China Chases Chip Independence

Beijing is offering subsidies that cut electricity costs by up to 50% for data centers using domestic chips, according to the Financial Times, as part of its push to strengthen its semiconductor industry and reduce reliance on Nvidia [NVDA]. The incentives target major players such as ByteDance, Alibaba [BABA] and Tencent [TCEHY], which have faced higher energy costs after switching from US to local chips.

What’s New in the Teslaverse?

The electric vehicle (EV) giant [TSLA] has appointed Sharad Agarwal, former head of Lamborghini India, to lead its operations in the country, signaling renewed ambition after years of limited progress in the country’s fast-growing EV market. Elsewhere, ahead of Tesla’s annual meeting on Thursday, Norway’s $2.1trn sovereign wealth fund said it would vote against Elon Musk’s $1trn pay package.

Q3 Was Extraordinary for Palantir

Palantir Technologies [PLTR] posted what CEO Alexander Karp called “arguably the best results that any software company has ever delivered,” boasting a Rule of 40 score above 100%. Revenue surged 63% year-over-year and 18% sequentially, driven by explosive US commercial growth — up 121% annually. Total contract value hit a record $2.8bn across 204 million-dollar deals, Seeking Alpha detailed.

Does This Credit-Scoring Stock Have a Monopoly?

Fair Isaac Corp [FICO] controls over 90% of the US credit-scoring market and recently introduced a direct pricing model that bypasses traditional credit agencies. The new model boosted FICO’s stock by roughly 20%, while competitors fell amid fears of losing relevance. On Substack, OPTO unpacks how, despite regulatory criticism and potential competition, FICO’s dominance and rising earnings make it a steady, defensible growth stock.

Pharma Giant Rails Against Taxes

Eli Lilly [LLY] has urged European governments to scrap clawback taxes on drug sales, warning that such policies could limit access to new medicines. The US pharma giant announced a €2.6bn factory in the Netherlands to expand oral drug production, including a forthcoming weight-loss pill. CEO David Ricks said Lilly plans to align global pricing by lowering US prices and raising European ones, calling clawback systems “unproductive” for innovation.

Big News out of the Renewables Space

Ørsted [DNNGY] has sold a 50% stake in its Hornsea 3 offshore wind farm — the world’s largest — to Apollo Global Management [APO] in a $6.5bn deal. The agreement gives Apollo equal funding responsibility for the 2.9GW project off England’s east coast, due for completion in 2027. CFO Trond Westlie said the sale marks an “important milestone” as Ørsted seeks to stabilize finances amid rising costs.

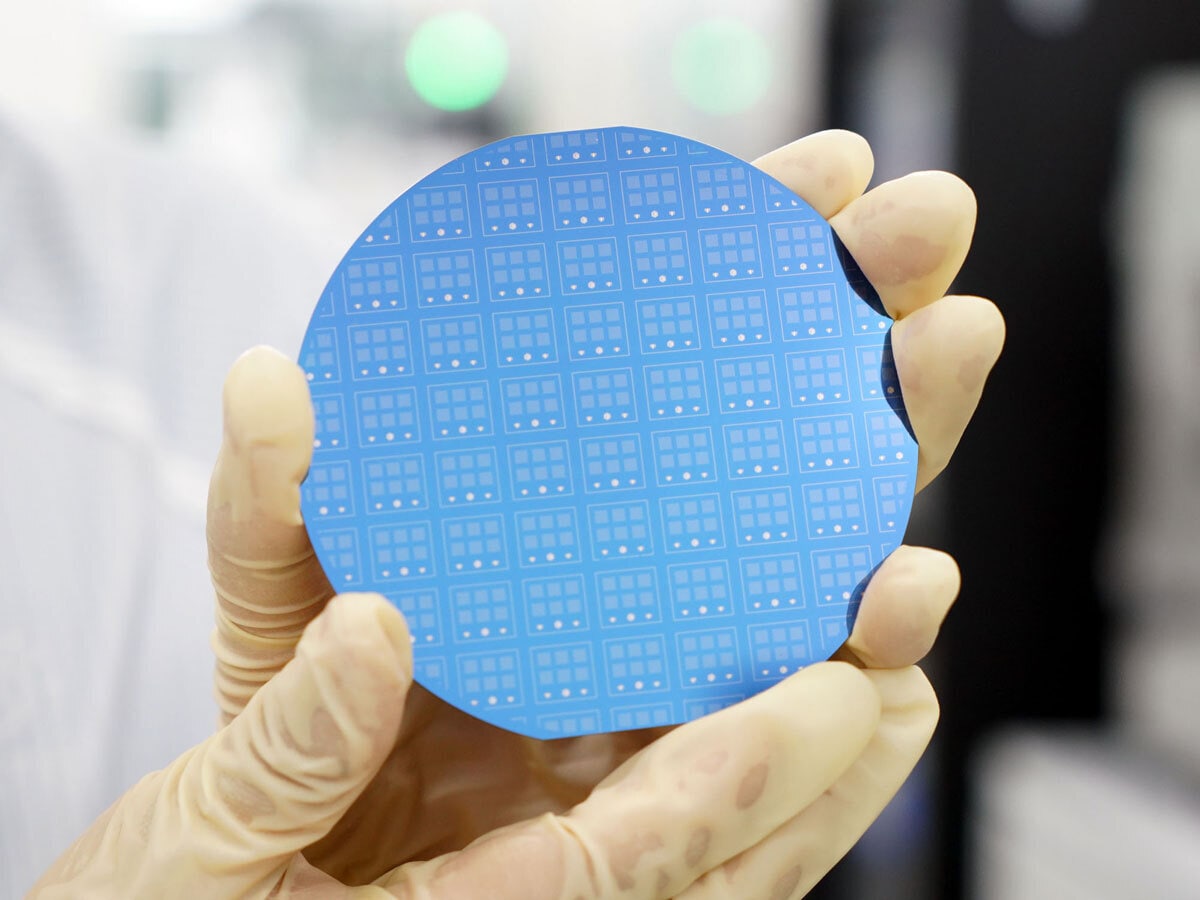

This Quantum Firm is Prepping for Cyber Security Doomsday

At the intersection of quantum computing and digital security, Vancouver-based BTQ Technologies’ [BTQ] value proposition rests on preparing for Q-Day, the point at which quantum technology has progressed enough to break the cryptography used in the majority of secure communications today. In the wake of the company’s Nasdaq debut, OPTO examines the company’s latest moves, and the bull and bear cases for this high-risk, high-reward quantum stock.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy