EV Price Wars Come to Europe

BYD [BYDDF] has launched the Dolphin Surf, its cheapest and smallest electric vehicle (EV), in the UK. While competition has sparked a cut-throat price war in their home market, Chinese brands are taking a more restrained approach in Europe, with tariffs impacting pricing. However, as more affordable EV options in the compact car segment become available, analysts see prices dropping for both local and international brands.

Nvidia, Samsung Back Robotics Software Start-Up

In a Series B funding round led by SoftBank [SFTBY], the semiconductors firm [NVDA] and the Korean tech giant [SSNLF] have taken minority stakes in Skild AI worth $25m and $10m, respectively. The US-based robotics software start-up is the latest benefactor from the increasing focus on “physical artificial intelligence (AI)” — meaning robots and autonomous vehicles capable of thinking for themselves — as a future growth area.

Voyager Skyrockets on NYSE Debut

The Denver, Colorado-based space and defense firm [VOYG] secured a $3.8bn valuation in its IPO on Wednesday, with shares more than doubling from $31.00 to $69.75. The company is benefiting from activity in the wider space segment, fueled in part by US defense projects such as the proposed $175bn Golden Dome initiative. It had a backlog of $179.2m as of March, with ongoing projects to develop propulsion and guidance systems for Lockheed Martin [LMT] as well as a potential successor to the International Space Station for NASA.

Oracle Up on Sunny Cloud Forecast

Shares of the Austin, Texas-based firm [ORCL] jumped nearly 8% Wednesday after it announced an expected two-fold increase in cloud computing contracts in 2026. Revenue for Q4 rose 11% to $15.9bn, beating Wall Street estimates, and its cloud infrastructure business is expected to grow 70% in the next fiscal year. Back in March, OPTO examined ORCL stock’s prospects following the announcement of the expansive Stargate AI initiative.

Talen and Amazon Extend Partnership to 2042

On Wednesday Talen Energy [TLN] announced it had expanded its nuclear energy partnership with Amazon [AMZN], agreeing to supply 1.92GW of electricity for Amazon Web Services’ data centers. The deal is expected to last until 2042, representing a long-term revenue stream for the US-based utilities firm. The two companies are also looking to boost the output of the Susquehanna plant in Pennsylvania by deploying small modular reactors.

Why Is This Fintech Sizzling?

Sezzle [SEZL] is a Minnesota, Minneapolis-headquartered fintech that offers buy now, pay later services, competing with firms such as Affirm [AFRM] and Block [XYZ] in a relatively controversial area of fintech. The company has seen its share price rocket 896.20% in the past 12 months, but a December 2024 short report questioning its lending practices could point to deeper financial health issues. Head to OPTO’s Foresight for a deep dive into this red-hot fintech.

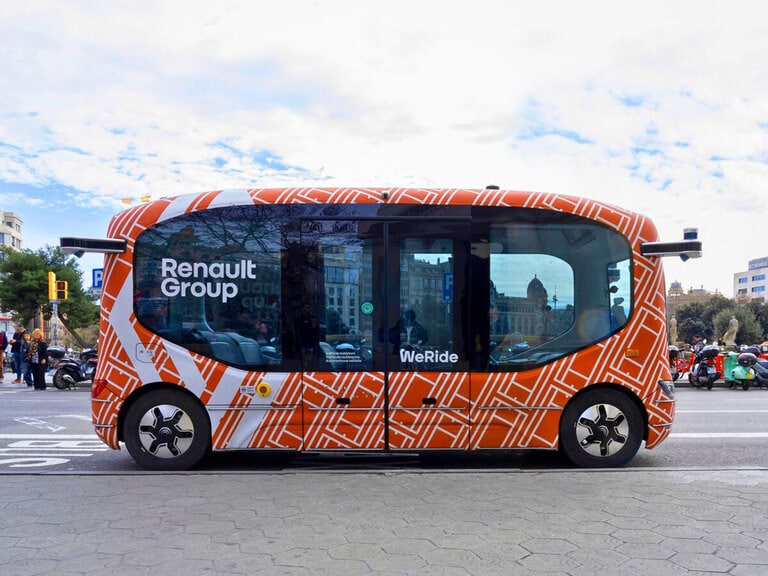

WeRide Set for Global Expansion

The Guangzhou-headquartered robotaxi firm [WRD] has set its sights on markets around the world, with autonomous driving licenses in China, the UAE, Singapore and the US and recent partnerships with Chinese tech giant Tencent [TCEHY] and ride-hailing service Uber [UBER]. However, continued US-China tensions could serve as a headwind, with the threat of delisting and increasing competition from Tesla [TSLA]. Read more about this firm’s road to expansion.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy