In today’s top stories, on the back of wildfire hype around ChatGPT, chipmaker Nvidia’s share price jumped and its CEO’s wealth increased by some $5bn. This comes as Alphabet announces plans to build a ChatGPT rival. Elsewhere, Intel CEO Pat Gelsinger is to take a 25% pay cut, and UK cybersecurity firm Darktrace is launching a £75m buyback plan after fraud allegations. Lastly, sentiment on the EV industry seems to be improving, with the Global X Lithium & Battery Tech ETF rising 20.7% in January.

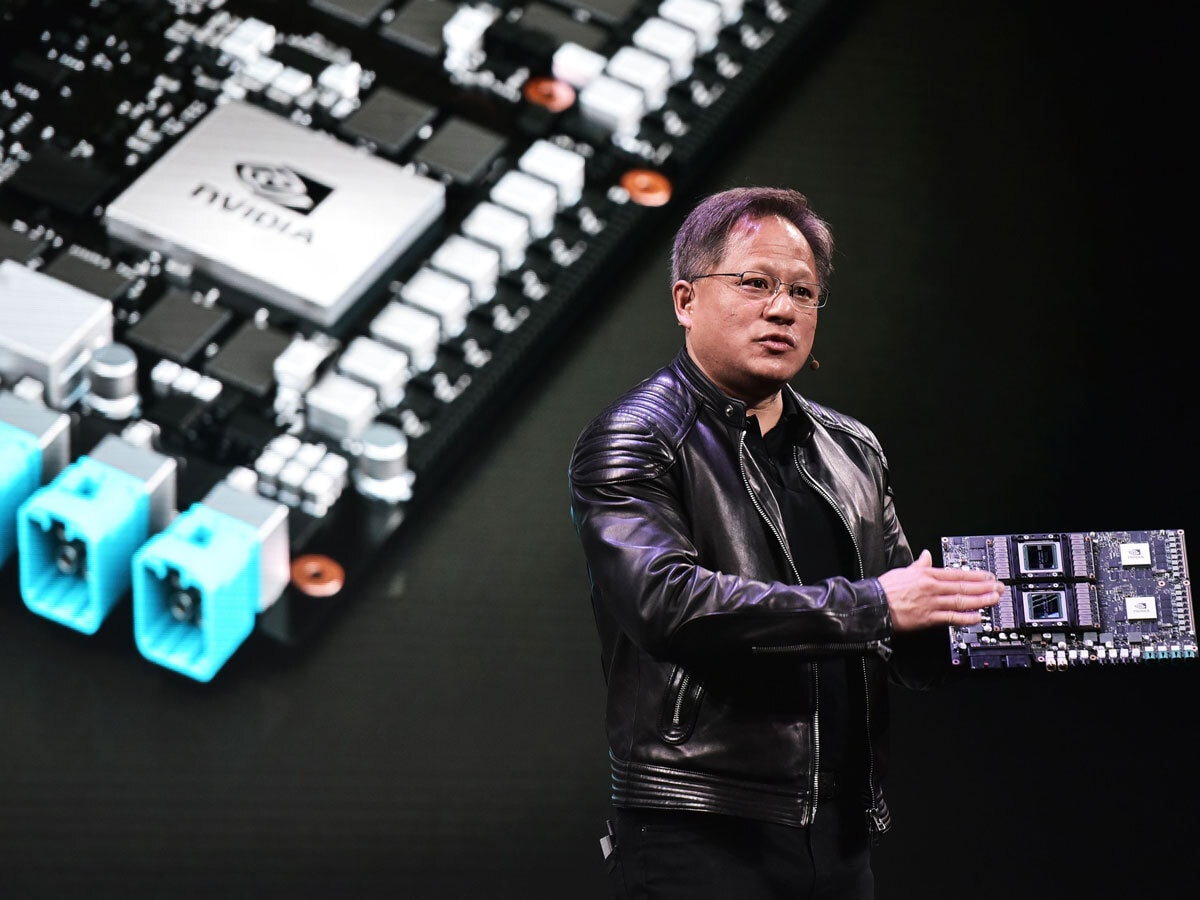

Nvidia rises on ChatGPT excitement

The hype around language chatbot ChatGPT is expected to prompt companies to boost their AI operations. The Nvidia [NVDA] share price jumped in January, as investors bet that there will be a ramp up in investment in its graphics chips. Meanwhile, $5.1bn was added to CEO Jensen Huang’s wealth, one of the largest net-worth percentage gains among US billionaires in 2023 so far, according to the Bloomberg Billionaires Index.

Darktrace buyback follows short report

Shares in UK cybersecurity favourite Darktrace [DARK.L] tumbled to an all-time low on Tuesday following the release of a short-seller report alleging fraud. Quintessential Capital Management has accused the company of “marketing activities to channel funds back into its partners as payment for apparently fictitious purchases”. Darktrace says it has “full confidence” in its accounting practices and has commenced a £75m buyback plan to lift its share price.

Alphabet plans to build ChatGPT rival

The AI battle between big tech giants is heating up. Alphabet [GOOGL] is testing products with conversational learning technology. The project, nicknamed ‘Atlas’, is a “code red” response to Microsoft’s [MSFT] investment in ChatGPT owner OpenAI, according to CNBC. It remains to be seen how the products could be integrated into Alphabet’s services, but a spokesperson for the conglomerate told the TV channel “that AI is foundational and transformative technology that is incredibly useful for individuals, businesses and communities.”

Sentiment on EVs gathers pace

Investor sentiment on the EV industry appears to have turned a corner with the Global X Lithium & Battery Tech ETF [LIT] rising 20.7% in January. The gain was led by a 29.8% rally in miner Albemarle [ALB], the fund’s top holding with a 10.56% weighting as of 31 January. US semiconductor maker Wolfspeed and German chip supplier ZF Friedrichshafen have announced plans to build a $3bn EV chip plant in Germany.

Intel boss takes pay cut

Intel [INTC] CEO Pat Gelsinger is to take a 25% pay cut as the chipmaker looks to shore up cash for future investment, which will help “accelerate our transformation and achieve our long-term strategy”. Intel has issued a grim outlook amid soft PC demand, but rival AMD [AMD] is faring better: despite CEO Lisa Su expecting the PC total addressable market will be down 10% in 2023, she believes that cloud demand should recover in the second half of the year.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy