Bitcoin heads into 2026 after a turbulent year that, by early December, has left the asset largely flat on the charts. It was initially buoyed by Trump’s election win but soon came under pressure as a series of policy surprises unsettled markets. In October, the announcement of 100% China tariff measures triggered one of the largest liquidation events in the crypto asset class’s history.

Further strain emerged from renewed concerns surrounding Digital Asset Treasury companies, including Saylor’s Strategy [MSTR] (formerly MicroStrategy). MSCI, a firm that provides major stock indexes, launched a consultation on whether companies whose primary activity is holding Bitcoin or other digital assets should be classified more like fund structures rather than operating businesses, a change that could affect their eligibility for key equity indexes. JPMorgan estimates that removal from MSCI indexes could prompt around US$2.8bn in outflows, potentially increasing to about US$8.8bn if additional index providers adopt similar classifications. The final decision, due on 15 January 2026, could be an early catalyst for Bitcoin in the new year.

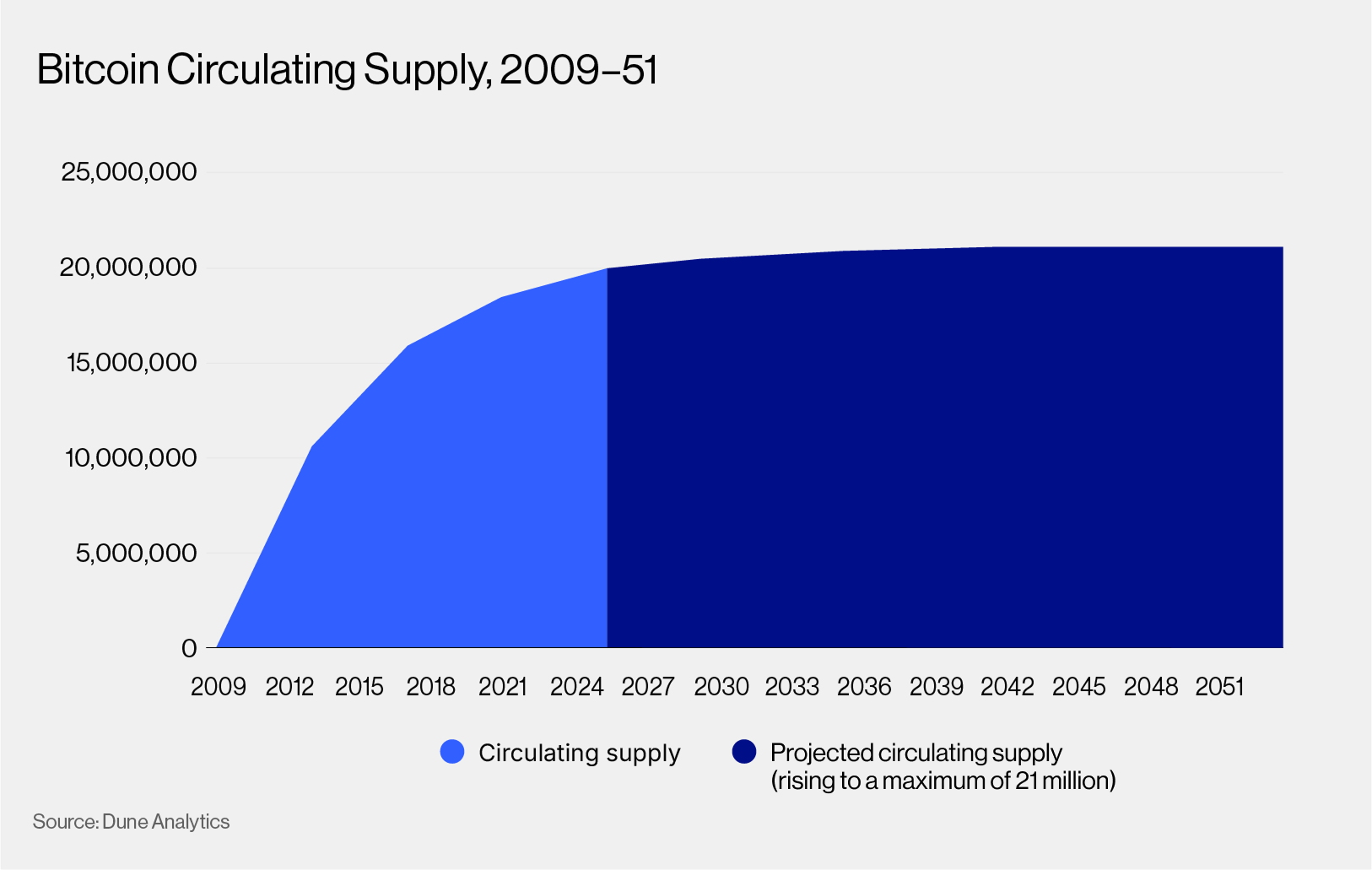

In light of recent pullbacks in Saylor’s Strategy and the forthcoming MSCI decision, the ongoing trend of corporate adoption will be important to monitor in 2026. Public companies held roughly 4,100 Bitcoin in January 2020. By January 2023, that figure had risen to around 200,000. As at early December 2025, corporate holdings have surged to approximately 1.06 million Bitcoin, according to Bitcointreasuries.net, with 209 public companies and more than 70 private firms holding Bitcoin on their balance sheets.

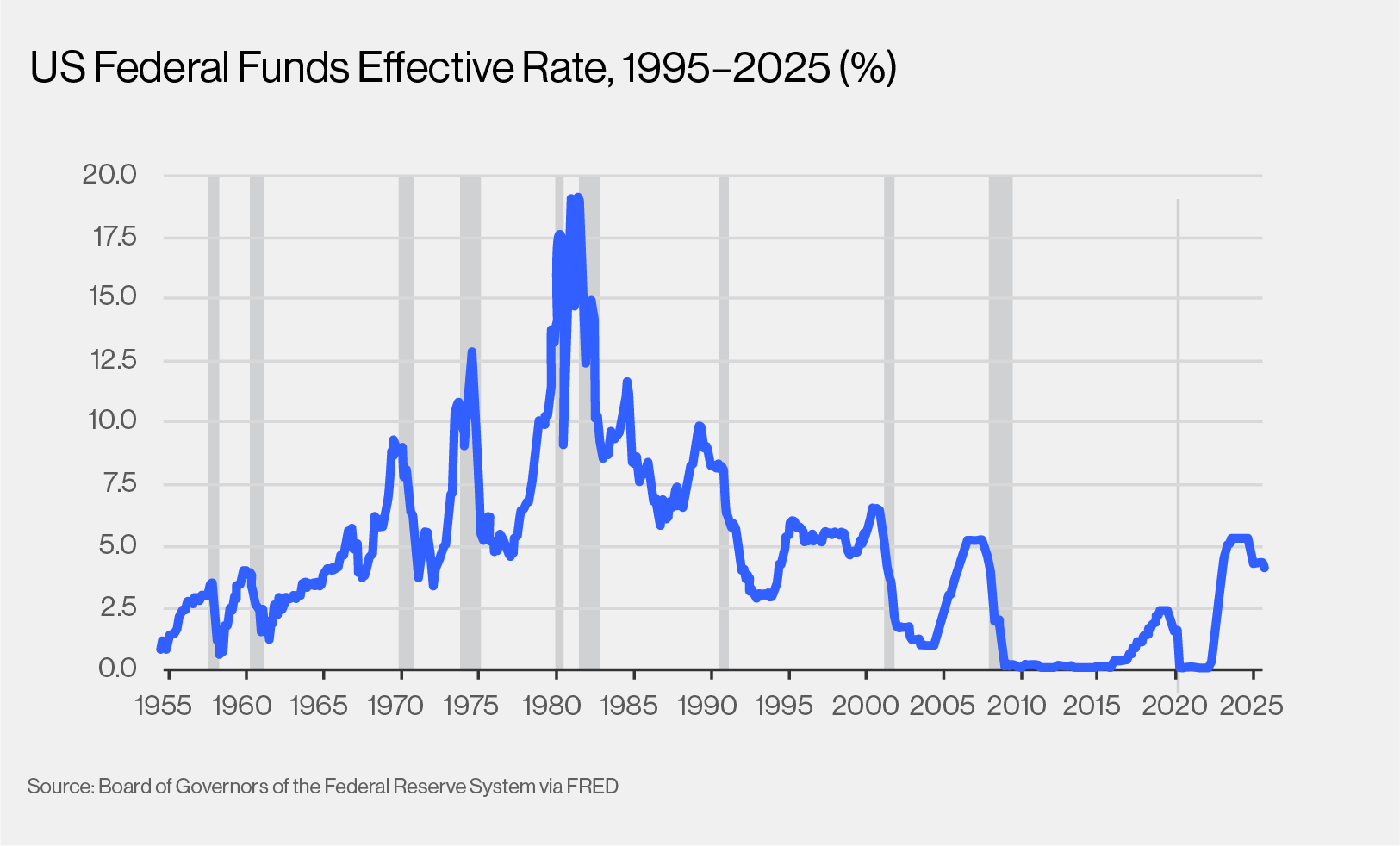

In addition to corporate holdings, Bitcoin ETFs and funds hold roughly 1.5 million BTC, making them another critical driver heading into 2026. Vanguard’s recent reversal, allowing selected crypto-based ETFs from December 2025, is striking given its CEO stated in 2024, “We’ll never offer Bitcoin ETFs, we’re not going to change our mind around this.” This shift raises an important question for 2026: does mainstream asset manager resistance continue to fade, and do ETF inflows accelerate in a lower rate environment?

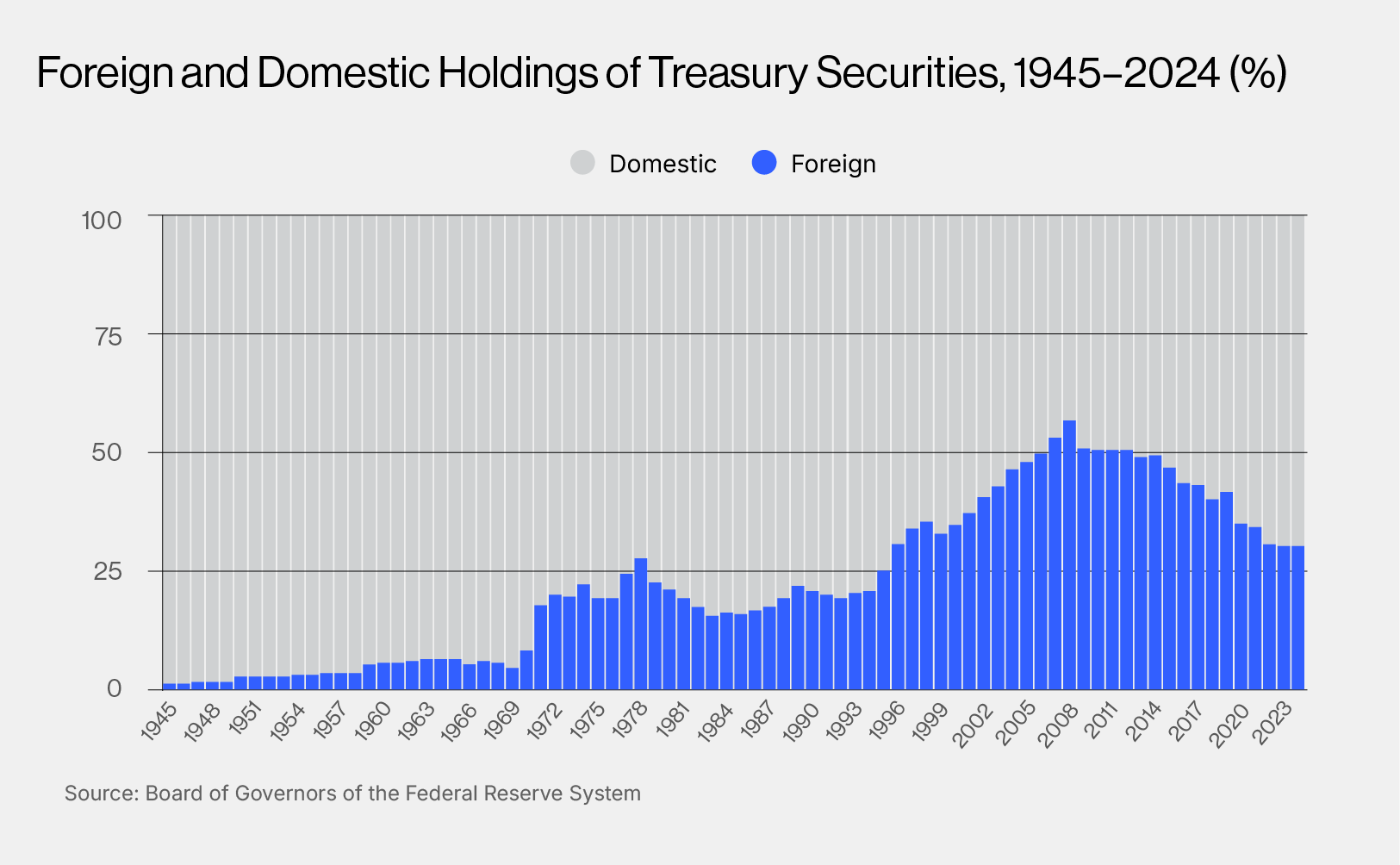

This accumulation trend is now extending into an even larger domain, as sovereign entities begin to explore Bitcoin in a more deliberate way. The United States’ Strategic Bitcoin Reserve is one example, with government entities globally holding about 645,000 Bitcoin. To date, these balances have largely come from assets seized from illegal activity rather than purposeful accumulation.

Even so, 2025 delivered early signs of strategic interest. State-backed sovereign wealth funds, including those of Abu Dhabi and Norway, invested in Bitcoin, and Texas became the first US state to purchase Bitcoin for its treasury. More proactive sovereign involvement in 2026 could have significant ramifications, potentially encouraging other countries to follow suit. The scale of these players, should they become more active alongside corporates and funds, means Bitcoin is likely to be shaped less by retail flows and more by the decisions of large allocators.

With these factors in play, markets are watching whether Bitcoin continues to track traditional four-year cycle dynamics, which may imply further consolidation, or whether a more elongated cycle begins to take shape in 2026, potentially allowing for a broader range of upside outcomes. Any regulatory decisions in the United States will be closely watched.