Yet Another AI Frenzy

Global chipmakers’ market value surged on a slew of good news from artificial intelligence (AI) firms, driving tech stocks to record highs. Some commentators sounded a cautious note, however: “Tech momentum shows no sign of fading — as if gravity doesn’t exist — with headwinds brushed aside and every AI headline sparking bursts of euphoria,” Hebe Chen, an analyst at Vantage Markets in Melbourne, told Bloomberg. Upcoming Q4 earnings may be a reality check, Chen added.

OpenAI Overtakes SpaceX

One major catalyst for the rally was the news that OpenAI’s latest deal values the AI firm at $500bn, surpassing SpaceX’s $400bn July valuation and thus making it the world’s most valuable startup. The secondary sale lets employees sell $6.6bn of stock to investors, the Financial Times reported. Previously valued at $300bn in a $40bn round led by SoftBank [SFTBY], OpenAI allowed up to $10bn in employee sales, though many held onto shares.

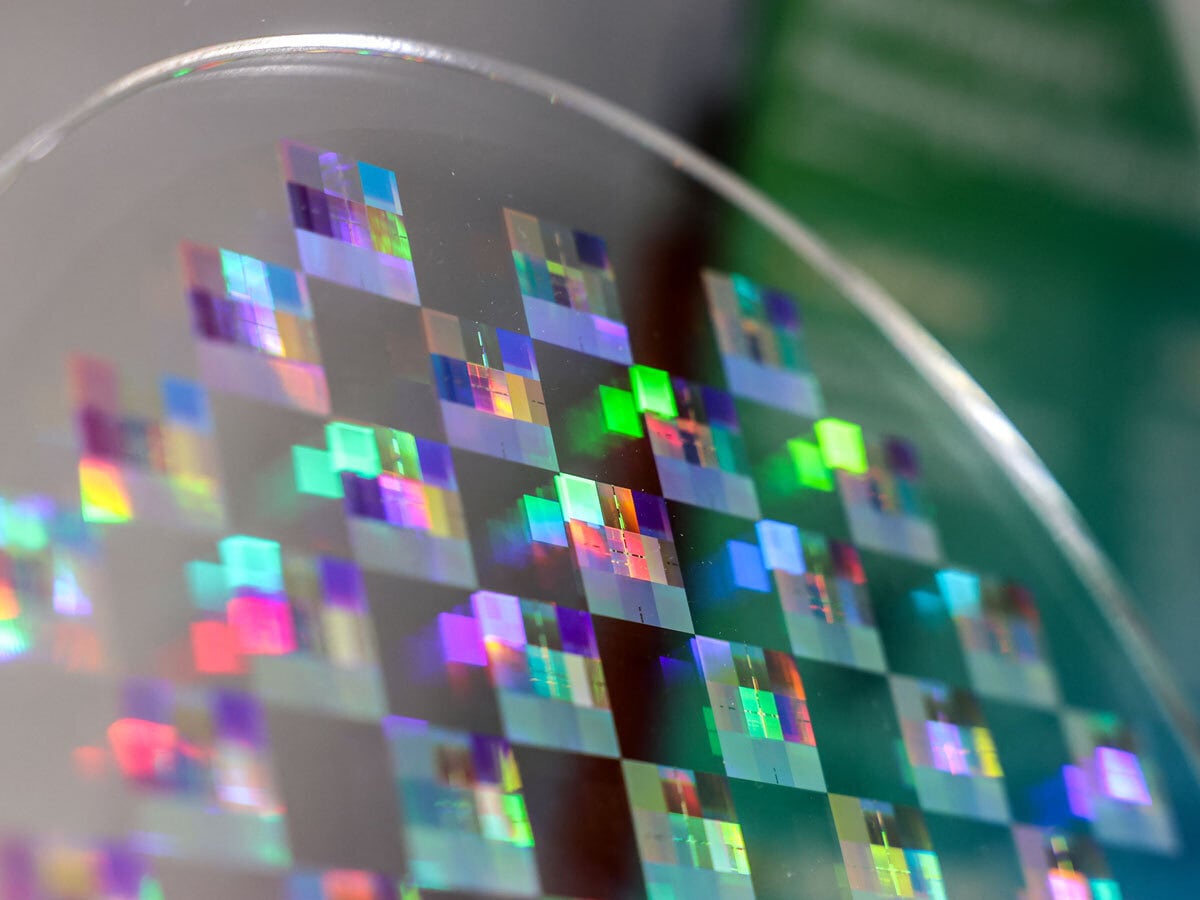

Korean Chipmakers Surge on Stargate Deal

SK Hynix [000660:KS] and Samsung Electronics [SSNLF] shares surged after signing a letter of intent (LOI) with OpenAI to supply chips for its $500bn Stargate data center project. SK Hynix plans to meet demand for up to 900,000 DRAM wafers per month, more than double current HBM capacity. The LOI followed OpenAI CEO Sam Altman’s Seoul visit, which included meetings with South Korea’s president.

Will AI Be the Key to Opendoor’s Success?

Opendoor [OPEN] is a proptech “iBuyer”, a platform that makes instant cash offers on homes. In recent weeks, the firm has generated attention through a steep stock rally, driven in part by retail trading and new leadership moves. OPTO details how this rally may also be connected to a pivot toward an agent-led, AI-first model, expanding services like mortgages, title, home warranty and tools for partner agents.

Apple Follows Meta’s Lead on Smart Glasses

Apple [AAPL] has paused development of a Vision Pro follow-up to focus on AI-powered smart glasses, Bloomberg reported. Engineers are working on two versions: one paired with an iPhone without its own display, potentially dropping in 2026, and another with a built-in display like Meta’s [META] Ray-Ban model. The glasses will feature voice interaction, AI capabilities, an upgraded Siri and a significantly lower price than the $3,499 Vision Pro.

Trump Presses Pause on Pharma Tariffs

Following Pfizer’s [PFE] move to cut US drug prices, President Donald Trump has paused his threat of 100% tariffs on imported pharmaceuticals, giving other drugmakers time to follow suit. The White House is seeking similar deals, while Trump launched TrumpRx, a site for discounted drugs. The shift comes ahead of Trump’s self-imposed September 29 deadline under his “most favored nation” policy, Seeking Alpha detailed.

PayPal is Reinventing Itself

After building its reputation as a pure payments processor, PayPal [PYPL] is morphing into what CEO Alex Chriss describes as a “dynamic commerce platform”. Branded checkout, AI shopping integration via its Honey product and international expansion, along with a multiyear AI partnership with Alphabet’s [GOOGL] Google, could all catalyze new growth for this fintech mainstay. OPTO examines the investment case for PYPL stock, plus how competition could eat into its addressable market.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy