WeRide [WRD] is an autonomous driving technology company that develops robotaxis and advanced driver assistance system solutions.

Early investor enthusiasm for WRD stock has waned since its debut on the Nasdaq stock market in late October 2024. As of June 12, WeRide’s share price was trading about 43.35% below its IPO price of $15.50 per share.

This stock spotlight will discuss the latest developments, earnings, market performance and key risks for WRD stock.

WeRide Expands Globally with Uber Partnership

WeRide, formerly known as JingChi Inc, was established in 2017 in China. Over the years, the company has developed a suite of autonomous driving services and solutions, including its robotaxi, robobus and robosweeper.

The Guangzhou-headquartered firm claims to be the only company in the world to simultaneously hold autonomous driving licenses in China, the UAE, Singapore and the US.

In 2025, the company made further strides in its global expansion as it entered markets in the UAE and Saudi Arabia to test and launch robotaxi services.

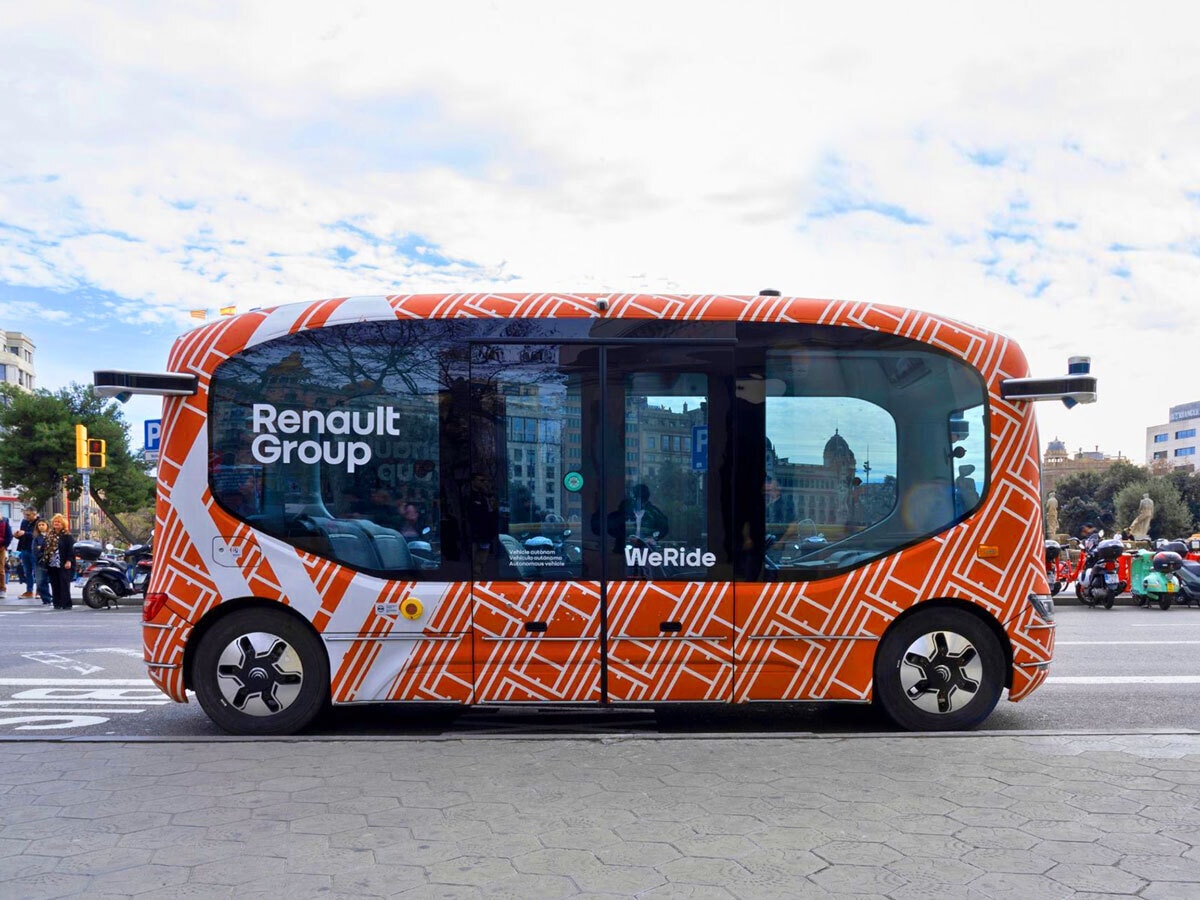

In March, WeRide, in collaboration with French autonomous mobility network operator beti, obtained a Level-4 driverless public road testing and operating permit in France. This comes on the back of its launch of Europe’s first public-road commercial autonomous minibus service in Drôme, France .

WeRide also entered strategic partnerships with Chinese tech giant Tencent [TCEHY] and ride-hailing service Uber [UBER] this year.

Tencent and WeRide will explore the commercial deployment of driverless autonomous robotaxis in China and international markets.

Meanwhile, Uber plans to invest another $100m in WeRide and will make the company’s robotaxi services available through its ride-hailing app in 15 cities across Europe and the Middle East over the next five years.

WRD Share Drop from IPO Price

WeRide listed on the Nasdaq stock market on October 25, 2024. The stock rose as much as 27.7% to $19.80 on its debut.

WRD stock went on to see its best trading day ever on February 14, 2025, after a regulatory filing revealed that semiconductor chip maker Nvidia [NVDA] held 1.7 million shares in the company. The WRD share price closed the day 83.5% higher.

WeRide shares extended gains in the next session to hit an all-time high of $44.

However, WRD stock has experienced a bearish trend since hitting its peak, weighed down by heightening US-China tensions. As of June 11, the stock was trading at $8.78, 43.35% below its IPO price.

Revenue Growth Stalls

For the year ended December 31, 2024, WeRide reported a 10.1% year-over-year decrease in total revenue to RMB361.13m.

Product revenue, which represented the sales of autonomous driving vehicles, jumped 61.9% year-over-year to RMB87.71m.

Service revenue, which represented earnings from autonomous driving-related operational and technical support services, fell 21.4% year-over-year to RMB273.42m.

Product revenue and service revenue accounted for 24.3% and 75.7% of total revenue earned in fiscal 2024, respectively.

Full-year loss widened to RMB2.52bn from RMB1.95bn a year previously.

As of March 31, 2025, WeRide had RMB4.428bn in cash and cash equivalents.

The company reported long-term bank borrowings of RMB47.5m and short-term bank borrowings of RMB60.0m.

Comparing WeRide, Aurora Innovation and Mobileye Global

Aurora Innovation [AUR] is an autonomous vehicle (AV) technology company co-founded by former Alphabet [GOOGL], Tesla [TSLA] and Uber employees. The company acquired Uber’s self-driving unit in 2020.

Mobileye Global [MBLY] is a company that develops autonomous mobility systems including cameras, chips and radars. The company was acquired by Intel [INTC] in 2017.

Metric | WRD | AUR | MBLY |

Market Cap | $2.54bn | $10.52bn | $13.12bn |

P/S Ratio | 51.65 | - | 7.06 |

Estimated Sales Growth (Current Fiscal Year) | 132.61% | 0% | 5.89% |

Estimated Sales Growth (Next Fiscal Year) | 188.51% | 843.87% | 14.79% |

Source: Yahoo Finance

WRD Stock: The Investment Case

The Bull Case for WeRide: Robotaxis

Robotaxis are a big part of WeRide’s growth story. According to the company’s CFO Jennifer Li, WeRide’s robotaxis are expected to be at least 50% more cost-effective in developed markets compared to traditional taxi and ride-hailing services.

Li said the traditional ride-hailing model sees the driver take home roughly 60% of each fare. In contrast, WeRide’s robotaxis reduce the driver cost to “nearly nothing”.

Li added that WeRide’s experience in navigating the electric vehicle supply chain in China, strong relationships with automakers and adoption of a modularized design for AV sensors allow the company to optimize expenses.

WeRide’s robotaxi business is nascent but growing. In the first quarter of 2025, the company said revenue from the segment contributed 22.3% to the company’s total revenue, up from 11.9% reported a year ago.

The Bear Case for WeRide: US Delisting and Competition

Over the short term, the deterioration of US-China relationships over sensitive topics such as national security and trade tariffs is a key risk for WeRide.

Lawmakers in the US have urged the Securities and Exchange Commission to delist 25 Chinese companies over alleged military links. According to Nikkei Asia, WeRide is looking to shield itself from such risk by pursuing a secondary listing in Hong Kong.

Investors should also note that WeRide’s relationship with automakers and ride-hailing services is crucial for its business. The company collaborates with automakers to custom-create robotaxis and lists them on global platforms such as Uber.

WeRide does not have an exclusive relationship with Uber, which has partnered with rival firm Wayve Technologies to launch autonomous ride-hailing services in the US and the UK.

Competition in this emerging market is heating up, with Tesla [TSLA] expected to launch its self-driving taxi service in late June.

Conclusion

WeRide operates in a highly competitive robotaxi market that has the potential for enormous growth. The company boasts a strong presence in China and a first-to-market advantage in key markets such as the Middle East.

Investors must continue monitoring WRD’s financial growth while acknowledging key risks such as potential US delisting and changing regulations.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy