One year ago, Netflix’s share price tumbled on news that its membership base shrank for the first time in its history. In its latest report, a 7.7 million increase in subscribers appears to have restored some positivity around the stock, with shares gaining 7% in after-hours trading.

- Netflix shares up 7% after hours despite earnings miss.

- Subscriber numbers smash analyst estimates.

- First Trust S-Network Streaming & Gaming ETF gains 10% year-to-date.

Netflix’s [NFLX] share price gained as much as 7.1% in after-hours trading on 19 January despite reporting an earnings miss that day.

Strong subscriber numbers fuelled positivity. Netflix said that it added 7.7 million new paid members during Q4, 67% more than Wall Street analysts had anticipated, according to CNBC.

In November, Netflix introduced a new $6.99 ad-supported membership tier in order to stem the outflow of subscribers reported a year ago. While the impact of the offering, called 'Netflix Basic with ads’, was not provided in this earnings report due to its mid-quarter introduction in limited geographies, the overall positive subscriber numbers support Netflix’s rebuttal of early reports that adoption had been slow.

Basic with ads accounted for 9% of of November’s US signups, according to data from Antenna published in the Wall Street Journal, making it Netflix’s least popular service tier for the month.

“Advertising for us is ‘crawl, walk, run’,” Netflix CEO Ted Sarandos told the UBS Global Technology, Media & Telecom Conference in December. “We just turned it on, and it works.”

Rising subscriber numbers make up for EPS miss

Netflix’s revenue increased 1.9% year-over-year to $7.9bn, in line with the consensus expectation of analysts polled by Refinitiv. Diluted EPS slumped from $1.33 a year ago to $0.12 in Q4, a decline of 91% and 73% short of analysts’ expected $0.45.

Netflix attributed its decline in profitability to the reduced strength of the US dollar relative to the euro. Average revenue per membership (ARM) fell 2% year-over-year “but grew 5% on a F/X neutral basis”. Likewise, a fall in operating margin from 8% to 7% was attributed to dollar strength.

For the full fiscal year, Netflix met analyst expectations of $31.62bn revenue, but missed the expected $10.37 EPS by 4.1%.

With Netflix having started 2022 with its first ever quarterly fall in paid memberships, however, it was subscriber figures that caught investors’ attention. Netflix finished the quarter with 230.8 million members, up 4% from the previous year. StreetAccount estimates had predicted 4.6 million new subscribers. Netflix gained 7.7 new users in the quarter; the 67% upside surprise prompted a flurry of after-hours trading, with Netflix’s share price reaching an after-hours high of $341.50, 8.1% above its closing price of $315.78.

Since 20 January 2022, Netflix’s share price has fallen 37.9%, with investors wary following the membership decline experienced a year ago. Its latest results will encourage investors that Netflix is still able to grow its subscriber base in the current economic climate.

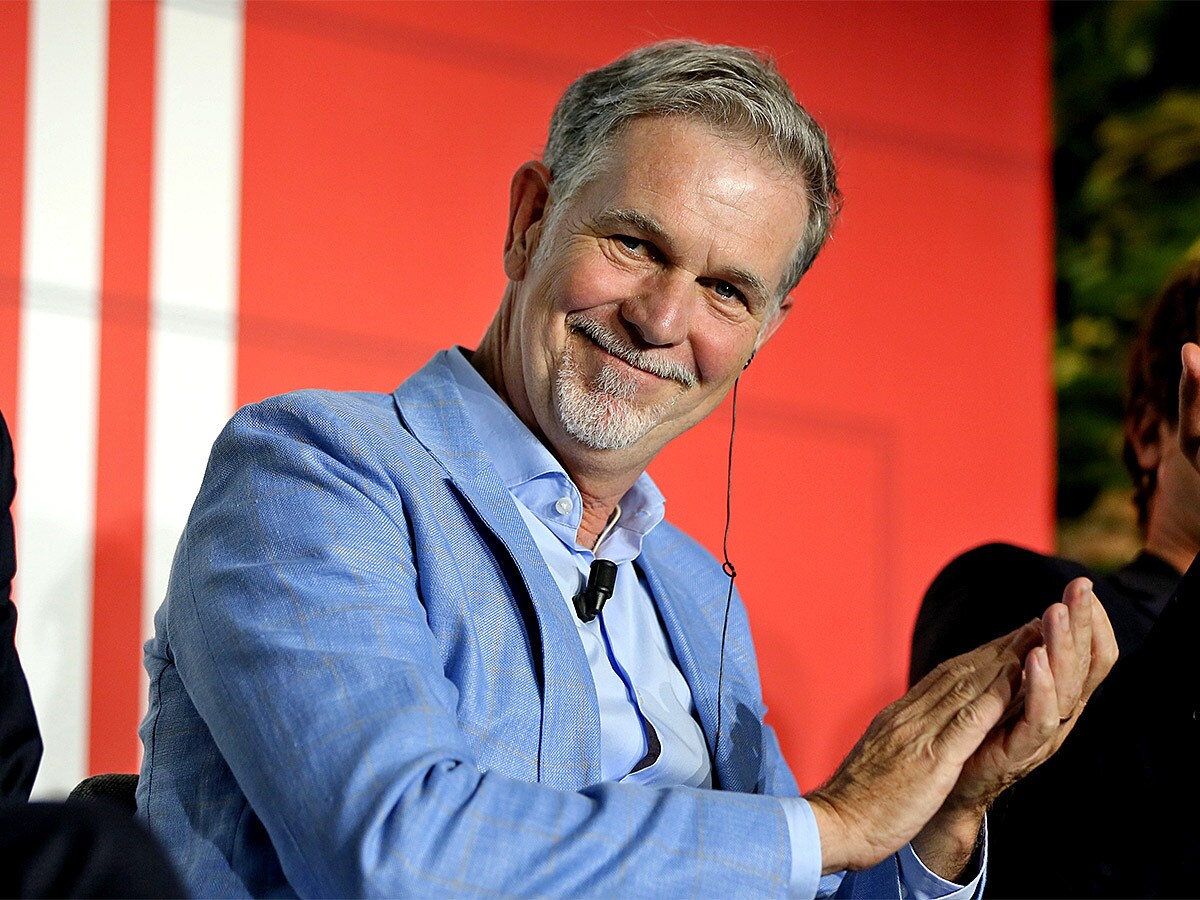

Alongside its earnings, Netflix also announced that chief operating officer Greg Peters is being promoted to co-CEO with Ted Sarandos, replacing co-founder and CEO Reed Hastings. Hastings is stepping down from his co-CEO role to serve as the company’s executive chair. Netflix’s “board has been discussing succession planning for many years”, Hastings wrote in a note on the company’s web site Thursday.

A tricky year for streaming platforms

With fellow streaming services Disney [DIS] and Roku [ROKU] not expected to announce earnings until February, Netflix’s earnings report marks an early gauge of the streaming industry’s health going into the new year.

Third-party data firm Parrott Analytics suggests the industry is saturated. Almost 80% of the US population already pays for a streaming service, and Netflix and Disney+ are no longer adding new subscribers in the US in significant numbers.

This, Lucas Shaw writes for Bloomberg, will likely cause streaming services to become more expensive in the near future, with HBO Max having hiked its prices for the first time earlier this month, as attention turns from subscriber growth to profitability. Netflix’s Basic with ads service tier could, over time, push up the price of its ad-free tier. That said, services are under pressure to maintain their value-for-money offering, with churn rates currently at all-time highs.

A 19 January report from The Business Research Company, however, expects the global content streaming market to grow to $138.6bn in 2023 at a compound annual growth rate (CAGR) of 13.8%. By 2027, the industry could grow to $223.9bn at a CAGR of 12.7%.

Funds in focus: First Trust S-Network Streaming & Gaming ETF

According to ETF.com, 264 ETFs hold Netflix. Among those with the most Netflix exposure are the Invesco Dynamic Media ETF [PBS] and the First Trust S-Network Streaming & Gaming ETF [BNGE].

As of 18 January, Netflix is the second-largest holding in PBS with a 5.46% weighting. The fund also holds Disney at a 5.20% weighting, making it the fund’s third-largest holding. In the past year, the fund has fallen 27.1%, but has gained 8.1% so far in 2023.

As of 19 January, Netflix is the fourth-largest holding in BNGE with a 5.12%. The fund also holds Disney as its tenth-largest holding at 3.83%. Roku is further down the list at a weighting of 1.15%. Over the past 12 months, the fund has dropped 22.8%, but has gained 10.2% in 2023. BNGE’s top holding, Tencent [0700.HK] has gained 23.5% in the year so far, benefitting from easing conditions in China

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy