Investing in small-cap stocks has long been a good approach for investors trying to capture growth.

Here Joe Kunkle, head research analyst at Relativity Capital Advisors and founder of Options Hawk, highlights five small-cap growth stocks that he believes have huge growth potential.

The insurance industry’s rising star

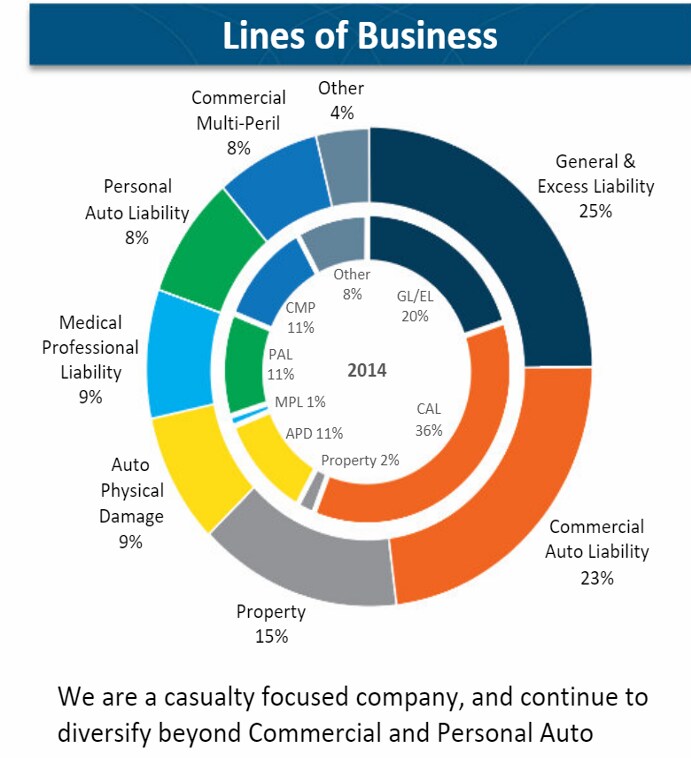

Hallmark Financial [HALL] is based in Dallas, Texas and targets excess and surplus lines for small and mid-sized enterprise risks in niche markets. The company’s investment portfolio has high liquidity and short duration, with 76% of debt securities and maturities of five years or less.

It has been using data and analytics to lower its expense ratio, which is well below its peer’s average. Texas accounts for 30% of its revenues, while California accounts for 10%, but it has businesses in all 50 states. Hallmark’s president and CEO bought 6,500 shares in August at $16.38/share. Shares have been forming a weekly bull wedge since September and if they hit above $19 could make another trend move higher.

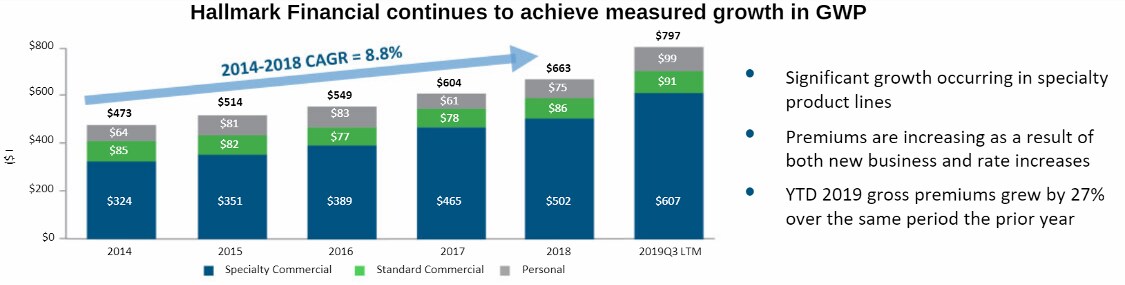

Hallmark is a new small-cap discovery, the $320m property and casualty insurance company trades at 10.85 times earnings, 1.06 times book and has a 12.8% return on equity. Hallmark’s financial growth surged in 2019, with 25% increase in its top line and a 44.5% jump in EPS growth. As the year comes to a close, it expects an 11% increase in revenue and a 9.5% increase in earnings for fiscal year 2020

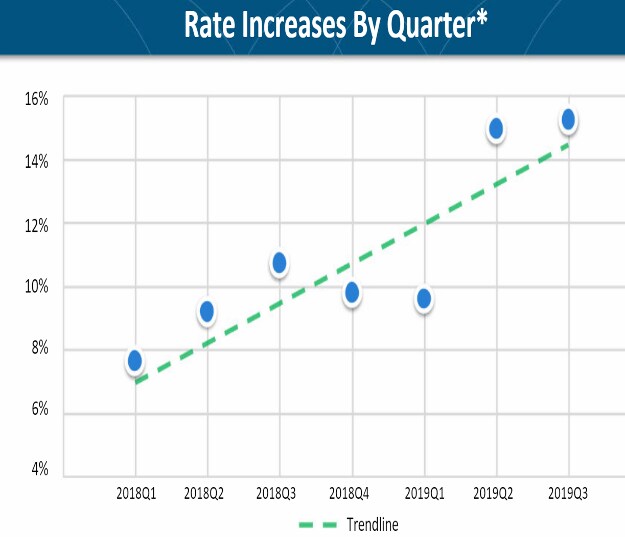

In 2019, Hallmark Financials’ net premiums rose 37% and its combined ratio was 95.6%. Rates are also showing steady growth in its speciality businesses over the last two years and its expense ratio compares very favourable to peers due to its efficiency gains through technology and process improvements.

In an insurance industry where growth is hard to come by, Hallmark Financial really stands out as an excellent operator, while its digital transformation efforts are likely to continue to bear fruit.

The world’s leader in aerogel technology

Aspen Aerogels [ASPN] is a $230m company making aerogel, a synthetic ultralight material derived from a gel, for insulation products used in energy infrastructure and building material markets. Shares have climbed 185% over the past year and the CEO was an active buyer of shares last May.

Aspen Aerogels is focused on developing high-performance aerogel products, targeting large-scale energy infrastructure facilities and the $3.1bn insulation market, and the building materials market where it is partnered with BASF [BAS].

The company’s main targeted end markets are refineries, petrochemical, liquefied natural gas, oil sands, offshore and power. Revenues from the US and Canada represent 44% of its total revenues, while Asia Pacific accounts for 34%.

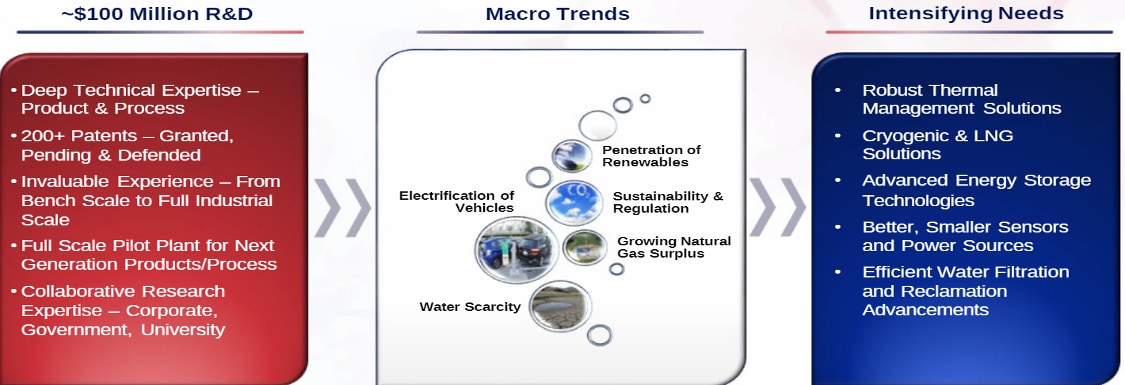

Aspen Aerogel’s cryrogel product is being used at liquefied natural gas and floating liquefied natural gas facilities. The company sees demand growing across all its products, as a need for more robust thermal management solutions cryogenic and liquefied natural gas solutions, advanced energy storage, smaller and better sensors and power sources, and efficient water filtration advancements grows. Macro trends such as water scarcity, electrification of vehicles, growing natural gas surplus, penetration of renewables, sustainability and regulation are seen as positive tailwinds.

Aspen Aerogel sees a major opportunity in building materials with buildings responsible for 40% of global energy consumption and can replace high-performance combustible insulation. Its Aspen Battery unit is also interesting targeting a $100B energy storage opportunities and its platform stabilizes higher energy density battery materials while maximizing the driving range.

The company is not only expanding its partnership with BASF but leveraging its aerogel tech platform with new partners, as it enters new markets. It also optimizing its cost structure and balance sheet to set the stage for stronger profitability in 2020. A stronger pricing market, lowered costs, and capacity expansion put Aspen Aerogel in a good spot moving forward.

Aspen Aerogel shares currently trade at 1.7 times enterprise value-to-sales. The company’s revenues jumped 26.6% in 2019, they are expected to grow 17.8% in 2020 and 20.7% in 2021. It also has positive EBITDA expected for fiscal year 2020. In Aspen Aerogel’s latest quarter, it noted “revenue growth accelerated 48% versus last year”.

“We increased our gross profit by a factor of five versus last year, and we expanded our gross margin by nearly two times relative to the first half of 2019,” the company noted in the earnings release.

Aspen Aerogel also has signed two agreements in the battery materials segment with significant global companies for its carbon aerogels, though not likely to drive meaningful revenues until 3–5 years from now. It shows validation of its platform and positions it as a unique growth name positioned for the secular growing trend in electric vehicles.

A healthcare stock with a promising growth story

Exagen [XGN] is a $270m commercial-stage diagnostics company that went public in late 2019, with a focus on patients affected by rheumatic diseases. Physicians face significant difficulties in making a definitive diagnosis of a specific allergic respiratory disease (ARD) because patients with different diseases often present with a common set of symptoms.

Exagen currently markets nine products under its Avise brand. Avise Lupus is a proprietary diagnostic test that provides an enhanced solution for patients presenting with symptoms indicative of a wide variety of ARDs such as systemic lupus erythematosus (SLE), Rheumatoid Arthritis (RA), Sjögren’s syndrome, scleroderma as well as other disorders that mimic ARDs such as fibromyalgia. ARDs are a group of approximately 30 chronic disorders, which create a significant burden on the healthcare system.

These chronic diseases can cause lifelong inflammation in the joints, tissues and internal organs, resulting in serious complications, such as irreversible organ damage. It is estimated that 11 million patients in the United States suffer from ARDs, and patients afflicted with fibromyalgia and autoimmune thyroid disease have many of the same clinical symptoms as patients with ARDs.

Since the launch of Avise CTD in 2012, Exagen has delivered over 326,000 tests, representing a compound annual growth rate of 87% through 31 December 2018, with limited incremental investment in its commercial infrastructure.

Approximately 83,000 Avise CTD tests were delivered in 2018, representing an 18% increase over 2017, and the number of ordering physicians in the fourth quarter of 2018 reached 1,298, representing 18% growth over the same period in 2017.

In the first half of 2019, 50,792 Avise CTD tests were delivered, representing approximately 30% growth over the same period in 2018, and the number of ordering physicians in the first half of 2019 reached 1,711.

Exagen has been expanding its salesforce after its December 2018 agreement with Janssen, a pharmaceutical company owned by Johnson & Johnson [JNJ], to exclusively promote its Simponi treatment in the US for the treatment of rheumatoid arthritis.

Revenue grew 35.4% year-over-year to $5.2m for the six months ended 30 June 2019, primarily due to an increase in the number of diagnostic tests delivered and an increase in the average reimbursement per test.

The number of Avise CTD tests, which accounted for 83% of revenue in the six months ended 30 June 2019, and 86% in 2018, increased to 50,792 tests delivered in the six months ended 30 June 2019 compared to 39,134 tests delivered in the same 2018 period

Exagen is currently trading 4.8 times enterprise value-to-sales and just 3.5 times cash. Forecasts are calling for a 35.6% increase in top-line growth in fiscal year 2020 and 30% growth in fiscal year 2021 while profitability may come as soon as fiscal year 2022. The company is an intriguingly niche player in a hot diagnostics industry and could attract a strategic buyer at this cheap valuation.

A soaring software stock with significant upside

Red Violet [RDVT] is a $250m software company. It has a technology platform called “CORE”, which serves industries within risk management including law enforcement, financial services, government, insurance and corporate risk and compliance customers. The company’s mission is to transform data into intelligence, utilising its proprietary technology platform to solve complex problems for clients.

Red Violet’s business model has a fixed-cost model and is subscription-based, with 66% of revenues on customer contracts. It estimates a $10bn serviceable market as of today and a total $100bn addressable market, according to IDC. The company has tremendous operating leverage and an experienced management team that has precious built companies that were acquired.

New customer adoption followed by further penetration for increased customer spend including custom solutions and also expanding into new products, markets and channels leaves a vast growth opportunity for Red Violet.

Red Violet shares trade just 3.6 times fiscal year 2018 enterprise value-to-sales. In 2018, revenues climbed 90%, which followed an 87% revenue growth in 2017. The company has a 94% net revenue retention.

It is a niche software name with impressive growth, an attractive valuation and, overall, has a strong financial profile. Red Violet has impressive operating leverage and a business model that can rapidly scale. The CEO has over 20 years of experience in the data and analytics industry and has sold companies for nearly $1bn in his career.

An internet of things company that’s powering ahead

PowerFleet [PWFL] has made a strong start to 2020, with the stock moving out of a narrow decade-long trading range. The $220m company provides subscription-based wireless internet of things (IoT) and machine-to-machine (M2M) solutions. Its solutions are used in the transportation and logistics industries.

It was formerly known as IDSystems before changing its name last year. It bought CarrierWeb, a provider of real-time, in-cab mobile communications technology, electronic logging devices, two-way refrigerated command and control, and trailer tracking allowing for it to offer a fully integrated logistics technology offering.

It then bought Pointer Telocation to position the company as a provider of IoT and M2M technology in its markets. PowerFleet shares trade three times enterprise value-to-sales and is seeing rapid revenue growth recently, with 52.7% growth in 2019 and 83% growth expected in 2020 while also turning profitable in 2019.

PowerFleet is positioning itself in an emerging large market opportunity for global IoT and connected vehicle markets. The global logistics market is expected to grow at a 7.5% CAGR through 2023. The global warehouse management systems market is seen at a 15.2% CAGR and connected vehicles at 14.2% CAGR – two of the more exciting growth opportunities. More than half (55%) of PowerFleet’s revenues are related to recurring services and has 15% adjusted EBITDA margins.

The company sees a clear path to $200m in revenues and $50m EBITDA. As a small player in a rapidly growing large market with strong financials and a stable balance sheet, PowerFleet could be a long-term winner in the logistics tech space.

By Joe Kunkle, who is the founder of Options Hawk, a service that provides news, analysis and option movement research. Alongside this, he runs his personal trading account and is head research analyst at investment firm Relativity Capital.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy