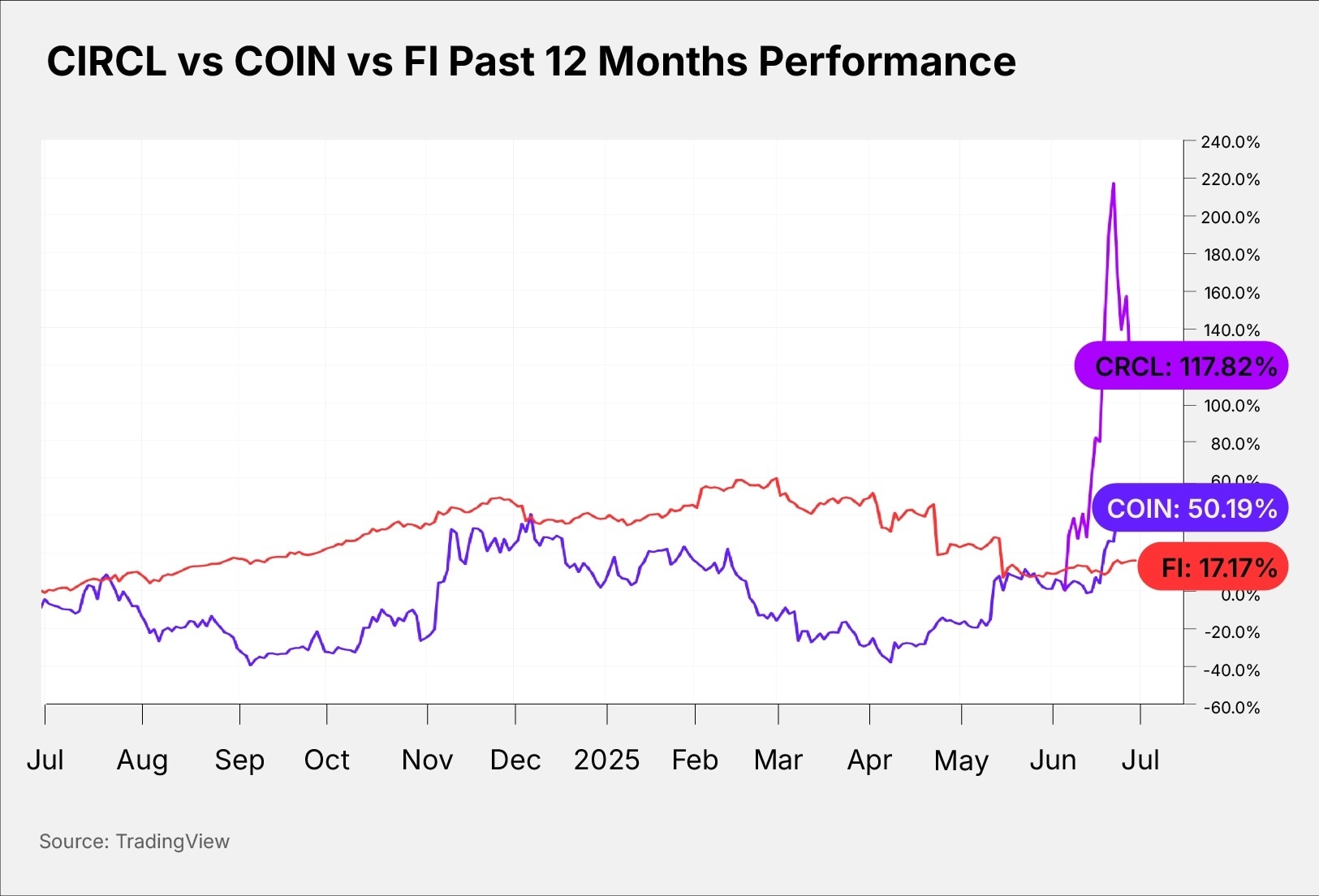

Circle Internet [CRCL], Coinbase [COIN] and Fiserv [FI] are corporate players in the stablecoin sector.

Circle is an issuer of a US dollar-pegged cryptocurrency called USDC stablecoin. Coinbase is a cryptocurrency exchange that owns a stake in Circle. Finserv is a fintech company that launched a stablecoin called FIUSD in June.

Here, OPTO examines the recent performances of CRCL, COIN and FI and presents the bull and bear arguments for each.

Sector Talk: Moves to the Mainstream

In early June, Circle became the first pure-play stablecoin issuer to list on the New York Stock Exchange in what was described as a “blockbuster” IPO by the media. CRCL’s share price surged as much as 270% from its IPO price on its first trading session as Wall Street showcased its appetite for stablecoins.

Stablecoins are cryptocurrencies that are designed to hold a steady value and are pegged to fiat currencies such as the US dollar and the Euro.

Circle’s stablecoin, USDC, is currently the second-largest stablecoin in the world, with a market cap of over $61.21bn, according to cryptocurrency data firm DefiLlama. The USDT stablecoin issued by a company called Tether is the largest stablecoin, with a market cap about 2.5 times that of Circle’s USDC.

The USDC stablecoin was created by Circle and Coinbase in 2018 as a compliant and trustworthy alternative to Tether’s USDT, which continues to be marred by transparency concerns about the reserves backing it.

Circle’s compliance-first approach is set to give the company a headstart over its rivals following the US Senate’s passage of stablecoin legislation known as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act on June 17.

The GENIUS Act looks to regulate stablecoin issuers in the US by introducing strict rules to maintain reserves backing stablecoins on a one-to-one basis, prevent the reuse of reserves, and protect end users.

The crypto-friendly stance of the Trump administration — alongside the departure from the former US Securities and Exchange Commission chair Gary Gensler’s hostile approach — is drawing more players into the stablecoin and the broader cryptocurrency sector.

In late June, payments firm Fiserv joined the likes of PayPal [PYPL] to become the latest publicly listed company in the US to issue stablecoins.

Elsewhere, Mastercard [MA] announced the launch of a stablecoin-focused payment network with 24/7 real-time and cross-border settlements for financial institutions and businesses. Meanwhile, JPMorgan [JPM] is expected to launch a stablecoin-like product that pays interest, similarly to a bank deposit.

CRCL, COIN and FI surge

Circle priced its IPO at $31 per share. On June 5, Circle’s share price opened at $69 before surging to a high of $103.75 on its debut.

On June 23, CRCL shares rose to an all-time high of $298.99, an increase of 864.48% from its IPO price.

In June, Coinbase’s share price surged to $382, the highest since its debut month of April 2021.

COIN stock has increased by 41.16% year-to-date, as of June 30. In comparison, Bitcoin, the world’s most valuable cryptocurrency by market cap, is up 14.29% year-to-date, while the US equity market benchmark index S&P 500 has increased by 5.50% year-to-date.

Fiserv’s share price hit an all-time high of $238.59 in March 2025, following which FI stock saw three consecutive months of losses between March and May.

FI stock price is down 16.07% since the start of the year.

Here are how the fundamentals of the three stocks currently compare to each other.

| CRCL | COIN | FI |

Market Cap | $40.34bn | $89.27bn | $95.59bn |

P/E Ratio | 2,080 | 65.88 | 30.52 |

Estimated Sales Growth (Current Fiscal Year) | N/A | 13.50% | 8.78% |

Estimated Sales Growth (Next Fiscal Year) | 31.45% | 9.46% | 8.43% |

Source: Yahoo Finance

CRCL, COIN and FI Stock: The Investment Case

The Bull Case for Circle: Stablecoin Growth

Described as one of the few crypto products to have found product-market fit, stablecoins offer borderless, instantaneous and low-cost transactions.

The sector could be poised for accelerated growth in the coming years, especially with GENIUS reinforcing its legitimacy and paving the way for broader adoption.

Circle’s USDC is among the fastest-growing stablecoins in the market, supported by its trusted image and compatibility with 20 of the biggest public blockchain networks. Circle also issues a Euro-backed stablecoin called EURC.

“It’s the first and only pure-play way to bet on stablecoin growth, something that investors have been seeking for over seven years (Arca included). For that reason alone, and the expected growth of stablecoins to well over $1trn in AUM, it is a good investment story,” noted Jeff Dorman, Chief Investment Officer at digital asset management firm Arca.

The Bear Case for Circle: Interest Rates Impact

Circle is highly sensitive to interest rate changes as the company earns the majority of its revenue from interest on its stablecoin reserves.

Over the past three years, reserve income accounted for about 95–99% of Circle’s annual revenue.

Since September 2024, the US Federal Reserve has cut interest rates on three separate occasions, bringing borrowing rates down from 5.5% to 4.5%.

Economic thinktank ING said that the Fed may cut rates further by half a percentage point in 2025, but “Donald Trump wants deeper, faster cuts”.

The Bull Case for Coinbase: A Complete Cryptocurrency Platform

Coinbase is more than just a cryptocurrency exchange. The company has expanded beyond its core spot trading business to serve institutional clients, offer derivatives trading and custodial services, manage stablecoins, and operate a public blockchain network.

According to crypto research firm Artemis Analytics, derivatives are the most profitable segment in crypto trading. To support its growth in the space, Coinbase spent $2.9bn in a cash-and-stock deal to acquire a crypto options exchange called Deribit in May.

Coinbase and Circle share interest income generated from USDC stablecoin reserves, comprised of US treasuries and overnight repurchase agreements. Additionally, Coinbase earns a significant portion of transaction fees paid by users on Base, which is one of the most popular cryptocurrency blockchains in the world.

The Bear Case for Coinbase: Crypto ETFs Competition

Coinbase is seeing increased competition in its core spot trading operation from crypto-native firms such as Binance, traditional finance brokerages such as Robinhood [HOOD], decentralized exchanges such as Uniswap and cryptocurrency ETFs.

The launch of Bitcoin and Ether ETFs in the US in 2024 dramatically shifted the crypto trading landscape, as it introduced a convenient and safe entry point into cryptocurrencies. Users can now gain exposure to Bitcoin and Ether without having to rely on crypto exchanges such as Coinbase.

Note that 44% of crypto trading fees earned by Coinbase in 2024 were from bitcoin and ether trades.

The Bull Case for Fiserv: Institution-focused Stablecoin

A key differentiator for the FIUSD stablecoin over its rivals is that Fiserv has designed it to be a “bank-friendly coin.” While the likes of USDC and USDT focus mainly on retail adoption, FIUSD will focus on institutional adoption.

Fiserv’s payment processing network serves about 10,000 financial institutions and 6 million merchant locations, which will provide “instant scale” for FIUSD. Fiserv’s stablecoin is also being integrated into Mastercard’s global payment networks, which will further expand its reach to more than 150 million global merchants.

“PayPal and Fiserv are among the few traditional fintechs actively launching or supporting their own stablecoins. While market response has been lukewarm so far, any adoption within their existing ecosystems could be a game-changer,” noted Koen Hoorelbeke, investment and options strategist at Saxo Bank.

The Bear Case for Fiserv: Slowing Revenue Growth

Fiserv investors are concerned about earnings growth. On April 24, Fiserv stock closed about 18.5% lower in what was the company’s worst trading day in over nine years, after it missed Wall Street estimates for Q1 revenue.

Company CFO Robert Hau commented that the growth of Fiserv’s Clover, a platform that provides point-of-sale and business management solutions for small businesses, will not improve from the last quarter, which sent FI stock further down by over 16% on May 15.

Conclusion

The stablecoin sector could yet see more listings before the end of the year, encouraged by the reception that Circle received. Blockchain tech provider Ripple and stablecoin issuer Tether are among the names that are touted as possible candidates by market watchers. Meanwhile, Coinbase and Fiserv are likely to exert an expanding influence in the space.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy