Trailing stop-loss orders

A trailing stop-loss order is a type of risk-management tool. Trailing stop-loss orders are similar to regular stop-loss orders, which allow you to set a price at which your position automatically closes out if the market moves against you. The difference with a trailing stop-loss order is that it adjusts as the price of a financial instrument changes. This helps you lock in potential profits while limiting risk by capping your potential losses.

Watch the video below to learn more about trailing stop-loss orders and how to use them on our trading platform.

What is a stop-loss order?

Before we take a closer look at trailing stop-loss orders, let's first make sure we understand regular stop-loss orders. A stop-loss order is a risk-management tool that limits your losses if the market moves against you. When you add a stop-loss order to a trade with us, you're giving us an instruction to close the trade if the instrument's price reaches the level you've set. If that price level is reached, your trade will be closed at the next available market price. A stop-loss order remains in place until it's triggered, you cancel it, or your position is liquidated.

There are different types of stop-loss order. You can pay a premium for a guaranteed stop-loss order to ensure that a trade will close out at the exact price you set, eliminating the risk of slippage (the price difference that can occur in the brief moment between clicking or tapping to open or close a trade and the instruction being executed) and gapping (when an instrument's price opens higher or lower than its previous closing price, or when its price changes suddenly during the trading day, perhaps due to unexpected news). Another type of stop-loss order is the trailing stop-loss order, which we'll look at in more detail in the following sections.

What is a trailing stop-loss order?

A trailing stop-loss order is a type of stop-loss order that automatically adjusts as the price of an instrument fluctuates, helping to lock in potential profits while limiting your downside risk.

How does a trailing stop-loss order work?

You set the level of your trailing stop-loss order to be a percentage or a number of points away from an instrument's current market price. The stop level then 'trails' or follows the instrument price as it moves. If the price rises, the stop level moves with it, maintaining the distance that you set. If the price falls, the stop level remains locked in place to cap your potential losses.

If the instrument price reaches your trailing stop level, the stop-loss order will be triggered, and your trade will be closed at the next available market price, preventing you from holding on to a losing trade and risking further losses.

Trailing stop-loss orders, like other types of stop-loss order, can form part of your risk-management strategy. Learn more about risk management in trading.

When to use a trailing stop-loss order

Trailing stops can be particularly useful in a trending market (a market moving predominantly in one direction), when the idea is to stick with a trade as long as it's moving in your favour. If you’re going long (placing a 'buy' trade), then your trailing stop needs to be placed below the current market price. If you’re going short (placing a 'sell' trade), then your trailing stop must be above the market price.

Trailing stops can also offer protection during periods of market volatility, when prices may rise or fall erratically, or when trading particularly volatile instruments. In forex trading, for example, a trailing stop may be useful when trading a volatile currency pair, such as AUD/JPY. However, it’s important to remember that high levels of volatility may result in your stop-loss order being triggered early on.

This is why the placement of your trailing stop-loss is so important. Placing the trailing stop too close to the instrument's current price may result in an early exit from the trade, whereas setting it too far away means risking more capital. When deciding where to set your trailing stop, it's a good idea to analyse the instrument's historical performance and the current market conditions. It’s also worth considering the volatility of the market over an extended period, as well as how the instrument tends to behave on a daily basis.

Some traders use technical analysis indicators to guide their trailing stop decisions. One potentially useful tool is the average true range (ATR) indicator, a volatility gauge that measures the average price movement of an instrument over a specified period. Be aware, though, that while the ATR indicator can offer an indication of typical price fluctuations, it may not account for the impact of an unexpected market announcement or news event.

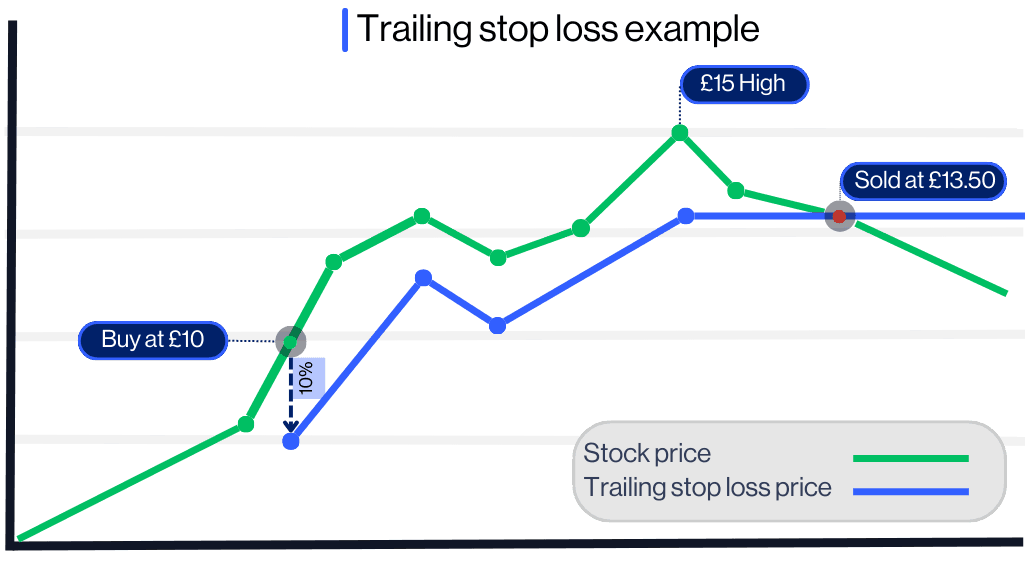

Example of a trailing stop-loss order

Let's imagine you've decided to trade in shares of XYZ Company. You enter the trade when the 'buy' price is £10. Instead of adding a regular stop-loss order to sell if the price drops to £9, you set a trailing stop-loss order at 10% below the market price.

Now, if the price falls to £9, the stock would be automatically sold as the price would have dropped 10%. However, if the share price rises, the trailing stop would rise with it, remaining 10% below the market price. So, if the share price rises to £15, your trailing stop-loss would rise to £13.50. If the stock's 'sell' price dropped to £13.50 at this point, your trailing stop-loss order would be triggered and you would make a profit of £3.50.

How to set up a trailing stop-loss order

Adding a trailing stop-loss order to your trades with us is free and easy to set up. If you wish to add a one-off trailing stop-loss order to a trade, you can do so in the order ticket. Simply expand the '+ Stop Loss' section of your order ticket, select the drop-down arrow under Regular and select Trailing Stop Loss Order. Then enter your stop-loss level, expressed either as an amount, or a number of points or a percentage away from the market price. When you're ready, place your trade, and the trailing stop-loss order will be in play.

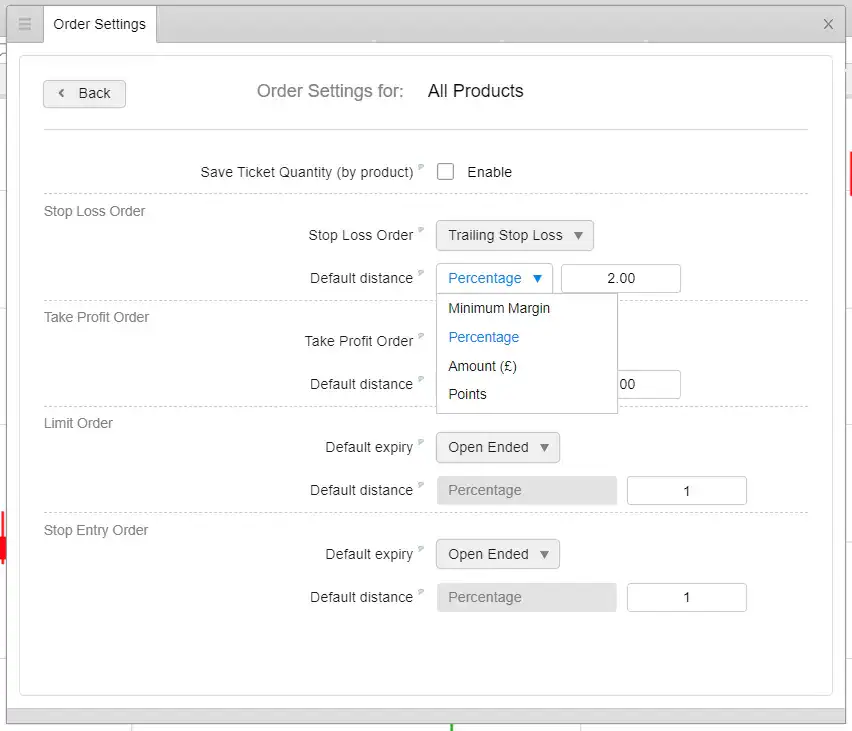

If you wish to add a trailing stop-loss order to all your trades with us, you can set this up in the platform. Go to Settings and select Order Settings. In the pop-up window that appears, scroll down to All Products and select Edit, or choose the asset class you wish to trade (for example, Commodities) and select Create. You can then select the type of stop-loss order you'd like to add to your trades, and the default distance from the market price.

The screenshot below shows the pop-up window for All Products. In this illustration, the trader has chosen to add to their trades a trailing stop-loss order 2% away from the market price.

The bottom line

As we've learned in this article, a trailing stop-loss order is a free risk-management tool that can help to lock in potential profits while capping potential losses. As the trailing stop only adjusts when the instrument price moves in your favour, it can be an effective way to protect any unrealised gains. You decide where to set your trailing stop, choosing either a price, a percentage or a number of points away from the market price.

Further reading: Learn more about the different order types available on our trading platform.

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.