Introduction to Trading Gold as a Commodity

Gold is one of the world’s oldest and most precious metals. It’s what we award athletes who finish first; it’s designed into the jewelry we give loved ones, and some cultures have even gone so far as to build entire temples out of it.

Gold is also - and has been for a long time - crucial to the world’s economy.

For traders, it can offer potential opportunities for diversification, hedging, and speculative gains. Here’s everything you should know about gold as a tradable commodity.

What is the gold market?

Gold has been tied to money for centuries. In the Byzantine Empire (395 - 1453AD), it was used directly as currency through the solidus, a pure gold coin.

Fast forward to the 20th century, and gold was still central, with most countries operating on the gold standard, where their paper money was backed by actual reserves of gold.

Is gold a commodity or a currency?

A commodity is a physical good with market value, like oil or coffee.

Currency is a system of money used for exchange, like USD or EUR.

Gold is traded as a commodity, but often behaves like a currency.

The free market system we currently trade in allows gold to act very similarly to a currency. Though it isn’t often used for direct payments, gold is highly liquid and can be easily converted to cash in most currencies.

That said, gold is, first and foremost, a commodity - often grouped with other precious metals like silver, platinum, and palladium.

What factors impact the price of gold?

Gold prices respond mainly to investor sentiment and economic conditions. Keep an eye out for major announcements that could impact inflation, such as unemployment figures, interest rates, energy price changes, and natural disasters.

Unlike oil or coffee, gold isn't consumed. Since it is virtually indestructible, most of the gold that’s ever been mined still exists today. As a result, its price is influenced more by investor behaviour and economic conditions than by everyday supply and demand.

When other investments seem too risky, gold is often seen as a "safe haven,” and it generally performs well during global crises like wars and pandemics.

Economic policy matters too. For example, when the US Federal Reserve cuts interest rates, the US dollar has weakened in the past. Since gold is priced in USD, a weaker dollar can make it more appealing to investors, and gold’s price has sometimes risen under such conditions.

Why do people trade gold?

Gold offers traders a mix of security and potential returns, making it a popular choice in uncertain markets.

Hedge against inflation: Inflation happens when the value of a currency, say the US dollar, decreases over time, while the price rises. Some traders store some of their wealth in gold to counteract this trend, since, unlike currency, gold is a finite resource.

Safe haven: Gold is often viewed by investors as a safe investment, meaning demand for it can increase during times of market uncertainty or economic stress.

Currency proxy: Gold prices are often used to measure the relative value of a local currency and, in some situations, can be traded as a substitute.

Ways to trade gold

There are several ways to trade gold depending on your goals and risk tolerance. In a nutshell:

Let’s look at each of these approaches in a bit more detail:

Spot gold

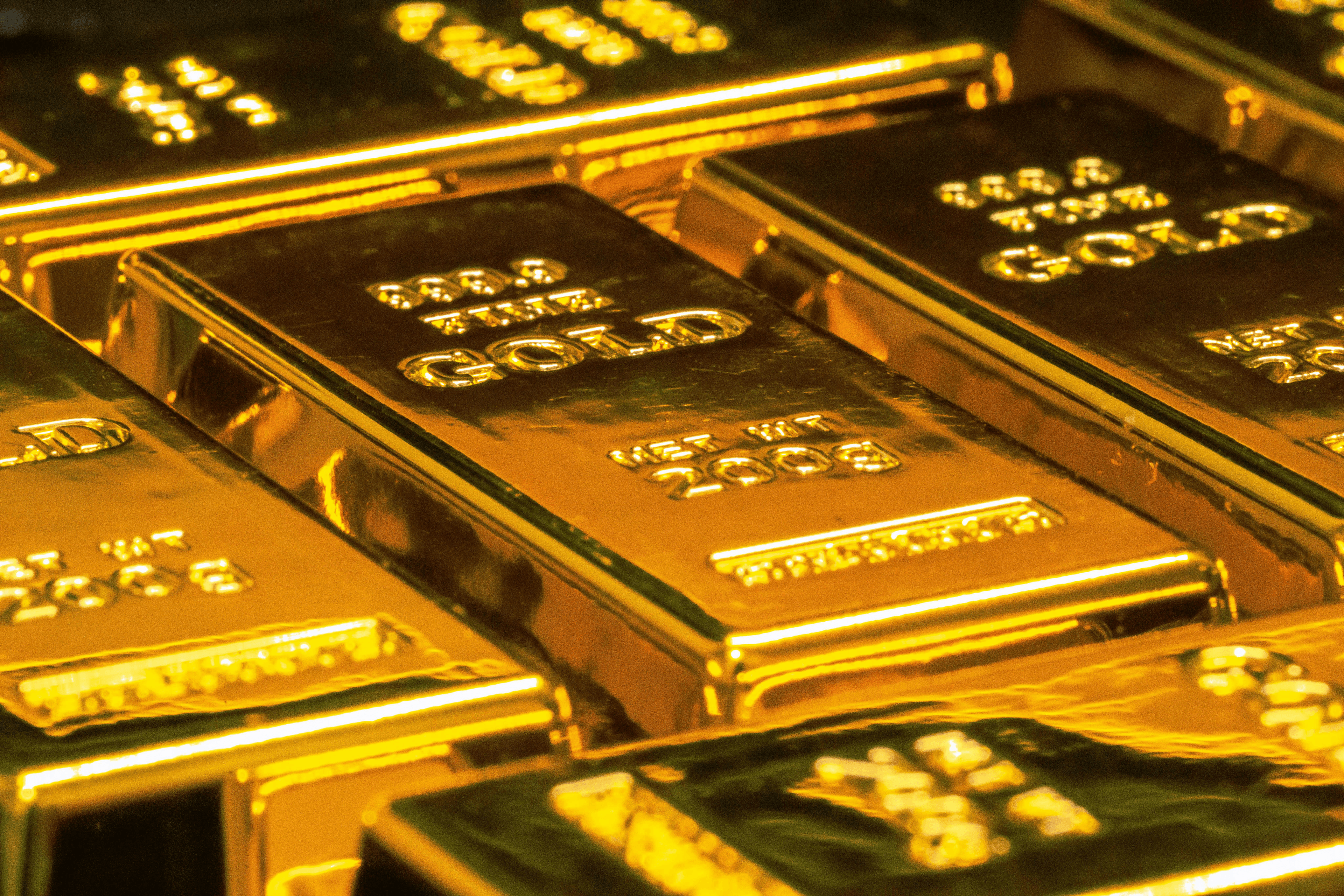

Spot gold is the immediate delivery of physical gold, priced at the current market rate.

Gold is an over-the-counter asset, with 70% of global gold trading being physical, via the London Bullion Market Association.

While hefting gold bars between vaults may not sound practical, most participants are international banks, bullion refiners, and dealers.

Gold futures and options

Futures and options are contracts to buy or sell gold at a set price on a future date.

The biggest exchange for gold futures (code: GC) is the COMEX section of the Chicago Mercantile Exchange (CME), which offers electronic trading virtually 24 hours a day.

The contract size is 100 troy ounces (3.11kg), and as gold is used globally, it is traded on almost all stock exchanges.

Investing

One way to gain exposure to gold without buying physical bars is through shares or exchange-traded funds (ETFs).

ETFs are funds that bundle together assets - such as company shares or commodities - so you can invest in them collectively rather than buying each one individually.

Trading via CFDs

Lastly, you can trade gold contracts for difference (CFDs). Put simply, you can buy or sell positions and speculate on gold price movements without physically purchasing the commodity.

How to trade gold

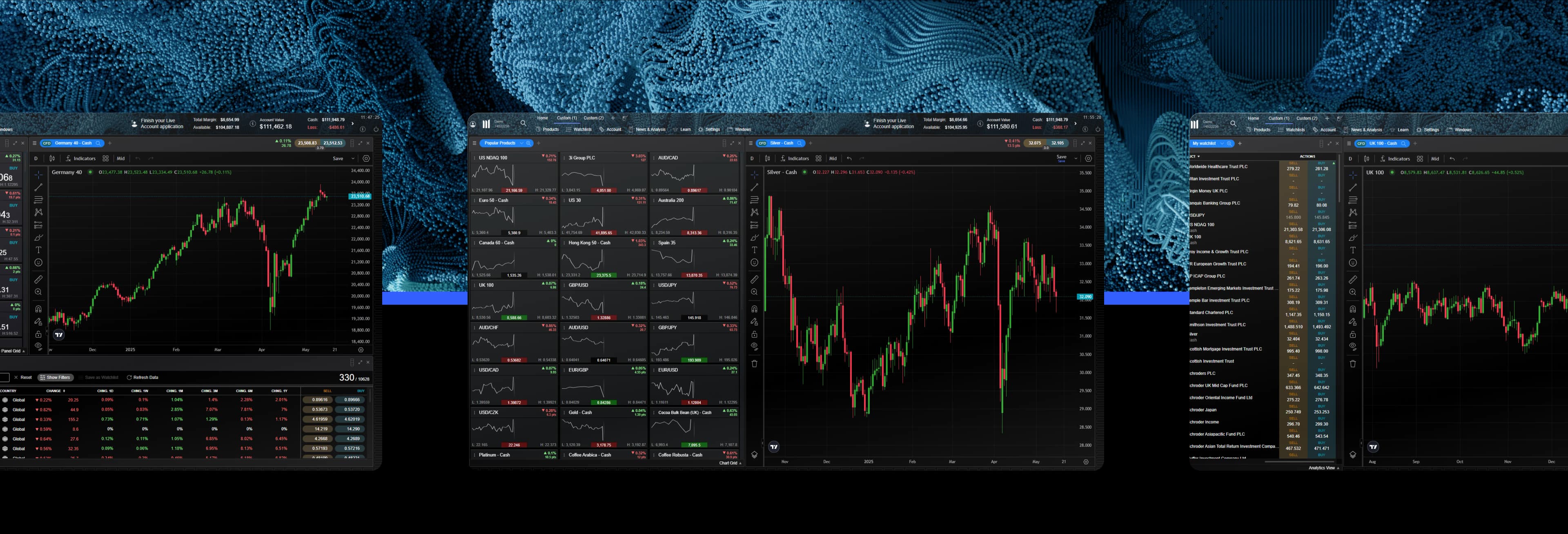

Open an account with CMC Markets. Choose between a live account to get started straight away or practice with virtual funds on our demo account.

Deposit funds into your account. CFDs are leveraged products, so you’ll only need to deposit a small percentage of the total trade value. Profits and losses will be based on the overall value of your position.

Research the best time to trade gold. Certain political and economic events can impact the price and volatility of the commodity market. This means that the risk of gold investment can either pay off or cause serious losses.

Monitor price movements. Keep up with the latest trends of your gold trade online using our range of technical indicators.

Consider your risk management strategy. Assess your potential risks carefully and put the appropriate measures in place.

Gold stocks

Traders should open a position based on whether they think the share price of the gold company will rise or fall, and subsequently profit or lose based on where the price movement goes.

Choosing the right gold stocks requires assessing both a company’s production and broader market conditions. Here are some of the largest gold mining stocks companies.

At CMC Markets, we offer over 9,000 stocks and ETFs on our online trading platform. Get started today to diversify your portfolio and explore opportunities in several markets.

Gold ETFs

Beyond individual stocks, ETFs provide another way to gain diversified exposure to gold. The following are examples of gold ETFs available for trading on our platform:

SPDR Gold

SPDR Gold is the largest and most popular physically backed gold ETF in the world, and can be traded on several stock exchanges globally. Seeking to reflect the performance of gold bullion’s price, this ETF is often used for hedging against the volatility of other markets, including forex and stocks.

iShares Gold Trust

iShares Gold Trust seeks to reflect the price of gold in general. It has one of the lowest expense ratios for gold ETFs, which is attractive for cost-conscious investors.

Aberdeen Standard Physical Swiss Gold Shares

Also issued to reflect the performance of the price of gold bullion, Aberdeen Standard Physical Swiss Gold Shares is a potentially cost-effective and convenient alternative to purchasing and storing gold directly.

Gold market overview

Over many centuries, the gold trade has seen it all. Empires have risen and fallen, economies have prospered and crashed, and though demand has waxed and waned, there’s always been a market for gold.

This is why many see it as a safe investment. Still, its prices will fluctuate over time, which creates potential opportunities and risks for traders.

While gold remains a cornerstone of commodities trading, it is just one of many options. You may also choose to focus on oil, grains, or coffee to diversify your portfolio and manage risk.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.