27 monthly dividend stocks and ETFs to watch

Stocks that pay monthly dividends are a popular investment for those who strive to earn returns on a more frequent basis. In this article, we will highlight some of the top monthly dividend stocks that you can invest in, as well as exchange-traded funds (ETFs) from across the world.

Are stock dividends paid monthly?

Stock dividends are most commonly paid on a quarterly basis (every 3 months) to shareholders, four times per year. However, some companies choose to pay these on a monthly or even annual basis. A company's board of directors usually approves the dividend, and then announces when the dividend will be paid, the amount of the dividend, and the ex-dividend date.

Investors can either reinvest dividend payments back into their portfolio or collect the payments as income. In particular, investors who use the latter option may be more partial to companies that pay a monthly dividend, as this will supply them with a consistent form of income (provided that the company remains profitable).

Many real estate investment trusts (REITs) are known for paying dividends on a monthly basis. This may be because they are required to distribute at least 90% of their taxable income to shareholders annually.

List of monthly dividend stocks

Financial data is sourced from MarketBeat and is up to date as of December 2021.

Realty Income [O]

This company comes with the trademark tagline ‘The Monthly Dividend Company’, solidifying its position on the monthly dividend list. Realty Income is a real estate investment trust that has cash flows from more than 7,000 properties across the US, UK, and Spain, investing in free-standing, single-tenant properties. The company has headquarters in San Diego, California and is listed on the New York Stock Exchange, as well as being a constituent of the S&P 500 index.

Prospect Capital Corp [PSEC]

Prospect is a leading business development company that makes debt and equity investments in middle-market, later stage, and emerging markets businesses, across a range of industries. It’s listed on the Nasdaq exchange in New York. Prospect Capital Corp has over $6.5bn in total assets covering a portfolio of more than 375 funded investments.

Shaw Communications [SJR]

Shaw is a Canadian telecommunications company with headquarters in Calgary, Alberta. The company provides telephone, internet, television, and mobile services under its several subsidiaries, including Freedom Mobile, Shaw Broadcast Services, and Shaw Direct. Shaw has around 7.08 million subscribers across the country and is listed on the Toronto Stock Exchange (TSE).

LTC Properties [LTC]

This REIT focuses on investing in seniors housing and healthcare through the means of joint ventures, mortgage financing, sale-leasebacks, and preferred equity. LTC works with 33 partners across 27 states in the US, with its headquarters located in California. It has over 181 property investments and the company is working towards integrating ESG initiatives into its operations. LTC Properties is listed on the NYSE.

Itaú Unibanco [ITUB]

Formed by the merger of Banco Itaú and Unibanco in 2008, this financial services company is the largest banking institution in both Brazil and Latin America. It specialises in credit cards, loans, and investment banking services for more than 60 million customers across the region. Itaú Unibanco has total assets of approximately R$1.74tn. The bank is listed on the B3 in São Paolo and NYSE in New York.

Gladstone Investment [GAIN]

This investment fund belongs to the family of Gladstone Companies, which also includes Gladstone Capital, Gladstone Commercial, and Gladstone Land. It’s a private equity fund focusing on acquiring mature, lower middle-market companies that show a history of strong financials and internal company fundamentals. All four investment funds are listed on the Nasdaq exchange offering monthly dividend payouts, and the parent company is headquartered in Washington D.C.

Pembina Pipeline [PPL]

Pembina Pipeline is a Canadian oil and natural gas company that is a leader in energy transportation and midstream services. It operates over 18,000 kilometres of conventional, transmission, oil sands and heavy oil pipelines across North America, including the US, from the company’s base in Calgary, Alberta. This is for the transportation of hydrocarbon liquids and natural gas products produced in the Western Canadian Sedimentary Basin. Pembina Pipeline is listed on the TSE.

STAG Industrial [STAG]

Another REIT on this list, STAG Industrial focuses on the acquisition and operation of single-tenant, industrial properties throughout the US. It has headquarters in Boston, Massachusetts and is listed on the New York Stock Exchange. The company invests in more than 517 buildings across the US, including 44 states such as California, Indiana, and South Carolina. It has an enterprise value of $8.7bn.

Kelly + Partners Group Holdings [KPG]

A small-cap stock with headquarters in Sydney, Kelly + Partners is a chartered accounting network that provides a range of financial services to private businesses and clients, including accounting and taxation services. The holding stock is listed on the Australian Securities Exchange. Since the company’s inception in 2006, it has expanded to 26 operating businesses across 17 locations in the Asia-Pacific region.

AGNC Investment Corp [AGNC]

AGNC is an internally managed mortgage REIT that makes money by investing in single-family residential mortgages securities and obligations guaranteed by the US government. The company generates income from interest earned on its investment assets, net of associated borrowing and hedging costs, and net realised gains and losses on activities. AGNC was founded in 2008 and has headquarters in Maryland, with a listing on the Nasdaq exchange.

Horizon Technology Finance [HRZN]

Horizon is a leading venture lending platform that provides structured debt products to companies within the technology, pharmaceutical, and life sciences industries. The company has invested more than $5bn in venture loans to thousands of worldwide companies, both established and growing, since its inception. Headquartered in Connecticut, Horizon is listed on the Nasdaq exchange and offers loans up to a transaction size of $25m for the expansion, research and development, and sales and marketing of its business portfolio.

Ellington Financial [EFC]

This US-based specialty finance company invests in a wide range of financial assets, including residential and commercial mortgage loans, mortgage-backed securities, consumer loans, derivatives, equity investments, and other strategic investments. It’s listed on the NYSE and has headquarters in Greenwich, Connecticut.

Global Water Resources [GWRS]

GWRS is a water resource management company headquartered in Phoenix, Arizona. It owns and operates nine utility businesses across the country to provide water, wastewater, and recycled water utility services. Global Water Resources consumes more than 3.3 billion gallons of water per year on average. The stock is listed on the Nasdaq exchange.

Banco Bradesco [BBD]

Another emerging markets stock that pays monthly dividends is Brazil’s Banco Bradesco, which is also headquartered in São Paolo and New York City. It’s the third largest banking institution in Brazil and Latin America. The company offers products and services such as commercial banking, insurance, pensions, loans, credit cards, leasing, and savings bonds. BBD has acquired several companies in recent years and has over 70.2 million clients worldwide, as well as 8,840 branches.

EPR Properties [EPR]

This real estate investment trust is a leader in experiential properties, investing in entertainment venues such as ski resorts, national parks, casino resorts, marinas, gold centres, concert venues, amusement parks, and fitness centres, spas, and gyms. It has over $6.5bn in total investments across 350+ locations throughout the US and Canada. The stock is listed on the NYSE.

Please note that past performance is not indicative of future results and these dividends are subject to change.

Are there monthly dividend ETFs?

As well as individual stocks, some ETFs also offer monthly dividend payouts to shareholders in the same way. Here’s a list of some monthly dividend ETFs to explore.

iShares MBS ETF [MBB]: tracks investment grade mortgaged-backed securities issued by the US government, including Fannie Mae, Freddie Mac, and Ginnie Mae.

Global X SuperDividend ETF [SDIV]: invests in the highest dividend yielding equities in the world, with over 100 from a wide range of countries and sectors.

WisdomTree US Quality Dividend Growth Fund [DGRW]: tracks high-quality dividend growing companies from the US which meet the fund’s ESG criteria.

Vanguard Mortgage-Backed Securities ETF [VMBS]: invests in US agency mortgage-backed pass-through securities. The fund has a dollar-weighted average maturity of 3 to 10 years.

First Trust Senior Loan Fund [FTSL]: actively managed fund that invests in a diversified portfolio of first lien senior floating-rate bank loans in the US.

Are there any monthly dividend stocks in the UK?

There are a number of shares and ETFs listed on the London Stock Exchange (LSE) that offer monthly dividend payouts to both UK and international investors. We explore these in further detail below.

BMO Commercial Property Trust [BCPT]

This investment trust belongs to parent company BMO Global Asset Management and is dedicated to investing in commercial UK properties. It holds a diversified portfolio of three commercial property sectors: office, retail, and industrial, while also providing exposure to leisure, residential property, and student housing. BMO has headquarters in London and the BCPT trust is a constituent of the FTSE 250 index.

TwentyFour Select Monthly Income Fund [SMIF]

SMIF is a closed-ended fund owned by TwentyFour Asset Management that is designed to take advantage of premium returns available from less liquid instruments across the debt spectrum. The fund aims to highlight a relatively overlooked part within the market by investing in a diverse portfolio of fixed income credit products. It focuses mainly on banking, insurance, and asset-backed securities (ABS) sectors and has a market cap of £183.8m.

Ediston Property Investment Company [EPIC]

This company is a real estate investment trust that invests in UK real estate assets belonging mainly to the office, retail, and industrial sectors. The business has a portfolio of assets with lot sizes ranging from £10m to £50m, often non-institutional to start. In total, Ediston’s portfolio value is approximately £283.4m.

NB Global Monthly Income Fund [NBMI]

NBMI is an investment trust belonging to parent company Neuberger Berman (NB), which aims to deliver a consistent monthly income by investing in traditional credit, alternative credit, and private loans. It has a diversified portfolio across multiple sectors that is hedged to the British pound sterling (GBP).

Why invest in shares that pay monthly dividends?

Investing in monthly dividend stocks may provide more frequent returns than companies that distribute on a quarterly basis, but do the pros outweigh the cons? Let’s take a look at some of the benefits and drawbacks of investing in monthly dividend shares.

Advantages

Monthly dividend stocks can provide a steady base of income for full-time investors, so they don’t have to wait for quarterly payments. This is perhaps the main appeal for why an investor would choose monthly over quarterly dividend payouts, if investing is their main source of income.

Monthly dividend stocks in particular have a very generous dividend yield in comparison with quarterly dividend stocks, as shown in the statistics above. Therefore, if the stock is successful, investors may be receiving a higher payout at a more regular frequency.

Disadvantages

Some companies don’t pay monthly dividend because it may not be as cost efficient as quarterly payouts. A shift to monthly distribution may result in additional costs for all shareholders that they don’t necessarily need or want to pay.

There are limited options when it comes to monthly dividend stocks. For example, most companies listed on the FTSE 100 or S&P 500, two popular stock indices that investors tend to follow, offer a reasonable dividend payout but on a quarterly basis. Therefore, investors may be investing in more complex funds than they understand, such as investment trusts.

For some investors, they may use their monthly dividends as income and live off this money as a full-time living. Others may decide to reinvest earned dividend payments back into their portfolio so they can build a larger sum of money over the long term.

Investing in companies that pay a quarterly dividend may be easier, but it doesn’t necessarily produce higher returns. For example, the majority of stocks listed on the FTSE 100 pay a quarterly dividend to shareholders, including high-yielding stocks like Evraz, M&G, and Imperial Brands. Check out our article on the best FTSE dividend stocks in the UK.

When calculating monthly dividends, the maths is fairly straightforward. You can simply divide the quarterly (which is usually the standard rate) dividend by three. For example, if the company tends to pay a quarterly dividend yield of $0.45, then $0.45 / 3 = $0.15 per share.

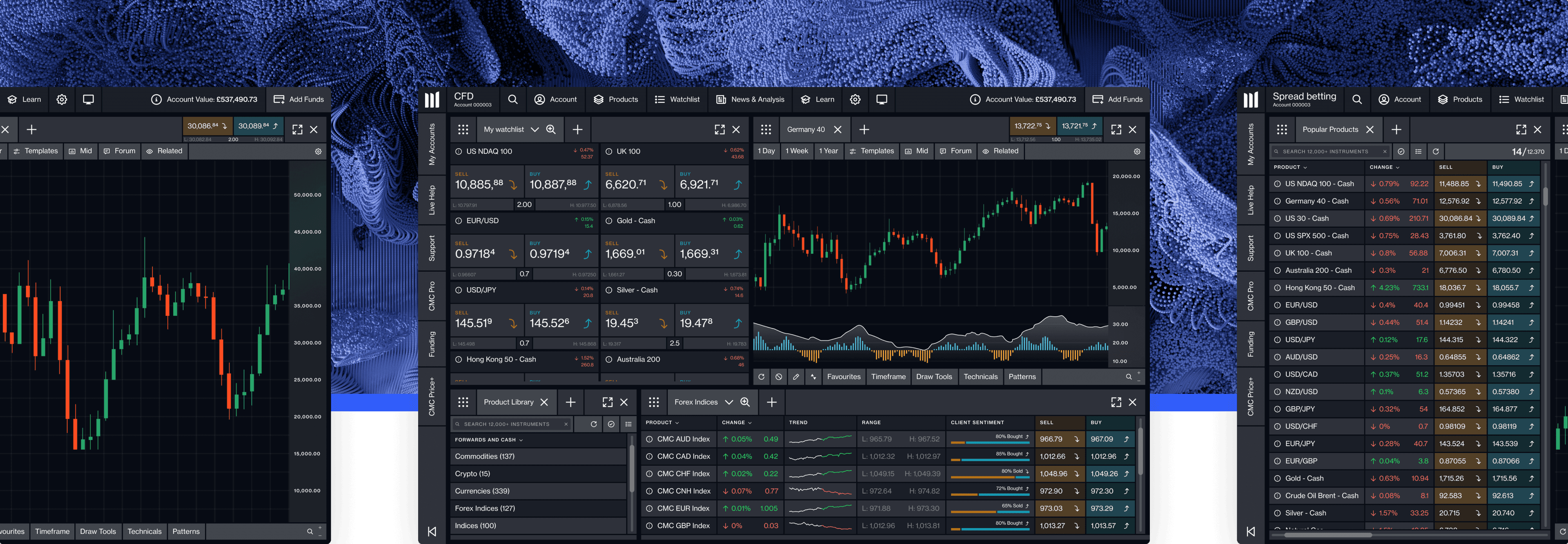

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.