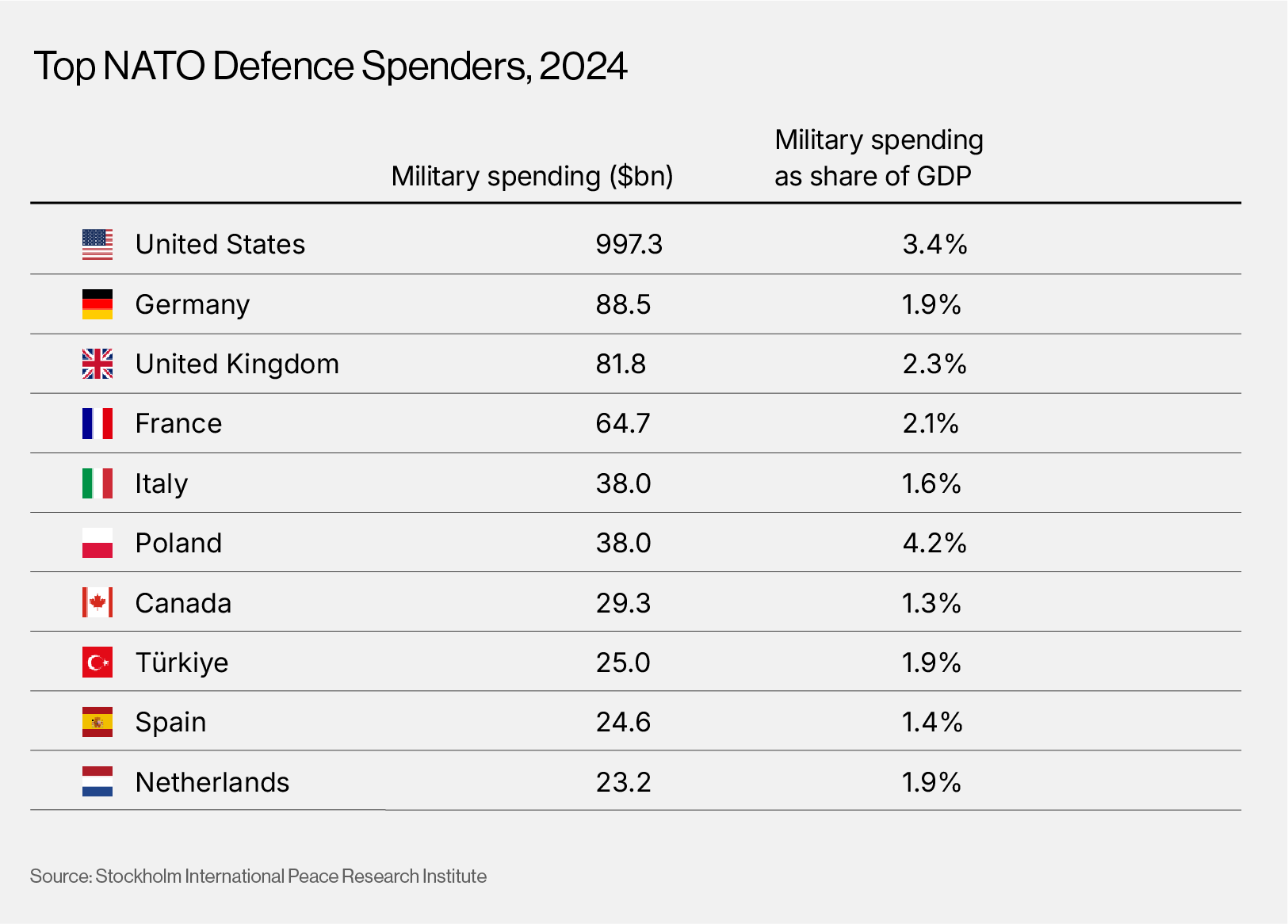

In Europe, Russia’s threat and pressure from President Trump pushed NATO members to commit to more than doubling defence spending, targeting 5% of GDP by 2035.

In 2024, the average NATO member spend was 2.2% of GDP, just above the previous target of 2%, SIPRI data showed.

Germany led the response, loosening fiscal rules to create a €500bn infrastructure fund before removing caps that had kept defence spending near 1% of GDP.

Dusseldorf-headquartered Rheinmetall [RHM:DE] has been one of the main beneficiaries of the boost in European defence spending. Its OTC shares surged about 170% in the year-to-date as the ammunition maker reported a 20% rise in sales for the first nine months of 2025 and forecast annual growth between 25% and 30%.

Sweden-based jet fighter maker Saab [SAABF] and tank gearbox manufacturer Renk [RNKGF] were among the top winners, with year-to-date gains of 131% and 158%, respectively.

For much of 2025, DroneShield [DRO] was one of the hottest defence stocks on the ASX, lifted by strong demand for its counter-drone systems. The Sydney-listed stock surged more than 700% at one point after the company reported a threefold increase in H1 revenue on the back of larger government orders.

That momentum collapsed after a misleading contract announcement and heavy insider selling, with CEO Oleg Vornik, chairman Peter James, and a director unloading nearly $70m worth of stock in November. Governance concerns have added to the pressure. Taken together, these factors have dragged the stock down 70% from its peak, trimming its year-to-date gain to around 150%.

Cyber security names also turned into major winners in 2025 as a rise in cybercrimes and hacks, alongside the rapid adoption of generative AI technology and autonomous bots, prompted organisations to spend more on protecting their systems and sensitive information.

Cloudflare [NET], which launched a tool that stops bots from scraping website content without consent, climbed 75% year-to-date. CrowdStrike [CRWD] was up 43% year-to-date, despite forecasting weaker H2 results linked to costs from a 2024 outage.

Palo Alto Networks [PANW], the most valuable cyber security firm in the world, dipped into the M&A market to expand its AI-powered cyber security offerings. The company paid $25bn to acquire Israeli company CyberArk Software in July and followed it up with a $3.35bn deal for agentic AI-focused security firm Chronosphere.

The First Trust Nasdaq Cybersecurity ETF [CIBR] is up 14% year-to-date, while the iShares US Aerospace & Defence ETF [ITA] is up 37% in 2025.

2026 Outlook: US Defence Sector Set for Reform, Cyber Security Becomes Top Corporate Priority

2026 is shaping up to be a defining year for the US’s legacy defence contractors. For decades, these firms dominated Pentagon spending after post–Cold War consolidation shrank the US defence industrial base from 51 major contractors to only five. Between 2020 and 2024 alone, Lockheed Martin, RTX, Boeing, General Dynamics [GD] and Northrop Grumman took in 54% of the Pentagon’s $4.4trn in discretionary spending, studies showed.

Experts argue that this concentration has created complacency and slowed innovation. The US Government Accountability Office highlighted this when it reported that Lockheed delivered 110 F-35s in 2024, each delayed by an average of 238 days. US Army Secretary Dan Driscoll also criticised the primes for overcharging the military, pointing to a $47,000 Black Hawk control knob that could be made commercially for $15.

This inefficiency forms the backdrop for what could be one of the most consequential shifts in the industry in decades. The US Department of Defence (DoD) has rolled out sweeping procurement reforms that aim to break dependence on slow, expensive legacy processes and bring commercial technology into the defence ecosystem.

The new approach focuses on off-the-shelf buying, faster procurement cycles, stronger cooperation with Silicon Valley and a fundamental overhaul of incentive structures.

“(The) defence industrial base broadly and the primes in particular, conned the American people and the Pentagon and the Army … The system has changed. You will no longer be allowed to do that to the United States Army,” stated Secretary Driscoll, as reported by Reuters.