Confidence with every trade

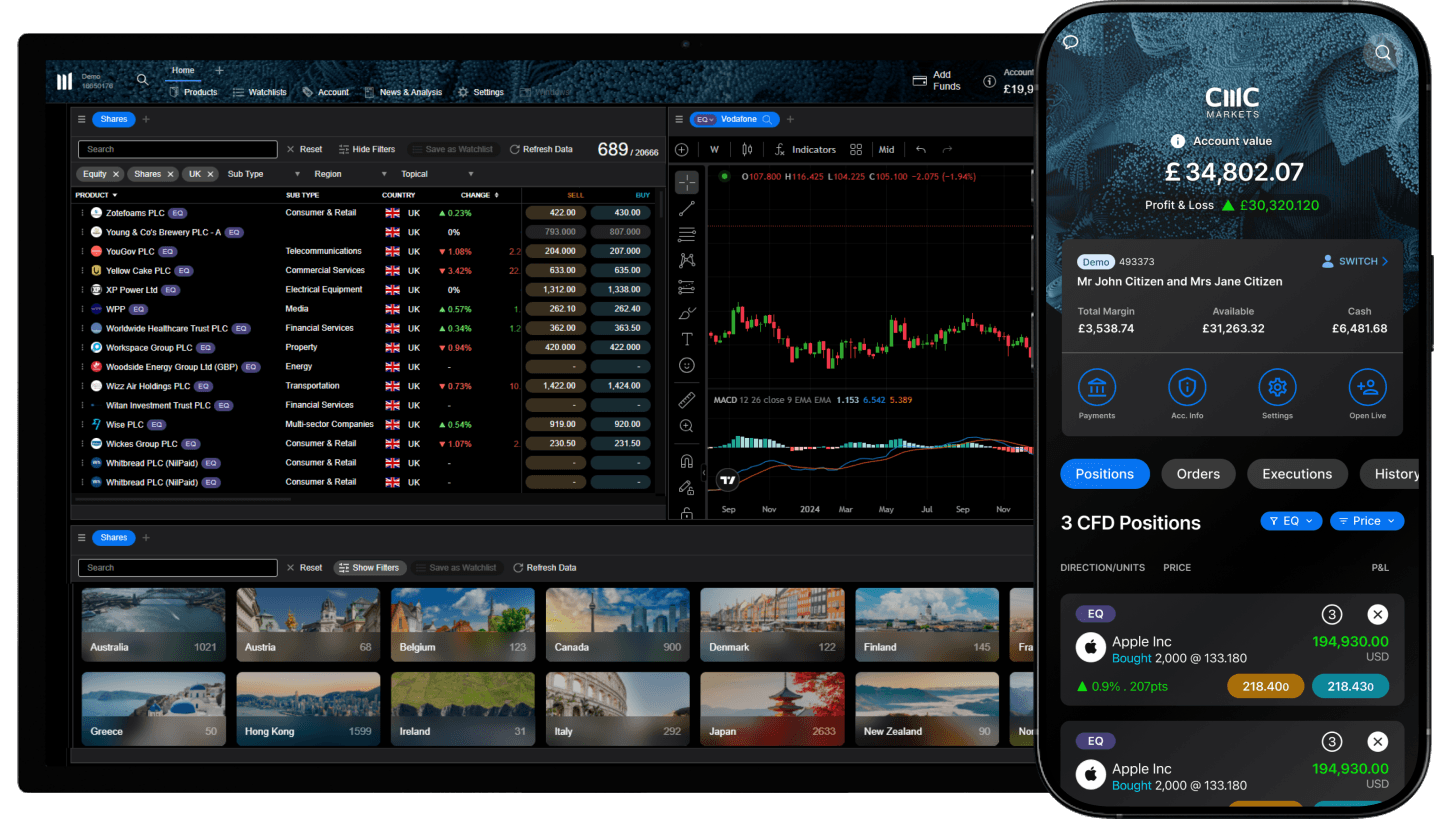

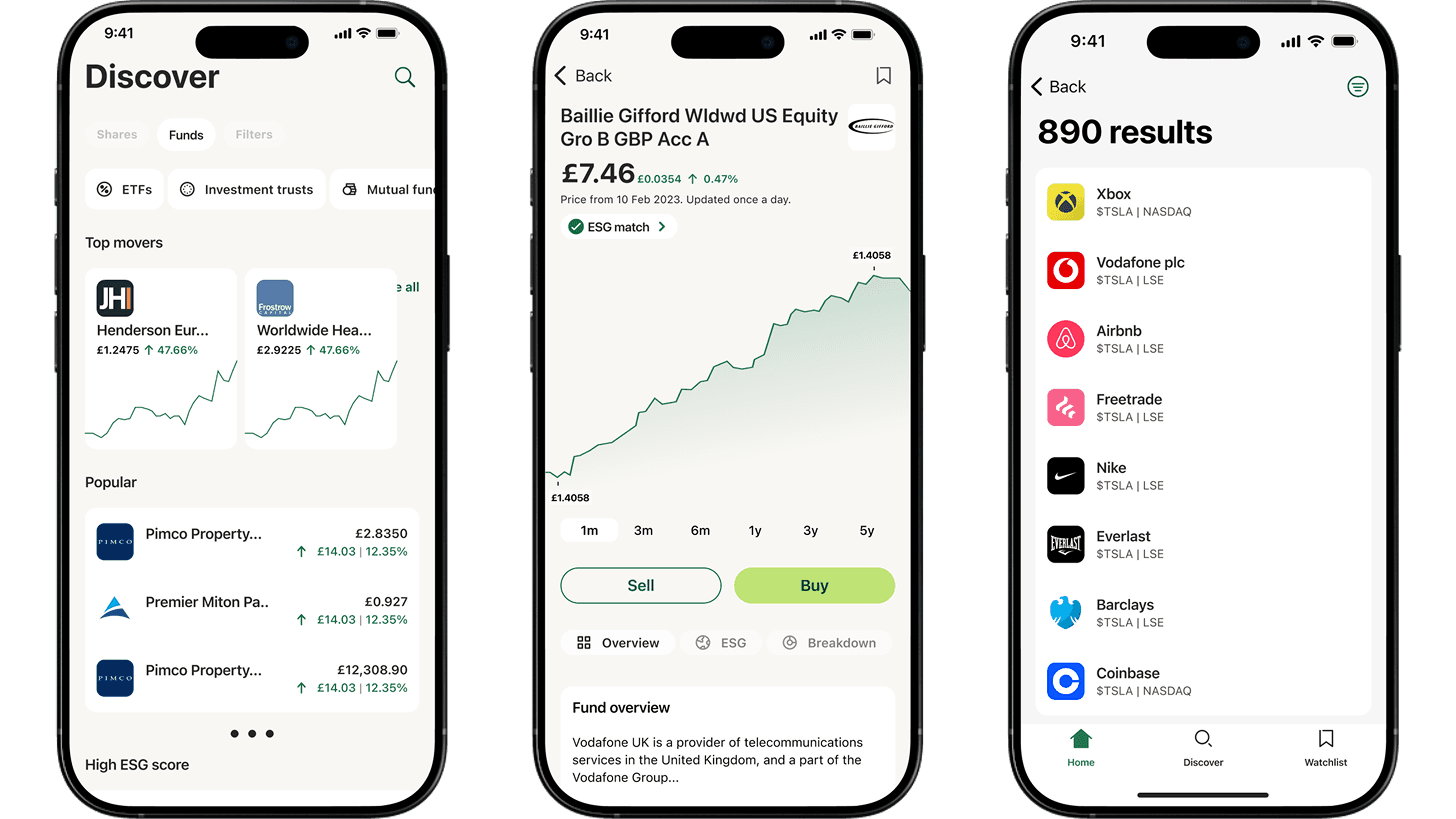

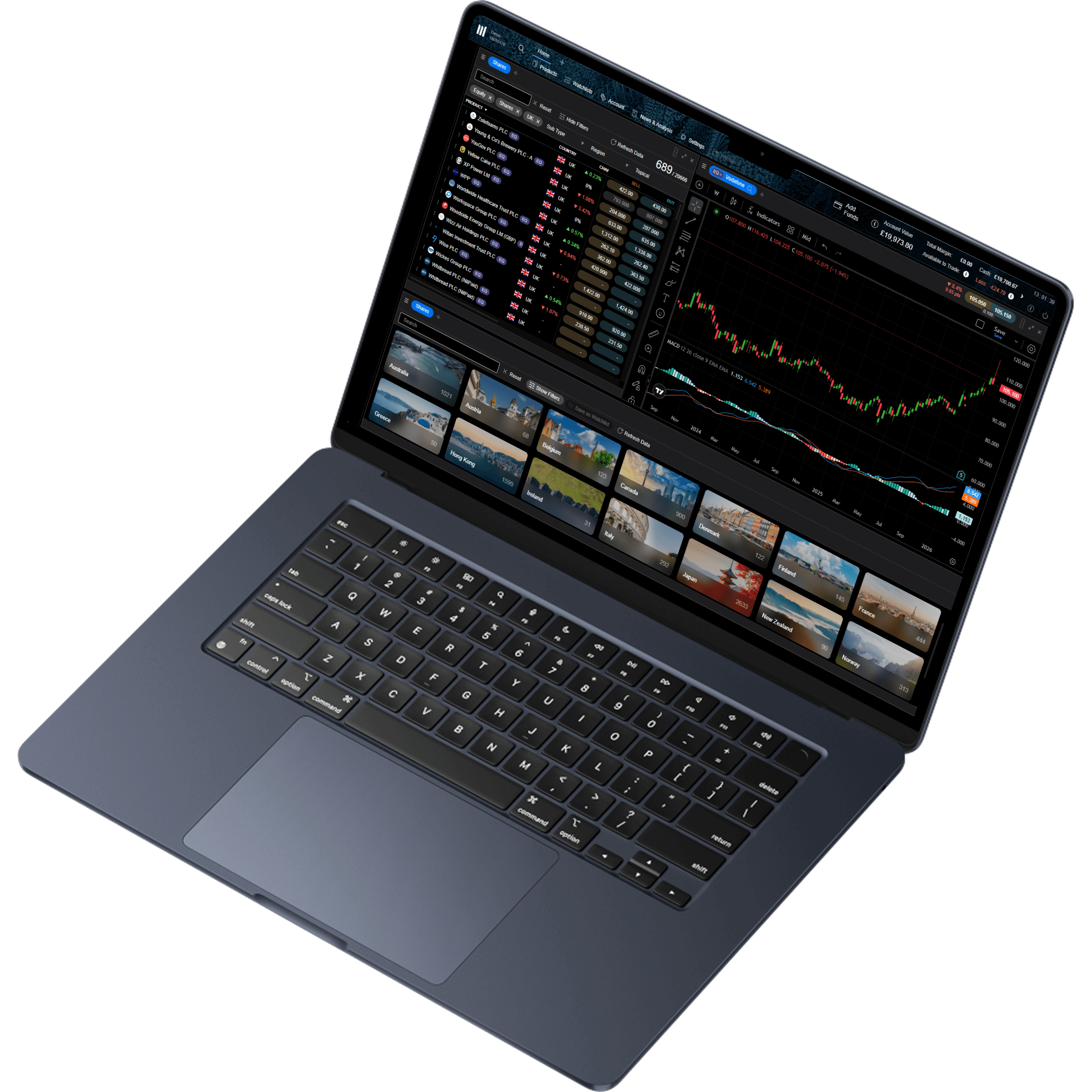

Choose your platform

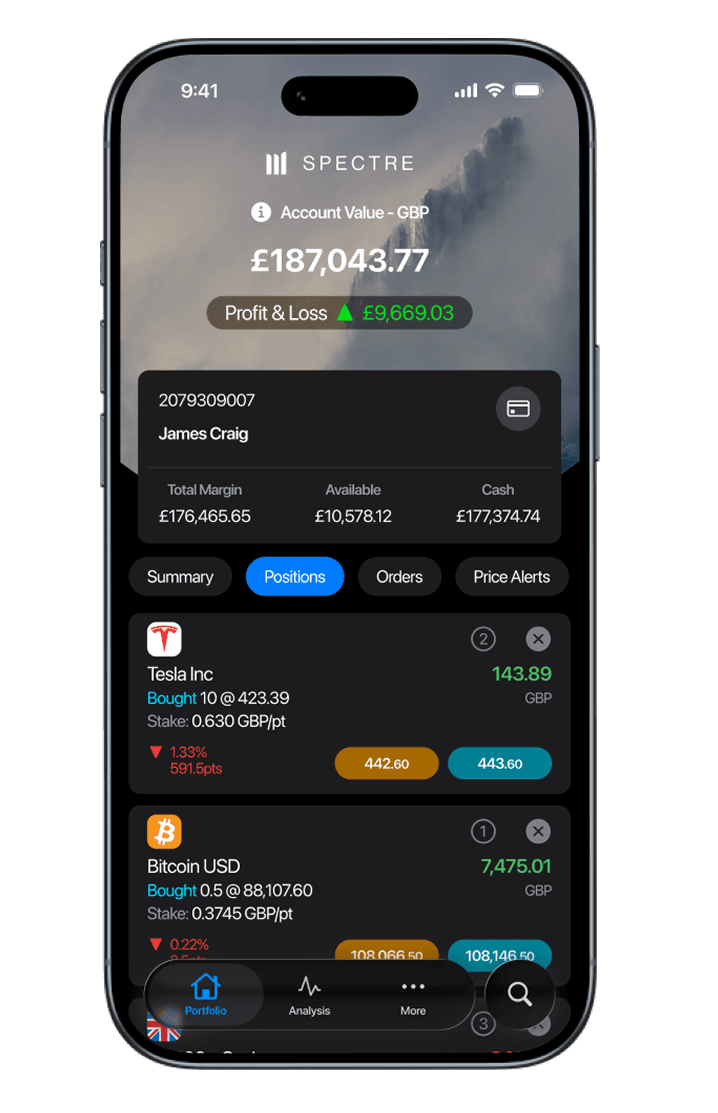

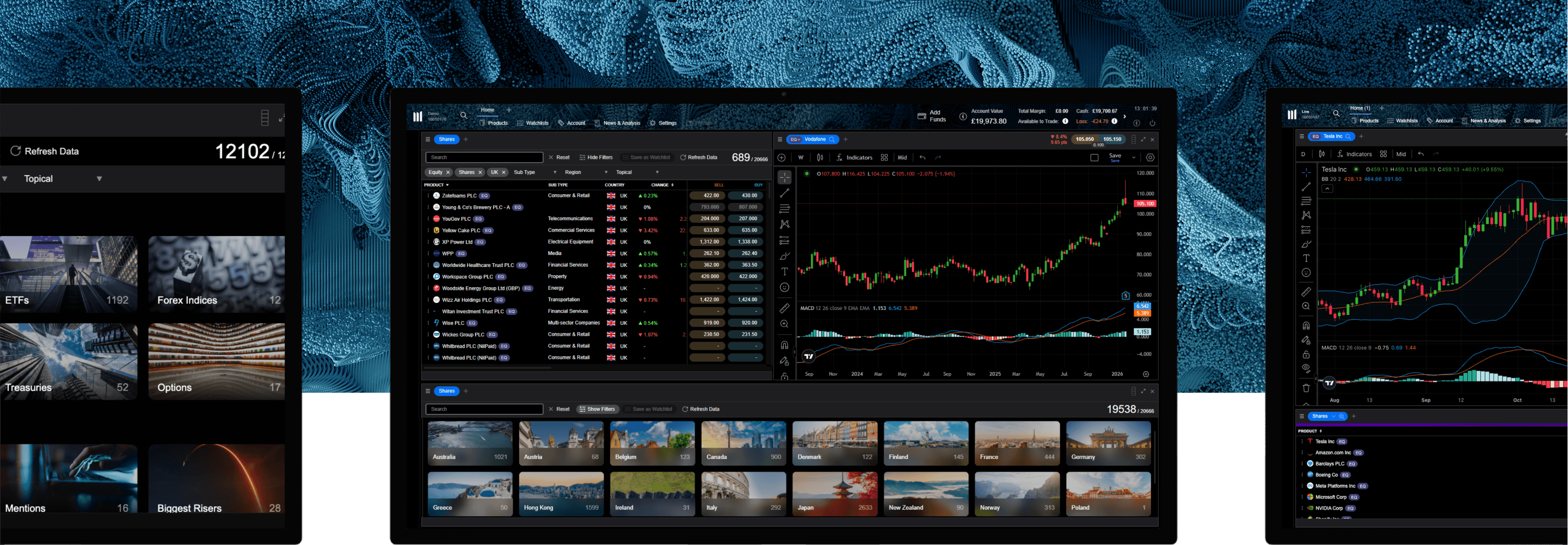

Our award-winning platform²

We’ve invested £100m+ into our platform, creating pioneering technology for all traders and investors around the world.

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

10,000+ global shares

Invest in or trade on more than 10,000 shares across global stock markets.

Any questions?

Email us atclientmanagement@cmcmarkets.co.uk

or call on +44 (0)20 7170 8200We're available whenever the markets are open, from Sunday night through to Friday night.

1Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

2Recent awards include: No.1 Most Currency Pairs & Best-in-class for Overall Excellence, MetaTrader, Mobile Trading App, Professional Trading, Research & TradingView, ForexBrokers.com Awards 2026; Best Broker for Active Traders, Professional Trader Awards 2025; Best Mobile Trading Platform and Best Spread Betting & CFD Education Tools, ADVFN International Financial Awards 2025; No.1 for Commissions & Fees, ForexBrokers.com Awards 2025.

Loading...

Loading...