CFDs vs ETFs

CFDs (contracts for difference) and ETFs (exchange-traded funds) are both popular products for trading on the financial markets across the world. They share many similarities, ETFs and CFDs nevertheless present several operating differences, which should be understood before choosing one or the other of these financial products.

CFDs and ETFs are among the most traded products on the financial markets. Long reserved for institutional investors, these products are now attracting an increasing number of retail and professional traders that are drawn to their relative simplicity; however, they are not always fully aware of their operating methods. This article explores several characteristics and differences concerning CFD vs ETF trading.

CFDs and ETFs explained

Contracts for difference (CFDs)

Contracts for difference are derivative products that allow traders to speculate on the price movements of underlying assets. This can involve the index, share, commodity, forex and treasury markets.

When trading CFDs, the investor does not actually own the underlying financial asset. Instead, it is an agreement where traders will exchange the difference in an asset’s value from the initial start of the contract until the position is closed. Those who wish to bet on financial products without managing the constraints of buying and selling therefore greatly appreciate this type of product. Whether CFDs lead to profits or losses depends on which direction the market moves in. For example, if the value of the asset increases, the investor will earn a profit, provided that the amount earned exceeds the brokerage fees. Conversely, if the value of the CFD decreases, the investor will instead lose money when reselling. In a short-selling situation, the performance result reverses: the investor earns money in the event of a drop in value but loses in the event of a rise.

To trade CFDs with us, you simply need to open an account. The particularity of CFDs and what makes them attractive to many investors is partly due to the use of leverage. This means that a trader only needs to deposit a small fraction of the full trade value in order to open a position, giving you better exposure to the financial markets. While this can result in magnified profits if successful, this can equally result in significant losses.

Exchange-traded funds (ETFs)

Exchange-traded funds are part of the UCITS investment funds that are publicly traded and regulated across the world. They are able to track the performance of an index, for example, the FTSE UK 100 stock market index, showing whether its value moves up or down. An ETF reflects only a fraction of the value of an index; it can be worth one thousandth of the index’s value. There are various types of exchange traded funds, which are explained below.

A passive ETF works by replicating the characteristics of an underlying stock market index for an investor to buy and hold the position in the long-term, in order to track its movements. Index investing does not seek to beat the market and it has lower management fees, therefore it is cheaper than trading active ETFs. This passive style of investment is the most commonly used.

An active ETF offers a certain degree of freedom to the portfolio manager, who can move away from the composition of the underlying stock market index in order to improve its performance and reduce risks. Mutual fund investors often use day-trading strategies with ETFs rather than investing in direct mutual funds, making the portfolio much easier to manage.

Among these passive and active ETFs, there also exists physical ETFs and synthetic ETFs. Within the framework of physical ETFs, portfolio managers buy each of the components of the stock market index directly in order to replicate their performance, and synthetic ETF managers use swaps and other derivative financial products to replicate the performance of the index. Therefore, if physical ETFs can offer the advantage of replicating the performance of the underlying index with great precision, they are generally accompanied by significant costs. Conversely, if synthetic ETFs have more attractive fees, their performance may turn out to be uneven, especially since certain counterparties may be lacking in comparison with financial derivatives.

Differences between ETFs and CFDs

While there seems to be many similarities between these two financial products, there are still several differences, two of which are particularly significant.

The first fundamental difference lies in the ownership of the underlying financial security. With a physical ETF, the investor indeed owns a tiny part of the multiple stocks listed. For example, in the case of investing in an exchange-traded fund for the FTSE UK 100 index, investors are partial owners of each of the 100 companies. When trading CFDs, on the other hand, the investor does not own any underlying asset. It is simply an open position with an overview to record gains or losses, based on market price variations.

A second fundamental difference refers to something of a legal nature. Whereas an ETF is regulated according to the rules of a centralised exchange, a CFD belongs to the over-the-counter (OTC) market. This means that broker benefits from more flexible operating rules when trading CFDs, in the form of more attractive prices, as traders can customise the terms and conditions of OTC contracts. However, a financial exchange is generally considered to be safer, as the contractual agreements are regulated and standardised, and usually provide faster transactions because of this.

ETFs remain a relatively simple financial product that can be acquired in the same way as a share in the stock market. To speculate more flexibly on the financial markets, the majority of short-term investors and traders tend to prefer CFD trading. However, share trading is more similar to ETFs in the sense that the investor can physically own the asset, and as you purchase the shares for the full capital value, you do not need to use leverage. Share trading is an alternative to both CFDs and ETFs.

3 advantages of CFDs over ETFs

Greater flexibility

CFDs allow traders to bet on price movements for an abundance of financial instruments, while adjusting the size of its positions more precisely using leverage. This means that when opening and closing positions, the investor therefore has better agility.

Continuous quotes

Whereas an ETF can only be processed during the opening hours of the stock exchange, this is not the case for CFDs, which instead have their quotes extended. The forex market, for example, can guarantee consistent quotes, which allows investors to take advantage of longer trading sessions, while reducing the risk of slippage from one session to another.

Better accessibility

The steps to trade ETFs can sometimes prove to be complex, especially for beginner traders. On the other hand, CFDs are much easier to access by simply opening an account and speculating on price movements of the underlying asset. We offer both live and demo accounts, so that our traders can practise with virtual funds before opening a position with real capital.

Risks of CFDs and ETFs

Despite the points above, with all trading benefits come risks. One major risk of trading CFDs is the use of leverage. While leveraged trading provides better exposure to the financial markets, as it only requires traders to deposit a small fraction of the overall value, this can also cause major losses if the market moves against you. This is because both profits and losses are based on the full value of the trade, so you could end up losing five times of your deposit amount.

If you do not have sufficient funds to cover your losses, then you will also be at risk of an account close-out. Traders should therefore monitor their account balance in order to deposit additional funds if necessary to cover all trading costs, including overnight fees. Read a complete overview of CFD risks.

While the above points do not necessarily apply to individual ETFs, exchange-traded funds come with their own drawbacks. Given that most investors choose to buy and hold ETFs in the long-term, they do not have the opportunity to trade both sides of the market. This is where CFD trading is useful, as short-term traders can use CFDs to trade on the underlying price movements of the ETF, both in the short and long-term. This method also brings the risk of market volatility and gapping, so you should read about effective risk-management controls if you are considering opening a CFD position for ETF trading.

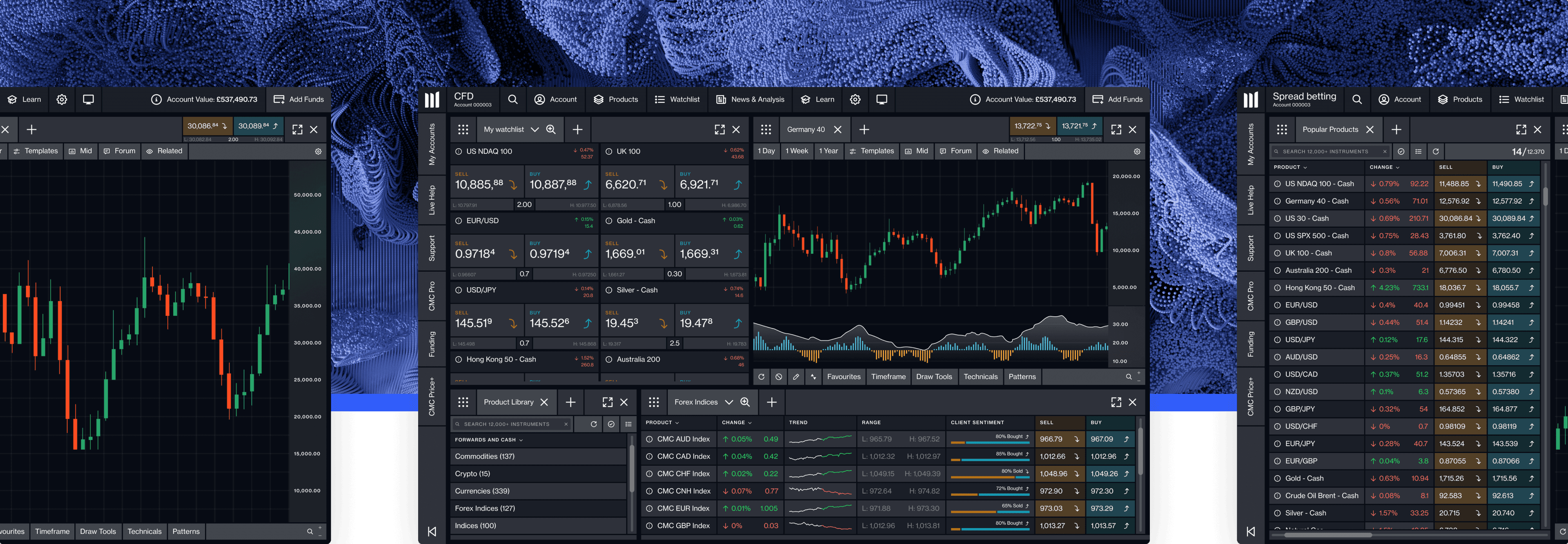

Online trading platform for CFDs and ETFs

Our award-winning trading platform, Next Generation, allows you to trade CFDs on a wide range of financial markets, including forex, indices, shares, treasuries and commodities. You can also trade CFDs on over 1,000 ETFs, where instead of directly taking ownership of the asset, you speculate on its price movements. This means taking a buy or sell position based on whether you think the ETF’s price will rise or fall.We offer popular exchange-traded funds from Vanguard, iShares and Invesco. It is a simple and easy process to register for a live account. Our platform comes complete with price projection tools, technical indicators and drawing tools for live charts. View our platform video tutorials to get started with Next Generation.

Summary

This article has explored the common characteristics and differences between ETFs and CFDs. It is generally accepted that ETF trading may be better-suited for opening long-term positions, whereas many traders turn to CFD trading for more short-term operations, as they simply want to trade on the asset for a quick profit and not own the underlying security. These types of traders use short-term strategies such as scalping, day trading and swing trading.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.