Fitness stocks

Going for gold? Fitness stocks to look out for

The 2025 London Marathon is around the corner, and in the spirit of keeping active, we’ve flexed our data-gathering muscles to put together a list of some of the biggest names in fitness for you to keep pace with.

First, a quick note on the statistics we used. The data we’ve cited below was drawn from Google Finance and Yahoo Finance and was correct as of 10 April 2025.

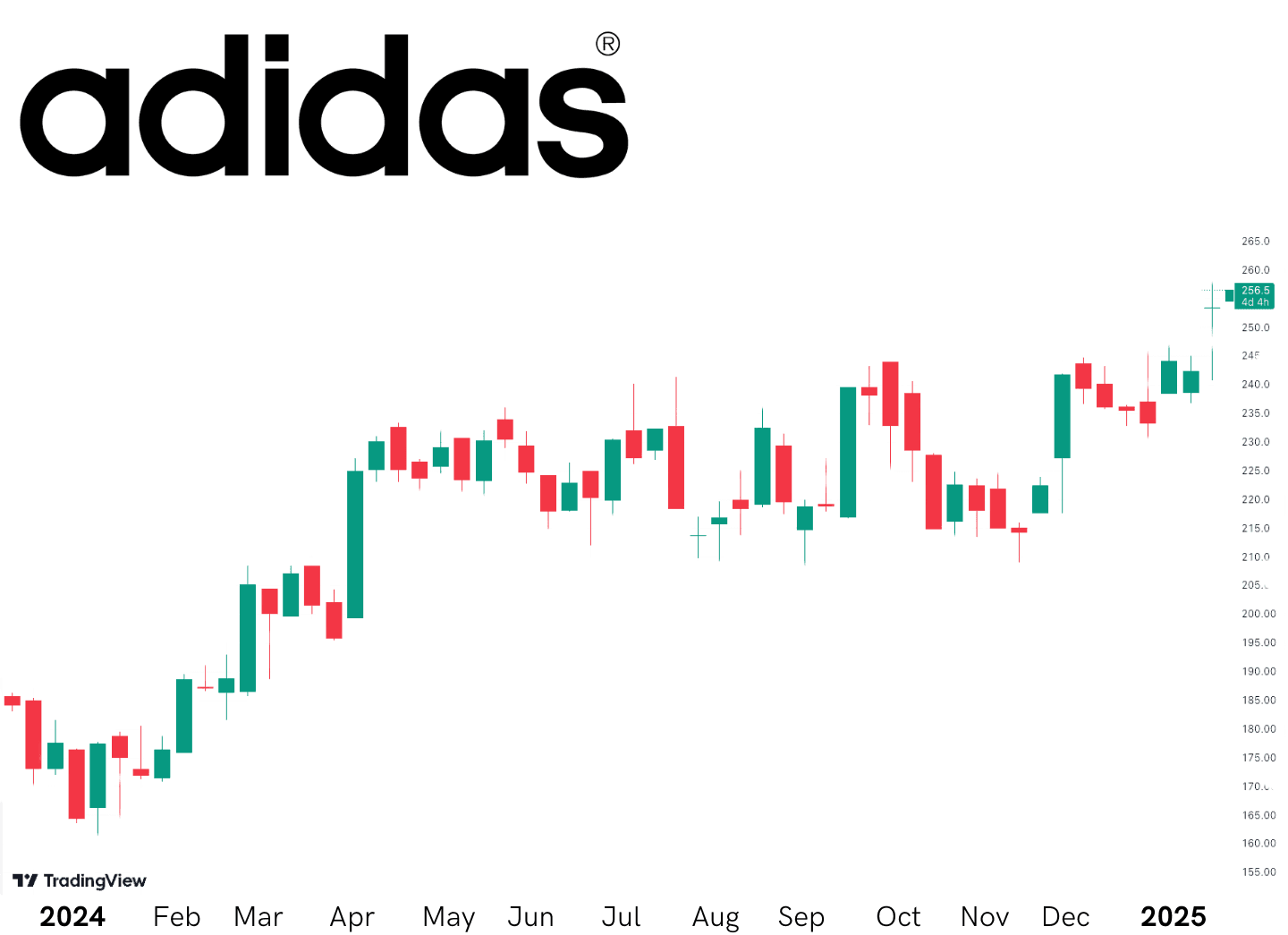

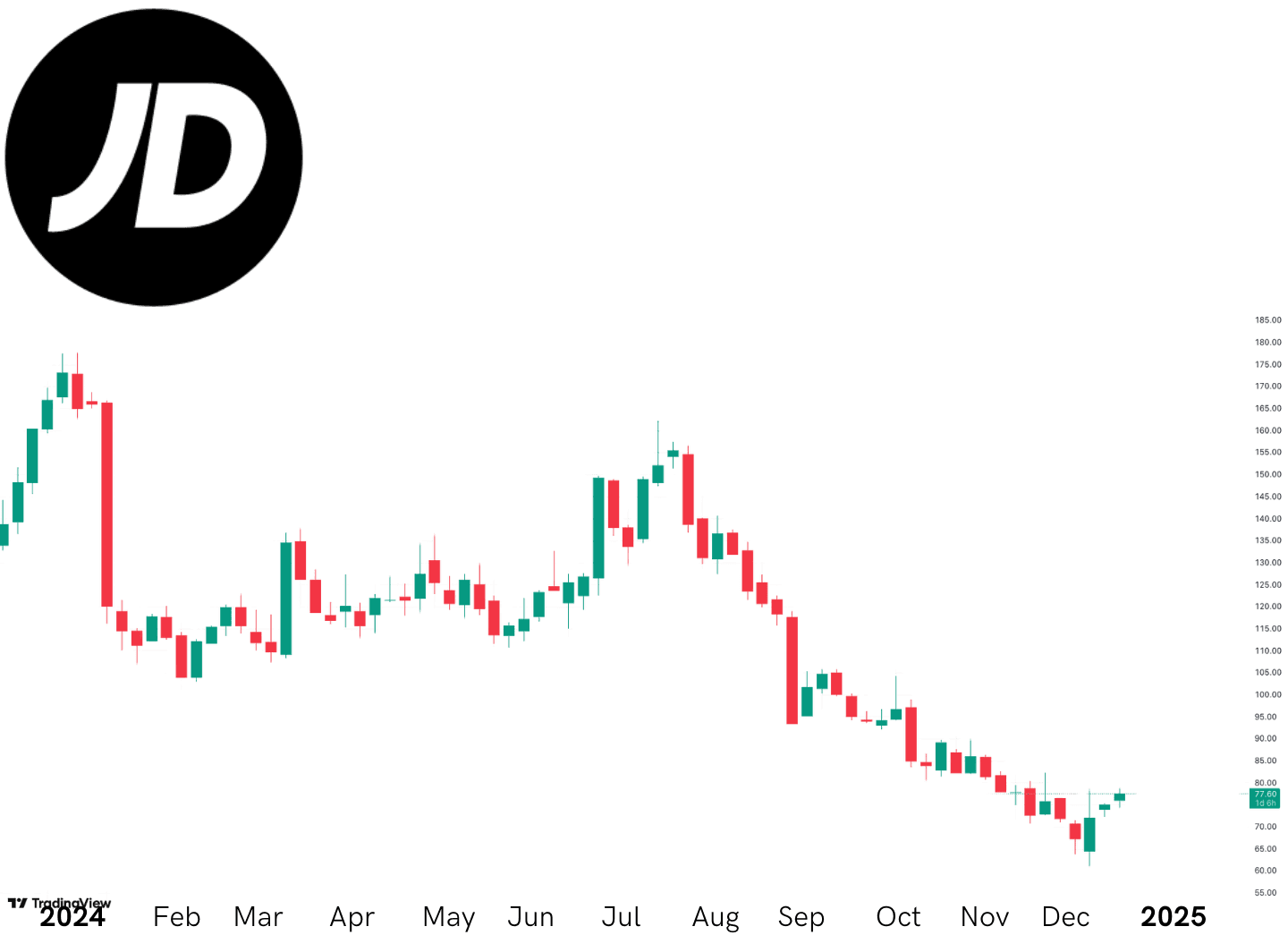

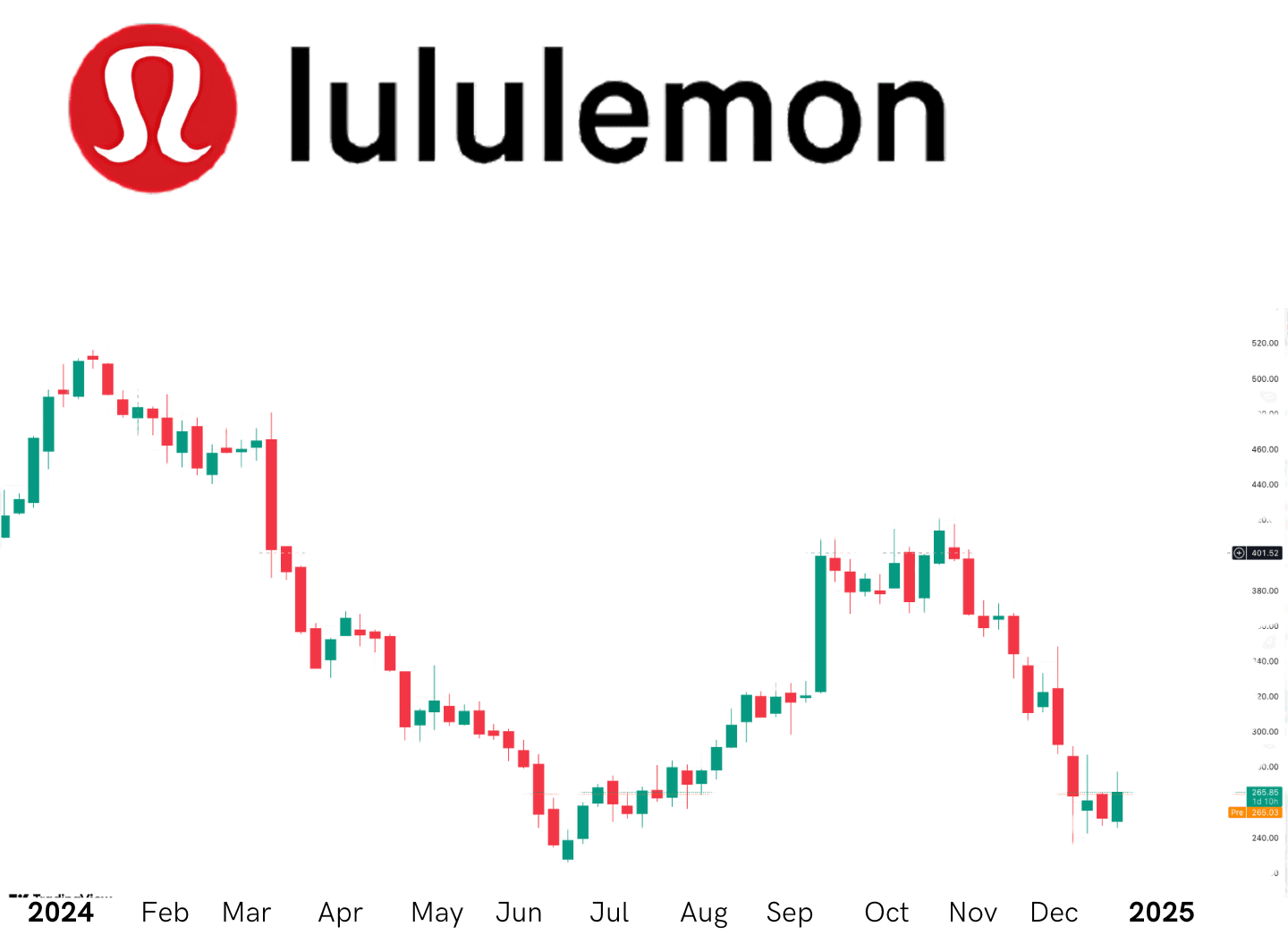

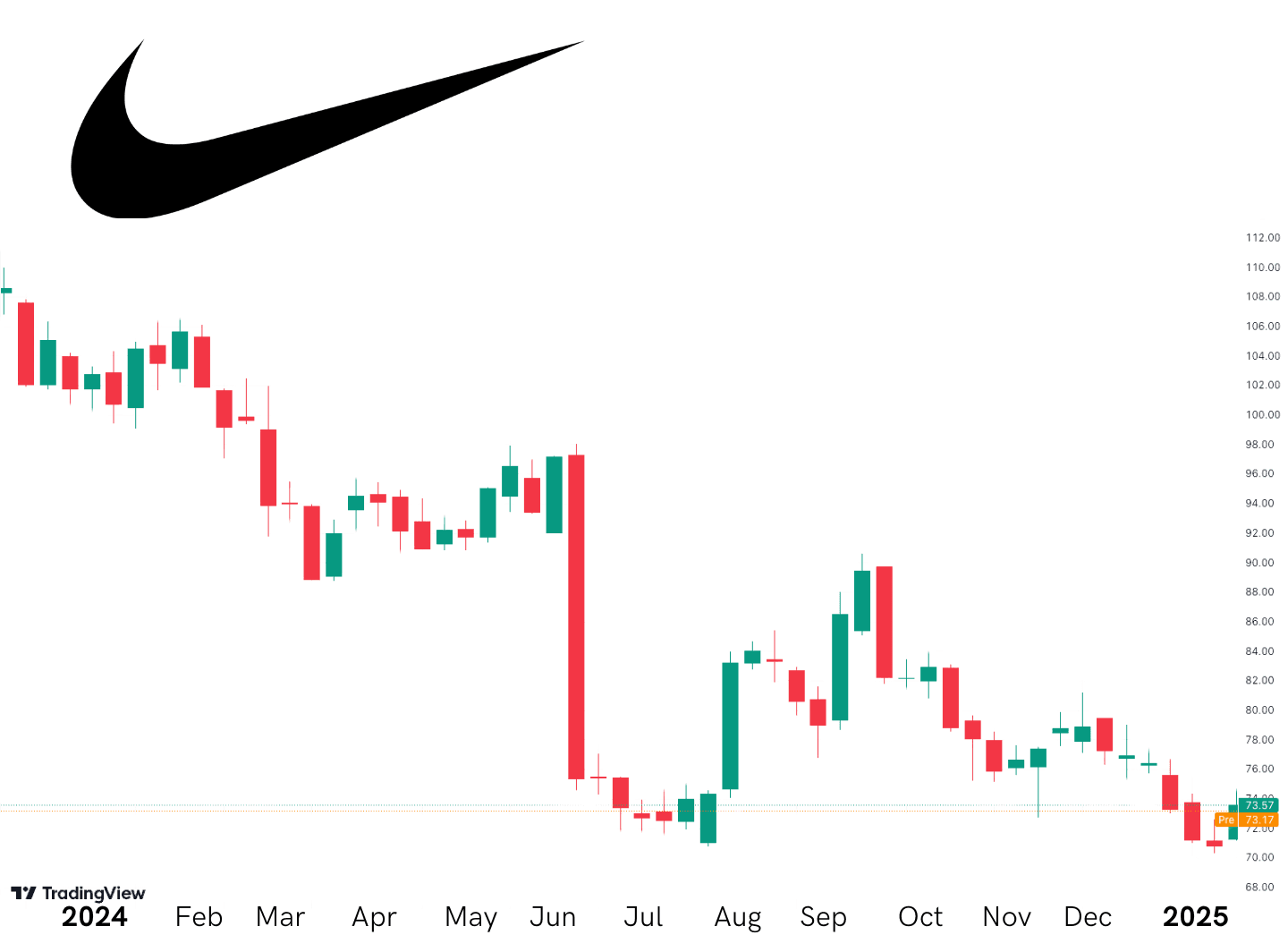

Like many stocks in 2025, the stocks in this list have been impacted by US president Donald Trump’s wide-ranging imposition of global tariffs, which have created extreme market volatility. As such, we’ve included each stock’s share price change over 2024 for a more representative snapshot of their financial performance, accounting for this year’s more unpredictable global markets.

Fitness fashion stocks

These companies specialise in athletic apparel and sportswear, and include high-street names. These labels have taken a bit of a financial hit due to the ongoing cost-of-living crisis, with some consumers opting for cheaper exercising methods, such as working out from home – perhaps the growing “athleisure” trend will allow these companies to capitalise on this shift in behaviour.

Fitness technology stocks

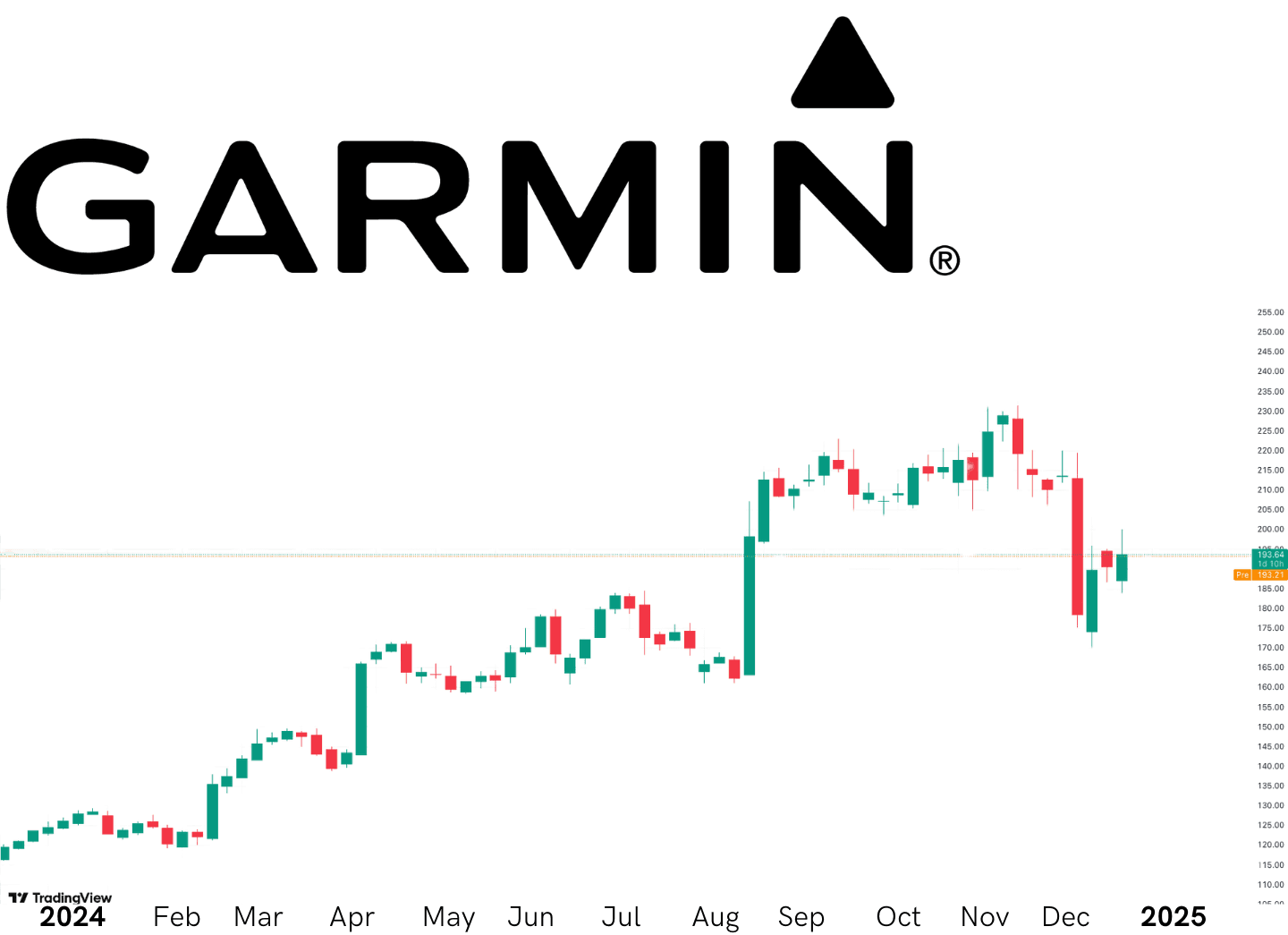

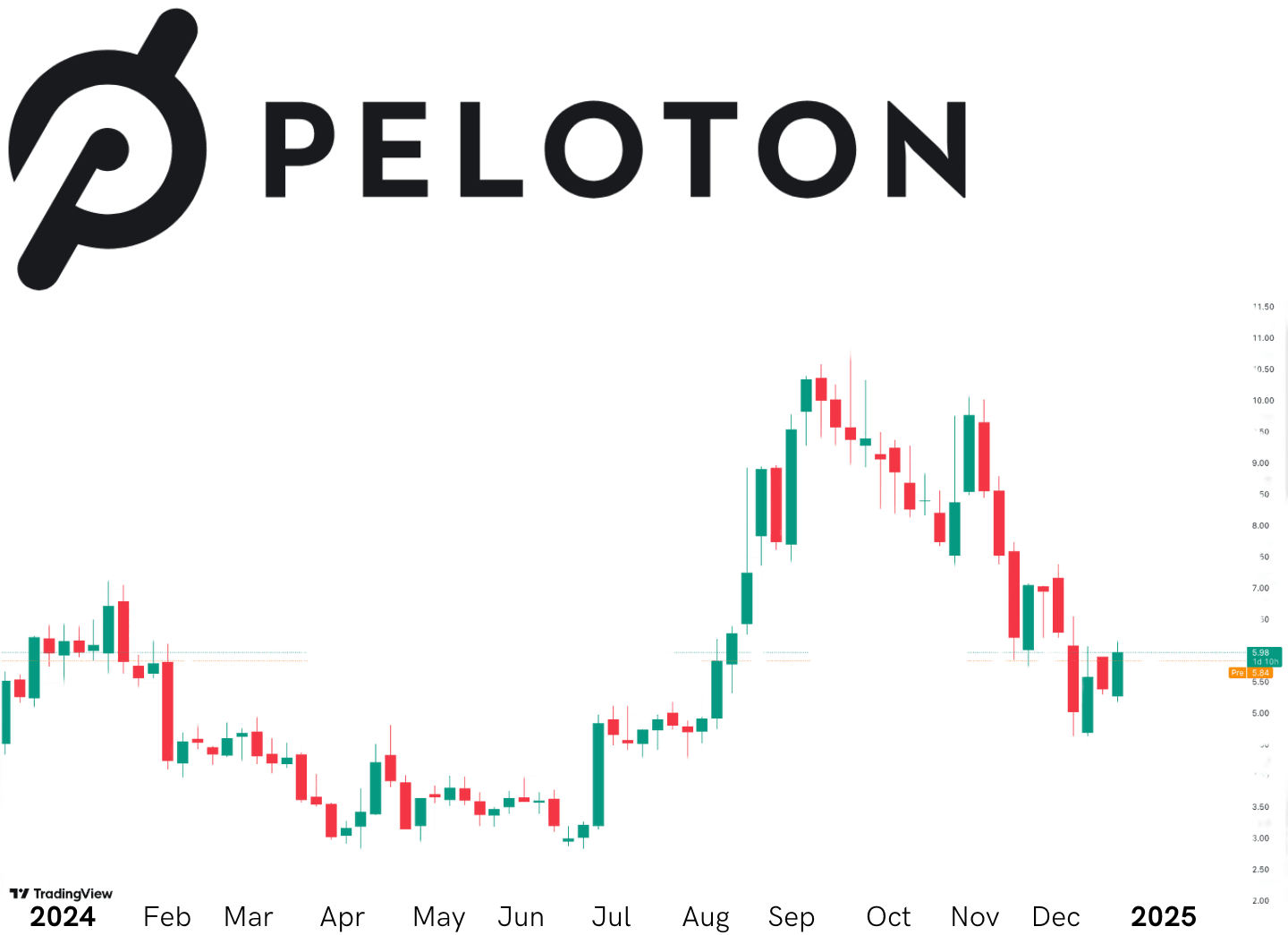

These companies specialise in sports technology, including fitness sensors and exercise equipment. While fitness wear faced challenges from changing consumer behaviour and economic stressors over 2024, technology stocks experienced a significant boom, driven by market excitement over developments in artificial intelligence. Fitness tech stocks also benefited from shifting attitudes to fitness – as customers move towards working out from home, technology to facilitate cheaper ways of working out, including smartwatches and exercise equipment, could see increased demand.

Where next for fitness stocks?

Our look at fitness stocks shows that 2024 was a mixed year for the world of athletics. Tech-adjacent stocks like Peloton and Garmin were able to ride the technology wave that largely defined 2024 and reap significant share price gains. In contrast, the companies with a tighter focus on sportswear have struggled to keep up in the face of increasingly volatile markets, as well as competition from upstart brands.

Unfortunately for these stocks, 2025 is unlikely to represent a reprieve from market volatility – in fact, it’s quite the opposite, as US president Donald Trump’s Liberation Day US tariff rollercoaster has shown. The announcement of the tariffs caused each of the stocks featured in this article to decline significantly.

While the 90-day pause on tariffs announced by the White House on 9 April could give sports companies time to regroup and recover from the stock market crash, it is still only a pause rather than a full halt. As athletics companies outsource their production to overseas factories, the re-implementation of these tariffs could significantly impact the production of and consumer demand for athletic apparel and equipment.

Whether fitness stocks will go for gold or be left in the dust is still up in the air, but industry watchers will likely be keeping a close eye on fitness stocks regardless.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.