The artificial intelligence (AI) revolution is reshaping the global economy.

In 2025, OpenAI’s mega-deals with big tech ignited a trillion-dollar rally across markets, making AI the defining investment theme of the year. As capital expenditure soars and compute supply tightens, 2026 will test whether this momentum can translate into lasting productivity gains.

For investors and traders, the next phase of AI could be shaped by two key forces: the rise of agentic, industry-specific applications, and growing concerns that AI is a gigantic bubble, one which is ready to pop.

2025 Review: The Year of AI Mega-Deals and the “OpenAI Trade”

This year OpenAI turned everything it touched to gold. The ChatGPT creator signed multi-billion-dollar deals with major US tech companies, including Microsoft [MSFT], Advanced Micro Devices [AMD] and Broadcom [AVGO], sending their stock prices soaring each time.

Microsoft’s market cap surged to over $4trn in late October after OpenAI committed to purchase $250bn in additional cloud services. The same announcement introduced a new for-profit entity, OpenAI Group PBC, in which Microsoft holds a 27% stake.

Oracle [ORCL] also joined the OpenAI frenzy, partnering through the Stargate Project, a joint effort to invest over $500bn in US AI infrastructure.

On September 10, ORCL shares hit an all-time high of $345.72, jumping 35% in one session on reports of a $300bn cloud-computing contract with OpenAI.

Chipmakers AMD and Broadcom signed their own OpenAI deals in October. As of the December 1 close, AMD stock was up 82% year-to-date and AVGO was up 66%. Both companies have outperformed rival Nvidia [NVDA], which was up 30% year-to-date over the same period.

In early October, OpenAI took a stake in AMD and agreed to deploy 6 GW of AMD’s graphics processing unit (GPU) chips in its upcoming data centres.

Meanwhile, the OpenAI-Broadcom deal saw the two companies collaborate on developing custom AI chips, with a commitment to deploy 10 GW worth of capacity.

AI frontrunner Nvidia signed a deal of its own with OpenAI to deploy at least 10 GW of its GPU chips in the latter’s upcoming data centres. Nvidia also said that it intends to invest up to $100bn in OpenAI.

OpenAI’s Busy 2025

Date | Partner | Deal details |

January 21, 2025 | SoftBank, Oracle, MGX, Arm, Microsoft, Nvidia | $500bn to be invested over the next four years to build new AI infrastructure for OpenAI in the US |

July 22, 2025 | Oracle | Oracle to develop 4.5 GW in a partnership worth over $300bn over next five years |

September 22, 2025 | Nvidia | Partnership to deploy 10 GW of Nvidia's chips |

October 6, 2025 | Advanced Micro Devices | Takes stake in AMD and commits to deploy 6 GW of AMD's GPU |

October 13, 2025 | Broadcom | Collaboration for 10 GW of custom AI accelerators |

October 28, 2025 | Microsoft | Agrees to purchase an incremental $250bn of Azure services |

Soaring expectations that AI will transform every aspect of human life fuelled a powerful rally in AI stocks throughout the year, highlighted by Nvidia’s historic milestone on October 29 as it became the first company to reach a $5trn market value.

The AI wave has also revived interest in fallen tech giants such as Intel [INTC].

The INTC share price is up about 100% in the year to date after the US government bought a stake worth $8.9bn to boost domestic chip manufacturing.

Market attention has turned to Intel’s foundry business, which may strengthen its position against established industry leaders such as Taiwan Semiconductor Manufacturing Company [TSM], Samsung Electronics [SSNHZ] and Micron Technology [MU].

To cap off a strong year, in late November the US Government signed into law a new national initiative, the Genesis Mission. The administration has likened it to a mobilisation on the scale of the Manhattan Project, highlighting the urgency and ambition behind using AI to accelerate scientific discovery. The move may further reinforce structural tailwinds for AI infrastructure and related industries.

2026 Outlook: Agentic AI, Application Verticalisation Amid Bubble Concerns

After spending nearly $400bn in 2025, big tech companies are expected to extend their capital spending spree into 2026. According to Morningstar, Alphabet [GOOGL], Meta [META] and Microsoft plan to allocate up to 35% of annual revenue toward AI-related investments.

Most of the money will go into data centre construction, as compute supply remains extremely tight. While such market conditions benefit data centre operators and cloud compute providers, the supply-side shortage is said to be so severe that companies must spend heavily to capitalise on surging demand.

On this front, companies like IREN [IREN], Nebius Group [NBIS] and Cipher Mining [CIFR] emerged as key players in 2025 for their role in building out the backbone of the AI economy. Each has recently landed major multi-billion-dollar contracts with hyperscalers. Their growing role in AI infrastructure has drawn strong attention this year, with share prices soaring by hundreds of percent, though the climb has come with sharp swings along the way.

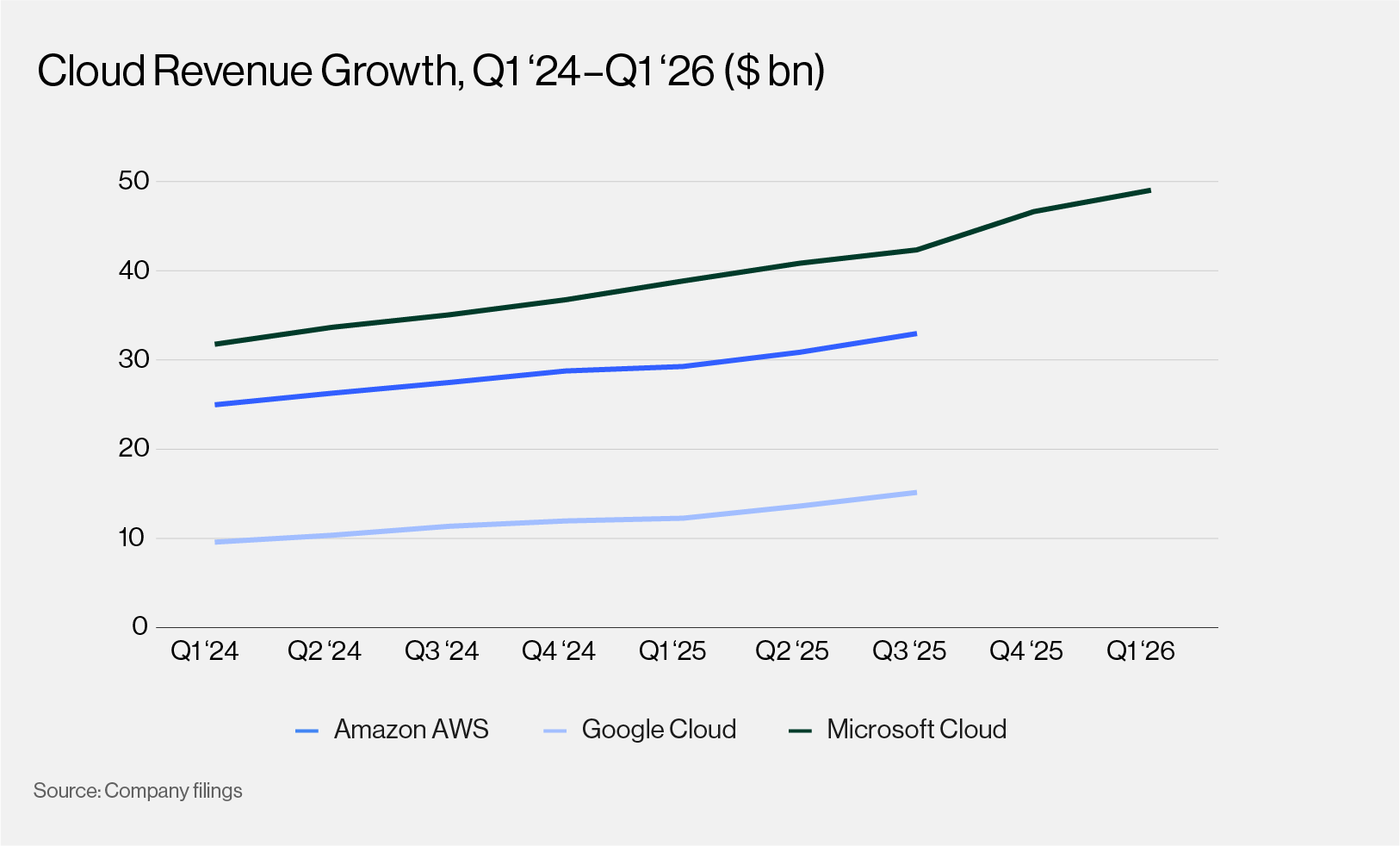

At the upper end of the market, the cloud divisions of Amazon, Alphabet, and Microsoft have also seen strong growth in 2025.

In the quarter ended September 2025, Microsoft’s cloud revenue, which accounted for 63% of total revenue, increased 26% year-over-year, and Google Cloud saw a 34% jump in revenue to $15.2bn. AWS revenue climbed 17% year-over-year to $60.14bn in the first half of the year.