Outlook 2026: Will the gold rush continue?

As part of our series exploring the outlook for key financial instruments and markets in the year ahead, our market analyst Luis Ruiz assesses whether the boom times can continue for gold , silver and other precious metals in 2026.

Market analyst

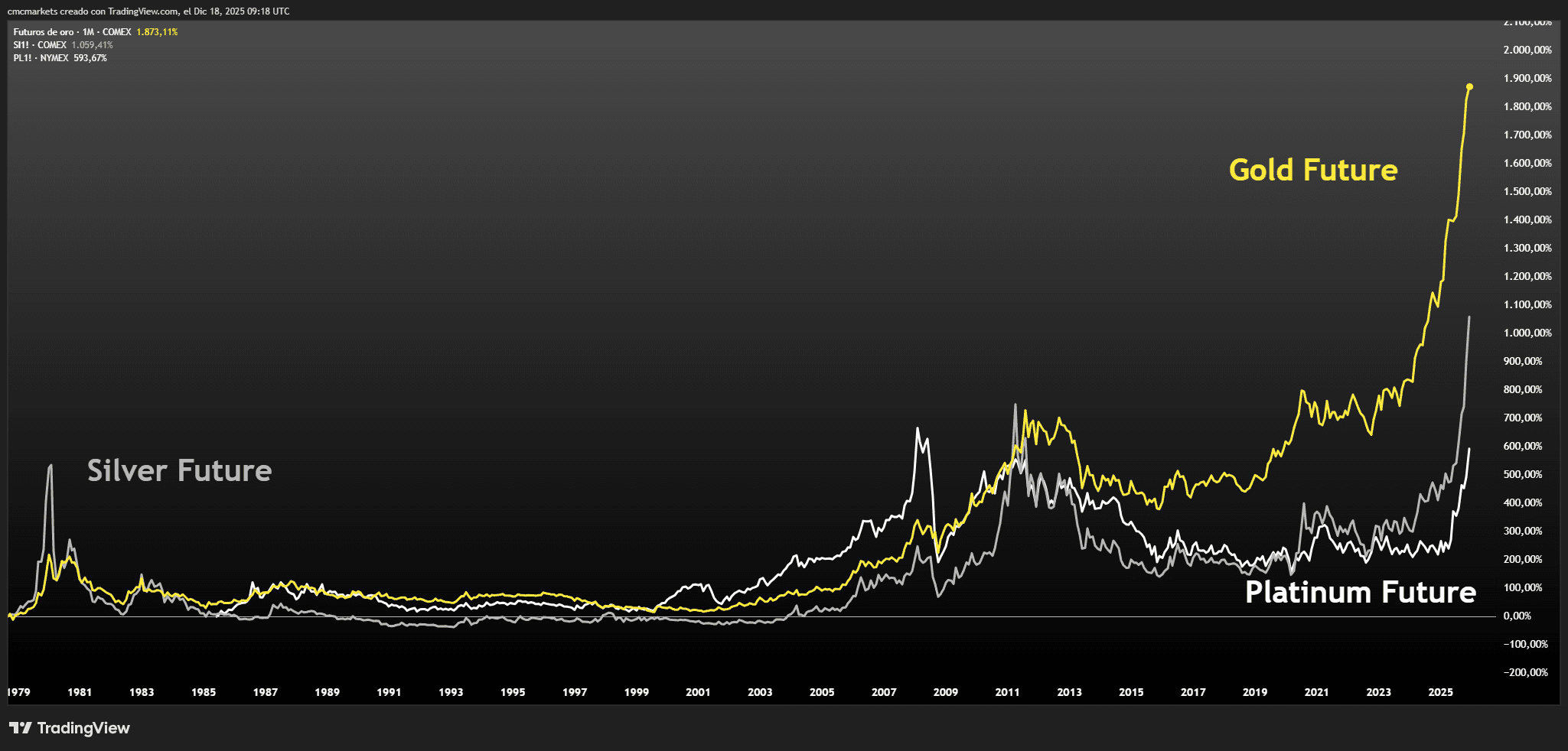

Precious metals were 2025’s strongest asset class by a wide margin. Gold rallied more than 65% in the past 12 months, marking a third consecutive year of gains. Silver surged even more sharply, climbing more than 125%. Platinum also posted triple-digit gains, while palladium soared more than 90%.

The last time precious metals went on this kind of a tear was in the late 1970s, when the oil crisis pushed inflation into double-digit territory for several years.

An uncomfortable echo of the 1970s

Today’s environment is clearly different from half a century ago. Inflation has been brought back under control after its post-pandemic spike, oil prices are falling, and economies are growing, albeit only slightly in some cases. Yet if precious metals act as an early warning signal, the resemblance to the end of the 1970s is hard to ignore.

Gold, silver and platinum futures, monthly chart, 1979-present

Source: TradingView, 18 December 2025

Demand for physical gold and silver remains strong. Central banks are steadily adding to their reserves, while retail investors are increasing their exposure through physically backed exchange-traded funds (ETFs). What is striking is that both institutional and individual investors are buying at the same time, seemingly unfazed by record prices.

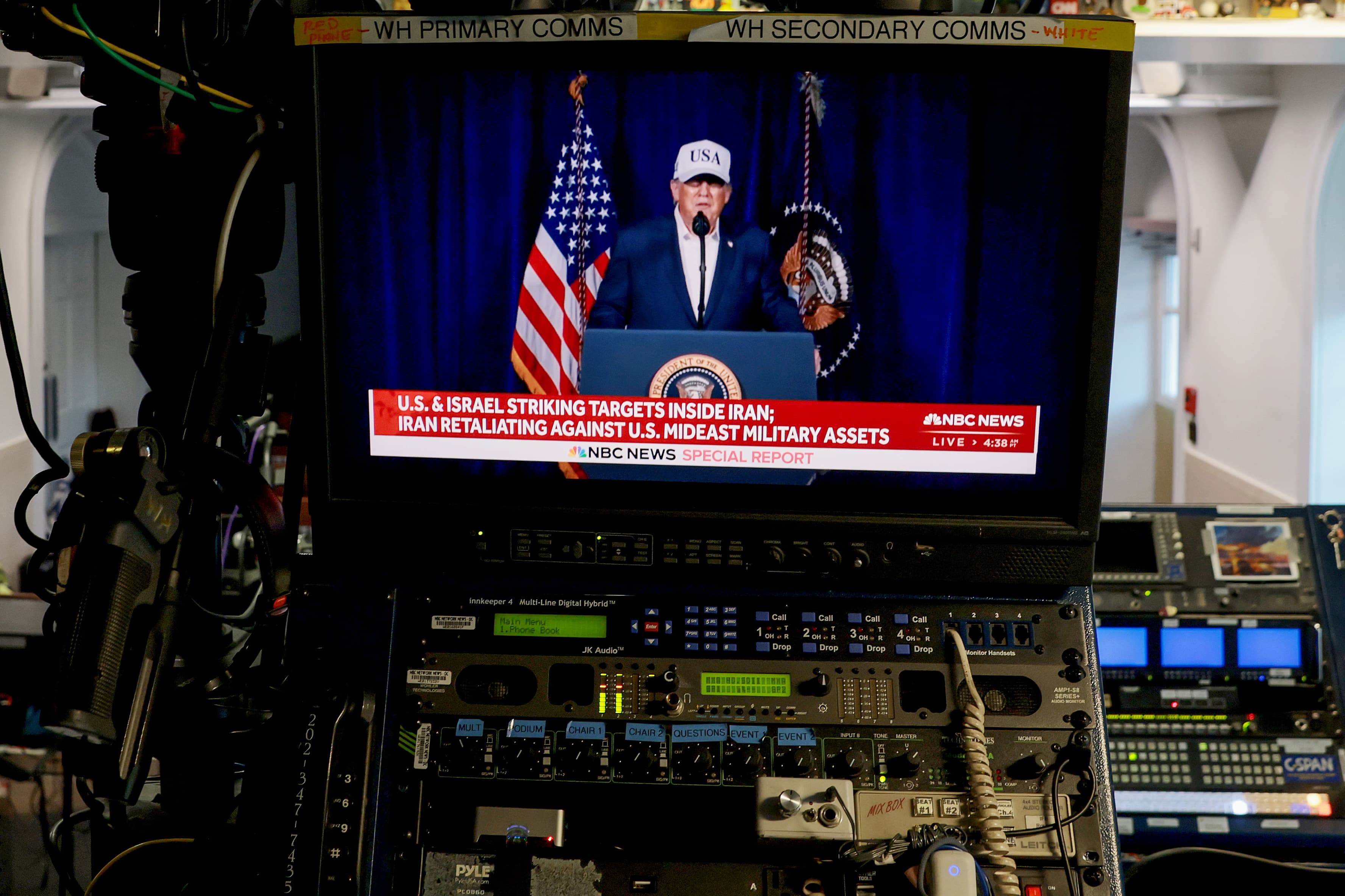

Uncertainty, debt and a fractured world

Precious metals are traditionally seen as safe-haven assets, and their appeal tends to rise when uncertainty increases. Little wonder, then, that gold and silver have had a strong year. As 2025 draws to a close, the global backdrop is marked by growing political divisions, heightened geopolitical tensions and rising defence spending, much of it funded through additional borrowing.

Throughout 2025, these concerns have been reinforced by economic policy shifts around the world. Germany relaxed its long-standing debt brake. France continues to struggle with political instability and persistent budget deficits. The UK tried and failed to rein in welfare spending to ease the pressure on the public finances. In Japan, the election victory of Sanae Takaichi led to the introduction of a large fiscal stimulus programme. Each case adds to the sense that government debt is becoming a growing and widespread issue.

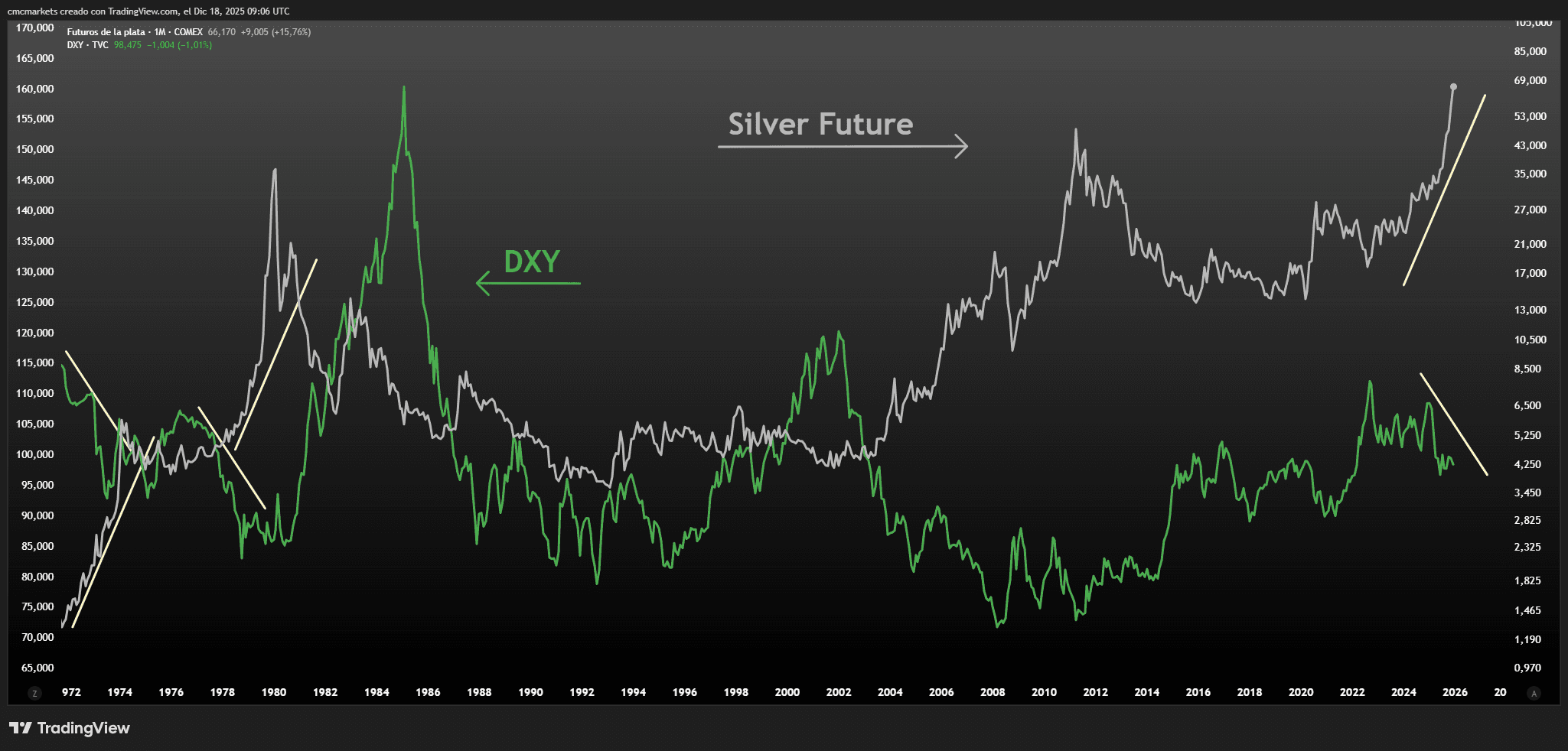

The US dollar and the strain on fiat currencies

The United States is no exception. Public debt continues to rise, with the budget deficit expected to come in at close to 6% of GDP in 2025. Interest costs on government debt have moved firmly above $1tn a year. At the same time, the Federal Reserve has ended its balance sheet reduction and returned to buying government bonds.

Efforts to rein in deficits, whether through spending restraint or trade policy, have so far fallen short. As a result, the Fed has once again stepped in to stabilise the system. Against this backdrop, the US dollar, the world’s dominant fiat currency, has weakened, showing patterns that some investors associate with past periods of fiscal stress, including the 1970s.

Dollar index and silver futures, monthly chart, 1972-present

Source: TradingView, 17 December 2025

Looking ahead to 2026: how much further can prices rise?

The outlook for 2026 remains broadly supportive for precious metals. The forces driving demand are deeply rooted and unlikely to fade quickly. New investors continue to enter the market, while existing holders have little reason to sell unless they need cash or find a more attractive alternative.

This creates a form of momentum that underpins the longer-term uptrend. However, sustaining the pace of recent, near-vertical gains would likely require a fresh trigger. At current levels, gold already accounts for a sizeable share of many portfolios, often around 10%. Without a clear escalation in economic or financial stress, the rally may struggle to maintain the pace of 2025.

In short, the long-term case for precious metals arguably remains strong, but any path higher in 2026 may be more measured than the extraordinary gains seen in 2025.

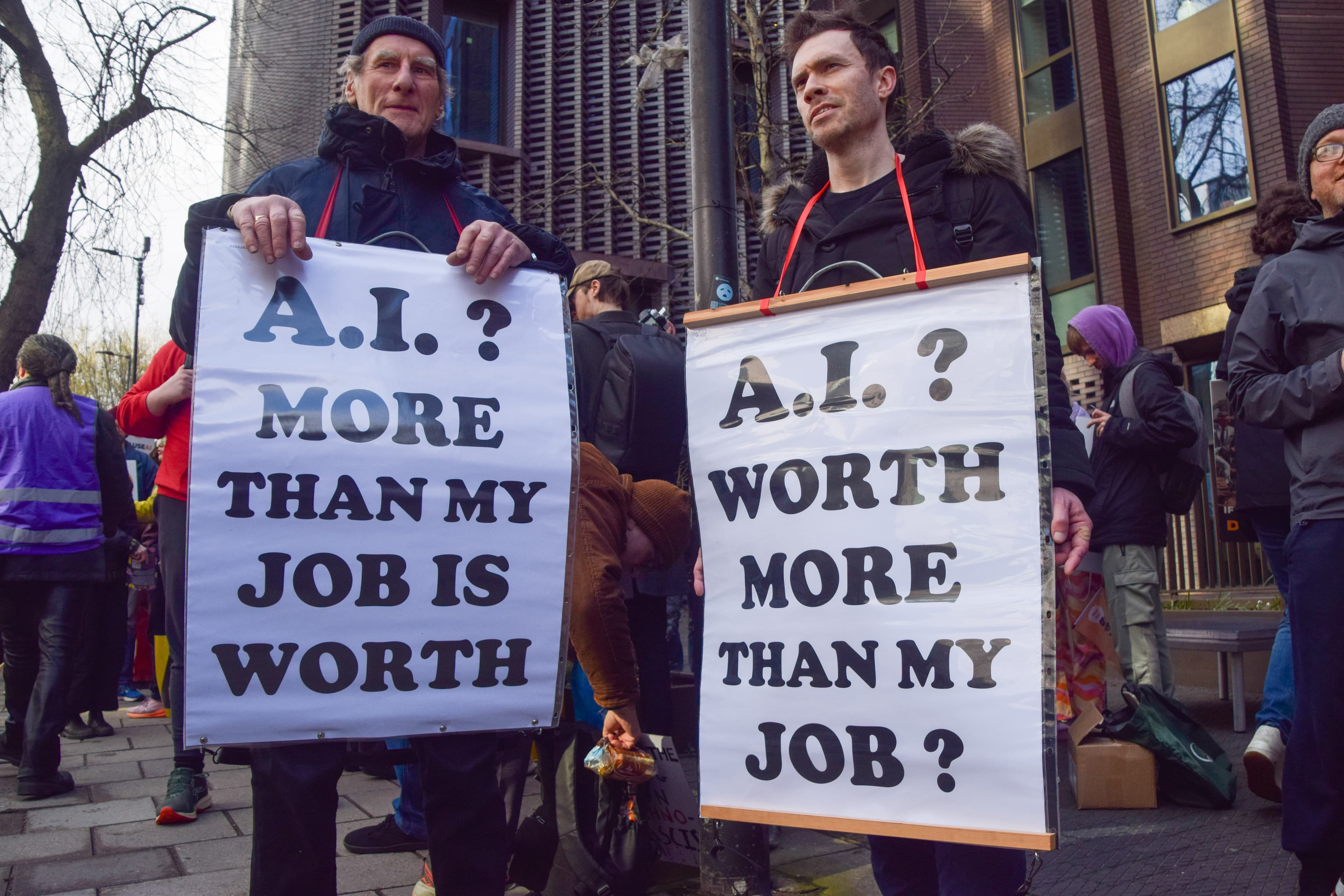

Is AI disrupting the labour market?

The US labour market still reflects a “low-hire, low-fire” pattern, but rising layoff announcements and the growing role of artificial intelligence are testing its stability. The key question is whether AI is beginning to drive a more structural shift in employment.

DAX slides further as Middle East conflict, rising energy prices and Beiersdorf results weigh

The DAX remains under pressure as escalating tensions in the Middle East push oil and gas prices higher and dampen investor sentiment. Weak earnings from Beiersdorf add to the negative tone ahead of key economic data releases.