In this article, Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies, discusses the US manufacturing sector’s robust growth and how it has boosted the price of commodities, as well as covering luxury giant LVMH’s return to growth and Coinbase’s public debut.

A raft of positive economic news was released last week, pointing to a robust ongoing recovery from the coronavirus pandemic-triggered downturn and adding to the thesis that inflation is set to accelerate.

Leading manufacturing data from the Federal Reserve Banks of Philadelphia and New York were extremely constructive for business activity going forward. The Philadelphia Federal Index registered a 50.2 this month, which is the highest level in nearly 50 years if you can believe it.

Close to three in four firms reported higher input prices for raw materials as well as higher prices for their own manufactured goods. Manufacturers in New York reported the same, with input prices rising at the fastest pace since 2008 and selling prices surging at a record-setting pace.

Indeed, the producer price index (PPI), issued monthly by the Bureau of Labor Statistics (BLS), shows prices rising at multiyear highs. The index for processed goods, for instance, moved up 4% in March, the biggest increase since August 1974. For the 12-month period, unprocessed goods exploded 41.6%, the strongest such growth since July 2008.

A number of commodities have been on a tear lately. Lumber futures are up for the 15th straight day. And just take a look at corn prices. Futures for the crop spiked above $6 a bushel for the first time since June 2013 on tight supply and strong demand from China and South Korea. Corn prices are now up 85% compared to the same time last year and could double before we see a retreat.

Copper continued its rally last week on a bullish report from Goldman Sachs [GS], which sees the red metal climbing to an all-time high of $15,000 per metric ton by 2025 on an unprecedented supply-demand imbalance brought on by renewable energy.

According to the analyst group, current copper prices of around $9,000 “are too low to prevent a near-term risk of inventory depletion”. Only a price point of around $15,000 is enough to incentivise the development of new copper projects.

Our favourite copper play continues to be Ivanhoe Mines, led by billionaire Robert Friedland, who sees the lack of new mines as a national security issue. Speaking at the virtual CRU World Copper Conference last week, Robert told listeners that markets still haven’t quite recognised how disruptive the transition to renewable energy and electrification-of-everything will be, nor just how much copper will be required.

“It’s all copper, copper, copper, copper, copper, copper,” Robert said. Ivanhoe Mines [IVN.TO] also announced it produced a record 400,000 metric tons of ore grading 5.36% copper at its Kakula and Kansoko mines in March.

Luxury giant LVMH returns to growth

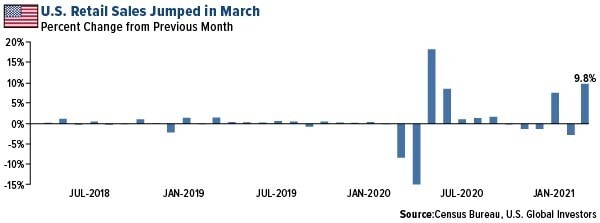

In March, retail sales jumped a whopping 9.8% from the previous month, the second largest surge on record, as consumers made good use of their stimmy checks.

As I shared with you recently, sales of cars and light trucks were up an unbelievable 58% in March compared to last year, with many luxury carmakers setting new monthly and quarterly sales records.

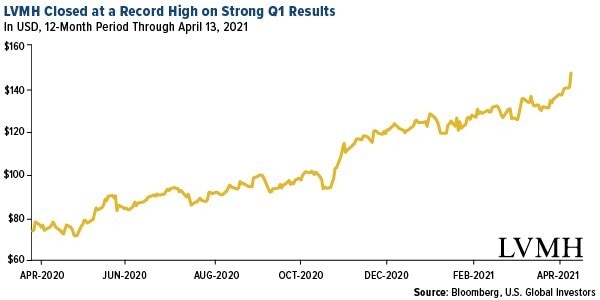

The French luxury giant LVMH Moet Hennessy Louis Vuitton [MC.PA] announced last week that it had returned to growth following the pandemic, reporting first-quarter revenue of €14bn, or $16.75bn.

Fashion and leather goods had an excellent start to the year, generating record revenue that was 52% higher than the same period in 2020 and an increase of 37% from 2019. The conglomerate was helped by its recent acquisition of US jeweller Tiffany, bringing the number of companies it owns to over 75.

I’m very pleased with how LVMH has performed over the course of the pandemic, during which the fortunes of wealthy consumers have expanded. With a market cap of nearly €320bn ($383bn), LVHM is Europe’s most valuable company.

First-quarter sales were driven by Asia, particularly China, and the US, which have done a much better job of combating COVID-19 than Europe. The increasing traffic at US seaports is a clear sign that demand is strong right now.

Following its record-setting February, the Port of Los Angeles processed 957,599 twenty-foot equivalent units (TEUs) in March, representing the busiest March in the port’s 114-year history. All combined, it was also the busiest first quarter ever for the seaport.

To see the top 10 countries with the largest shipping fleets, click here.

Coinbase goes public, opening the crypto floodgates

On a final note, digital currencies stormed Wall Street in a big way last week. Cryptocurrency exchange Coinbase [COIN] went public in a direct listing, opening the floodgates for a number of other crypto-related companies.

This move brings us one step closer to mass acceptance of cryptocurrencies. Before now, investors seeking to participate had a few options other than to hold the underlying assets.

The most obvious among these is to own shares of the crypto miners, including HIVE Blockchain Technologies [HIVE], the only publicly traded firm to mine both Bitcoin and Ether using green energy. There are also futures contracts through CME Group, and a number of issuers have filed for a Bitcoin ETF.

With Coinbase, investors get exposure to the entire $2.2trn crypto ecosystem, including not just Bitcoin and Ether but also smaller yet fast-growing coins like Dogecoin. All cryptos mentioned hit fresh new highs last week following Coinbase’s debut.

The stock traded a staggering $29bn in volume on its first day, which could be an all-time high, according to Bloomberg’s Eric Balchunas.

Several commentators pointed out that Coinbase ended lower than it opened at. As I told Cointelegraph last week, I’ve seen this story play out many times over my 30 years in managing money. Often when a company is up 300% in a year and goes public, it can easily sell off 30%. I don’t believe investors should be too worried about Coinbase’s volatility. I’m incredibly bullish.

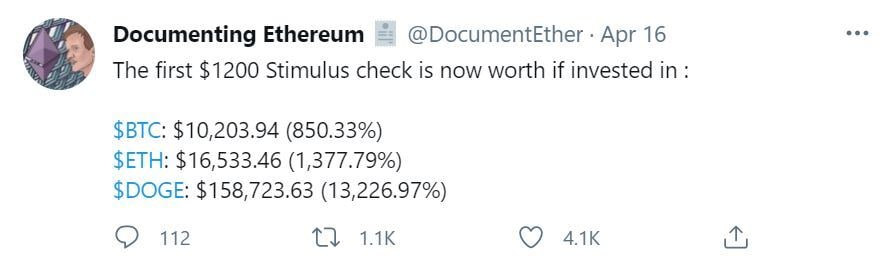

That’s not to say the industry isn’t volatile. It remains extremely volatile. A tweet by Documenting Ether on Friday (see above) shows just how much your investment would be today had you used the April 2020 stimulus check to buy Bitcoin, Ether or Dogecoin. It’s hard to look at these figures and not kick yourself.

This article was originally published on Frank Talk, a blog by Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy