Is an AI Pullback Coming?

“We’re not there yet, but that’s one of the risks out there that I think a lot of people are underestimating,” renowned short-seller Jim Chanos told Bloomberg. Chanos compared today’s artificial intelligence (AI) euphoria to the 1990s networking craze, warning that a sudden pullback in enterprise AI spending could hit corporate earnings hard. He cited the dotcom-era collapses of Cisco [CSCO] and Lucent as cautionary parallels.

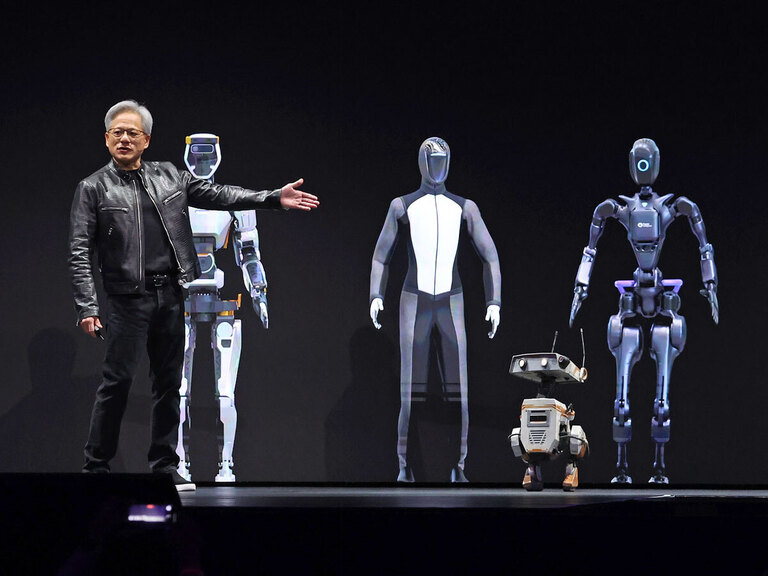

Nvidia Insider Selling Surges

Insiders at the chip giant [NVDA] have sold over $1bn in shares over the past year, with more than $500m offloaded this month alone, the Financial Times reported. CEO Jensen Huang began selling for the first time since September under a pre-set trading plan. Despite the sales, Huang retains most of his holdings. The activity comes as investors continue piling into Nvidia, now the world’s most valuable company.

Can OpenAI Stop the Meta Brain Drain?

“I feel a visceral feeling right now, as if someone has broken into our home and stolen something,” OpenAI Chief Research Officer Mark Chen wrote in a memo seen by Wired, referring to Meta’s [META] recent poaching of several senior researchers. Chen said that the OpenAI leadership team had “been more proactive than ever before, we’re recalibrating comp, and we’re scoping out creative ways to recognize and reward top talent.”

Bitcoin Fever Hits London’s Micro-caps

A growing number of London-listed micro-cap firms are embracing bitcoin to lift their share prices, the Financial Times reported, aligning with a global trend of companies turning into crypto proxies. At least nine firms — among them a gold miner and AI firm TAO Alpha [TAO:L] — have disclosed bitcoin treasury plans in the past week. OPTO recently outlined this growing trend, highlighting the stocks that are leading the way.

Renewables Slide on Package Details

Vestas Wind Systems [VWSYF] and Ørsted [DNNGY] slumped after a new version of US President Donald Trump’s spending package proposed a more aggressive wind-down of US clean energy tax incentives. Projects must now be fully operational by end-2027, rather than just under construction by 2025, to qualify. The bill also penalizes use of Chinese materials, according to Bloomberg.

New Weight Loss Challenger out of China

Novo Nordisk [NVO] and Eli Lilly [LLY] are facing their first major obesity drug competitor in China, Seeking Alpha reported, after Innovent Biologics [IVBXF] won regulatory approval for mazdutide. Licensed from Lilly in 2019, mazdutide has shown comparable weight loss efficacy to Lilly’s blockbuster Zepbound in Chinese patients. The approval, based on successful Phase 3 results, marks a key step in China’s efforts to curb obesity with domestic innovation.

AI Energy Demand is Fueling These Uranium Stocks

Power-hungry data centers built to power AI and crypto mining are putting a strain on the US grid. In response, the Trump administration is targeting a four-fold increase in domestic nuclear power production, from 100GW to 400GW, by 2050. OPTO explores if a planned “nuclear renaissance” could help uranium and nuclear-adjacent stocks like Cameco [CCJ], Oklo [OKLO] and Uranium Energy [UEC] rally.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy