Commodity index trading

Spread bet and trade CFDs on baskets of commodities with our Agricultural Index, Energy Index and Precious Metals Index. These indices offer a unique way to trade on the wider commodity market, giving you exposure to multiple commodities in one trade.

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

More than a commodity trading platform

Trade on 'cash' and forwards across a wide range of precious metals, energies and agricultural commodities.

Speculate on popular commodities like gold, silver, crude oil and natural gas from Sunday night through to Friday night (includes a short daily break).

Take a view across a whole commodity sector from a single position, with our bespoke commodity indices.

Tighter spreads, no rollovers and charting back as far as 2011 to help your analysis.

Experienced customer service available 24/5, whenever you're trading.

No dealer intervention – we don't reject or partially fill trades based on size.

What do our customers say about trading with us?

Major commodity indices to trade

The Agricultural Index contains Soybean, Corn, Soybean Meal, Wheat, Coffee Arabica, Soybean Oil, Sugar Raw, Cotton, US Cocoa, Coffee Robusta, Sugar White and Oats, covering a broad spectrum of the soft commodities sector.

The Energy Index is designed to give an indication of how the energy sector is performing. Its constituent commodities are Heating Oil, Natural Gas, Crude Oil Brent & WTI, Gasoline and Low Sulphur Gasoil.

The Precious Metals Index groups several precious metals to give you exposure to the sector as a whole. It consists of Gold, Silver, Platinum and Palladium.

How do commodity indices work?

Our commodity indices group together individual commodities to make a commodities 'basket'. The indices track the underlying prices of the commodities within that index. If the individual commodity prices in that index increase, then the value of the index goes up. Conversely, if the individual commodity prices decrease, then the value of that index falls.

There are several benefits to commodity index trading as opposed to trading individual commodities. It can be a more cost-effective and efficient way of trading the market, allowing you to take a view on a commodity sector as a whole without having to open individual positions on each commodity. This can be a good way to diversify your portfolio.

However, it's important to be aware that CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, profits and losses will be based on the full value of your position. While you could profit if the market moves in your favour, you could just as easily make significant losses if the trade moves against you and you don't have adequate risk management in place.

Commodity index costs

View the spreads, margin rates and trading hours for our three major commodity indices in the table below.

How our commodity indices are weighted

For the Energy Index and Agricultural Index, the components were initially weighted according to the average daily trade value of the nearest six futures contracts, where available, for the 12 months preceding the index launch date, based on the initial index value of $10m.

For the Precious Metals Index, Gold and Silver are split equally to collectively make up 70% of the index weight. The remaining two components, Platinum and Palladium, are also split equally and collectively make up 30% of the index weight. Subsequent index reviews are applied as shown in the index methodology.

*Agricultural Index divisor: 9,935.59. Index created at a base level of 1,000 as of 29 March 2019. Initial target index value = $10 million.

**As of last review date, 21 March 2025.

Energy and Agricultural Index methodology [pdf]

1Energy Index divisor: 10,164.13. Index created at a base level of 1,000 as of 29 March 2019. Initial target index value = $10 million.

2As of last review date, 21 March 2025.

Energy and Agricultural Index methodology [pdf]

1Precious Metals Index divisor: 10,004.16. Index created at a base level of 1,000 as of 29 March 2019. Initial target index value = $10 million.

2As of last review date, 21 March 2025.

Precious Metals Index methodology [pdf]

Platforms to suit every trader

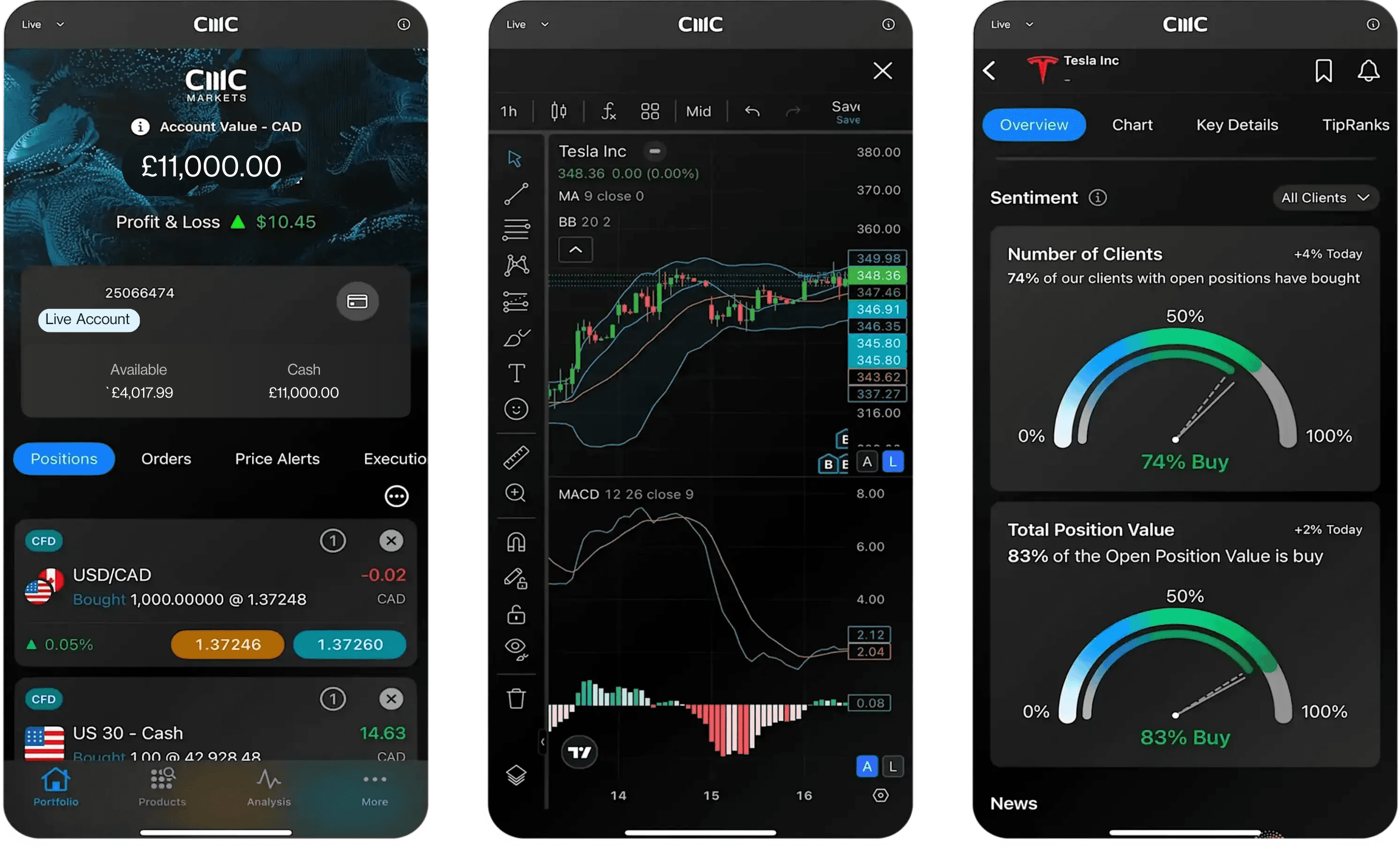

An award-winning platform & app

Advanced order execution

Intuitive charting, with mobile-optimised charts

Pattern recognition scanner

Gauge market sentiment

Morningstar equity research and Reuters news

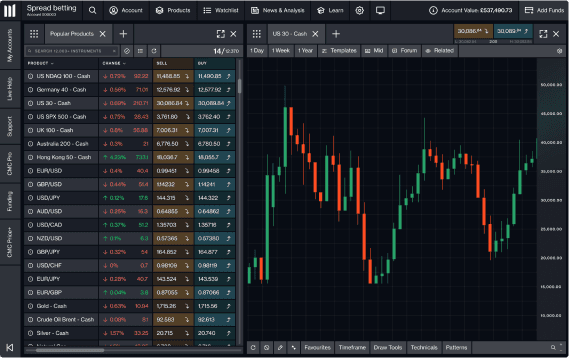

Desktop

We've built our web trading platform to be powerful and intuitive. It combines leading-edge features and security, fast execution, and best-in-class insight and analysis. Designed to support any strategy.

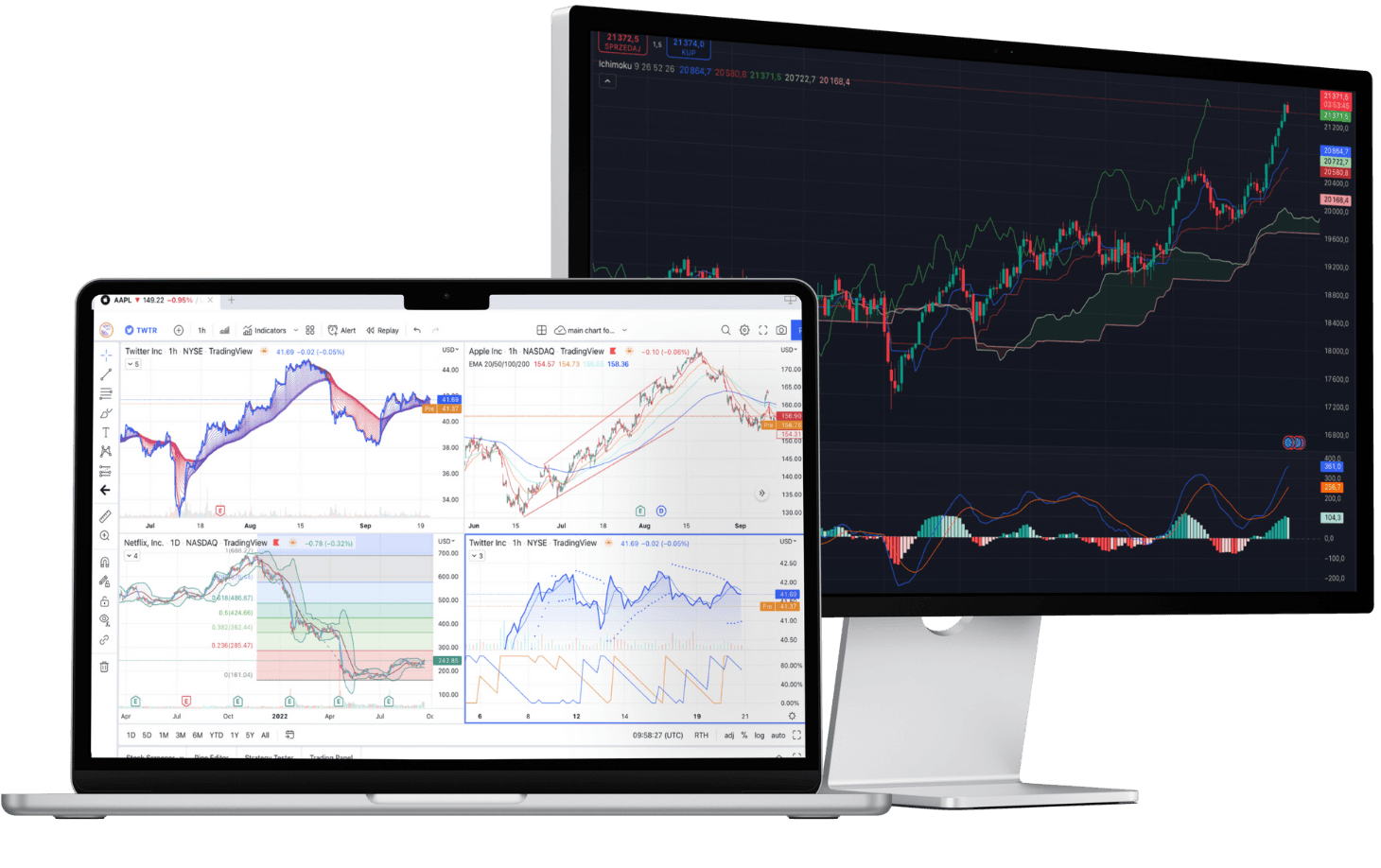

TradingView

A globally-renowned charting experience for every trader. Enjoy the best of both worlds: TradingView's supercharged charts, with our tight spreads.

Supercharged charting

Join the community

Market calendar

Flexible price alerts

Smooth integration

Mobile app

TradingView's mobile apps are available on the App Store and Google Play Store. Ensure that your device is up to date and your operating system is supported.

Google PlayApp StoreMetaTrader 4

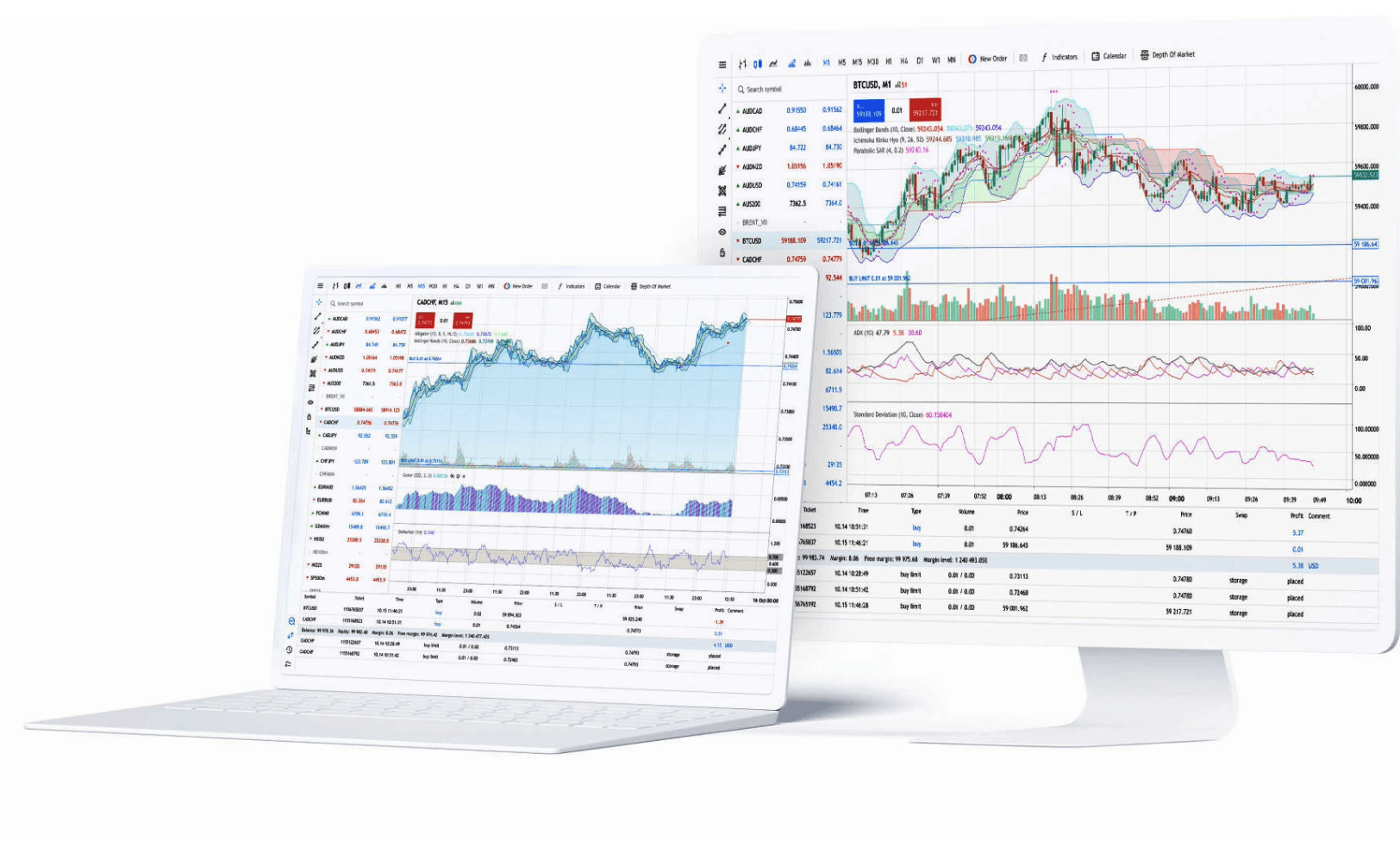

Trade on forex, indices and commodities

Tight spreads starting from 0.0 pips with our FX Active account

One-click trading and lightning-fast execution speeds

Customisable charts with pre-installed indicators

Automated trading with Expert Advisors

Mobile

Desktop

Download MetaTrader 4 for PC or MAC and trade on the world's most popular trading platform.

Award-winning broker

ADVFN International Financial Awards

ForexBrokers.com Awards

FAQs

A commodity is a physical good that can be bought or sold on commodity markets. Commodities can be categorised into either hard or soft varieties. Hard commodities are natural resources like oil, gold and rubber, and are often mined or extracted. Soft commodities are agricultural products such as coffee, wheat or corn.

Spread betting or trading CFDs on commodities offers the opportunity to speculate on the underlying price movement of popular metals like gold and silver, energies like Brent and West Texas crude oil, and natural gas, plus soft commodities such as wheat.

There are no commission fees to pay, although other charges may apply, including the instrument's spread, plus overnight holding costs if you're holding the trade open for longer than one day. View our trading costs for more details.

One of the features of spread betting and CFD trading is that you only need to deposit a percentage of the full value of your position – the initial margin requirement – to open a trade, known as trading on leverage. Trading on leverage amplifies your profits and losses equally, so it's important to manage your risk.

There's no cost to open a live trading account with us. You can also view prices and use tools such as charts, Reuters news, or Morningstar quantitative research equity reports, free of charge. You'll need to deposit funds in your account to place a trade.

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC, and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, also make a contribution to our overall revenue.

Ready to get started?

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.