Outlook 2026: Where next for the DAX?

As part of our series exploring the outlook for key financial instruments and markets in the year ahead, our market analyst Luis Ruiz analyses Germany’s DAX index and asks whether its small- and mid-cap sister indices could have their moment in 2026.

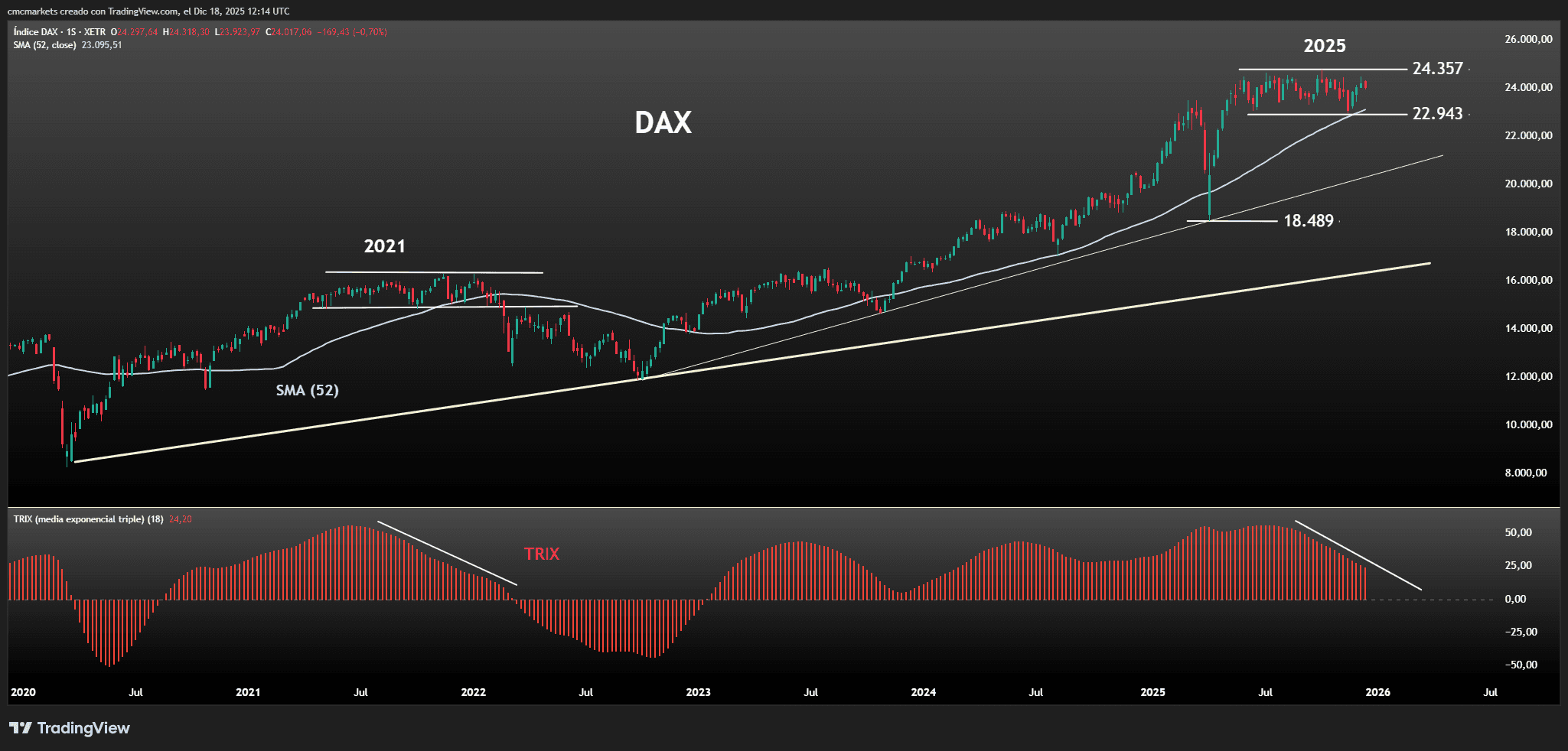

Germany’s next market rally may not be in the DAX. The index of the top 40 German stocks had a stellar 2025 on paper, rising more than 20% during the year to start the week of Christmas at 24,300 points. But appearances can be deceptive. Most of those gains came in the first five months of the year. Since May 2025, the DAX has been flatlining.

An overvalued index under pressure

The DAX appears to have run out of momentum. For the past seven months, it has fluctuated in a narrow range between roughly 22,900 and 24,400. This lack of progress suggests the index is losing strength, even though the longer-term trend remains positive. There are three main reasons for the standstill.

First, valuations look stretched. The DAX is currently trading on a price-to-earnings ratio of around 21, well above its historical average of around 15.

Second, geopolitical pressures are mounting. German companies face increasing competition from China, while the risk of new US trade tariffs continues to hang over export-oriented industries.

Third, financing costs are rising. Higher bond yields have pushed up borrowing costs, which is particularly painful for an index dominated by capital-intensive sectors such as carmakers, utilities and chemicals.

DAX weekly chart, 2020-present

Source: TradingView

A fiscal boost for Germany, but not for the DAX

The German government has taken a dramatic step by loosening its constitutional debt brake and approving a €500bn investment programme known as the ‘Sondervermögen’. The aim is to modernise the economy through spending on infrastructure, digital networks and energy, while also maintaining defence spending above 2% of GDP.

Bond markets reacted quickly. Yields on German government bonds jumped by around 50 basis points and have since settled near 2.9%, reflecting the large volume of new debt needed to fund the programme. This rise in yields has also pushed up borrowing costs for companies, with industrial firms particularly affected.

Despite the scale of the plan, large DAX-listed companies are unlikely to benefit directly. Around 80% of their revenues are generated outside Germany. Instead, they face mostly the downside, as higher interest rates increase financing costs for businesses that rely heavily on debt and long-term investment.

Could 2026 be the year of ‘Little Germany’?

Germany’s small and medium-sized companies, represented by the SDAX (small-cap) and MDAX (mid-cap) indices, are far more closely tied to the domestic economy than the DAX. These firms are expected to be the main beneficiaries of government spending as projects move from planning into execution.

According to economic research institutes such as IFO and ZEW, the bulk of the spending is likely to take place in the second half of 2026. As funds begin to flow, companies involved in construction, engineering and services should see a meaningful boost in activity.

Several investment banks, including Oddo BHF and Berenberg, expect earnings in the MDAX to rise by around 30% in 2026. This is particularly striking given how cheaply these indices are currently valued. Data from Stoxx, the European stock index provider, shows that both the MDAX and SDAX trade at significant discounts to the DAX on measures such as price-to-sales and price-to-book ratios.

MDAX vs ZEW survey of economic conditions, 2006-present

Source: TradingView

A shift in focus for German equities

After several years in which large, globally-focused companies dominated returns, the balance may be starting to change. Valuations, earnings growth and government spending could point towards improved prospects for Germany’s smaller, domestically-focused firms.

If the investment programme delivers as planned and economic conditions stabilise, 2026 might mark a revival for the MDAX and SDAX, even if the DAX itself struggles to regain momentum.

The USD/CAD reaches critical pivot point

USD/CAD is testing key resistance at 1.37, with a breakout potentially opening the way higher and failure risking a move back towards 1.35.