Renewables Overtook Coal in H1

Renewable energy surpassed coal as the world’s top electricity source in the first half of the year, according to energy think tank Ember, as reported by the BBC. Soaring solar and wind output met 100% of new demand and drove a drop in coal and gas use. China led clean energy growth, adding more capacity than the rest of the world combined, while India also cut fossil fuel use. The US and EU, by contrast, increased reliance on coal and gas.

Debt Drives Dollar Debasement

Rising fiscal strain in major economies is fueling a “debasement trade”, with investors rotating from major currencies into bitcoin, gold and silver, according to Bloomberg. Gold hit a new high on Monday, with silver near a record and bitcoin hovering near its latest record, set over the weekend. This is the “familiar pattern of dollar debasement against alternative reserve assets amid Washington dysfunction”, JPMorgan analysts wrote in a note last week.

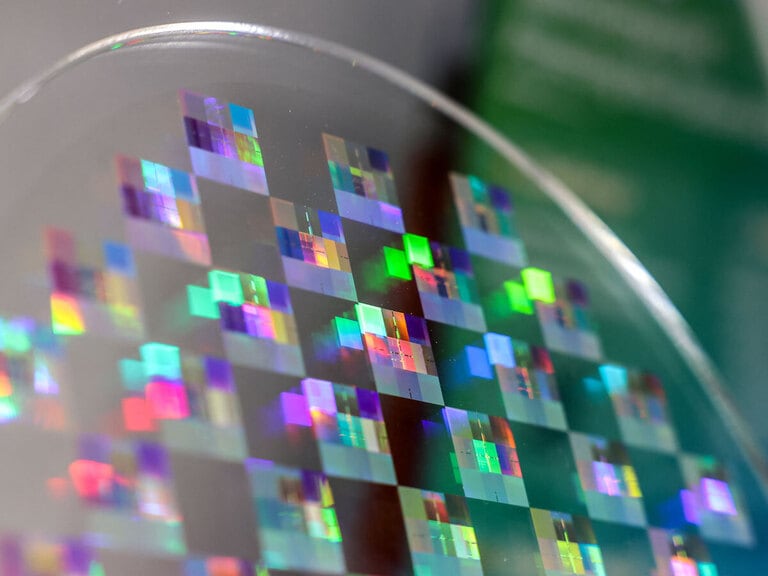

Should OpenAI Really Be Making All These Deals?

OpenAI has signed roughly $1trn in computing power deals this year — with Nvidia [NVDA], Oracle [ORCL], CoreWeave [CRWV] and, most recently, Advanced Micro Devices [AMD] — to run its artificial intelligence (AI) models, the Financial Times detailed. However, analysts warn these deals far exceed OpenAI’s revenue. The firm is “is in no position to make any of these commitments,” and could lose about $10bn this year, said Gil Luria of DA Davidson.

These Three Nuclear Energy Stocks Have Doubled This Year

Nuclear energy is experiencing a resurgence in the US after years of skepticism over safety concerns, radioactive waste disposal and high capital costs. As a result, US-listed nuclear energy stocks Oklo [OKLO], NuScale Power [SMR] and Lightbridge [LTBR] have more than doubled their share prices since the start of the year. OPTO covers regulatory developments, analyzes each stock’s price performance and reflects on the bull and bear cases for OKLO, SMR and LTBR.

Musk Moves to Shore up xAI

Elon Musk has named former Morgan Stanley [MS] executive Anthony Armstrong as CFO of both xAI and X. Armstrong, who advised Musk on his $44bn Twitter acquisition, will oversee finances for both ventures as Musk seeks to revive X and expand xAI. Valued at $200bn, xAI is reportedly losing about $1bn a month amid soaring AI infrastructure costs.

APP Collapses on SEC Probe

AppLovin [APP] shares fell up to 17% after reports that the Securities and Exchange Commission (SEC) is investigating its data-collection practices. The probe, handled by the agency’s cyber and emerging tech unit, focuses on allegations that AppLovin violated partner agreements to deliver more targeted ads. The inquiry follows a whistleblower complaint and recent short-seller reports, Bloomberg reported. AppLovin and the SEC declined to comment.

Bitcoin Miner Rises on Google-Backed Deal

Cipher Mining [CIFR], a New York-based operator of bitcoin mining data centers, has become a major beneficiary of the AI gold rush. Miners that have built up computing capacity for bitcoin mining have been profiting from the demand for data centers to train and deploy AI models. On Foresight, OPTO details how CIFR stock has been riding high on the back of a recent data center deal, and asks whether the rally can continue if the AI boom proves to be a bubble.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy