In this article, Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies, considers to what extent luxury goods could recover.

A new report published in May says that global sales of luxury goods have a shot at fully recovering to 2019 levels this year. Consultancy firm Bain & Company believes there’s a 30% probability that the luxury market could meet or exceed $340bn in sales of high-end items such as apparel, handbags and jewellery, which would be the most in two years.

This marks an adjustment up from Bain’s prior forecast of a full recovery by 2022 or 2023. What’s changed, the Boston-based group says, is China and the United States’ unexpectedly strong economic rebounds, thanks in large part to swift vaccine distribution.

Some may question Bain’s optimism. After all, the luxury goods market saw its biggest annual decline on record in 2020, falling 23% due to pandemic-related lockdowns and financial uncertainty.

But a recovery has already begun. The French luxury giant LVMH Moet Hennessy Louis Vuitton [MC.PA] announced in April that it had returned to growth in the first quarter, with $16.75bn in sales across its more than 70 brands. Fashion and leather goods, in particular, had an excellent start to the year, generating record revenue of $6.7bn, or 37% higher than the same period in 2019.

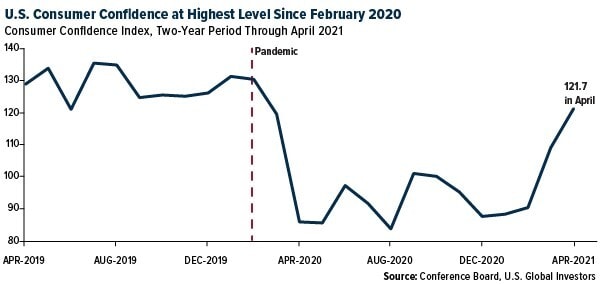

Like Bain, I’m very bullish and believe that US and Chinese consumers are well-positioned to maintain this momentum. Vaccines continue to be administered, though at a slightly slower pace than before, while stimulus cheques helped US disposable incomes jump an unheard-of 29% in March compared to the same month last year. Over $17trn sit in US commercial banks at a time when consumer confidence has climbed to its highest level since soon before the pandemic.

Asia projected to contribute $10.3trn in new spending by 2030

Consumers in China have likewise shown incredible resilience. According to the National Bureau of Statistics, retail sales of consumer goods rose 17.7% in April compared to the same month in 2020, 8.8% compared to April 2019. As strong as this growth sounds, it’s a slight slowdown from February and March, when sales increased 33.8% and 34.2%, respectively, over last year.

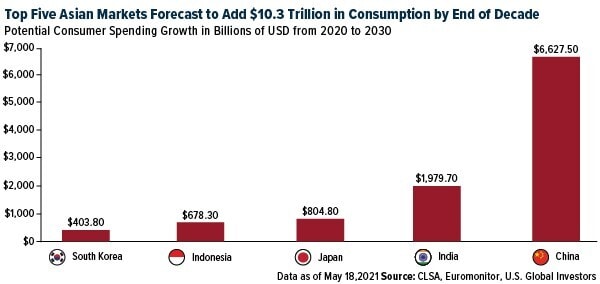

Looking ahead, China is set to contribute an additional $6.6trn in global consumption between now and the end of the decade, according to Hong Kong investment bank CLSA. When combined with four other large Asian markets — India, Japan, Indonesia and South Korea—the total amount in new consumer spending could be as much as $10.3trn.

If accurate, this could be highly supportive of the luxury goods market, which already depends on a strong Asian consumer base. As CLSA analysts write, Asian members of Generation Z — those born between 1995 and 2009 — represent the largest consumer base in the region through 2030 at nearly one billion strong. They’re more affluent and better educated than older demographic groups, and their spending habits more closely resemble those of Western consumers as incomes steadily rise.

A way to play the luxury boom

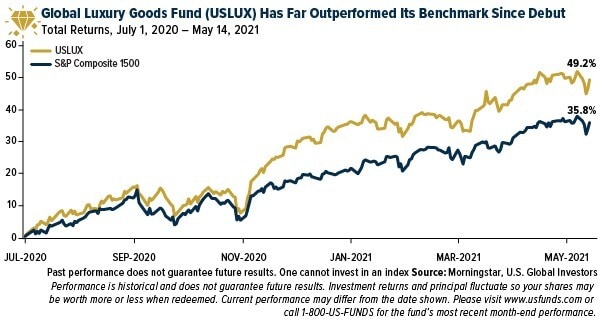

I believe an attractive way to play the recovery in luxury sales is with our Global Luxury Goods Fund [USLUX]. As its ticker suggests, USLUX is truly global, with half of the fund containing companies domiciled in the US. The other half includes companies in Western European markets — primarily Germany, France and Switzerland — and Canada.

USLUX is well-diversified, with exposure to not just traditional luxury goods manufacturers (think LVMH, Burberry [BRBY] and Prada [1913]) but also carmakers (Tesla [TSLA], BMW [BMW], Ferrari [RACE]), retailers (Costco [COST], Home Depot [HD]) and even gold producers (Barrick [GOLD], Newmont [NEM]).

Why gold producers, you might ask. Jewellery manufacturers represent the second-largest source of demand for physical gold following investment, putting gold miners near the front of the luxury goods supply chain.

USLUX changed its investment strategy on 1 July 2020 and, since then, the fund has far outperformed its benchmark, the S&P Composite 1500 Index. USLUX was up close to 50% as of May 14 where the index was up 35%.

This article, which includes more details on the U.S. Global Investors’ Global Luxury Goods Fund, was originally published on Frank Talk, a blog by Frank Holmes, CEO of U.S. Global Investors. You can read the original here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy