Thematic investing relies on exposure to long-term trends. However, many thematic indices and funds contain stocks that do not align with their stated objectives.

Seasoned emerging markets (EM) investor Kevin T Carter made this point on OPTO Sessions when explaining the drawbacks of the MSCI Emerging Markets Index, which he says selects companies based on the location of their headquarters. “When you’re investing in EM consumer technology, you don’t care about where the company is. You care about where the revenue is coming from.”

In other words, to gain exposure to a trend (such as EM consumer technology), it’s important to clearly identify a company’s, fund’s, or index’s source of revenue. In this new OPTO series, we examine stocks that offer the purest exposure to key themes through a detailed assessment of their revenue streams.

In our first instalment, we ask: is Coinbase [COIN] a good choice for investors who want exposure to blockchain?

Coinbase

Coinbase is a cryptocurrency trading exchange that allows investors to buy and sell crypto, store it in a digital wallet, and spend it via its Coinbase card.

According to B2B media and information platform Business of Apps, Coinbase is the largest cryptocurrency exchange in the US. It has 98 million users worldwide, and nine million people are actively exchanging on the platform every month.

It is the second-largest cryptocurrency exchange in the world by revenue and by global trading volume, behind Binance, which has a much stronger footprint in Asia.

According to Mark Hooson in Forbes, Coinbase’s wallet offers “an unparalleled breadth of support for coins and tokens”.

Business of Apps thinks Coinbase appeals principally to amateur traders; Investopedia praises it as a helpful site for newcomers to digital asset trading but lists high transaction fees and control over users’ private keys as cons.

As one of the largest marketplaces for digital assets in the world, Coinbase is closely tied to blockchain technology, particularly as it pertains to crypto and digital assets.

Blockchain Revenue Streams

According to Coinbase’s Q3 2023 earnings report, its revenue streams break down as follows:

- Transaction revenue: $288.6m, up 21.1% year-over-year

- Subscription and services revenue: $334.4m, up 58.9%

- Net revenue: $623m, up 8.2%

- Corporate interest and other income: $51.1m, up 265%

- Total revenue: $674.1m, up 14.2%

Coinbase’s most recent 10-Q report confirms that transaction revenue comprises fees paid by both retail and institutional customers for executing crypto-related transactions. In other words, all of this revenue can be said to derive directly from the blockchain (and specifically crypto) ecosystem.

Subscription and services revenue is broken down as follows:

- Stablecoin revenue: $172.4m, up 124.2% year-over-year

- Blockchain rewards: $74.5m, up 18.6%

- Interest income: $39.5m, up 58.6%

- Custodial fee revenue: $15.8m, up 9%

- Other subscription and services revenue: $32.3m, up 2.9%

Stablecoin revenue and blockchain rewards are both tied to the blockchain ecosystem. In defining custodial fee revenue, the 10-Q states that Coinbase “provides a dedicated secure cold storage solution to customers and earns a fee, which is based on a contractual percentage of the daily value of assets under custody”.

While not specified, it is implicit that the assets in question are crypto or at least blockchain assets, given the nature of Coinbase’s services, so this revenue can also be attributed to the blockchain ecosystem.

Interest income and other subscription and services revenue are slightly more ambiguous.

Interest income is interest Coinbase earns on the fiat cash that its customers deposit with the company, which it in turn deposits into various bank accounts. While this cash does not touch the blockchain itself, the deposits are made in exchange for crypto assets. Its supply is therefore a reflection of demand for crypto and it can be counted as a blockchain-related revenue stream.

Other subscription and services revenue “primarily comprises revenue from Coinbase One, Coinbase Cloud, which includes staking application, delegation and infrastructure services, Learning Rewards campaign revenue, Prime Financing and revenue from other subscription licences”. All of the services named relate directly to the blockchain ecosystem.

Therefore, with the possible exception of interest income, all of Coinbase’s net revenue derives from the blockchain ecosystem. Corporate interest and other income — which accounted for 7.6% of Coinbase’s total Q3 revenue — is its only revenue stream that is distinct from the blockchain ecosystem.

Spot Prices

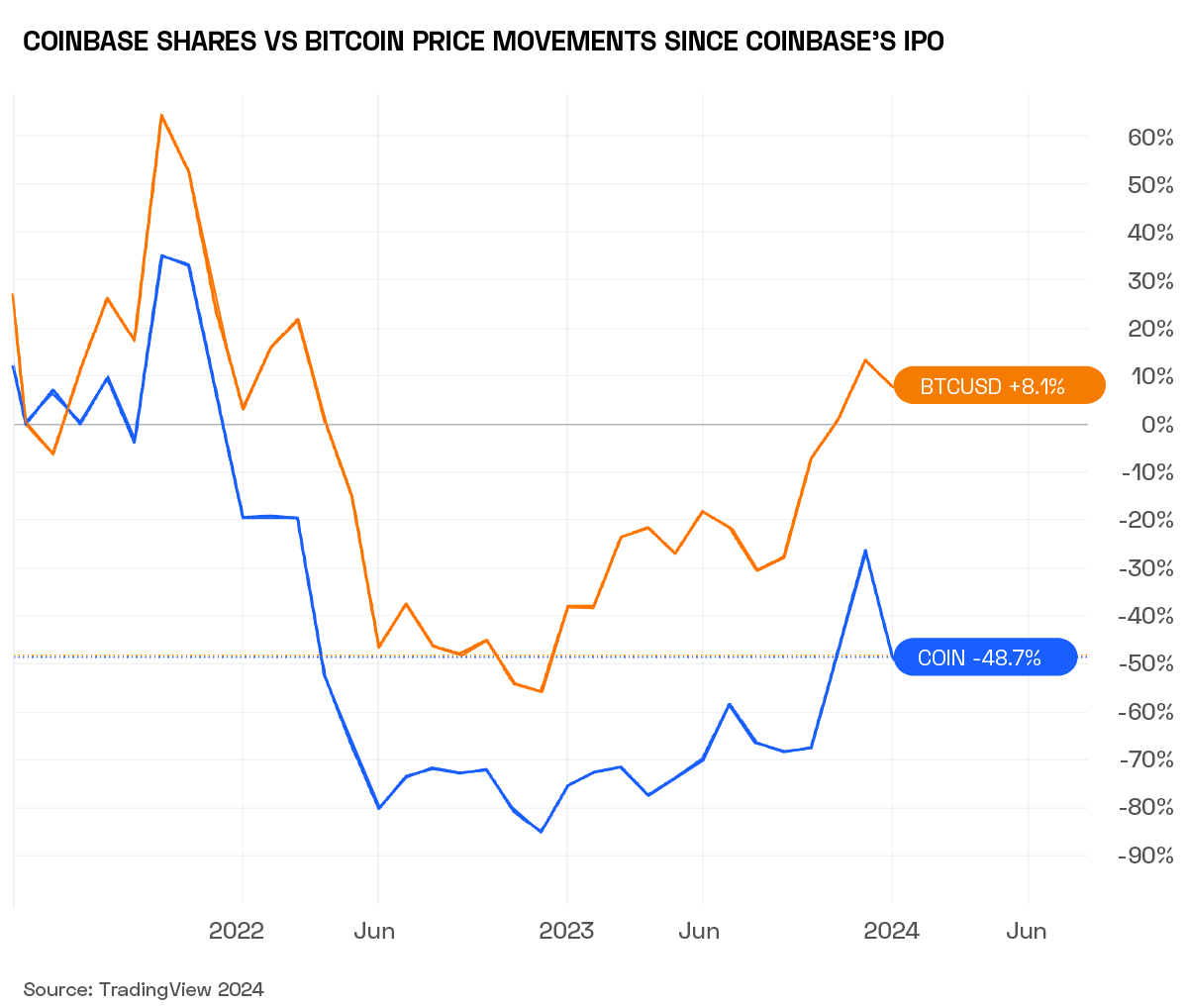

The performance of cryptocurrencies — especially bitcoin — has a major influence on Coinbase’s price movements.

As of January 2024, there are several tailwinds in the industry’s favour.

Bitcoin rose 73.4% against the dollar in the 12 months to 24 January. Its price was buoyed in the build-up to the much-anticipated approval by the Securities and Exchange Commission (SEC) of 11 spot bitcoin ETFs on 10 January. Since the close on 10 January, however, the spot bitcoin price has dropped 14%.

In the past 12 months, Coinbase shares have gained 130%, outperforming bitcoin. Since the SEC’s landmark approval, however, they have fallen 19.8% — a worse drop-off than bitcoin’s. In other words, it appears one possibility might be that Coinbase is correlated to bitcoin price movements, but could be more volatile than the cryptocurrency itself.

Investors seeking a closer correlation with bitcoin price movements (without owning bitcoin directly) can now select one of the spot bitcoin ETFs mentioned above, such as the VanEck Bitcoin Trust [HODL], which launched on 11 January. Since then, however, the ETF has fallen 17.9% — a steeper decline than bitcoin’s, but less than that of Coinbase.

Coinbase is a custodian for a large number of the new spot bitcoin ETFs, so analysts such as Moshe Katri of Wedbush believe that the SEC’s approval will be a tailwind for the company. However, Matthew Sigel, Head of Digital Assets Research at VanEck, thinks they could impact demand for Coinbase’s services.

“A retail investor who’s clicking the buy button on Coinbase pays a 2.5% transaction cost,” Sigel pointed out on a recent episode of the OPTO Sessions podcast. Spot bitcoin ETFs offer “a sizable all-in cost saving to the end investor” by comparison.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy