What is Margin in Forex?

When trading forex, margin is the amount of money you need to set aside to open a position. Instead of paying the full value upfront, you only put forward a percentage of the trade’s total size. Understanding how margin works is key, as it determines how much you can control in the market and how far your money can go when trading with leverage.

Margin is the deposit required to open a leveraged forex position. Instead of paying the full trade value upfront, you only need to put forward a percentage (typically starting around 2.2% in Canada for USD/CAD). This deposit unlocks leverage, allowing you to control larger positions with less capital.

Margin and leverage work together. If a broker requires a 3.3% margin, you get 30:1 leverage - meaning you can control $30 for every $1 you deposit. Lower margin requirements equal higher leverage ratios.

Your margin level shows your trading capacity. Calculated as (equity / used margin) × 100, it indicates how much of your funds are available versus locked in open trades. When the margin level drops below 100%, you cannot open new positions.

Margin calls happen when your account balance falls too low. If losing trades cause your margin level to drop below the required threshold, your broker will request additional funds or may liquidate your positions. Monitoring margin levels and using stop-loss orders helps avoid this scenario.

Forex margin explained

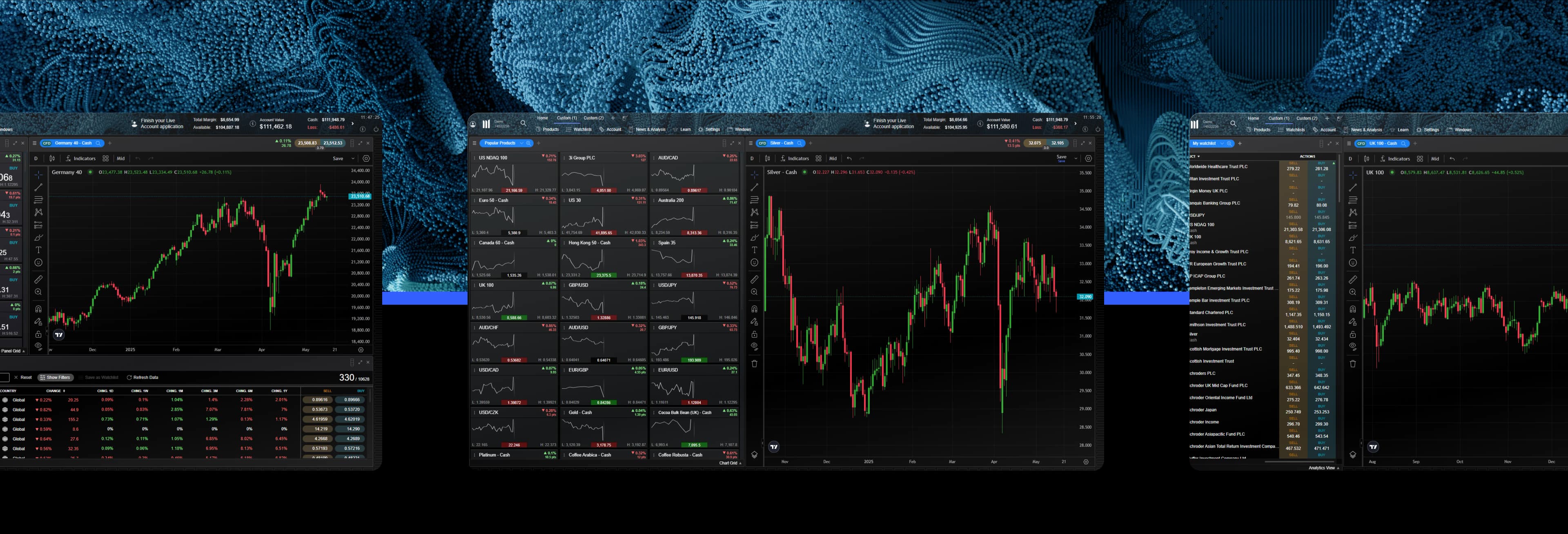

Trading forex on margin lets you take a bigger position in the market than your account balance would normally allow. Margin is essentially a deposit that unlocks leverage, so you can control a much larger trade with a smaller amount of money upfront.

Think of it like putting down a deposit on a house. You don’t pay the full price, but you still get exposure to the whole property - and the risks that come with it.

That’s why margin is often described as a double-edged sword. It can amplify your profits if the trade goes your way, but it can also magnify losses, since gains and losses are calculated on the full value of the trade, not just the deposit you put down.

Breaking down margin and leverage

The amount of leverage you can use in forex trading depends on two things: your broker’s margin requirements and the limits set by regulators. In Canada, for example, the regulator CIRO sets specific rules that brokers must follow.

Margin requirements vary depending on the broker and where your account is based. For example, USD/CAD at CMC Markets Canada can typically start at around 2.2%.

Here’s what that means in practice: if a broker’s margin rate is 2.2% and you want to open a position worth $100,000, you’d only need to put down $2,200 as your deposit. The broker covers the remaining $97,800.

That works out to a leverage ratio of 34:1. In other words, for every $1 of your own money, you’re controlling $34 in the market.

And remember - the bigger your trade, the bigger the margin deposit required.

Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. It’s important to understand that trading on margin can result in larger profits, but also larger losses, therefore increasing the risk. You should also familiarize yourself with related terms, such as ‘margin level’ and ‘margin call’.

You can test your trading risk-free when you open a CMC Markets demo account.

What is the margin level?

In forex trading, your margin level is a percentage that represents how much money you have available in your account compared to how much is currently used to keep your trades open.

When you open a trade, your broker sets aside a small part of your money as a deposit. The total amount of your money being “held” to keep trades running is called your used margin.

The more trades you open, the more your money is “held” as used margin. The money that isn’t “held” and can still be used is called available equity.

Margin level shows the relationship between equity (total funds left in your account) and your used margin, expressed as a percentage. You can think of margin level like a safety gauge - it shows how much money you still have available to trade compared to how much is already locked up in open trades.

The formula to calculate the margin level is as follows:

Margin level = (equity / used margin) x 100

Margin trading example

Let’s say you place $10,000 in a forex account and open two forex trades. The broker requires a margin of $2,500 to keep these two positions open, so your used margin is $2,500.

In this scenario, the margin level is ($10,000 / $2,500) x 100 = 400%. The higher the margin level, the more cash you have available to use for additional trades. When the margin level drops to 100%, all available margin is in use, and you will no longer be able to place further trades.

Paying attention to the margin level is extremely important as it enables you to see if you have enough funds available in your forex account to open new positions. The minimum amount of equity that must be kept in your account to keep your positions open is referred to as ‘maintenance margin’. Many forex brokers require a minimum maintenance margin level of 100%.

What is a margin call?

A margin call happens when your open positions are losing money and your account balance falls too low. In other words, the funds in your account are no longer enough to cover the margin required to keep your trades open.

If your margin level drops below 100%, your broker will usually step in and request that you add more money to your account. This is known as a margin call.

With a CMC Markets account, for example, you’d get an alert via email if your account value reached this critical point.

If this happens, you will need to add more money to your account, or your open positions may be liquidated. If you wish to avoid both these scenarios, you should aim to avoid margin calls at all costs. You can do this by monitoring your margin level regularly, using stop-loss orders on each trade, and keeping your account adequately funded.

You can use margin trading with many different types of investments, including forex, stocks, indices, commodities, and bonds.

The difference between forex margin and leverage

Margin and leverage are closely connected, but they mean different things in forex trading.

Here’s a quick cheat sheet:

Margin is the money you need to deposit to open and keep a trade running.

Leverage allows you to control a much larger trade size with only a small portion of your own funds.

Think of margin as the deposit you need to put down, and leverage as how much bigger your trade can be compared to that deposit. The two connect when interpreting leverage ratios.

For example, if the leverage ratio is 30:1:

30 = your leverage

1 = your margin

This means for every $1 of your own money, you can trade with $30. So if you invest $1,000 (your margin), you can control a trade worth $30,000 (your leverage).

Different leverage ratios

Brokers set different leverage ratios based on the margin requirement—aka the required deposit amount you must put down to open a trade.

A lower margin equates to higher leverage, while a higher margin equates to lower leverage.

Here’s how it works:

What are pips and how do they affect leverage?

In forex trading, price changes are measured in pips, which stands for “percentage in points.” A pip is the smallest change a currency pair can make. For example, in most major currency pairs (like EUR/USD):

1 pip = 0.0001

100 pips = 1 cent

Pips are important to be aware of because when you trade in leverage, even tiny movements in the exchange rate can matter.

Here’s a simple example to show how pips and leverage work together:

You have $1,000 in your trading account, and you use a leverage of 30:1.

This lets you control a position worth $30,000.

Now, imagine the currency pair you’re trading moves 10 pips in your favor.

For this trade size, that 10-pip move could give you a profit of $300.

Without leverage, controlling only $1,000, the same 10-pip move would give you only about $10.

That’s why leverage plays such a big role in forex trading - it allows even small price movements to translate into bigger potential profits. However, the same applies to losses, which can also be magnified with small changes. This is why leverage should always be approached with caution.

Leverage isn’t unique to forex. It’s a common feature of derivatives like contracts for difference (CFDs) and can be used across many markets, including stocks, indices, and commodities.

Forex margin calculator

Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning you no longer have to calculate forex margin manually.

To calculate forex margin with a forex margin calculator, you simply enter:

The currency pair (e.g. EUR/USD)

The account currency (the currency your trading account is in)

Trade size/number of units (e.g. 100,000 units)

Leverage (e.g. 30:1 or the broker’s margin requirement %)

The forex margin calculator will then calculate the amount of margin required.

For example, let’s say a broker requires a 3.3% margin for EUR/USD, and you want to open 100,000 units at 1.1500 USD per unit.

When these details are entered into a forex margin calculator, it will calculate that the margin required is $3,795 (100,000 units x 1.15 x 0.033). In other words, $3,795 is needed to place the trade.

Forex margin calculators are useful for calculating the margin required to open new positions. They can also help you manage your trades and determine optimal position size and leverage levels.

Position size management is important as it can help you avoid margin calls.

Before you start trading on the foreign exchange market, it might help to get a better understanding of technical analysis and risk management, so you can better analyze price action and protect yourself from sudden market moves.

Final considerations

Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. However, at the same time, it’s important to understand that losses will also be magnified by trading on margin.

It’s important to take the time to understand how margin works before trading using leverage in the foreign exchange market. Having a good understanding of concepts such as margin level, maintenance margin, and margin calls will help you make informed decisions about your trades.

And always be aware that if your margin level falls below the minimum level required, your forex positions could be liquidated.

If you’re new to trading and keen to develop your skills, explore our suite of free educational tools and resources. You’ll find everything from trading strategies to webinars from our market analysts and more.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.