Here's how to earn up to $10,000 when you deposit

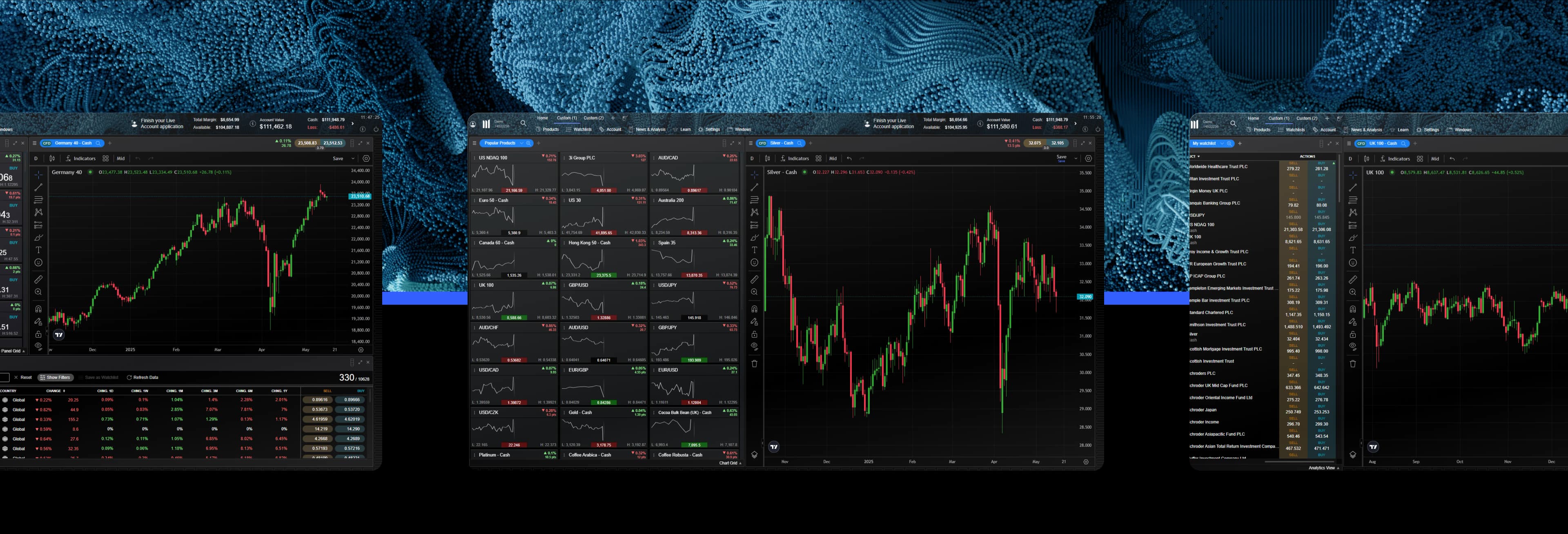

Follow the three steps below and start earning when you trade on the CMC platform or the MT4 platform.

Why trade CFDs with CMC?

Le trading de CFD offre un moyen pratique et flexible de négocier sur les marchés financiers mondiaux.

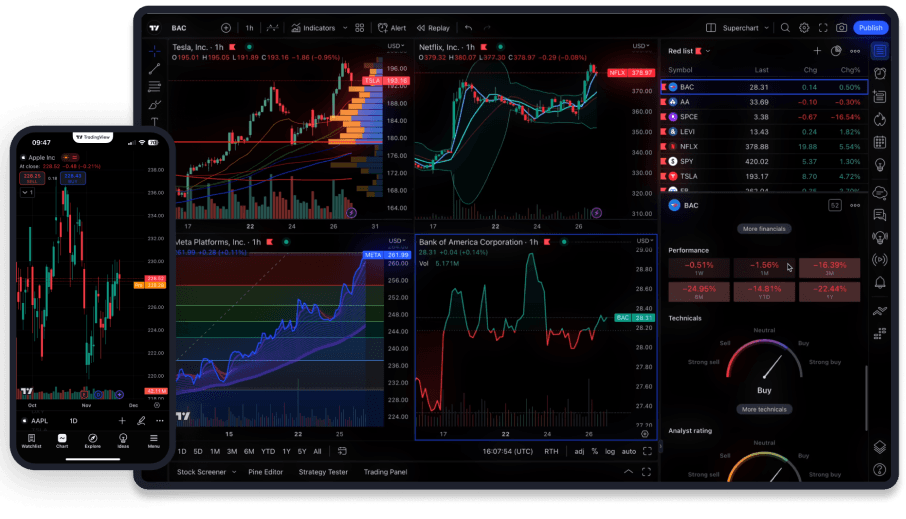

Trade CFDs on over 11,000+ instruments

With more forex pairs than any other major broker, and a huge range of indices, commodities, shares, ETFs, rates and bonds you can find all your favourites in one place.

NAME | MIN SPREAD | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|

NAME | MIN SPREAD | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|

NAME | MIN SPREAD | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|

NAME | MIN SPREAD | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|

NAME | MIN SPREAD | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

FAQs

There's no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you'll need to deposit funds in your account to place a trade.

You can open a free demo account with us to practice trading in a risk-free environment using virtual funds. When you’re ready to step up to a live standard CFD trading or FX Active account, there’s no upfront cost to pay and you can use your account to view charts, see market prices, and read Reuters news and Morningstar reports free of charge. However, you will need to add funds to your live account to place a trade, and certain fees – such as overnight holding costs – may apply. Find out more about the costs of placing a trade.

The list of costs and charges below is not exhaustive. Please see our CFD holdings costs page for a more comprehensive explanation of our GSLO premiums, margins, etc.

Overnight holding costs: at the end of each trading day at 5pm (New York time), any cash positions held in your account may be subject to a charge called a 'holding cost'. The holding cost can be positive or negative depending on the direction of your position. Historical holding rates, expressed as an annual percentage rate, are visible on our platform within the overview section of each product. This annual percentage is applied to the notional value of your trade when it was opened, and divided by 365 for the one night cost.

Commission charges: when trading CFD shares on our platform, a commission will be charged to your account upon execution of any order. See more about our trading costs.

Market data feeds: in order to view share prices on our platform, you will need to activate the relevant market data feed for the region in which the products you wish to see are traded.

Monthly subscription charges may apply depending on your market data classification and the type of account you hold, details of the charges can be found on the platform in the ‘market data’ section in ‘user preferences’.

A contract for difference (CFD) is a derivative product which enables you to trade on the price movements of underlying financial assets (such as forex, indices, commodities, shares and treasuries). It's an agreement to exchange the difference in the value of an asset from the time the contract is opened until the time it's closed.

With a CFD, you never actually own the asset or instrument you're trading, but you can still benefit if the market moves in your favour, or make a loss should the market move against you.

Trading CFDs involves trading on leverage, which means that you can enter a position with a set initial deposit, known as the margin requirement. It's important to remember that leverage amplifies your gains and losses in equal measure, based on the full value of the trade, and not just the initial margin amount.

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it's important to manage your risk.

Yes, CMC Markets Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by CMC Markets Canada Inc. acting as principal.

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

Yes, we offer a free demo account, with $10,000 in virtual funds, which allows you to try out our platform, practice placing trades, and experiment with trading strategies and techniques – all in a risk-free environment.

To open a demo account, you just need to enter your email address and a password. Once you’ve opened your demo account, we’ll send a verification link to your registered email address. Simply click or tap the link to activate your account, and that’s it. You can start using your demo account.