In the US, one of the defining deals came from the warehouse-automation space. Symbotic [SYM] agreed to buy Walmart’s [WMT] advanced systems and robotics unit for $200m. The deal also saw Walmart commit to purchase and deploy Symbotic’s automation systems at its Accelerated Pickup and Delivery centres over a multi-year period.

Notably, Walmart’s commitment could increase the backlog for Symbotic’s automation products to over $5bn, and the company’s shares have more than doubled this year.

Sticking to the theme of warehouse automation, Amazon [AMZN] announced that the company deployed its one-millionth warehouse robot, highlighting the pace of industrial automation. Alongside the hardware expansion, Amazon launched a new AI foundation model, DeepFleet, to coordinate robot traffic and reduce travel time inside fulfilment centres by roughly 10%.

Corporate performance from Fanuc [FANUY], the world’s largest industrial-robot manufacturer, was encouraging. After reporting flat growth in 2024, Japan-based Fanuc reported a 5.1% increase in half-yearly revenue on rising factory capex in China, Vietnam and India.

Across the East China Sea, China doubled down on its robotics leadership. The government’s 15th Five-Year Plan outlined a push for AI-driven, robot-enabled productivity, backed by subsidies, low-cost financing and mandates to integrate automation across key industries.

Shares of Chinese humanoid robot makers UBtech Robotics [9880:HK] and Xpeng [XPEV] are up 110% and 85%, respectively, in 2025.

According to the International Federation of Robotics, China was the world’s largest robot market, representing 54% of global deployments in 2024.

2026 Outlook: Sector Leaders to Emerge as Competition Steps Up

2026 is expected to be a defining year for robotaxis. As early adopters expand beyond pilot programs, the sector could finally begin to show clear leaders.

Tesla heads into the new year more committed than ever to autonomous mobility. The company has already piloted its robotaxi services in the US in 2025, with expansion plans earmarked. The next stage will see the company start production of a fully autonomous ride-hailing vehicle called the “Cybercab” in Q2 2026.

But competition is intensifying across the US and China. Waymo doubled its fleet to over 1,500 vehicles this year and is now expected to expand internationally. In China, Baidu [BIDU] continues to run one of the world’s most active networks. The company, often referred to as “China’s Google” due to its dominant search engine, now plans to deploy its robotaxis across Europe in partnership with ride-hailing platform Lyft [LYFT].

Hong Kong-listed electric vehicle (EV) company XPeng [XPEV] has emerged as a serious challenger. After rebranding itself as an “embodied intelligence company,” XPeng plans to launch three mass-produced robotaxi models in 2026.

XPeng’s robotaxi strategy closely mirrors Tesla’s. Both companies build their cars in-house and rely mainly on cameras instead of lidar to power self-driving. Waymo and Baidu take a different route, depending on external automakers like Jaguar and Geely [GELYF] to install their autonomous tech into vehicles rather than controlling the whole stack themselves.

In 2026, the conversation around robotaxis may well shift from operational viability to which approach scales better. Companies that are able to build sufficient fleet density, maintain high utilisation and demonstrate strong safety records may be better positioned to develop robotaxis into a sustainable business model.

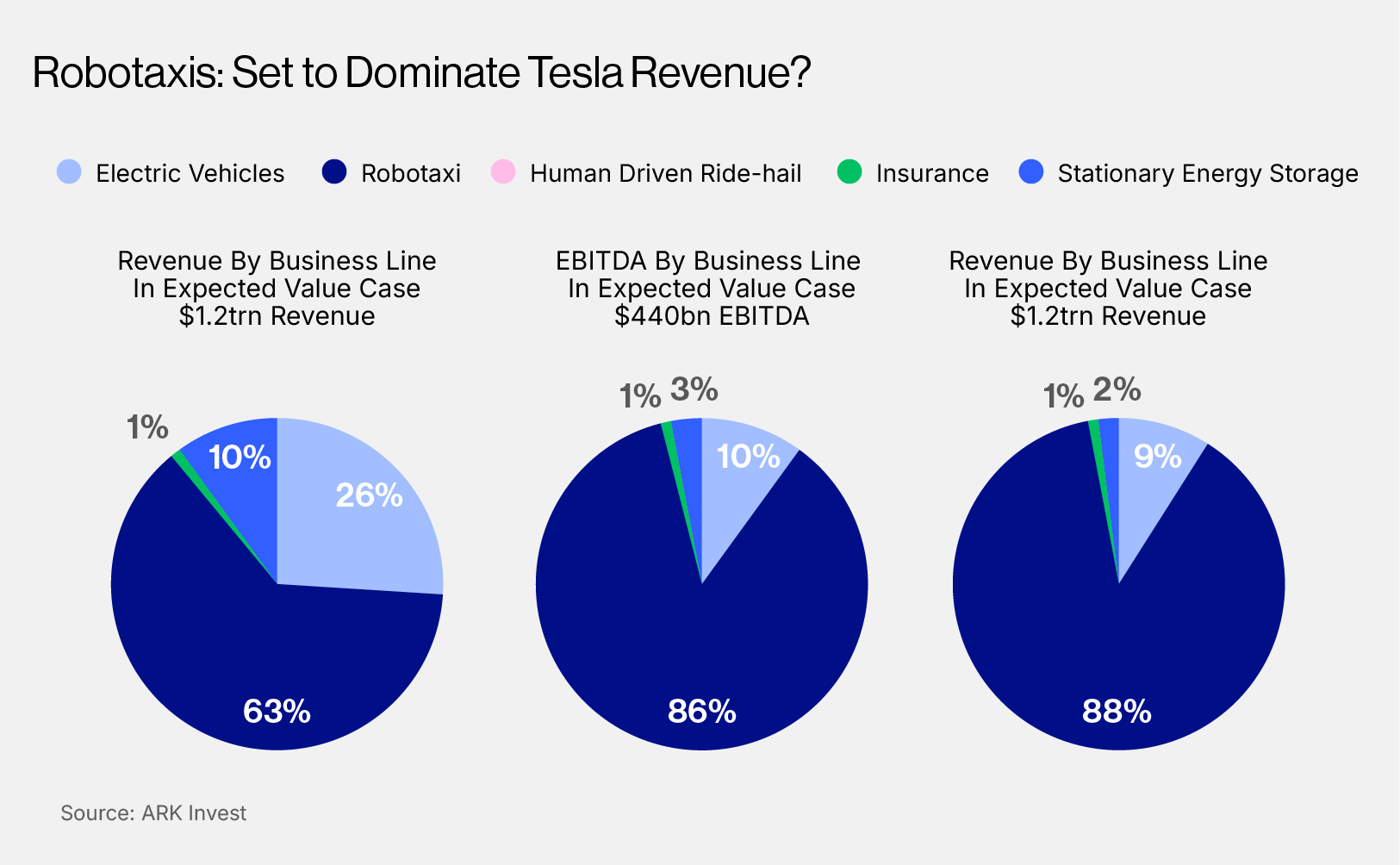

Tesla bull ARK Invest said it expects the company to dominate the US robotaxi market thanks to its “end-to-end vision-only AI, vertically integrated manufacturing and data advantages.” The research firm added that the robotaxi business could represent about 90% of its enterprise value by 2029.