“Batteries are a massive economic opportunity,” QuantumScape [QS] CFO Kevin Hettrich says during the latest episode of OPTO Sessions.

In the automotive space, for example, BloombergNEF expects electric vehicles to account for 56% of global passenger vehicle sales by 2035. An estimated 10% of those vehicles are expected to be powered by solid-state batteries, a technology being developed and commercialized by QuantumScape.

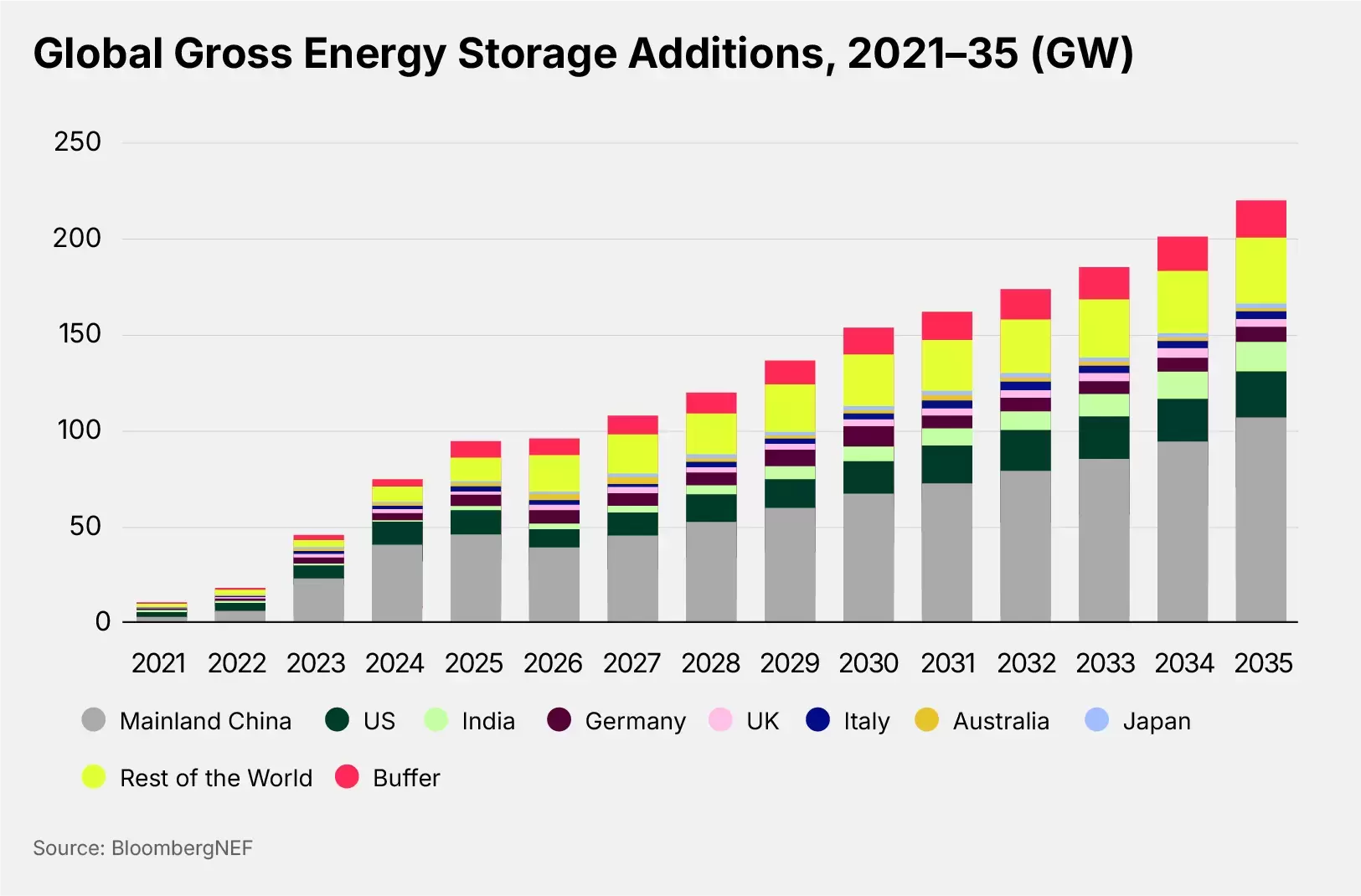

Zooming out, the prospects are even more compelling. Global energy storage capacity is expected to grow from 94GW in 2025 to well over 200GW by 2035, as shown in the graph below.

In this developing landscape, Hettrich says, QuantumScape’s goal has always been clear: “to give the world a significantly better battery.” Founded in 2010, the company has made deploying solid-state batteries its raison d’etre, with the new technology expected to provide a number of advantages over traditional lithium ion batteries.

As a pre-revenue startup, however, QuantumScape is still very much on the road to commercialization. Hettrich notes that leading an early-stage tech company to success requires a number of unique factors. “As a startup, especially as a hard tech startup, to be successful, you need to be contrarian and to be right,” he explains.

Proving a Hypothesis

One of the principal challenges Hettrich has had to face at QuantumScape is selling a product that has yet to reach full-scale commercialization. With such a product, “by definition, you’re doing something that no one has ever done before. It’s basically a set of hypotheses when you start out.”

In comparison to traditional lithium cells, solid-state batteries offer “an opportunity for your vehicle to significantly outperform on all of the dimensions that are important,” Hettrich says, citing improvements in range, charge time, safety, lifespan and cost.

Indeed, eliminating some elements of a traditional battery have provided several key improvements. First, “in enabling the solid-state lithium metal chemistry, we’ve removed two of the three organic materials from the cell that would contribute to fire.” Additionally, “we eliminate the graphite silicon that hosts the lithium ion, and in doing so that eliminates one of the sources of life-loss.” Lastly, with fewer components to source and integrate, the cell ends up costing less.

Wading into unknown territory comes with risks, but it can also help to create a company’s competitive moat, Hettrich notes. “We’re the only ones who’ve shown what we think is automotive performance. No one else has done that — in fact, everyone else is off by multiple dimensions.”

In the end, pulling it off comes down to the involved, hands-on work of creating the product itself. “I don’t think there’s any shortcut through that type of iterative problem-solving,” he admits.

A Page from the Semiconductor Book

QuantumScape’s CEO, Siva Sivaram, has extensive experience in the semiconductor space, having worked in firms such as SanDisk [SNDK], Matrix Semiconductor and Intel [INTC]. Since his appointment in February 2024, he has guided the company in constructing an ecosystem similar to that of the semiconductor industry, with different companies designing, manufacturing and providing the components of the final product.

As a result, Hettrich details, in the solid-state battery supply chain, “you have QuantumScape on the innovation side, PowerCo on the cell manufacturing side, and Murata Manufacturing [MRAAY] and Corning [GLW] in those ecosystem type roles. We’re literally trying to take a playbook right out of the semiconductor space.”

As they build that ecosystem, the parallel question is one of scale — how to take a solid-state cell from prototype to industrial production levels. “I think you point to things like yield, things like supply chain and intellectual property [IP] protection.”

How is QuantumScape increasing yield? “It is very non-sexy engineering,” Hettrich says. “There aren’t shortcuts. You just do it over and over and over again.”

In terms of supply chain, QuantumScape’s choice of ceramic components makes sourcing easier, and less exposed to macroeconomic risk. “We’ve settled on a separator that can meet performance requirements, but it is also made of earth-abundant materials whose producers are found in all the major regions across multiple different players.”

Lastly, protecting IP comes down to choosing the right partners and aligning incentives so that “they have the same incentives we do to both care for our IP.” The company’s ongoing partnership with Volkswagen’s [VWAGY] battery subsidiary PowerCo demonstrates this approach.

While all of these elements would hold true for a large chipmaker such as Nvidia [NVDA], batteries present a key opportunity in supply chain sustainability, Hettrich notes. “At the end of life, all of the materials that you put into the battery are still there.”

And since QuantumScape’s cells lack an anode — “one of the dirtiest and least economical components to recycle,” — “solid state lithium metal batteries can accelerate that [recycling process]”.

Ultimately, he imagines a closed-loop supply chain for even the most advanced batteries. “Over time, with penetration, substantially all of the inputs to make more batteries should come from recycling. The dependency on mining should dwindle down. That’s a very powerful concept in terms of a true closed loop, a secure supply chain that’s also sustainable.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy