Pharmaceutical stocks to watch

Pharmaceutical stocks are the shares of healthcare companies that focus on developing, manufacturing and distributing pharmaceutical products, such as drugs, medicines and vaccines. Investing in pharmaceutical stocks is a popular trend in times of political or economic instability. For example, during the Covid-19 crisis, pharmaceutical companies were in high demand, as they provided products and equipment, in turn increasing their share price and value.

This article contains a list of global pharmaceutical shares with some of the highest market capitalisations, dividend yield percentages and overall stock value according to stock market indices such as the FTSE 100.

Pharmaceutical share tips

The pharmaceutical industry is part of the wider healthcare sector, and these companies are active all year round, no matter the global situation. Share prices tend to represent the perceived value of a company by investors, and any subsequent profit and loss that may result after opening a trade. In order to value pharma stocks, it's important to analyse company fundamentals: the internal and external factors that may influence the performance of the business. This is part of fundamental analysis, which most traders will undertake before opening a position in the long term, though less often in the short term. Price-to-earnings (P/E) ratios help to value a company's share against its competitors.

Pharmaceutical stock investors look for growth and earnings potential and often prefer high-yield stocks, as this means that the company is likely to pay consistent dividends. Paying dividends to investors can help to strengthen loyalty, as well as confidence in success and future payouts.

Total return is also a good indicator of healthcare stock performance. It shows the return rate of an investment over a period of time, measured by interest, capital gains and dividend statistics. These aspects can all be used to measure the value of top pharmaceutical stocks.

Pharma penny stocks

In recent years, biotech stocks and pharmaceutical penny stocks have become a particular interest to investors as they have often grown into widespread, multinational corporations, including Novavax and Pharma Mar. Penny stocks in the pharma sector became especially popular throughout the Covid-19 pandemic, as many small businesses raced to develop a coronavirus vaccine, rivalling their larger competitors.

In particular, Pharma Mar claimed that its treatment for coronavirus was more than 2,800 times more effective than that of its biotech rival, Gilead Sciences. Pharma Mar's share price spiked higher as a result. The same situation applies to Inovio Pharmaceuticals, which was considered a pharma penny stock until February 2020, where its share price rose to around 10 times the original.

Top pharma stocks

You can spread bet and trade CFDs on the below shares through our trading platform.

Please note that shares are available in demo accounts for a limited period of 30 days for most countries, once you’ve activated the subscription. UK and Italy shares are available for up to a calendar month, based on when you activate the subscription.

Our live account includes access to 9,000+ global shares, plus 1,000 pharmaceutical ETFs, and a large range of advanced platform features and tools.

Please note that past performance is not a reliable indicator of future results.

AbbVie

[

AbbVie is a spin-off of Abbott Laboratories, dedicated to treating chronic autoimmune diseases on a global level, including blood cancers, Parkinson’s and Crohn’s disease.

Market capitalisation: $189.55bn

Dividend yield: 4.50%

AstraZeneca

AstraZeneca conducts its research and development in three global regions: Cambridge, UK; Maryland, US; and Mölndal, Sweden. It's one of the most advanced developers of prescription medicine for cardiovascular, respiratory and autoimmunity purposes.

Market capitalisation: $128.93bn

Dividend yield: 2.83%

Gilead Sciences

Gilead is a US biopharmaceutical company that produces antiviral solutions for illnesses that are often overlooked by other healthcare companies. This includes treatment for HIV, liver disease and other inflammatory diseases that are similar to influenza.

Market capitalisation: $79.01bn

Dividend yield: 4.31%

Moderna

Moderna is a US biotech company that researches and develops vaccines and therapeutics based on mRNA molecules. The company already has alliances with other top pharma companies, including AstraZeneca and Merck, suggesting a promising future within the healthcare sector.

Market capitalisation: $58.51bn

Dividend yield: N/A

Novartis

Headquartered in Basel, Switzerland, Novartis is one of the world’s largest pharmaceutical companies based on market capitalisation. Its main purpose is to generate prescription medicines on a global basis for immunology, dermatology and respiratory purposes.

Market capitalisation: $196.46bn

Dividend yield: 3.56%

Novavax

Novavax is a US vaccine developer for autoimmune diseases. In comparison with the blue-chip stocks in this list, Novavax is a small-cap pharma stock, with a newer and therefore smaller presence in the healthcare market. It showed fast-paced developments in clinical testing for the Covid-19 vaccine.

Market capitalisation: $15.19bn

Dividend yield: N/A

Pfizer

Pfizer is one of the world’s largest pharmaceutical companies, headquartered in New York City. It develops and distributes medicines and vaccines worldwide, for inflammatory and immunology diseases, including rare diseases. This blue-chip stock provides consistent dividends and opportunities for company growth and revenue, making it one of the most popular biotech stocks among traders.

Market capitalisation: $187.07bn

Dividend yield: 4.55%

Sanofi

Sanofi is a Paris-based pharmaceutical company that focuses on therapeutics, most notably for multiple sclerosis, various cancers and arthritis. It's one of the world’s largest pharmaceutical companies in terms of prescription sales from selling a wide range of over-the-counter drugs to consumers.

Market capitalisation: $114.98bn

Dividend yield: 3.69%

Sinopharm

Sinopharm is a Chinese healthcare network that owns many subsidiaries within the sector, relating to medical distribution, logistics, research and development, and retailing of clinical drugs. This is throughout mainland China and more recently, on an international level.

Market capitalisation: $6.94bn

Dividend yield: 7.13%

Investing in pharmaceuticals

Pharmaceutical shares are available to buy and sell on the stock market, and some investors choose to explore pharma stocks through ETF trading.

These shares are often listed on a major stock exchange, such as the London or New York exchanges. This method involves buying and holding a share for a long period, and means that you take a share of ownership of the stock.

An alternative to investing directly in pharmaceutical stocks, is to trade based on the underlying price movements of these stocks, which is explained in more detail below.

How to trade pharmaceutical stocks with us

You can speculate on pharmaceutical stocks on our platform through trading CFD (contracts for difference). You can also invest in pharmaceutical stocks through major stock indices, such as the FTSE 100, which contains companies such as Haleon and AstraZeneca.

With both derivative products, you open a position based on whether you think a pharmaceutical share price will rise or fall, and depending on which way the market moves, this will result in a profit or loss. CFDs are contractual agreements to exchange the difference in value of an asset between the time a position is opened and closed. Profits and losses also rely on the movements in the share market.

Please note that CFDs are leveraged products, which means that you're only required to place a deposit of the full trade value to gain exposure to the market. For this reason, profits and losses are magnified.

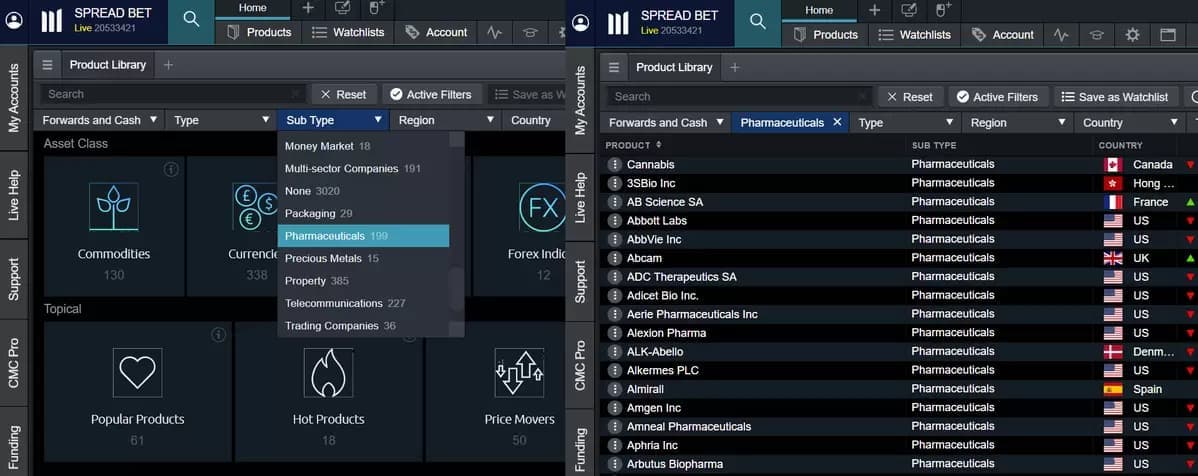

It's possible to filter pharmaceutical asset classes on our trading platform in order to see a relevant list of shares and ETFs, as shown below. Simply open the 'Product Library', filter sub-type by 'Pharmaceuticals' and this will open a list of almost 200 instruments within the sector.

Pharmaceutical stock news

While trading pharma stocks, it's important to keep up to date with news and key developments across the world. The stock market can be volatile and share prices often fluctuate based on announcements.

Our trading platform, which includes Reuters news and insights from our market analysts, an interactive market calendar for data and price charts, and fundamental analysis reports from Morningstar, can help you stay informed about market movements whenever they happen.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Pharmaceutical stocks can be considered a relatively good investment at any point in the year, as there is a consistent demand for healthcare services. Due to a constant stream of research, development and clinical trialling, pharmaceutical shares can provide long-term returns for investors, if successful. Read more about share trading.

To start trading on pharmaceutical stocks, first choose whether to spread bet or trade CFDs. We offer over 9,500 shares and ETFs within the stock market on our web-based platform, many of which belong to the pharmaceutical and wider healthcare industries.

Pharma penny stocks can be a risky investment, as these companies tend to be small, low-valued and in the growth stage of development, in contrast to blue-chip companies, such as Pfizer and GlaxoSmithKline. Learn more about trading penny stocks.

Trading pharmaceutical stocks can help to diversify your trading portfolio, as they can be grouped under categories such as research, development, retail and manufacturing. Most pharma companies also pay consistent dividends to investors, which is a major appeal for share traders. See our list of the highest dividend stocks to trade now. However, pharmaceutical stocks come with the usual risks of trading with leverage. This can help to magnify profits but equally losses as well.

Trading stocks from a variety of sectors, such as healthcare, technology and energy, as well as bonds and exchange-traded funds, can help to diversify your trading portfolio. This means that a well-performing stock can help to offset risk from a declining asset in your portfolio, reducing potential overall losses. Read more about portfolio diversification.