The NATO alliance’s 32 members have an agreement that they should commit at least 2% of their GDP to defense, but only 23 hit this target in 2024.

The US spent approximately 3.4% of its GDP on defense in 2024, according to official NATO data. Other countries’ failure to meet the threshold has been a bone of contention for US President Donald Trump.

Now, NATO is close to hiking the target to 5% under pressure from the Trump administration.

“This alliance, in a matter of weeks, will be committed to 5%: 3.5% in hard military and 1.5% in infrastructure and defense-related activities. That combination constitutes a real commitment,” said US Secretary of Defense Pete Hegseth at a NATO meeting last week.

In light of a potential NATO spending rise, here are three stocks to keep an eye on.

Reducing Reliance on the US

While there seems to be support for the 5% target, many countries, especially in Europe, have long relied on the US for defense. However, President Trump has previously threatened to pull his support to NATO members that are not paying enough. This could leave the continent facing the next security crisis alone.

Governments in Europe are waking up to the realization that they need to up their spending to boost their own capabilities.

“The defense sector has really been energized on a global scale … We’ve seen defense contractors report record backlogs in terms of orders and share prices appreciate in anticipation of higher revenues,” Andrew Ye, Investment Strategist at Global X ETFs, told OPTO Sessions.

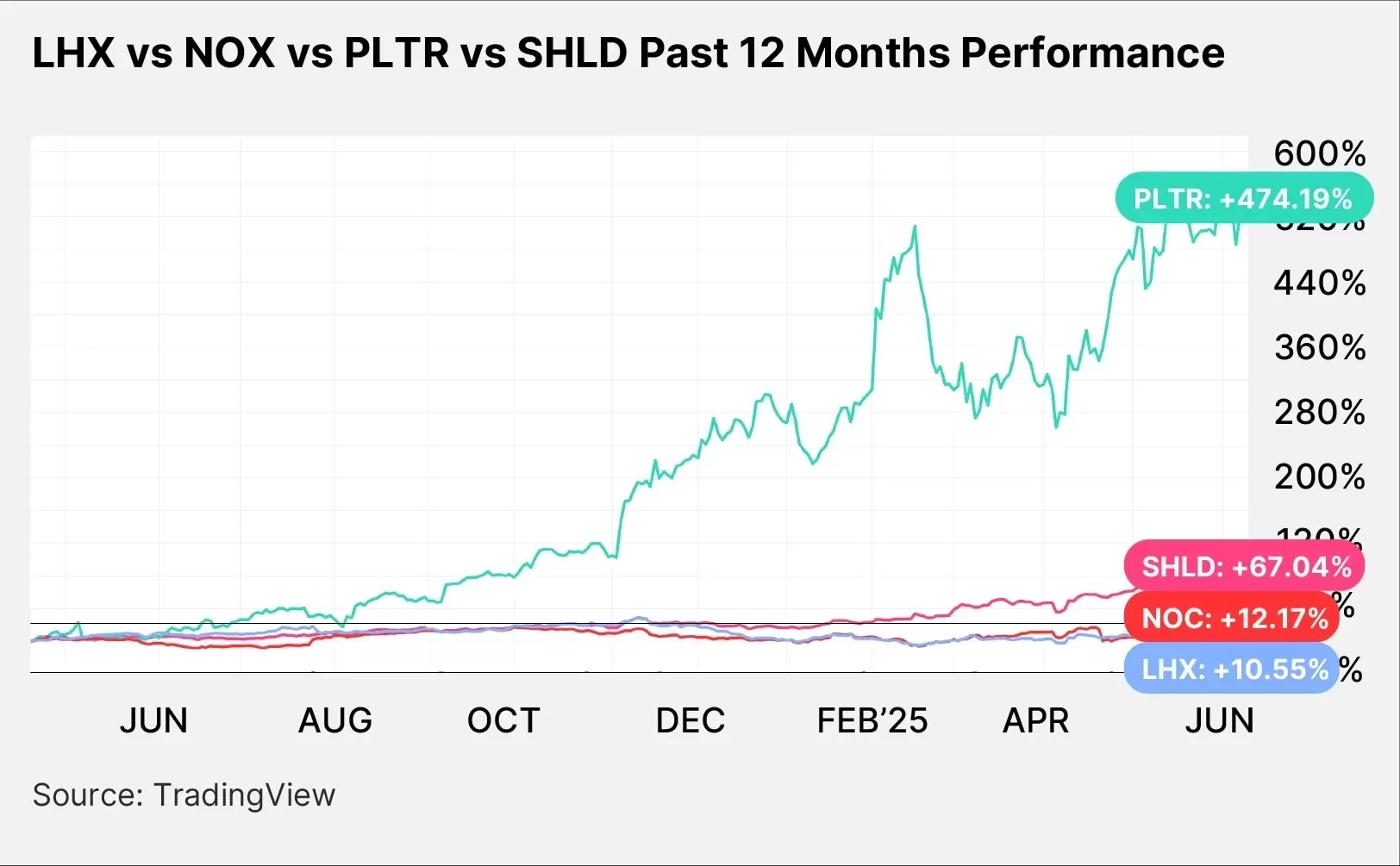

Defense stocks that could stand to benefit from increased defense spending among NATO members include L3Harris [LHX], Northrop Grumman [NOC] and Palantir [PLTR]. The three stocks are currently held by the Global X Defense Tech ETF [SHLD].

Defense Stocks Prove Resilient

The L3Harris share price has gained 17.63% year-to-date through June 10 and is up 12.13% in the past month.

The Northrop Grumman share price has edged up 5.13% since January 1 and rose 1.77% in the past month.

The Palantir share price has surged 75.6% since January 1 and is up 13.22% in the past month.

For comparison, SHLD has reported gains of 51.32% and 6.05% in the respective periods.

Recent Contract Wins

In March, L3Harris signed a $1bn long-term agreement with the Dutch Ministry of Defense to supply its Falcon IV radios to the Netherlands.

The radios “deliver industry leading resiliency, low probability detection and intercept, while ensuring secure and interoperable communications with US and allied forces,” L3Harris CEO Chris Kubasik said on its Q1 earnings call in April.

Northrop Grumman announced a $1.4bn deal in February that will see the defense contractor bolster the air and missile defense capabilities of the US Army and Poland.

“Expanding IBCS [Integrated Battle Command System] capabilities will keep the US Army and US allies, such as Poland, ahead of evolving threats and capabilities, giving warfighters more decision time to save lives,” said Kenn Todorov, Northrop’s Vice President, in a statement.

Palantir’s artificial intelligence (AI)-powered military system Maven was acquired by NATO at the end of March. The system utilizes generative AI, large language models (LLM) and machine learning to provide operational support to commanders.

“We are seeing rapid expansion and very significant demand for Maven, both in America and outside of America, as all part of our core mission to provide an unfair advantage to the noble warriors of the west,” said Palantir CEO Alex Karp on the Q1 earnings call in May.

Here are how the fundamentals of the three companies currently compare.

| LHX | NOC | PLTR |

Market Cap | $45.76bn | $70.35bn | $313.42bn |

P/S Ratio | 2.20 | 1.78 | 105.52 |

P/E Ratio | 29.11 | 19.39 | 574.17 |

PEG Ratio | 0.36 | 3.18 | 4.18 |

Estimated Sales Growth (Current Fiscal Year) | 1.11% | 2.67% | 35.96% |

Estimated Sales Growth (Next Fiscal Year) | 5.51% | 4.71% | 28.70% |

Source: Yahoo Finance

Despite the investment case for defense stocks being boosted by ongoing geopolitical tensions, it could be argued that LHX stock and NOC stock are trading at fairly low multiples. However, both are expected to see slow revenue growth.

At the other end of the spectrum, PLTR stock could be considered overvalued.

LHX Stock, NOC Stock and PLTR Stock: The Investment Case

The Bull Case for L3Harris

L3Harris has been touted as a potential contractor for President Trump’s Golden Dome, a defense shield that could cost up to $175bn and be operational by the end of his presidency.

The company announced in April that it had completed a $125m expansion of its Indiana facility to ramp production of sensors that will be a critical component of the Golden Dome.

The Bear Case for L3Harris

Revenue in Q1 was down 1.5% year-over-year to $5.13bn, below the $5.22bn analysts had been expecting. The fall was due to lower volumes associated with program timing and “continued challenges on classified development programs” that resulted in an 8% decline in sales in its space segment.

The Bull Case for Northrop Grumman

Northrop could also be a beneficiary of President Trump’s Golden Dome project. CEO Kathy Warden said in January that the company is “well-positioned” to support the architecture the US needs to defend itself with missiles.

The Bear Case for Northrop Grumman

The contractor cut its full-year profit guidance in April, on the back of a 49% drop in Q1 segment operating income, from a range of $4.65bn–4.8bn to $4.2bn–4.35bn.

Rising manufacturing costs for its B-21 stealth bomber program were to blame, leading to a $477m pre-tax loss in Q1.

The Bull Case for Palantir

Demand for Palantir’s LLM-based software has evolved into a “stampede” and a “ravenous whirlwind of adoption,” CEO Karp said in his Q1 shareholder letter.

US government revenue increased 45% year-over-year from $257m to $373m in the first three months of the year.

The Bear Case for Palantir

The software provider remains controversial. Last week, the New York Times ran a piece alleging the company has been “tapped” by the Trump administration “to compile Americans’ personal data”. The claims were strongly refuted by Karp in an interview with CNBC.

Conclusion

Defense stocks have had a strong first five months of the year and are likely to continue to surge as NATO members increase their spending and look to reduce their reliance on the US for defense support.

Trump’s proposed Golden Dome is likely to be another catalyst, especially once contracts are handed out.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy