In this article, Andrew Little, a research analyst at Global X, explores four companies that could play a major role in developing broad US infrastructure projects if legislation is passed for increased spending.

US Infrastructure development is front and centre in the national conversation. After many years of stagnation, the United States seems to be moving toward meaningful infrastructure spending.

On 31 March, the Biden Administration announced the American Jobs Plan. The plan seeks to revitalise the country’s backbone through sweeping federal spending across major infrastructure areas. These include components of physical infrastructure like roads and bridges, ports and waterways, buildings, and public transit; as well as next-gen areas like clean energy and related clean tech, modernised water utilities, and digital infrastructure.

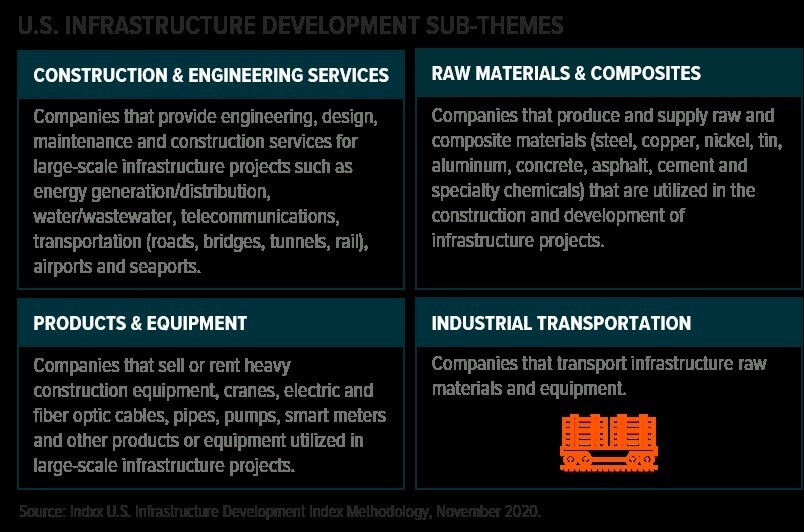

The Jobs Plan is currently the subject of spirited debate in Washington as members of both parties negotiate the specifics of what would be drafted into law. While it is uncertain how closely any legislation might mirror the Jobs Plan, we expect a significant public spending bill to pass in 2021, directing billions of dollars to US infrastructure-exposed companies. This includes companies involved in construction and engineering services, products and equipment, raw materials and composites, as well as industrial transportation.

In this piece, we highlight four companies that exemplify the sub-themes of US infrastructure development, including:

- Jacobs Engineering [J]: Providing construction and engineering services from end-to-end

- Hubbell [HUBB]: Manufacturing electrical products for an electrified future

- Insteel [IIIN]: Enabling resilience through raw materials and composites

- Union Pacific Corporation [UNP]: Delivering infrastructure components by rail and road

Jacobs Engineering: Providing construction and engineering services from end-to-end

Jacobs Engineering is a construction and engineering services company that provides a range of services which could play a role in developing 21st century infrastructure in the US. These services span both traditional and next-generation infrastructure verticals, including:

Transportation: Designs, plans, and executes transportation projects, including building out and retrofitting major highway and bridge systems, optimising the performance of ports and waterways through careful planning and construction, and expanding railroad corridors. Notable recent project involvement includes serving as the lead engineer for the $1.2bn reconstruction of Denver Colorado’s Interstate-70, leading the Port of San Francisco’s modernisation and resiliency effort as project manager, and designing the US’s first true high-speed rail in California.

Buildings: Engages in planning, design, and construction for projects related to buildings and other structures. Jacobs has a history of working with clients in government, healthcare and life sciences, information technology, aviation, manufacturing and more, providing diverse sustainable solutions across each end-market they serve. Relevant recent projects include providing full architectural and engineering services for the central building at the FDA’s headquarters, for new buildings at the University of Texas and University of Pennsylvania, and for about 600,000 square feet (or $650m) of Denver International Airport’s Concourse Expansion Program.

Clean energy and clean tech: Conducts end-to-end services related to renewable energy and electrification including concept design, project siting, environmental and impact assessments, permitting, project design and management, construction, and continued operations and maintenance. Past projects include wind energy, hydropower, geothermal, and solar photovoltaic. Jacobs also has expertise in hydrogen energy projects.

Water infrastructure: Provides engineering and consulting services for projects across the clean water value chain, including those pertaining to water withdrawal and sourcing, conveyance and storage, treatment and recycling, and wastewater management and collection. Recent contracted projects include serving as engineering design manager for California’s WaterFix Program, the largest water conveyance project in the state’s history, as well as for Colorado’s Prairie Waters water treatment project.

Digital Infrastructure: Offers digital infrastructure solutions including end-to-end services related to data centres, smart cities and mobility, telecommunications and networks, and cybersecurity. Over the past 5 years, Jacobs delivered over 10 million square feet and $13bn worth of data centres for its clients, also working with the City of Miami and the City of Peachtree, Georgia, to initiate their smart city efforts.

We think Jacobs Engineering and companies like it are optimally positioned to benefit from US infrastructure development. Jacobs offers solutions across most facets of infrastructure development, including those outlined in the American Jobs Plan. This includes more traditional infrastructure projects, such as those involving physical structures and transportation, as well as next-generation infrastructure projects, like those involving clean energy and digital infrastructure.

Jacobs also has a demonstrated history of executing these projects within the United States and for the public sector. According to September 2020 GeoRev data from Factset, 75% of Jacobs’ trailing 12-month revenue came from the United States.

And in 2020, Jacobs reported that contracts with the US government generated 33% of all revenues, or 44% of US revenues. As noted by CEO Steven Demetriou on Jacobs’ second quarter of 2021 earnings call, “as far as the U.S. infrastructure stimulus opportunity, [Jacobs is] extremely well-positioned with the organic capability [it has] today.”

Hubbell: Manufacturing electrical products for an electrified future

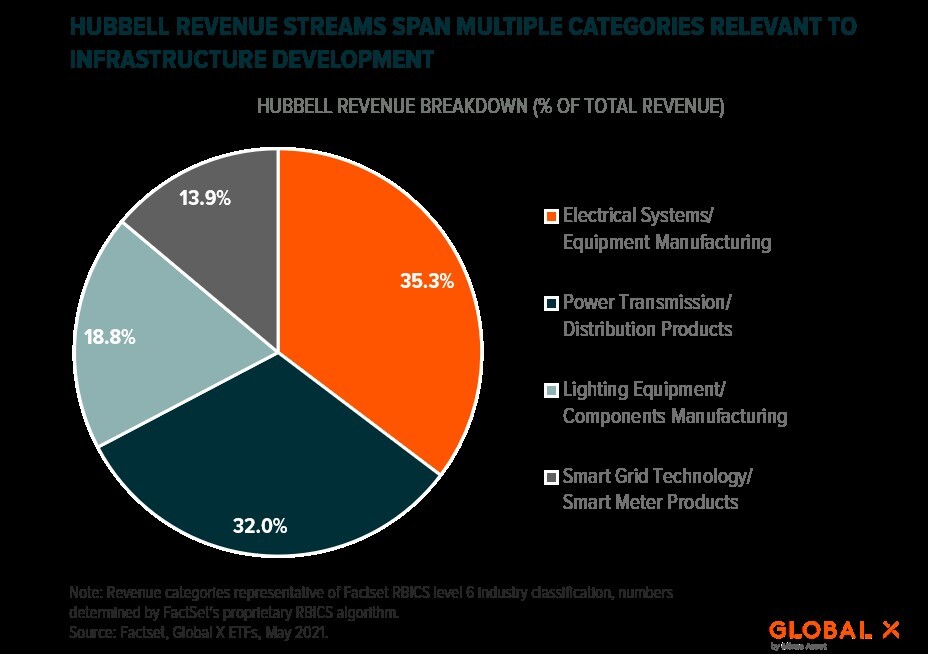

Hubbell is a products and equipment company that manufactures electrical products used across diverse end-markets and settings. Hubbell’s products could play a role in several areas US infrastructure development areas, including:

Buildings: Produces equipment and components used in electrified buildings and structures across most sectors, from residential to commercial and industrial. These include products related to electrical transmission, permanent/temporary lighting, and improving energy efficiency, as well as those used in building construction and engineering projects.

Clean energy and clean tech: Manufactures products used in renewable energy projects. This includes components used in renewable electricity generation and transmission, as well as in construction and installation of renewable energy sources. Hubbell also manufactures electrical products used in utility-level power distribution including smart grid components.

Digital infrastructure: Offers equipment and components used in data centres and telecommunications infrastructure. These products include cables, connectors, and devices used in data transmission and electrical transmission, as well as equipment like server racks, wall mounts, and cable management systems.

Products and equipment companies like Hubbell could benefit from broad investment in US infrastructure. The Jobs Plan features over $300bn of spending related to clean energy and clean tech.

Hubbell’s electrical product offering would position them to benefit from such spending. Though this portion of the Plan is a subject of great debate in Washington, less contested and similarly massive spending on buildings and digital infrastructure could also translate to revenues for Hubbell.

In our view, Hubbell’s 92% revenue exposure to the US and close relationship with construction engineering companies like Quanta Services adds credence to their ability to capture infrastructure revenues.

Insteel: Enabling resilience through raw materials and composites

Insteel is a raw materials and composites company that manufactures reinforcing steel wiring. Insteel products are employed across various concrete construction applications, including projects related to:

Transportation and buildings: Manufactures steel welded wire reinforcement (WWR) products that improve the structural integrity of concrete. One of these products, standard welded wire reinforcement, prevents concrete from cracking, an essential feature of resilient buildings and bridges. Engineered structural mesh, another WWR product, distributes weight evenly throughout concrete, fortifying weight-bearing infrastructure like tunnels and bridges. Insteel also sells drawn steel wire with a multitude of applications including use in railroads.

Water utilities: Offers concrete pipe reinforcement as a part of its WWR offering. This steel wiring reinforces concrete piping used for wastewater collection and management, as well as in irrigation projects.

Raw materials and composites companies like Insteel provide the critical ingredients that form physical infrastructure assets. Buildings, transportation, and water utilities are likely to feature welded wire reinforcement and other steel wire reinforcement products, as is standard.

A new emphasis on longevity and resilience could drive further usage of these products as infrastructure is built or retrofitted to withstand extreme weather events and the test of time. Insteel could be particularly well-positioned to benefit from this spending, considering its 99.5% revenue exposure to the US.

Union Pacific Corporation: Delivering infrastructure components by rail and road

Union Pacific is an industrial transportation company that operates the largest railroad network in the United States, spanning more than 50,000 miles across 23 states.

They serve clients across most sectors, shipping construction products, industrial chemicals, raw materials and composites, energy, and food across the western US Like many industrial transportation companies, Union Pacific’s services go beyond the reach of their railroads and include door-to-door and last mile delivery.

In our view, industrial transportation companies like Union Pacific are essential enablers of US infrastructure development. They are the companies that bring the products/equipment and the raw materials/composites that make up infrastructure to construction sites.

Infrastructure development often involves building new infrastructure in previously hard to reach places – this is a challenge for those initially building this infrastructure. Door-to-door industrial transportation services help solve these logistical challenges and improve the efficiency of construction and engineering companies.

Conclusion

Broad US infrastructure development legislation appears to be on the horizon and smaller, modular legislative efforts are already underway. In April, the Senate passed the bipartisan Drinking Water and Wastewater Infrastructure Act of 2021, which would invest $35bn in water infrastructure if passed into law.

And as a part of recent COVID relief legislation, Congress approved $7bn of spending on digital infrastructure and $31bn of spending on transportation systems. We expect this spending to translate to greater and additional revenue streams for companies across the US infrastructure development value chain.

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy