Yet despite the current or projected boom in demand, the utilities sector has struggled to translate that momentum into outperformance in 2025. Ageing grid infrastructure, limited generation capacity and long lead times for new projects have continued to constrain the sector. In the US, utilities have performed roughly in line with the S&P 500 this year, with the Utilities Select Sector SPDR Fund (XLU), which holds leading names such as NextEra, Constellation and Vistra, rising 16% in the year to 2 December.

While utilities tracked the broader market, nuclear stocks outperformed thanks to supportive policy shifts. President Donald Trump’s administration has designated nuclear power as a matter of national security, channelling significant funding into the sector. It has introduced new tax credits, backed small modular reactor (SMR) innovation and recommissioned shuttered plants. In contrast, clean energy has lost political favour, with several renewable tax credits rolled back.

Oklo [OKLO] has soared around 300% in the year to date (at one point 700% YTD) after signing deals with the US Government to build nuclear reactors and fuel lines. Meanwhile, uranium supplier Centrus Energy’s [LEU] share price has risen more than 200% year to date on the back of the US Government’s push for nuclear energy dominance.

Meanwhile, big tech’s energy partnerships are reshaping power markets. Companies like Alphabet [GOOGL], Amazon [AMZN], Microsoft [MSFT] and Meta [META] have signed decade-long power purchase agreements with nuclear, solar, wind and hydro providers to secure clean, low-carbon electricity for their data centres.

Alphabet’s $3bn deal with Brookfield Asset Management [BAM] to source up to 3GW of US hydropower marked the world’s largest corporate clean-power contract. Meta’s agreement with Constellation Energy [CEG] to keep a nuclear reactor in Illinois operating for another 20 years was also a first-of-its-kind.

The underperformance of the oil- and gas-focused Energy Select Sector SPDR Fund [XLE] (up 5% year to date) against the iShares Global Clean Energy ETF [ICLN] (up 43% year to date) and VanEck Uranium and Nuclear ETF [NLR] (up 50% year to date) suggested a preference for clean energy assets over traditional fossil fuels among investors in 2025.

2026 Outlook: AI and Energy Couple as Bottlenecks Emerge

Global electricity demand is forecast to grow by 3.7% in 2026, described by the International Energy Agency (IEA) as among “some of the highest growth rates observed over the last decade”.

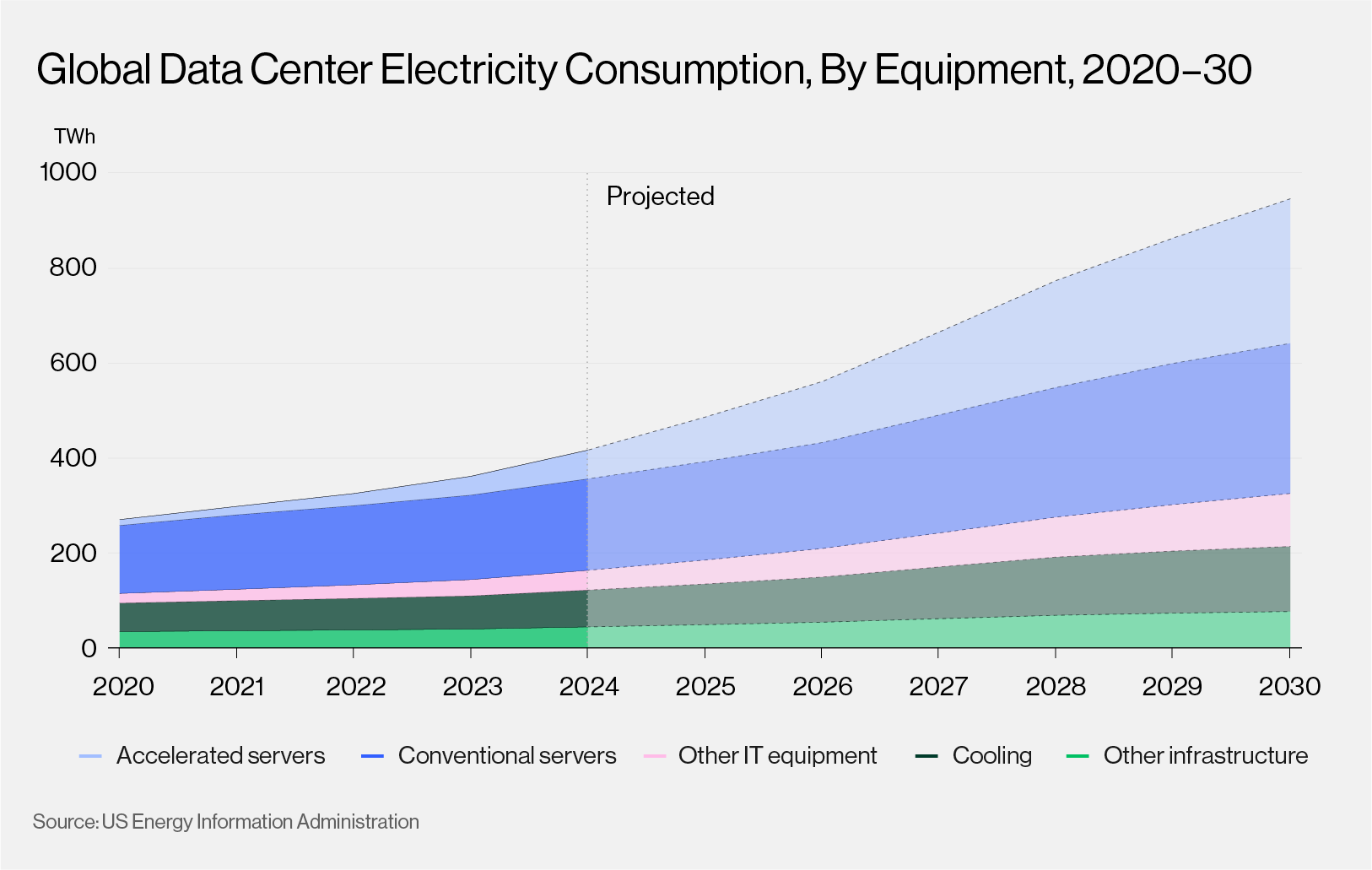

Energy and AI appear on track to remain closely linked through 2026 and beyond, with the IEA expecting electricity consumption from AI-driven servers to grow about 30% per year from 2024 to 2030 under its base-case scenario.

As the agency put it: “There is no AI without energy; at the same time, AI has the potential to transform the energy sector.”