Forex index trading

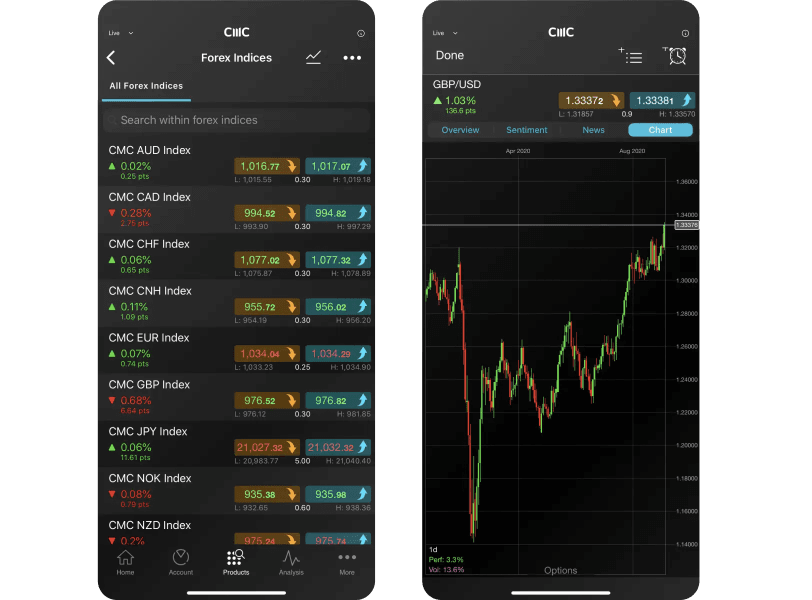

Trade CFDs on baskets of FX pairs with our forex indices. They offer a unique way to trade on a group of FX pairs which share the same base currency, such as USD, GBP and EUR, giving you exposure to multiple currencies in a single trade. Forex indices offer a benchmark overview for the international value of a currency.

ForexBrokers.com Awards

Good Money Guide Awards

ADVFN International Financial Awards

More than a forex trading platform

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Trade major forex pairs from 0.0 pips with an FX Active account.

Experienced customer service available 24/5 in EN, FR, and ZH to support you in your trading.

You're in safe hands - we're regulated by Canadian Investment Regulatory Organization (CIRO).

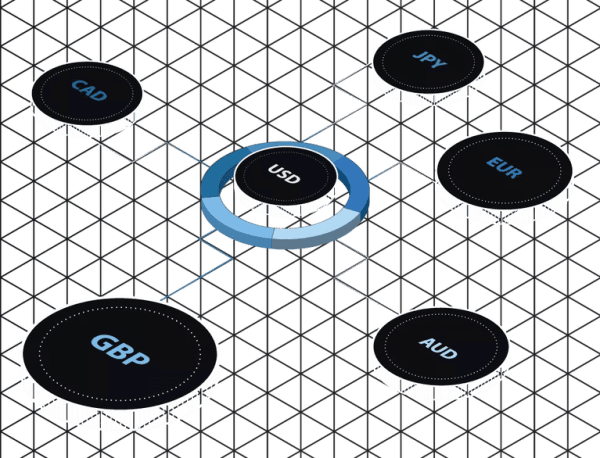

How do forex indices work?

Our forex indices group individual FX pairs with the same base currency to make a forex 'basket'. The indices track the underlying prices of the currency pairs within that index. If the individual forex prices in that index increase, then the value of the index will go up. Conversely, if the individual FX prices decrease, then the value of that index will fall.

Trading forex indices as opposed to individual currencies can potentially be a more cost-effective and efficient way of trading, as it allows you to take a view on one area of the forex market, without having to open a position on each FX pair. It can be a good way to diversify your portfolio; for example, geopolitical issues could affect one currency pair in the index, while the others may remain unaffected. Forex indices might also be used to hedge any unfavourable moves in a particular currency and spread your risk, through exposure to a wider range of currencies rather than just one currency pair.

It's important to be aware that CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, profits and losses are magnified as they are based on the full value of the position, not just your initial deposit on a trade. While you could profit if the market moves in your favour, you could also make a loss if the trade moves against you, particularly if you don't have adequate risk-management cover in place.

Major forex indices to trade

We offer 12 different forex indices. Each is made up of a range of currency pairs with the same base currency. So the CMC USD Index, for example, is made up of a collection of US dollar pairs. Our full range of forex indices is listed below.

Forex index details

View the spreads, margin rates and trading hours for our 12 major forex indices in the table below.

What are other traders saying about CMC Markets?

How our forex indices are weighted

Our forex indices were created with a base level price of 1,000 for the USD, GBP, EUR, AUD, NZD, CAD, CNH, CHF, SEK, NOK and SGD indices, and a base level price of 20,000 for the JPY index, as of 31 December 2018. The weighting of each index component is capped at 40% of the total trade volume.

Forex indices methodology [pdf]

Trade on forex indices

Our forex indices are a collection of related, strategically-selected pairs, grouped into a single basket. Trade on our 12 baskets of FX pairs, including the CMC USD Index.

Tools built to enhance your analysis

Pattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations.

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop-loss orders, partial closure, market and boundary orders, so you have the flexibility to trade your way.

More on order executionAward-winning app⁴

Powerful charting capability

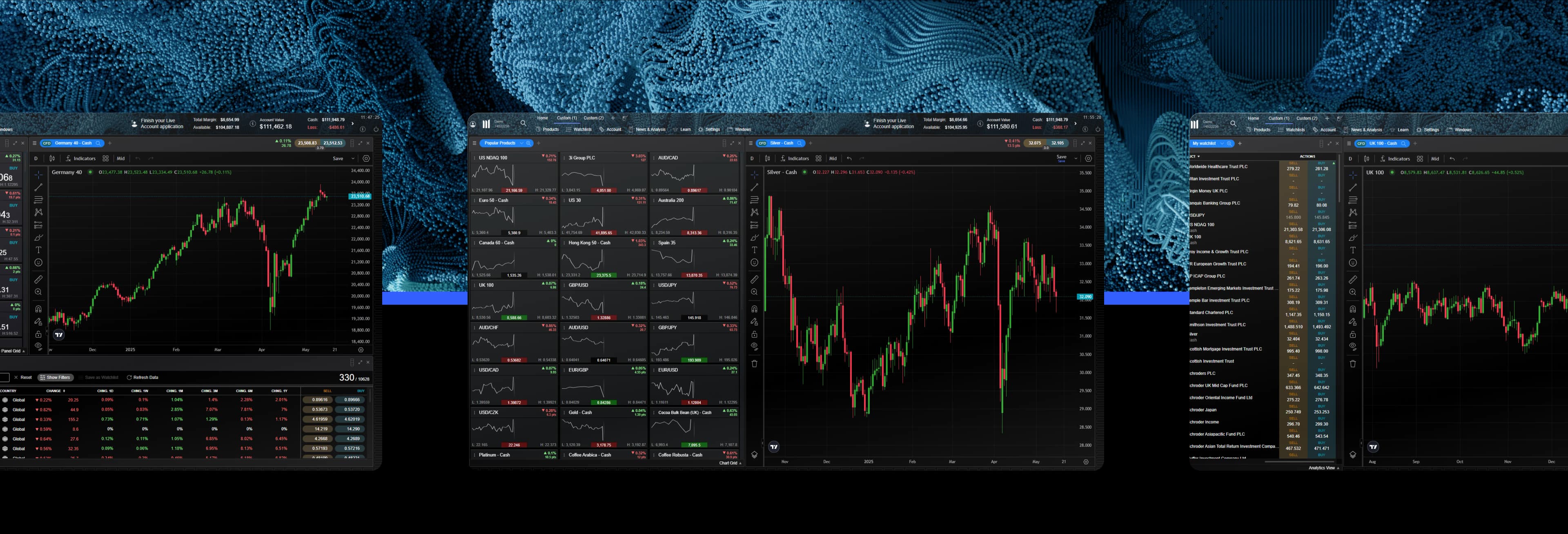

Powerful technology you can rely on

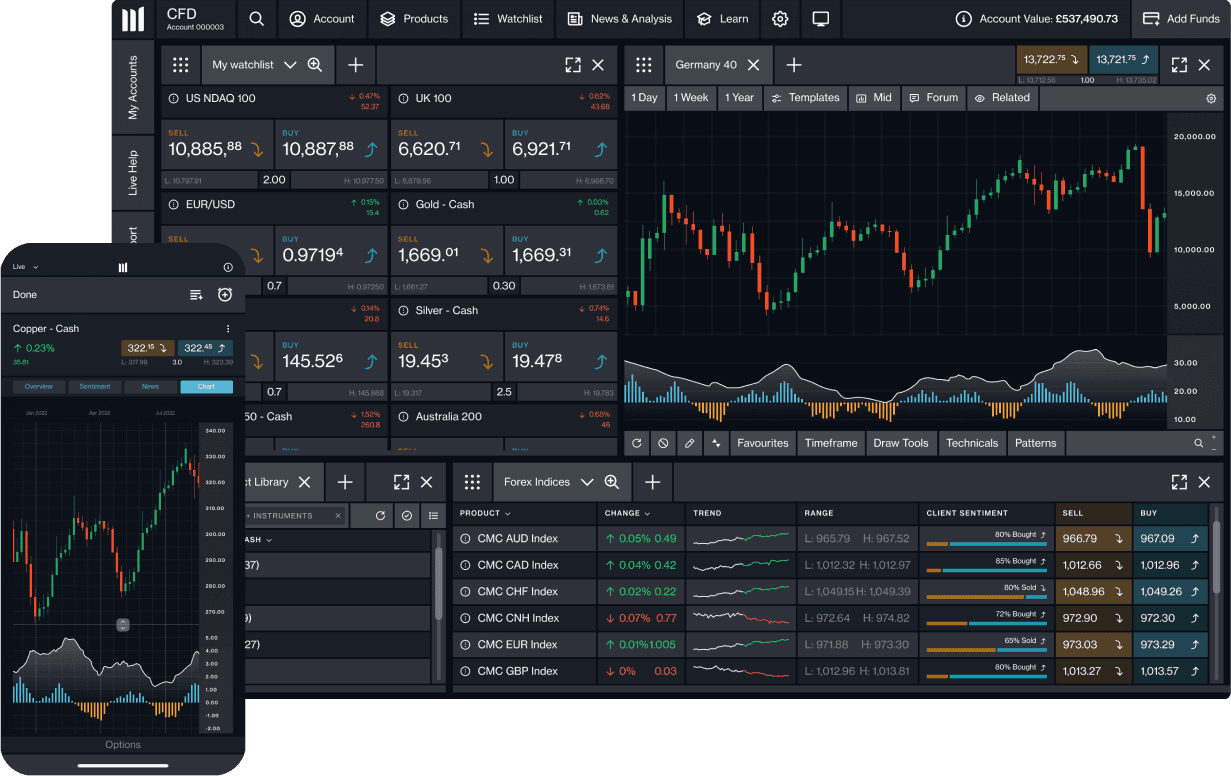

To trade with us, you choose a CFD account that suits the platform you want to use.

Standard CFD account provides access to our proprietary and award-winning Next Generation platform, available on PC and mobile. This account can also be linked to TradingView.

To trade on Metatrader 4, you must create a separate MT4 CFD account. This account is only compatible with MT4 and does not provide access to Next Generation or TradingView.

Note: MetaTrader 4 only offers trading in currencies, indices, commodities, and cryptocurrencies.

Read more below about the platforms we offer and find out which one best suits your trading style.

ADVFN International Financial Awards

Mobile app

Get the functionality of our web platform in your pocket with mobile-optimized charting, full order-ticket features and real-time alerts

ForexBrokers.com Awards

CMC platform

Award-winning broker

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

FAQs

There isn’t a specific forex index on the market. However, we've created bespoke baskets of currency pairs, which allow you to speculate on the price movements of one currency pair against a basket of pairs. Our forex indices include the USD Index and GBP Index.

Our forex indices have a base level price of 1,000 (or 20,000 for the JPY Index), and the weighting of each component within an index is capped at 40% of the total trade volume. Learn more about forex indices

We have one forex index that’s focused on emerging currencies, our CNH Index, as well as minor currencies including the NOK, SEK, and SGD.

As a CMC client, your money is held separately from CMC Markets’ own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of CMC Markets Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

Yes, CMC Markets Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by CMC Markets Canada Inc. acting as principal.

There's no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you'll need to deposit funds in your account to place a trade.

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.