What are shares? A beginner’s guide to stocks, shares and equities

When you buy a share, you own a small piece of a company. That single fact unlocks everything else: why companies issue shares, how shareholders earn returns and what risks come with ownership. This guide explains shares in plain terms, covers the differences in terminology, and outlines how UK investors can get started.

What are shares?

A share represents a unit of ownership in a company. If a business divides itself into 1,000 shares and you hold 10 of them, you own 1% of that company.

Companies issue shares to raise capital. Instead of borrowing money from a bank and paying interest, they sell portions of ownership to investors. Those investors become shareholders.

As a shareholder, you gain certain rights. You may receive a portion of the company’s profits, called dividends. You typically have voting rights on major company decisions. And you share in both the upside if the company grows and the downside if it struggles.

Think of it like a pizza. The company is the whole pizza. Each slice is a share. Buy more slices, and you own more of the pizza. If the pizza becomes more valuable, your slices are worth more too.

Stocks vs shares vs equities: what’s the difference?

The words stock, share and equity all refer to ownership in companies. In common parlance, the three terms are often used interchangeably: the phrases “I buy stocks”, “I buy shares” and “I buy equities” essentially mean the same thing. However, in some contexts these words can have subtly different meanings, as this table explains:

A company’s stock is made up of shares. To return to our previous analogy, think of stock as the whole pizza, and shares as the slices. And equities is really just another word for shares.

Remember, most people use these words interchangeably. The distinctions between them matter more in legal contexts and financial reporting than in everyday conversation, so it’s not something you need to worry about.

How do stocks and shares work?

Shares work through a simple mechanism: companies sell ownership to raise money, and buyers hope that ownership becomes more valuable over time.

Why do companies issue shares?

Companies issue shares primarily to raise capital without taking on debt. This capital funds expansion, research, acquisitions or daily operations.

A company typically issues shares through an initial public offering (IPO). In an IPO, the company lists on a stock exchange like the London Stock Exchange (LSE) or the Alternative Investment Market (AIM). Once listed, the public can buy and sell those shares.

Some companies remain private and issue shares only to founders, employees or private investors. These private shares cannot be traded on public exchanges.

How many shares does a company have?

There is no universal rule. A company can issue as few as one share or as many as billions.

The number depends on several factors:

The company’s total valuation

The desired price per share

Strategic decisions by the board

For example, Apple has approximately 14.78 billion shares, as of late December 2025. A small UK limited company might have just 100 shares split between two founders.

Companies can change their share count over time. They issue new shares to raise additional capital. They buy back shares to reduce the count and increase the value of remaining shares. They split shares to lower the price per unit and attract more investors.

Types of shares explained

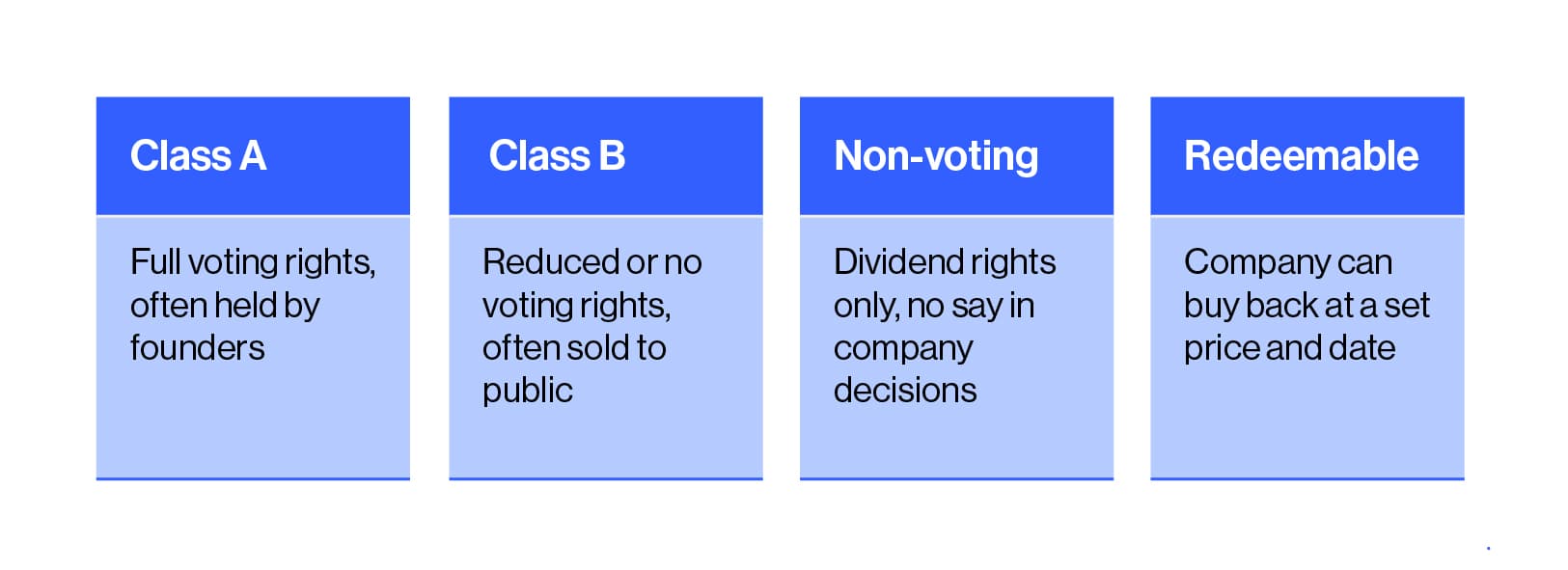

Not all shares carry the same rights. UK companies typically issue several classes of shares, each with different privileges.

Ordinary shares (common stock)

Ordinary shares are the most common type. Holders receive:

Voting rights at shareholder meetings

Variable dividends (when declared by the board)

A claim on assets if the company liquidates, but only after creditors and preference shareholders

Risk is typically higher with ordinary shares, as dividends are not guaranteed. If the company fails, ordinary shareholders are last in line for any remaining assets.

Preference shares

Preference shares offer more predictable income but less control. Holders typically receive:

Fixed dividends paid before ordinary shareholders

Priority claim on assets during liquidation

Limited or no voting rights

Preference shares suit investors seeking steady income rather than growth. However, the fixed dividend means you may miss out if the company’s profits surge.

Other share classes

Some companies create additional classes with specific rights:

When researching a company, check its articles of association to understand which share class you are buying and what rights it carries.

How do you make money from shares?

Shareholders can earn returns in two main ways: capital gains and dividends. Both carry risks, and neither is guaranteed.

Capital gains

Capital gains occur when you sell shares for more than you paid. If you bought shares at £10 each and sold at £15, your capital gain is £5 per share.

The opposite also happens. If shares fall to £7 and you sell, you realise a capital loss of £3 per share. Share prices fluctuate daily based on company performance, economic conditions and investor sentiment.

Historically, UK equities have tended to outpace inflation over very long periods. However, returns vary significantly by decade, and investors can experience long periods of poor or negative performance. However, past performance does not guarantee future results. Individual shares can lose significant value, and some companies fail entirely.

Dividends

Dividends are cash payments from company profits distributed to shareholders. Not all companies pay dividends. Growth-focused firms often reinvest profits rather than distributing them.

Dividend yield measures annual dividends as a percentage of the share price. A share priced at £100 paying £4 per year has a 4% yield.

The FTSE 100 average dividend yield was approximately 3.16% in December 2025, according to data from London Stock Exchange Group. However, dividends can be cut or cancelled during difficult periods. During the Covid-19 pandemic, an estimated 40% of FTSE 100 companies reduced or suspended dividends.

How to buy shares: investing vs trading

You can gain exposure to shares through two main approaches. Each suits different goals, timeframes and risk tolerances.

Investing in shares (long term)

Investing means buying shares and holding them for months or years. You take direct ownership. Your goal is typically capital appreciation and dividend income over time.

Key characteristics of investing:

Direct ownership of shares

Focus on company fundamentals

Longer holding periods (years to decades)

Potential for dividends

Capital gains tax (CGT) applies when you sell at a profit

Investors often use tax-efficient wrappers. A stocks and shares ISA allows UK residents to invest up to £20,000 per tax year with no tax on gains or dividends. A self-invested personal pension (SIPP) offers tax relief on contributions, but you typically cannot access your money until retirement. It is important to note that tax treatment depends on individual circumstances and may change.

Trading shares (short term)

Trading involves speculating on short-term price movements. Traders often use derivatives like spread bets or contracts for difference (CFDs) rather than buying shares outright.

Key characteristics of trading:

No direct ownership (with derivatives)

Focus on price movements and technical analysis

Shorter timeframes (minutes to weeks)

Ability to speculate on falling prices (going short), which increases complexity and risk

Higher risk due to leverage

Leveraged products amplify both gains and losses. With spread bets and CFDs, you deposit a fraction of the position’s value (margin) but gain full exposure. This means losses can exceed your initial deposit.

Benefits and risks of owning shares

Every investment involves trade-offs. Shares offer potential rewards but carry risks you must understand before committing capital.

Advantages of shares

The potential advantages of buying shares include:

Potential for growth over savings

Dividended income

Liquidity

Ownership rights

Accessible investing

Potential for growth: Shares have historically outperformed cash savings over long periods. The MSCI World Index has returned an annualised 8.88% over the 37 years to November 2025. Past performance does not guarantee future results.

Dividend income: Many established companies distribute profits to shareholders. This can provide regular income alongside potential capital growth.

Liquidity: Shares in listed companies can usually be bought or sold quickly during market hours. This contrasts with property or private equity, which can take months to sell.

Ownership rights: Shareholders can vote on company decisions and attend annual general meetings. This gives you a voice in how the business operates.

Accessibility: You can start investing with relatively small amounts. Some platforms offer fractional shares, allowing you to buy portions of expensive stocks. However, the risk of loss is the same regardless of investment size.

Risks of buying shares

Risks of buying shares include:

Capital loss

Volatility

Dividend uncertainty

Company-specific risk

Currency risk

Capital loss: Share prices can fall. You may get back less than you invested. In extreme cases, companies fail and shares become worthless.

Volatility: Prices fluctuate daily. The FTSE 100 fell 25% in the first three months of 2020 amid the onset of the Covid-19 pandemic. Short-term swings can test your resolve.

Dividend uncertainty: Dividends are not guaranteed. Companies can reduce or cancel payments during difficult trading periods.

Company-specific risk: Individual shares carry concentrated risk. Poor management decisions, industry disruption or fraud can destroy value regardless of broader market conditions.

Currency risk: If you hold international shares, exchange rate movements affect your returns when converted back to pounds.

Risk warning: The value of investments can fall as well as rise. You may get back less than you invest. Past performance is not a reliable indicator of future results.

How to start investing in shares in the UK

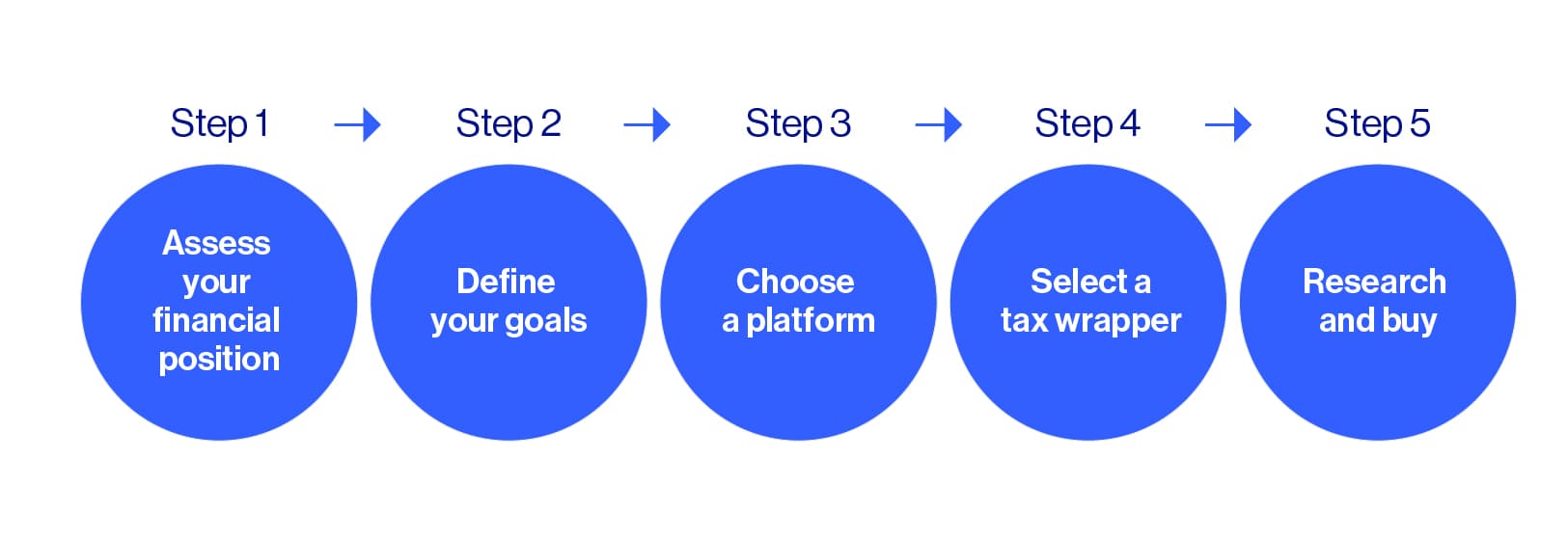

If you have decided that shares suit your goals and risk tolerance, follow these steps to begin.

Step 1: Assess your financial position

Before investing, ensure you have:

An emergency fund covering three to six months of expenses

No high-interest debt (credit cards, personal loans)

A clear understanding that you might lose money

Only invest money you can afford to leave untouched for at least five years.

Step 2: Define your goals

Are you investing for retirement in 30 years or a house deposit in five? Your timeframe affects which shares suit you. Longer horizons generally allow more risk tolerance.

Step 3: Choose a platform

UK investors can access shares through:

Online investment platforms

Traditional stockbrokers

Bank-linked investment accounts

Compare fees carefully. Look at dealing charges, platform fees, foreign exchange costs and withdrawal fees.

Step 4: Select a tax wrapper

Consider holding shares within a:

Stocks and shares ISA: Up to £20,000 per year; gains and dividends tax-free

SIPP: Tax relief on contributions; funds locked until age 55 (rising to 57 in 2028)

General investment account: No tax advantages but no contribution limits

Step 5: Research and buy

Before buying any shares, research the company. Review its financial statements, understand its business model and consider how it fits your overall portfolio.

Diversification can help to reduce risk. Spreading investments across multiple companies, sectors and geographies means poor performance in one area has less impact on your total wealth.

The LSE main market lists larger, more established companies with stricter regulatory requirements. The AIM is designed for smaller, growing companies with lighter regulation. AIM shares tend to be more volatile and less liquid.