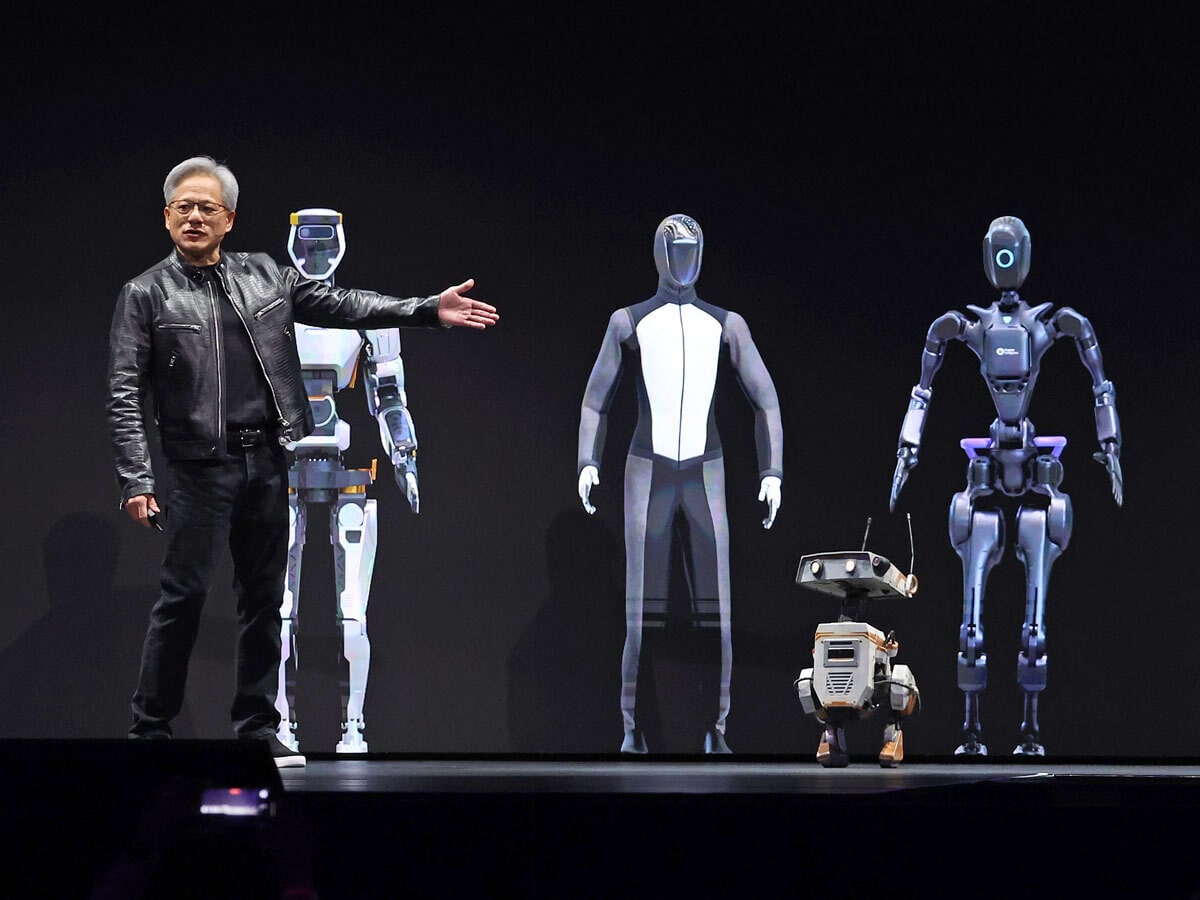

Huang: Robotics Are a Multitrillion Dollar Opportunity

Nvidia [NVDA] shares surged 4.3% to a record high on Wednesday, pushing the chipmaker past Microsoft [MSFT] to become the world’s most valuable company, with a $3.77trn market cap. The rally followed a bullish presentation by CEO Jensen Huang at Nvidia’s annual shareholder meeting, where he highlighted the “multitrillion-dollar opportunity” in artificial intelligence (AI) and robotics. He also noted that “demand for sovereign AI is growing around the world”.

Bulwark Against AI

Social media site Reddit [RDDT] is stepping up efforts to shield its communities from a flood of AI-generated content, as the platform’s archive of human conversation becomes a prized asset for training large language models. CEO Steve Huffman told the Financial Times that Reddit's “20 years of conversation about everything” has enabled multimillion-dollar deals with Alphabet’s Google [GOOGL] and OpenAI. As its authenticity grows in value, advertisers are shifting budgets toward the platform.

Meta Wins AI Victory vs Authors

Meta [META] has won a key legal battle over its use of millions of copyrighted books to train its Llama AI models, with a US federal judge ruling the practice falls under “fair use”. The lawsuit, filed by authors including Ta-Nehisi Coates, challenged how the $1.4trn tech giant accessed and used online literature. The court’s decision is a major victory for AI developers, though Judge Vince Chhabria noted the plaintiffs failed to properly argue their case.

SpaceX’s Pain is Blue Origin’s Gain

Blue Origin is reportedly leveraging tensions between Elon Musk and US President Donald Trump to gain an edge in the space race. Founder Jeff Bezos has met with Trump at least twice this month, while CEO Dave Limp visited the White House to lobby for government contracts, according to the Wall Street Journal. OPTO recently analyzed several stocks similarly seeking to steal a march on Musk’s SpaceX/Starlink in the ever more competitive space sector.

SoftBank’s Funding Diversification Drive

SoftBank Corp. [9434:T], the telecom arm of SoftBank Group [SFTBY], is launching its first US dollar bond offering, targeting around $1bn. Morgan Stanley is among the lead managers for the deal. The move comes as SoftBank seeks to diversify its funding beyond domestic debt and loans, aiming to support growing investments in AI, Bloomberg reported. Investor roadshows began June 26 across Asia, Europe and the US.

Drone Stock Soars on Earnings

AeroVironment [AVAV] surged up to 29% to an all-time high of $250 after posting blowout Q4 and full-year results. Revenue climbed 40% year-over-year to $275m, with adjusted EBITDA hitting $61.6m — both well above expectations — thanks largely to soaring demand for loitering munitions, which generated $138m, crushing forecasts. Analysts hailed the recent acquisition of BlueHalo as a key growth driver, Seeking Alphaoutlined.

OpenAI is Taking on the Tech Giants

Technically speaking, OpenAI is a start-up. In light of the firm’s size and ambitions, however, the term seems wildly inadequate: few start-ups are able to go toe-to-toe with big tech behemoths, or to play a key role in geopolitics. Today, OPTO considers the firm’s relationship with its various “frenemies” among the magnificent seven and unpacks its vision for the future of tech.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy