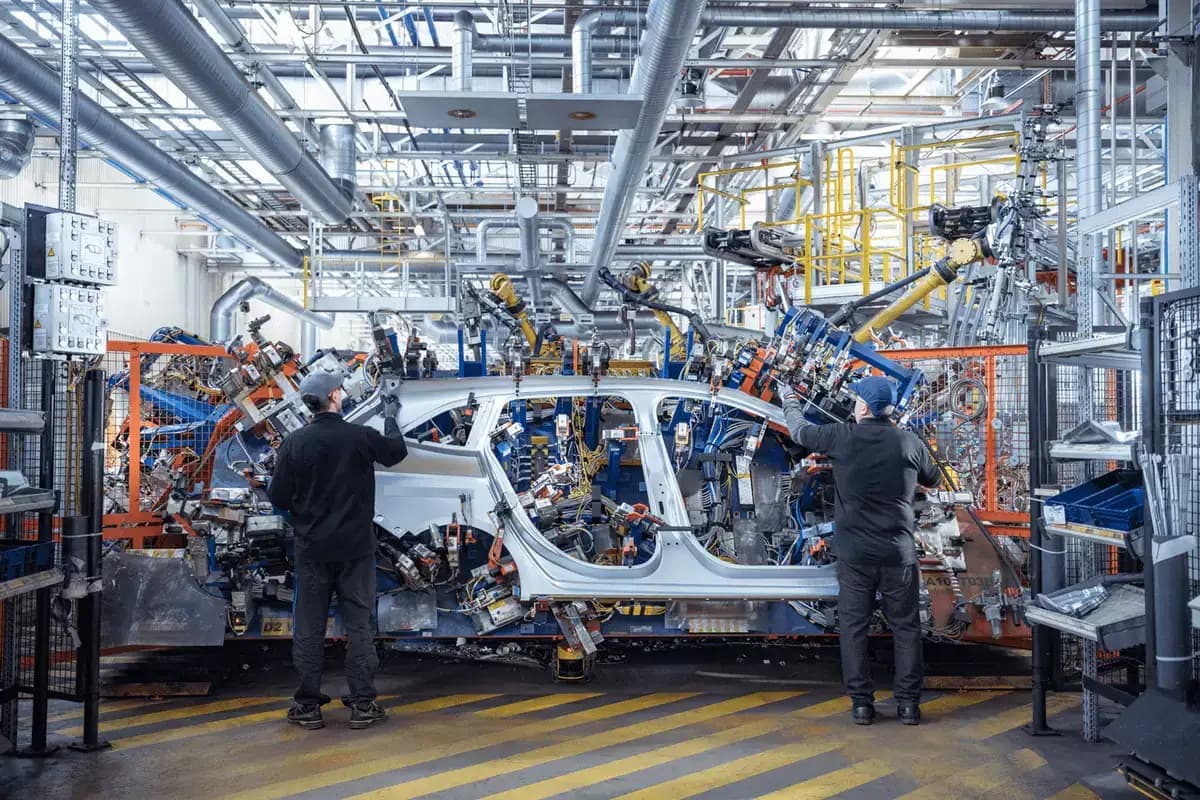

Japan is known for its thriving automotive industry, with major brands such as Mitsubishi, Toyota, Honda, Suzuki and Nissan contributing a large portion of profits. The Japanese equivalent of the Dow Jones 30 is the Nikkei 225 stock index , which is a benchmark of the blue chip companies in the Japanese economy. These are all listed on the Tokyo Stock Exchange, as well as being available internationally. The index features a range of stocks from different sectors, including technology, transportation, consumer goods and finance. You can invest in the Nikkei 225 through a range of exchange-traded funds (ETFs) . The Daiwa ETF - Nikkei 225 and the iShares Nikkei 225 ETF are both available to trade as CFDs on our online trading platform.

Japan has one of the lowest unemployment rates in the world, at just 2.3%. However, it also has the highest number of elderly people of the entire world’s population, which economists fear could negatively impact Japan’s economic growth in the future. Therefore, the Japanese government is working to keep the elderly population more active and increase the fertility rate, so that the economy is not affected. Despite this, the Japanese yen (JPY) is one of the most traded currencies in the world, along with the USD/JPY currency pair . The JPY has an inverse correlation with the Nikkei 225 index, meaning that when stocks are doing well, the yen appears weaker, prompting traders to invest in the safe haven JPY when their stock portfolio is in trouble.

4. Germany

Nominal GDP: $4.32 trillion

GDP (PPP): $4.74 trillion

Germany is the leader of the largest European economies and relies heavily on the export of high-quality manufactured goods. There are a variety of sectors represented within the German stock market. The DAX 40 is also an equivalent of the Dow Jones 30 stock index, which contains 40 blue-chip stocks from the Frankfurt Stock Exchange, which is the tenth largest stock exchange in the world by market capitalization. Adidas , BMW , Deutsche Bank , Merck and SAP are just a few of the established names that make up the DAX 40 stocks.

You can trade CFDs on the price movements of underlying shares on our platform, Next Generation , without taking ownership of the actual asset. This involves the use of leverage . Alternatively, you can also trade on the price movements of exchange-traded funds; one of our top ETFs that tracks the underlying German index is the iShares Core DAX UCITS ETF.

In addition to a successful stock exchange, the German treasury market contributes to its role as one of the world's largest economies. Its debt securities and government bonds have maturities of about 10 to 30 years and are considered medium- and long-term bonds. The German bond index reflects U.S. Treasury bonds. These include the long-term Euro Bund , the medium-term Euro Bobl , and the short-term Euro Schatz bonds .

5. United Kingdom

Nominal GDP: $3.12 trillion

GDP (PPP): $3.17 trillion

The UK has one of the most globalised economies in the world and international trade plays a major role in the economy. The services sector contributes around 80% of overall GDP, with a particular focus on the banking and finance sector as the UK is the world's second largest financial centre, after New York. The UK's central bank is the Bank of England, which is responsible for setting interest rates and maintaining a stable cost of living across the nation. You can trade on the share price movements of some of the UK's leading banks, including Barclays, HSBC and Lloyds, with our new UK Banks stock basket.

A leader in the aerospace industry, the UK has helped develop many popular aircraft models in collaboration with foreign manufacturers, such as Boeing and Airbus . The pharmaceutical industry is also very important and has contributed to research and development, retail, prescription drugs, and the development of vaccines in times of medical emergencies. Some of the best UK pharmaceutical stocks right now are GlaxoSmithKline (GSK) and AstraZeneca.

One of the most popular stock indices in the world for trading is the FTSE 100, which consists of the top 100 British companies by market capitalization. This index represents the best-performing stocks in the United Kingdom, including those mentioned above. This index helps position the United Kingdom as the fifth richest country in the world, overtaking India for the spot at the start of 2021.

6. India

Nominal GDP: $3.05 trillion

GDP (PPP): $10.21 trillion

Although India is sixth on this list, it is actually third in terms of PPP ranking. India has the fastest growing economy in the world and has increased in size sixfold since 2000. It is described as a developing market economy, as it tends to depend on supply and demand from other countries.

India is one of the world's largest suppliers of raw materials, with 66% of the population working in agriculture and food production. This includes milk, fruits and vegetables, seafood, rice, wheat , livestock , sugarcane and cotton . India contributes to the world economy in terms of textile production, natural resources, coal, cement, automobiles, and is a major exporter of crude oil and natural gas . Read our guide on how to trade commodities to find the best investment strategies in our selection of commodities. You can also trade CFDs on our commodity indices , which contain multiple assets from the same sector in a single trade. These include an agricultural index and a precious metals index .

7. France

Nominal GDP: $2.94 trillion

GDP (PPP): $3.23 trillion

In addition to being the most visited tourist destination in the world, France has a high GDP per capita, which means that there is a high standard of living in the country. France relies heavily on tourism revenue for its growing economy, but it is also a world leader in the chemical, pharmaceutical, and automotive industries. In particular, Sanofi is the fifth largest pharmaceutical company in the world, Groupe PSA is the sixth largest automaker in the world, and TotalEnergies is one of the seven largest oil companies in the world. These large-cap stocks offer promising returns in the stock market.

France has a particularly large agricultural presence in global markets, accounting for one-third of Europe's agricultural land. It is known for producing high-quality products, including cheese, wine, poultry, dairy products, and grain, which are major exports. Around 90 million tourists visit France each year to experience its beautiful culture and standard of living, and tourism accounts for about 10% of nominal GDP, as well as supporting about 11% of domestic employment.

8. Italy

Nominal GDP: $2.11 trillion

GDP (PPP): $2.61 trillion

The Italian economy is divided between the north and south of the country. The highly industrialized north contributes the majority of the country's economy, while the south appears less developed with higher levels of poverty and a much higher unemployment rate. Following the 2008 financial crisis, the unemployment rate began to rise, reaching 12.7% in 2014, affecting the younger generations in particular. However, this figure has managed to decrease to an average of 9.9% in 2019, which is a significantly lower rate.

Italy is the largest luxury goods hub in Europe and the third largest in the world. Their manufacturing sector includes many small and medium-sized businesses within Italy's "industrial triangle": Milan, Turin, and Genoa. These can be promising in terms of growth, and when trading small and mid-cap stocks, traders may want to take a look at the company's fundamentals to see if they will be a good investment. The northern regions of Italy tend to reflect the automotive, aerospace, and other technical industries, while the southern regions usually focus on more family-run businesses, as well as the production of textiles, tools, and raw materials.

9. Canada

Nominal GDP: $1.88 trillion

GDP (PPP): $1.98 trillion

Canada is famous for its precious metals mining and is home to some of the world's largest gold producing companies, which has had a huge impact on its overall economy. Goldcorp was once the world's largest gold supplier, before merging with US-owned Newmont Corporation in 2019, resulting in the rebranding of Newmont Goldcorp Corporation . Barrick Gold , Yamana Gold , and Kinross Gold , along with other Canadian gold stocks, are all listed on major international exchanges and available for trading on our platform.

Canada has one of the best employment rates in the world, with an average annual unemployment rate of around 5-6%, although this has risen significantly since the COVID-19 pandemic. This is partly due to its preeminence in the service and manufacturing sectors, as supply and demand are constantly growing, along with job opportunities.

10. South Korea

Nominal GDP: $1.81 trillion

GDP (PPP): $2.44 trillion

South Korea surpassed Brazil in 2021 as the world's tenth largest economy. The country has experienced rapid economic development in recent years, thanks to its strong education system and focus on the technology sector. In particular, South Korean telecommunications company Samsung is the world's largest mobile phone vendor, with over 20% of the market share. Other notable stocks include automotive companies Hyundai and Kia, steelmaker POSCO, and holding companies SK Group and CJ Group. South Korea is well known for its dominance of "chaebols," or family-run companies, all of which trade on the Korea Exchange or over-the-counter (OTC) for foreign investors.

Financial organizations have also noted the resilience of the South Korean economy against financial crises, such as the global financial crisis of 2007-2008, where it managed to avoid a recession and recovered fairly quickly. The country is one of the world's largest exporters of electronics, steel, and automobiles, and its economy relies heavily on trade with its major trading partners: China, the United States, Vietnam, Hong Kong, and Japan. However, tensions between South and North Korea can often impact the stock market performance and the overall economic health of the nation.

Trade with the world's strongest economies

You can start trading global markets now by setting up a CFD trading account . We offer access to over 300 forex pairs in the FX market, which is the highest in the industry, including the US dollar, euro, Japanese yen and many other exotic and emerging currencies. Over 10,000 stocks and over 1,200 exchange-traded funds (ETFs) are available to trade via CFDs on our trading platform, as well as government bonds , treasuries and over 100 commodities.

Open a live account now to start trading CFDs on assets within some of the world's strongest economies, including the stock market. Alternatively, you can practice trading all other global markets, including forex, bonds and indices with 10,000 euros of virtual funds on our demo account.