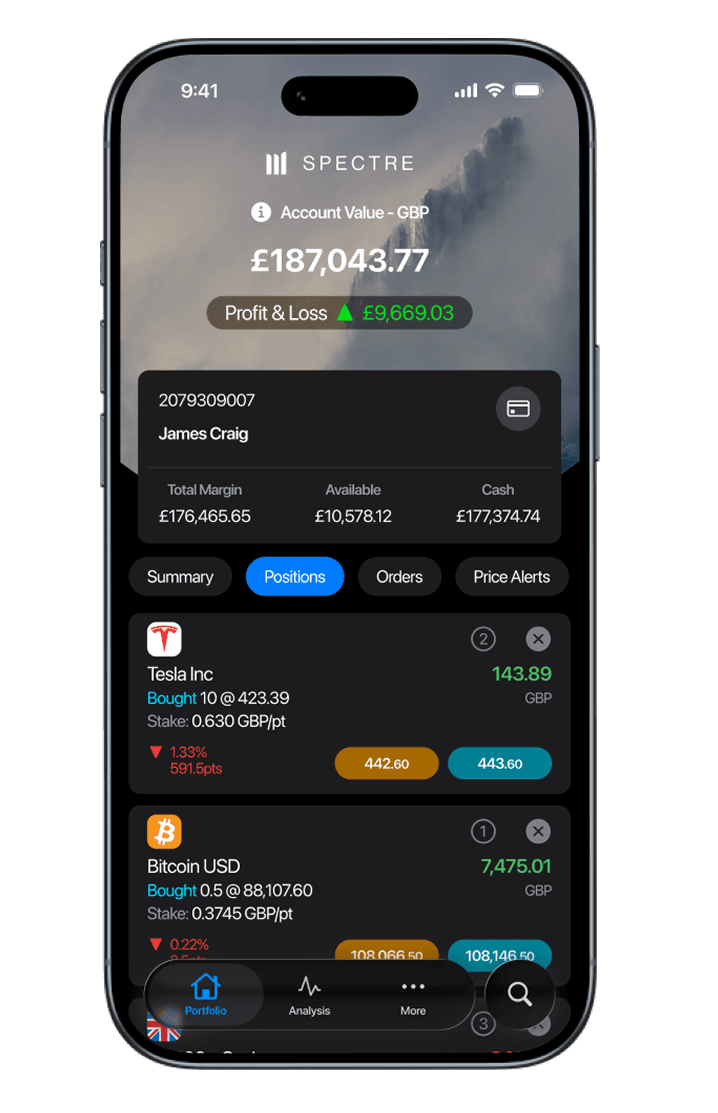

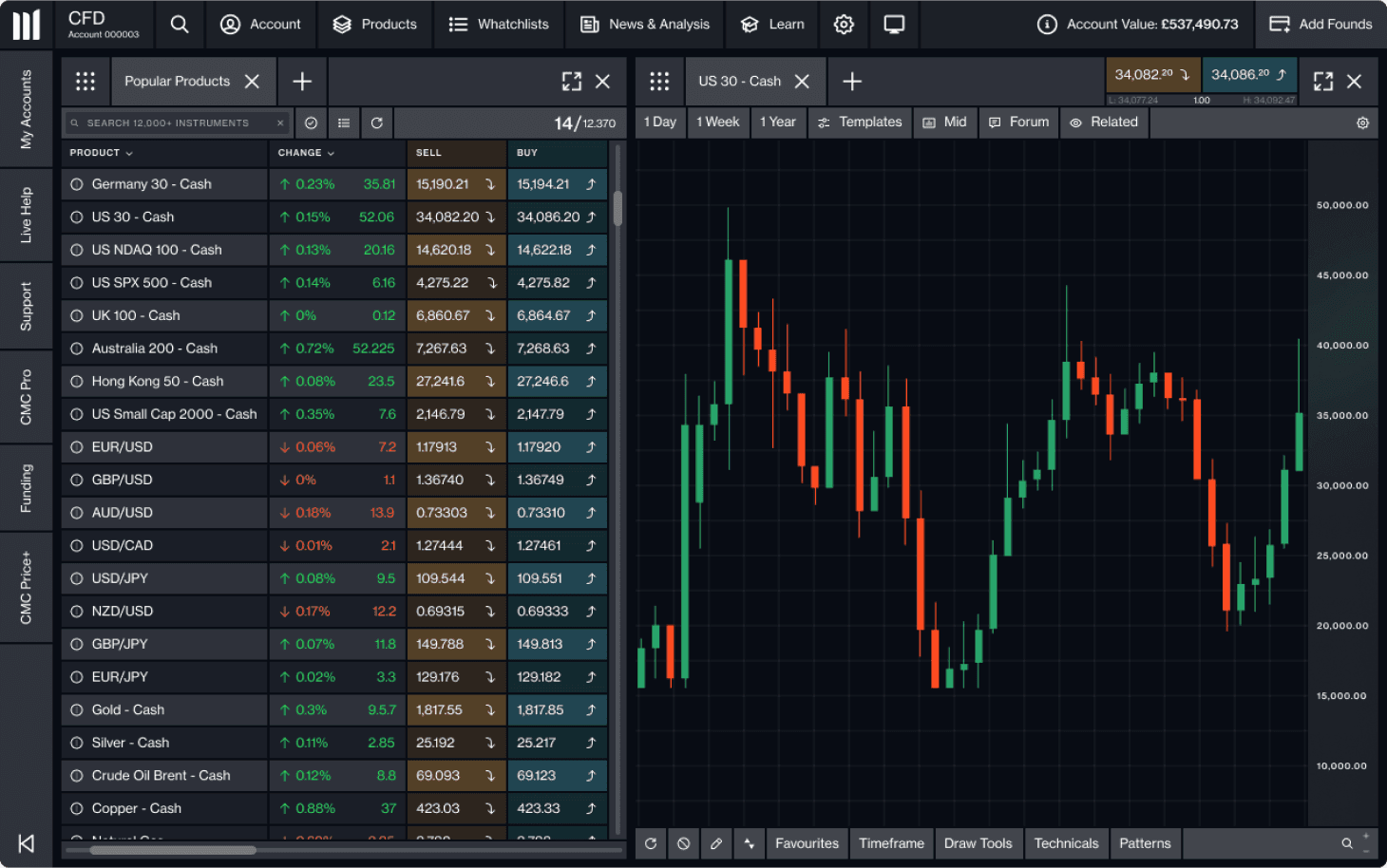

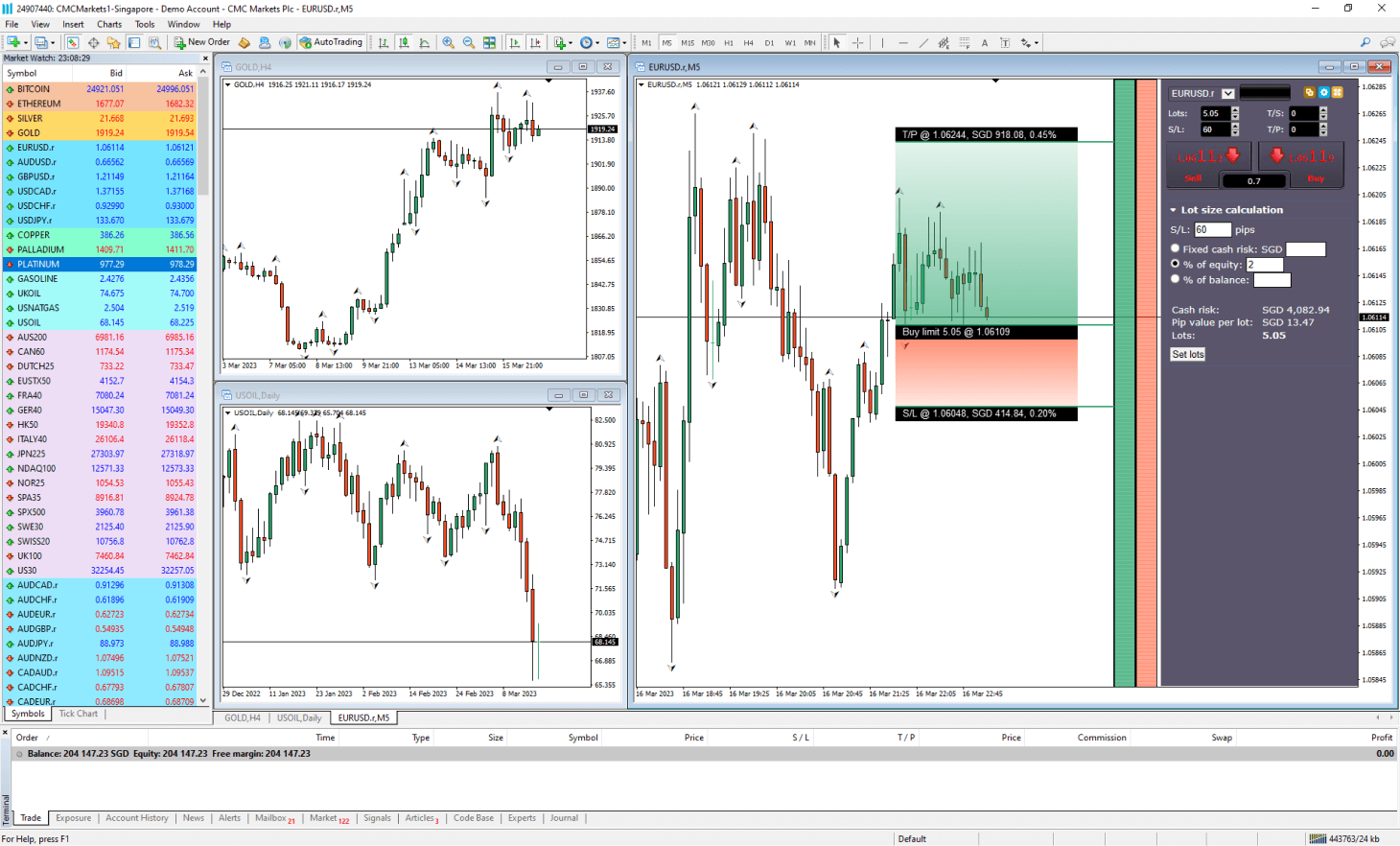

Pricing is indicative only. Past performance is not a reliable indicator of future results.

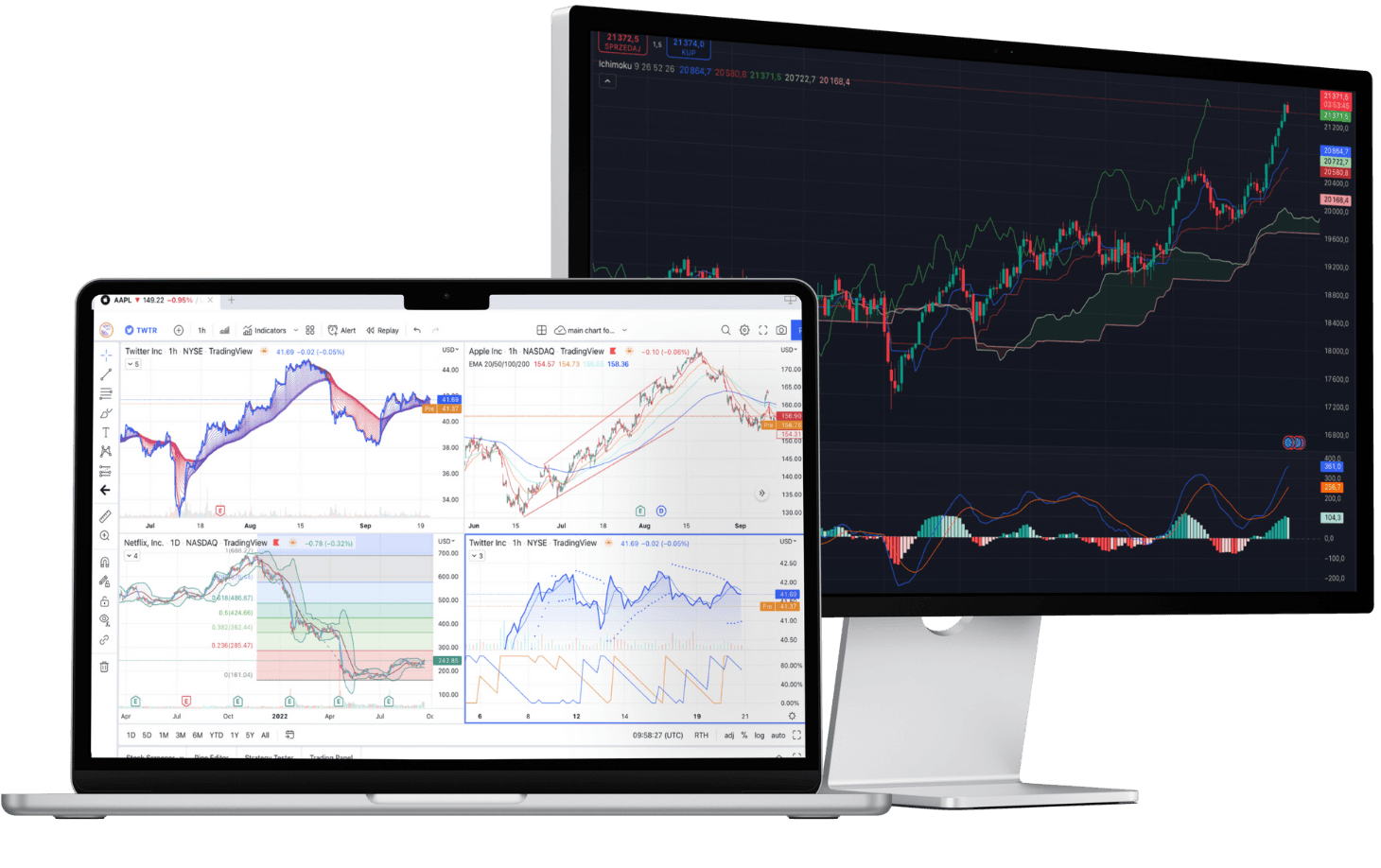

Pricing is indicative only. Past performance is not a reliable indicator of future results.

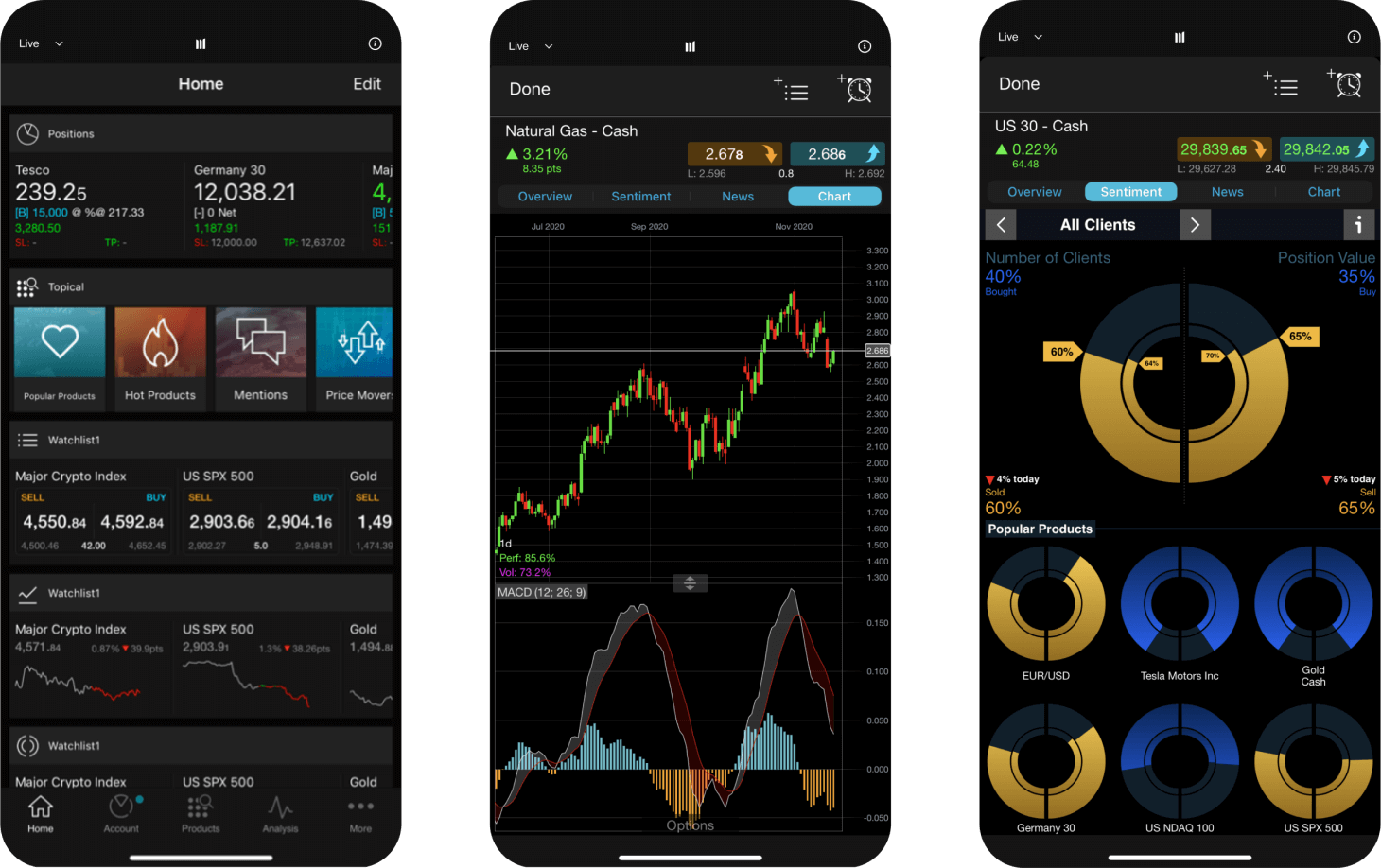

Pricing is indicative only. Past performance is not a reliable indicator of future results.

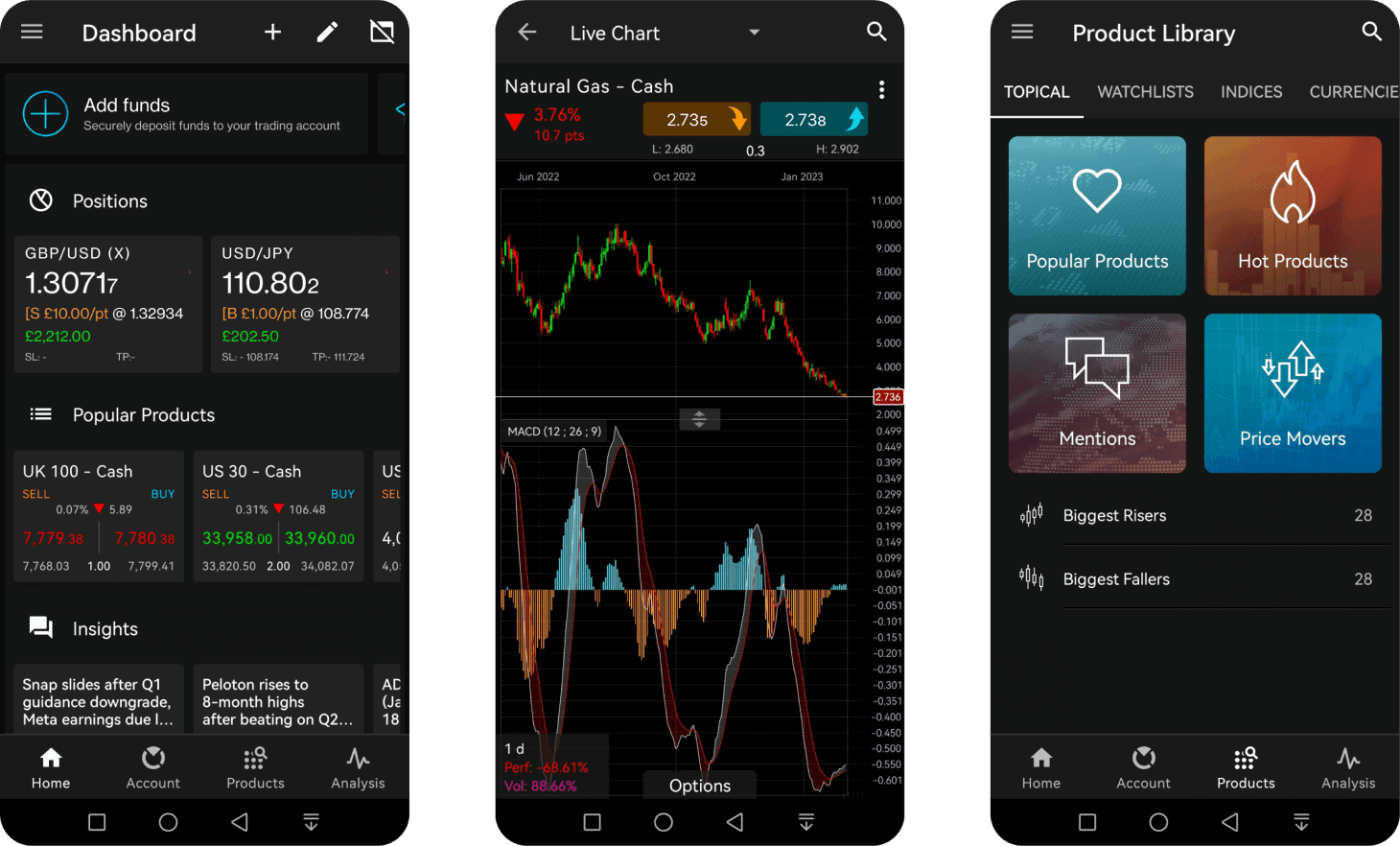

Pricing is indicative only. Past performance is not a reliable indicator of future results.

Pricing is indicative only. Past performance is not a reliable indicator of future results.

Pricing is indicative only. Past performance is not a reliable indicator of future results.

Pricing is indicative only. Past performance is not a reliable indicator of future results.

Pricing is indicative only. Past performance is not a reliable indicator of future results.

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

Dive deeper

Develop your trading skills with our free educational tools and resources. Discover a broad range of dedicated guides, trading strategies, articles and webinars.

Any questions?

Email us atclientmanagement@cmcmarkets.co.uk

or call on +44 (0)20 7170 8200We're available whenever the markets are open, from Sunday night through to Friday night.

1 Recent awards include: Best Broker for Active Traders, Professional Trader Awards 2025; Best Mobile Trading Platform and Best Spread Betting & CFD Education Tools, ADVFN International Financial Awards 2025; No.1 for Commissions & Fees & No.1 Most Currency Pairs, ForexBrokers.com Awards 2025; Best-in-class for Overall Excellence, Mobile Trading App, Platform & Tools, and Research, ForexBrokers.com Awards 2025.

2FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

3Tax treatment depends on individual circumstances and may be subject to change in the future.

4Spreads from 0.0 pips on EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY with our FX Active account. A fixed commission at 0.0025% per transaction applies.

5Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

Loading...

Loading...