How to buy shares in the UK: a beginner’s guide

Buying shares in a company can feel daunting if you have never done it before. The jargon alone is enough to put many people off. However, the process itself is straightforward once you understand the steps involved.

This guide explains how to buy shares in the UK from start to finish. You will learn which platforms to consider, how accounts differ, what fees to expect and how to place your first order. We also outline the risks, because investing always carries the chance of losing money.

What are shares and why invest in them?

A share represents a slice of ownership in a company. When you purchase shares in a business, you become a shareholder. In other words, you own a small piece of that company.

Companies issue shares to raise money for growth, research and to cover other costs of running a business. Investors buy shares hoping the company performs well. If it does, the share price may rise. Some companies also pay dividends, which are regular cash payments to shareholders.

Why do people invest in shares?

Over long periods, shares have historically delivered higher returns than cash savings, which often struggle to keep pace with inflation. For instance, in January 2026 savings accounts in the UK were typically paying around 2% to 3% in yearly interest – that’s below the rate of consumer price inflation, which was running at more than 3% at the time. By comparison, data suggests that UK equities returned an average of around 4.8% per year above inflation between 1900 and 2023. However, investment returns went up and down during this period, with individual decades varying significantly. The time period also included years in which investors incurred losses.

Past performance does not guarantee future results. Future returns may be lower or negative and share prices can fall as well as rise. You may get back less than you invest. Short-term volatility is normal, and some investors have lost significant sums during market downturns.

Think of buying shares like planting a tree. You cannot harvest fruit immediately. Growth takes time and some seasons bring storms or droughts. Patience and realistic expectations matter more than timing the market perfectly.

Now that we’ve established what shares are and why people invest, let’s look at how to buy shares in the UK.

Step 1: Choose an investment platform

You cannot buy shares directly from a stock exchange. You need an intermediary, typically a broker or an investment platform. These companies are authorised by the Financial Conduct Authority (FCA) to execute trades on your behalf.

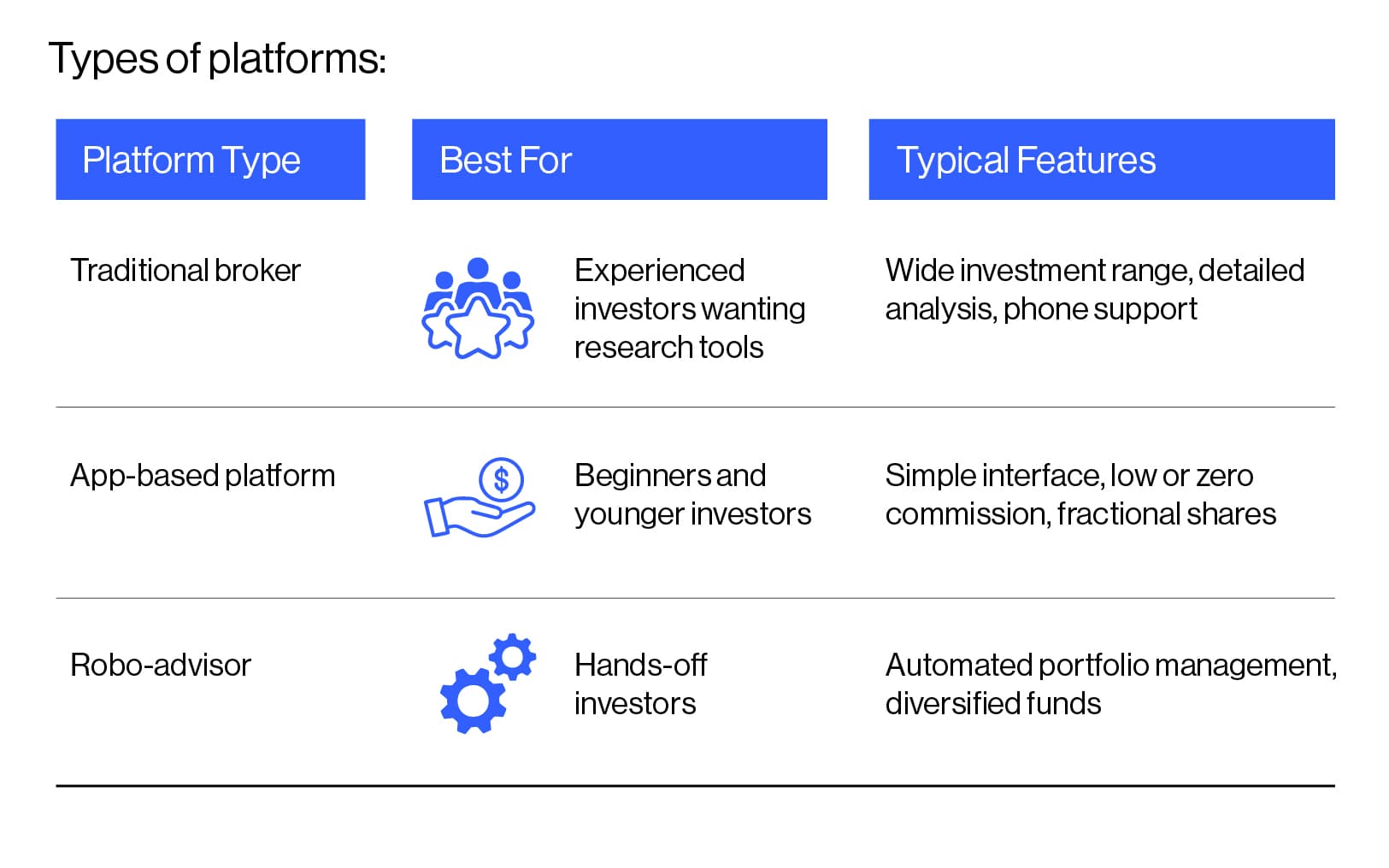

Types of platforms:

When comparing platforms, consider these factors:

FCA regulation (this should be non-negotiable)

Fee structure (any trading fees, platform fees or foreign exchange charges)

Available investments (UK shares, international shares, funds)

Minimum deposit requirements

Quality of research tools and educational resources

Customer service availability

Each platform has trade-offs. Low-cost options may offer fewer research tools, whereas full-service brokers charge more but provide comprehensive support. Choose your platform based on your needs and experience level.

Step 2: Select the right account for you

Before buying shares, you must open an account. The account type you choose affects how much tax you pay on any gains.

Stocks and shares ISA

An individual savings account (ISA) shelters your investments from tax. You pay no capital gains tax (GGT) on profits and no income tax on dividends within an ISA. The current annual ISA allowance in the UK is £20,000 for the 2025/26 tax year.

General investment account

A general investment account has no contribution limits. However, gains above your annual CGT allowance are taxable. Dividends above your dividend allowance are also subject to tax.

Beginner investors may opt for a stocks and shares ISA, as the tax benefits compound over time. For example, if an investment of £10,000 were to grow to £15,000 within an ISA, no tax would be due on the £5,000 gain. However, investments can also fall in value, and losses are not protected by the ISA tax wrapper.

Other account options

A self-invested personal pension (SIPP) offers tax relief on contributions but locks your money away until age 55 (rising to 57 in 2028). Junior ISAs allow parents to invest up to £9,000 per year for children under 18.

Step 3: Fund your account

Once your account is open, you need to pay in some money before purchasing shares. Most platforms accept bank transfers, debit cards and sometimes direct debits for regular investing.

The process typically works like this:

Log into your investment account

Select the deposit or ‘add cash’ option

Choose your payment method

Enter the amount

Confirm the transaction

Bank transfers usually arrive within one to three working days. Debit card payments often go through instantly but may carry small fees on some platforms.

Consider setting up a fixed monthly deposit. This approach, called pound-cost averaging, means you buy shares at different prices over time. Because the amount you deposit each month is fixed, you purchase more shares when prices are low and fewer shares when prices are high. This approach helps to smooth out the impact of market volatility. However, while it may spread the risk of investing a lump sum at an unfavourable moment, it does not protect against losses or guarantee better outcomes.

Step 4: Research and select your shares

This step requires the most thought. Choosing which shares to buy is where many beginners feel overwhelmed.

How to research companies

Start by understanding what the company does. Can you explain its business in one sentence? A common principle among long-term investors is to avoid investing in businesses you do not understand, as unclear business models can increase investment risk.

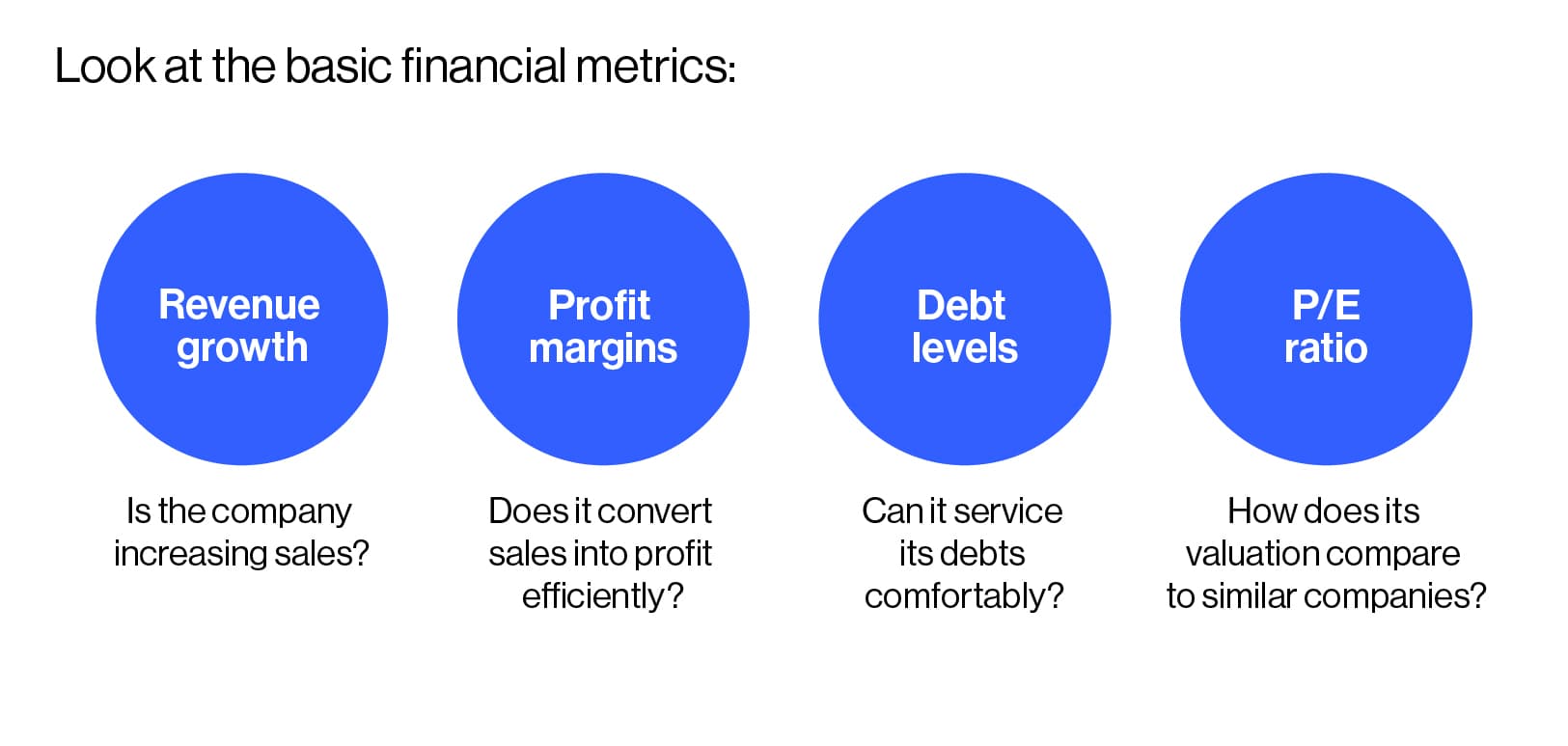

Look at the basic financial metrics:

Revenue growth: Is the company increasing sales?

Profit margins: Does it convert sales into profit efficiently?

Debt levels: Can it service its debts comfortably?

Price-to-earnings ratio (P/E): How does its P/E ratio (that’s the company’s share price divided by its earnings per share) compare to that of similar companies?

Most investment platforms provide this data on each company’s summary page. You can also find annual reports on company websites.

Diversification matters

Putting all your money into one company is risky. If that company performs poorly, your entire investment suffers. Spreading your money across different companies and sectors reduces this concentration risk.

For beginners, exchange-traded funds (ETFs) can offer instant diversification. A FTSE 100 ETF, for example, holds shares in the 100 largest UK companies by market cap. One purchase gives you exposure to multiple businesses.

Individual shares carry higher potential rewards but also higher risks. A single company can lose most of its value. Diversified funds spread this risk across many holdings.

Step 5: Place your order

You have chosen your shares. Now you need to place an order. Platforms offer different order types, including market orders and limit orders. Here we explain what the different order types do.

Market order

A market order executes immediately at the current available price. You get the shares quickly, but the exact price may differ slightly from what you saw. This is called slippage. Market orders suit investors who prioritise speed over price precision.

Limit order

A limit order executes only if the share price reaches your specified level. For example, if you want to buy shares at £5.00 but the current price is £5.20, a limit order waits until the price drops. The order may never fill if the price does not reach your limit.

Stop-loss order

A stop-loss order automatically sells your shares if the price falls to a certain level. This can limit losses, though in fast-moving markets the actual sale price may be lower than your stop level.

Placing your order

When you’re ready to place your order, the process typically works like this:

Search for the share by name or ticker symbol

Select buy

Choose your order type

Enter the number of shares or pound amount

Review the total cost including any fees

Confirm the order

UK shares attract stamp duty of 0.5% on purchases. This applies regardless of whether you buy shares inside or outside an ISA (the ISA “wrapper” only protects you from UK income tax and capital gains tax, not transaction-based taxes like stamp duty). US and many other international shares do not carry stamp duty, though you may face currency conversion fees.

How much money do you need to start buying shares?

One common misconception stops people from investing: believing they need thousands of pounds to start. This is not true.

Many platforms now allow investments starting from £1. Another way to minimise the cost of investing is to buy fractional shares. Fractional shares mean you can own a portion of expensive stocks. If a share costs £1,000, you could buy a tenth of a share for £100.

Other platforms require you to deposit a little more than £1, but may still be affordable for many. For example, Legal & General’s Stocks and Shares ISA can be opened with a £100 lump sum or £20 per month. Similar platforms also have low entry points.

Starting small has benefits. You learn how markets work without risking large sums. As your confidence and income grow, you can increase contributions.

However, small investments face a proportionally larger impact from fixed fees. If you pay £10 per trade and invest £100, fees will equate to 10% immediately. Check whether your platform charges percentage-based fees (better for small amounts) or fixed fees (better for larger trades).

Understanding the costs and fees

Fees reduce your returns. Understanding them helps you keep more of your gains.

Common fee types:

Some platforms advertise zero commission trading. Read the details carefully. They may charge wider spreads (the difference between buy and sell prices) or higher currency conversion fees instead.

Over 20 years, a 0.5% annual fee difference can significantly impact your final pot. For example, on a £50,000 portfolio growing at 5% annually, the difference between 0.25% and 0.75% fees amounts to over £11,000, based on compound calculations.

How do you make money from shares?

Understanding how you earn returns helps set realistic expectations. Shares generate returns in two ways.

Capital gains

If you buy shares at £10 and sell at £15, the £5 difference is your capital gain. This only becomes real money when you sell. Until then, gains (or losses) exist only on paper.

Share prices fluctuate daily. Short-term movements often reflect sentiment rather than company performance. Long-term investors focus on fundamental business growth rather than daily price swings.

Dividends

Some companies distribute part of their profits to shareholders as dividends. These payments typically arrive quarterly or twice yearly. You can take dividends as cash or reinvest them to buy more shares.

Not all companies pay dividends. Growth companies often reinvest profits into expansion rather than distributing them. Neither approach is inherently better. It depends on whether you want income now or growth later.

Dividend reinvestment compounds your returns over time. For example, according to Schroders, £1,000 invested in the FTSE 100 on 31 December 1999 could have grown to approximately £2,222 by 2020 if dividends were reinvested, compared to only £1,088 if they weren’t. This outcome depended on remaining invested throughout market downturns and may not be repeated in future periods.

Remember: dividends are not guaranteed. Companies can reduce or suspend them during difficult periods. The 2020 pandemic saw many firms cut dividends to preserve cash.

Tax considerations when buying shares in the UK

Tax rules affect your net returns. Understanding them helps you invest efficiently.

Inside an ISA

There is no capital gains tax and no dividend tax when you buy shares within an ISA. This simplicity is why ISAs suit most investors.

Outside an ISA

When you buy shares outside an ISA – for example, in a general investment account – capital gains tax applies to profits above your annual allowance (£3,000 for 2025/26). The rate depends on your income tax band: 10% for basic rate taxpayers, 20% for higher rate taxpayers.

Dividends above the £500 annual allowance for the current 2025/26 tax year attract tax at 8.75% (basic rate), 33.75% (higher rate) or 39.35% (additional rate).

Reporting requirements

If your gains exceed the annual allowance, you must report them through self-assessment. Losses can offset gains, potentially reducing your tax bill.

Tax rules change. The allowances mentioned here apply to the 2025/26 tax year. Always check current HMRC guidance or consult a tax professional for advice specific to your circumstances.

Common mistakes beginners make when buying shares

Learning from others’ errors saves money and frustration.

Investing money you cannot afford to lose

Only invest surplus funds you will not need for at least five years. Emergency savings should stay in accessible cash accounts. Selling shares during a market downturn to cover unexpected expenses locks in losses.

Chasing past performance

A share that rose 50% last year might fall 30% next year. Past performance does not predict future results. Buying simply because something has gone up often means buying at inflated prices.

Panic selling during downturns

Markets decline periodically. The FTSE 100 has experienced multiple drops exceeding 20% over the past three decades. Investors who sold during these dips and waited to reinvest often missed the subsequent recoveries. Remaining invested through periods of volatility has historically resulted in better outcomes for some long-term investors, although this has not been the case for everyone and future results may differ.

Neglecting diversification

Concentrating your portfolio in one share, sector or region magnifies risk. Spread investments across different areas. If one performs poorly, others may offset the damage.

Ignoring fees

Small percentage differences in fees compound into large sums over decades. Compare platforms and choose cost-effective options appropriate for your investment size.

Trading too frequently

Each trade incurs costs. Frequent buying and selling erodes returns. Many long-term investment approaches involve relatively infrequent trading, as repeated buying and selling can increase costs and reduce returns.

Yes, £100 is enough to open a Stocks and Shares ISA with many UK providers. At this level, choose a platform with percentage-based fees rather than fixed dealing charges to avoid fees consuming a large portion of your investment.

£1,000 provides a reasonable starting point for building a diversified portfolio. You could spread this across several funds or shares. Regular top-ups, even small ones, help your portfolio grow over time through compounding. Remember that all investments carry risk, and you may get back less than you invest.