Risk management

Risk management is a crucial aspect of trading. In short, the aim of risk management is to minimize potential losses without relinquishing upside potential. This quick guide covers the essential risk-management techniques you need to know about. You’ll learn what the main trading risks are and how to manage them using a range of tools and strategies

What is risk in trading?

There are various risks associated with trading complex derivative products like contracts for difference (CFDs). Below, we summarize the key risks to be aware of.

What is risk management?

As we mentioned at the outset, risk management is about trying to minimize potential losses while not giving up on the potential for gains. While the risks of trading cannot be eliminated entirely, when managed correctly the risks may be kept to a level that you can handle. Most traders use a mix of tools and strategies as part of their risk-management plan – a set of rules that guide a trader’s decisions and help him or her mitigate the risks of trading. A solid risk-management plan should consider the following:

Risk management tools

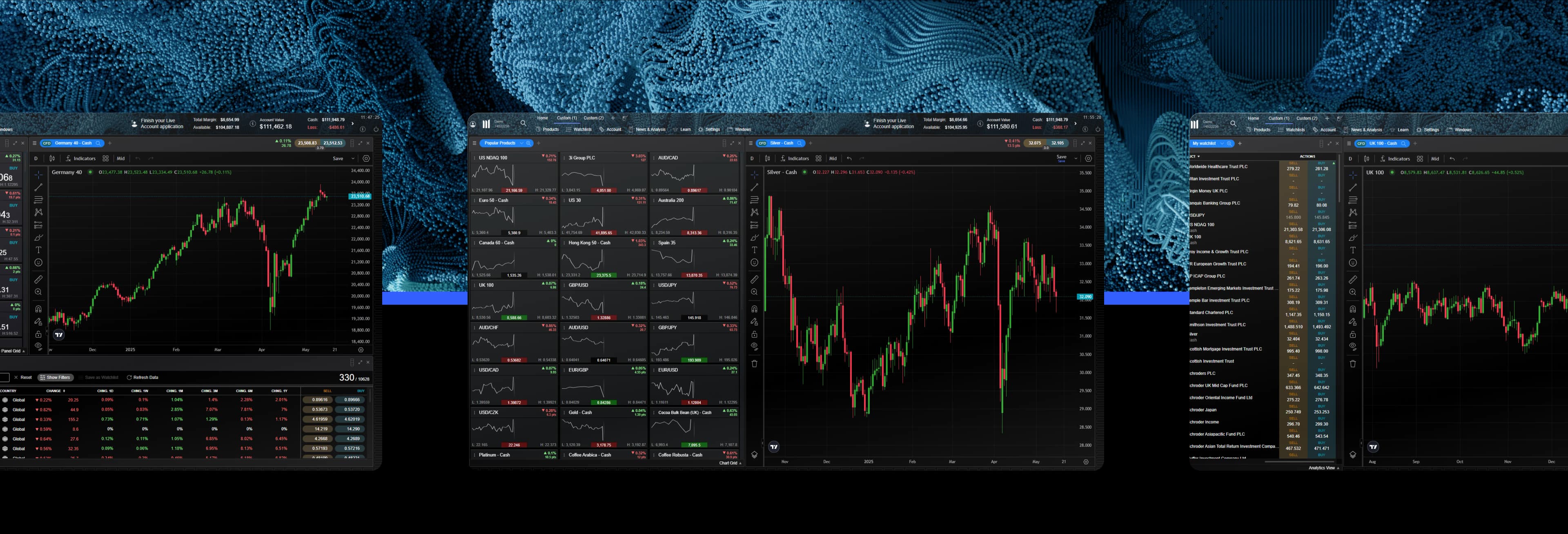

Having established what the main risks of trading are, and what risk management aims to achieve, let’s now explore some common approaches to managing risk. We’ll begin with a look at some of the key risk-management tools that we offer on our trading platform, before moving on to the risk-management strategies that you could consider implementing as part of your risk-management plan.

Risk-management strategies

In addition to the risk-management tools discussed above, there are a number of strategies, or approaches to trading, that you could adopt to help manage risk. Some of the most popular risk-management strategies are outlined below.

Limit your trading capital

Similar to the concept of betting only what you can afford to lose, it’s a good idea to decide how much of your capital you're willing to trade with. Settle on an amount that you wouldn’t miss if you lost it all, and stick to it. You could set a monthly trading budget, or a weekly amount if that suits you better. When coming up with a figure, factor in your:

Overall financial situation and needs

Trading objectives

Risk tolerance

Previous experience as an investor or trader

Conduct a stress test

One useful technique in deciding how much capital to allocate to your trading is to conduct a stress test. Simulate the worst-case scenario for your open positions, taking the potential for extreme market moves into account, to assess whether you could handle the financial and emotional impact of a downturn.

If you sustained a series of daily losses, what effect would that have on both your account balance and your wellbeing? If the stress and financial losses would be too severe, you may be allocating too much capital to your trades, or exposing yourself to too much risk, or both. In that case, try reducing your capital allocation and risk exposure to a level that you could handle even in volatile market conditions. This should ensure that you don’t overextend yourself or trade beyond your limits.

Use fixed-percentage position sizing

Calculate your position size on each trade so that a loss at your stop-loss level equals a small, fixed percentage of your account value, such as 1-2%. For example, a trader with $10,000 in their account might set the size of each new position so that a loss at the level of their stop-loss order is no more than 2% of their capital, or $200.

This method can help you maintain a consistent approach to your trading, while also reducing the potential for significant losses. It also creates a balance between your account value and your risk exposure. If you sustain losses, your next position will automatically be smaller; if you make money, your position sizes will gradually increase.

Cap the quantity of your trades

Limit the number of positions you have open to avoid overexposure. This can help protect you against the potential negative impact of a single market event.

For example, traders using a fixed-percentage position size of 1.5% may set themselves a rule that they will not have more than 10 positions open at any one time. This means their losses would be at most 15% of their trading capital if they lost on all the positions, assuming no slippage. It's up to you to set the limit appropriate for your circumstances.

Diversify your positions

Spread your risk across different assets, markets and sectors. Avoid concentrating your positions in closely related instruments, such as several trades involving the same currency or commodity.

Finding the right risk-management techniques for you

In this article we’ve explored the concept of risk in trading, and looked at several tools and strategies to help you manage those risks. As you develop your own approach to risk management, why not use your demo account to practice applying some of the techniques we’ve looked at? When you’re ready, you can apply what you’ve learned to live trades.

Remember, every trader is unique, and your risk-management plan should align to your personal circumstances, trading goals, risk tolerance, level of experience and trading style.

In closing, here are some of the key points to bear in mind as you develop your own risk-management plan:

Remember your risk tolerance: Don’t expose yourself to more risk than you can handle. Set limits and only place trades you can afford to lose.

Start small and adjust: New traders should begin with small positions and gradually scale as they build experience.

Consistency matters: The best traders consistently apply risk-management techniques, helping to protect their capital in both favourable and unfavourable market conditions.